Astrotech Reports Fiscal Year 2022 Financial Results

14 Setembro 2022 - 10:00AM

Astrotech Corporation (Nasdaq: ASTC) (the “Company” or “Astrotech”)

reported its financial results for the fiscal year ended June 30,

2022.

Financial Highlights & Fiscal Year

Developments

- Astrotech’s consolidated balance sheet remains strong with

$52.6 million in cash and liquid investments which is

anticipated to support our research and development, organic

growth, and potential acquisition targets.

- Our 1st Detect subsidiary’s commercial sales of the

ECAC-certified TRACER 1000™ explosive trace detector (ETD)

continued, leading to $869 thousand in total revenue

year-over-year, an increase of 160%.

- Gross margin doubled to 22% for the year compared to 11% in the

prior period, as we have increased production and benefited from

associated volume discounts.

- We secured a landmark purchase order from a distributor who

services the airport security checkpoint market. This key milestone

represents our first TRACER-1000 systems sold and delivered for use

in passenger screening.

- While we have encountered supply chain challenges, we continue

to take steps to mitigate these issues as they are identified and

have sufficient inventory to meet immediate demand.

- Our AgLAB Inc. subsidiary hired Joe Levinthal, a hemp and

cannabis industry veteran and an expert in mass spectrometry, as

its Chief Science Officer to help lead AgLAB’s product development

team.

- Our BreathTech Corporation subsidiary hired Dr. Karim Sirgi,

MD, MBA and FCAP as its Chief Science Officer to help lead

BreathTech’s product and research development as well as the

partnership with Cleveland Clinic in the development of

the BreathTest-1000™.

- BreathTech expanded its agreement with Cleveland Clinic to

include additional areas of focus. Ongoing work towards development

of a rapid breath test for COVID-19 is now being broadened to

screen for a variety of diseases spanning the entire body,

including bloodstream infections, respiratory infections such as

influenza types A and B and respiratory syncytial virus (RSV),

carriage of Staphylococcus aureus, and Clostridioides difficile (C.

diff) infections.

“Fiscal year 2022 saw continued traction for sales of our TRACER

1000 in our targeted markets of airport security and cargo

facilities, with an increase in revenue of 160% over the last

fiscal year,” stated Thomas B. Pickens, III, Astrotech’s Chairman

and Chief Executive Officer.

“We are in the process of introducing the AgLAB-1000-D2™ to the

nutraceutical processors market. The D2 will be used in high

throughput biomass-to-oil applications designed to substantially

increase THC and CBD yields, which we believe will have a directly

proportional impact on customer revenues. At BreathTech, Dr. Karim

Sirgi continues to collaborate with the Chairman of the Respiratory

Institute at Cleveland Clinic and his team. Pre-clinical trials are

underway to develop the BreathTest-1000, a rapid breath analysis

tool that could indicate the presence of a bacterial or viral

infection. Finally, we are well-capitalized to invest in the many

opportunities across all aspects of the company, and we’re excited

to share updates on our progress over the coming months,” concluded

Mr. Pickens.

About Astrotech Corporation

Astrotech (Nasdaq: ASTC) is a mass spectrometry company

that launches, manages, and commercializes scalable companies based

on its innovative core technology through its wholly-owned

subsidiaries. 1st Detect develops,

manufactures, and sells trace detectors for use in the security and

detection market. AgLAB is developing chemical

analyzers for use in the agriculture

market. BreathTech is developing a breath

analysis tool to provide early detection of lung diseases.

Astrotech is headquartered in Austin, Texas. For information,

please visit www.astrotechcorp.com.

About the AgLAB-1000™ and the

BreathTest-1000™

This press release contains information about our new products

under development, AgLAB-1000 and BreathTest-1000. Product

development involves a high degree of risk and uncertainty, and

there can be no assurance that our new products will be

successfully developed, achieve their intended benefits, receive

full market authorization, or be commercially successful. In

addition, FDA approval will be required to market BreathTest-1000

in the United States. Obtaining FDA approval is a complex and

lengthy process, and there can be no assurance that FDA approval

for BreathTest-1000 will be granted on a timely basis or at

all.

Forward-Looking Statements

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, the severity and duration of the COVID-19 pandemic and

its impact on the U.S. and worldwide economy, the timing, scope and

effect of further U.S. and international governmental, regulatory,

fiscal, monetary and public health responses to the COVID-19

pandemic, the Company’s use of proceeds from the common stock

offerings, whether we can successfully complete the development of

our new products and proprietary technologies, whether we can

obtain the FDA and other regulatory approvals required to market

our products under development in the United States or abroad,

whether the market will accept our products and services and

whether we are successful in identifying, completing and

integrating acquisitions, as well as other risk factors and

business considerations described in the Company’s Securities and

Exchange Commission filings including the Company’s most recent

Annual Report on Form 10-K. Any forward-looking statements in this

document should be evaluated in light of these important risk

factors. Although the Company believes the expectations reflected

in its forward-looking statements are reasonable and are based on

reasonable assumptions, no assurance can be given that these

assumptions are accurate or that any of these expectations will be

achieved (in full or at all) or will prove to have been correct.

Moreover, such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

the Company, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements.

In addition, any forward-looking statements included in this press

release represent the Company’s views only as of the date of its

publication and should not be relied upon as representing its views

as of any subsequent date. The Company assumes no obligation to

correct or update these forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

Company Contact: Jaime Hinojosa, Chief

Financial Officer, Astrotech Corporation, (512) 485-9530

Tables follow

ASTROTECH

CORPORATIONConsolidated Statements of Operations and

Comprehensive Loss(In thousands, except per share data)

| |

|

Years Ended |

| |

|

June 30, |

| |

|

2022 |

|

2021 |

|

Revenue |

|

$ |

869 |

|

|

$ |

334 |

|

| Cost of revenue |

|

|

677 |

|

|

|

298 |

|

| Gross

profit |

|

|

192 |

|

|

|

36 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

6,006 |

|

|

|

4,741 |

|

|

Research and development |

|

|

2,781 |

|

|

|

2,692 |

|

|

Disposal of corporate lease |

|

|

— |

|

|

|

513 |

|

| Total operating expenses |

|

|

8,787 |

|

|

|

7,946 |

|

| Loss from

operations |

|

|

(8,595 |

) |

|

|

(7,910 |

) |

|

Other income and (expense), net |

|

|

265 |

|

|

|

(235 |

) |

|

Gain on extinguishment of debt - PPP loan |

|

|

— |

|

|

|

542 |

|

| Loss from operations

before income taxes |

|

|

(8,330 |

) |

|

|

(7,603 |

) |

|

Income tax benefit |

|

|

— |

|

|

|

— |

|

| Net loss |

|

$ |

(8,330 |

) |

|

$ |

(7,603 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

47,702 |

|

|

|

21,984 |

|

| Basic and diluted net

loss per common share: |

|

$ |

(0.17 |

) |

|

$ |

(0.35 |

) |

| Other comprehensive loss, net

of tax: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,330 |

) |

|

$ |

(7,603 |

) |

|

Available-for-sale securities |

|

|

|

|

|

|

|

|

|

Net unrealized losses, net of zero tax expense |

|

|

(1,176 |

) |

|

|

(23 |

) |

| Total comprehensive

loss |

|

$ |

(9,506 |

) |

|

$ |

(7,626 |

) |

| |

|

|

|

|

|

|

|

|

ASTROTECH

CORPORATIONConsolidated Balance Sheets(In thousands,

except share and per share data)

| |

|

June 30, |

| |

|

2022 |

|

2021 |

|

Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

26,453 |

|

|

$ |

35,936 |

|

|

Short-term investments |

|

|

26,173 |

|

|

|

27,351 |

|

|

Accounts receivable |

|

|

56 |

|

|

|

5 |

|

|

Cost and estimated revenue in excess of billings |

|

|

2 |

|

|

|

— |

|

|

Inventory, net: |

|

|

|

|

|

|

|

|

|

Raw materials |

|

|

864 |

|

|

|

1,056 |

|

|

Work-in-process |

|

|

136 |

|

|

|

147 |

|

|

Finished goods |

|

|

518 |

|

|

|

297 |

|

|

Prepaid expenses and other current assets |

|

|

748 |

|

|

|

318 |

|

| Total current

assets |

|

|

54,950 |

|

|

|

65,110 |

|

|

Property and equipment, net |

|

|

1,098 |

|

|

|

263 |

|

|

Operating leases, right-of-use asset, net |

|

|

162 |

|

|

|

249 |

|

|

Other assets, net |

|

|

11 |

|

|

|

11 |

|

| Total

assets |

|

$ |

56,221 |

|

|

$ |

65,633 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

169 |

|

|

$ |

396 |

|

|

Payroll related accruals |

|

|

816 |

|

|

|

344 |

|

|

Accrued expenses and other liabilities |

|

|

961 |

|

|

|

888 |

|

|

Income tax payable |

|

|

2 |

|

|

|

2 |

|

|

Term note payable - related party |

|

|

500 |

|

|

|

2,500 |

|

|

Lease liabilities, current |

|

|

234 |

|

|

|

81 |

|

| Total current

liabilities |

|

|

2,682 |

|

|

|

4,211 |

|

|

Lease liabilities, net of current portion |

|

|

303 |

|

|

|

215 |

|

| Total

liabilities |

|

|

2,985 |

|

|

|

4,426 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Convertible preferred stock, $0.001 par value, 2,500,000 shares

authorized; 280,898 shares of Series D issued and outstanding at

June 30, 2022 and 2021 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 250,000,000 and 50,000,000 shares

authorized at June 30, 2022 and 2021 respectively; 50,567,864 and

49,450,558 shares issued and outstanding at June 30, 2022 and 2021,

respectively |

|

|

190,642 |

|

|

|

190,641 |

|

|

Additional paid-in capital |

|

|

79,505 |

|

|

|

77,971 |

|

|

Accumulated deficit |

|

|

(215,712 |

) |

|

|

(207,382 |

) |

|

Accumulated other comprehensive loss |

|

|

(1,199 |

) |

|

|

(23 |

) |

| Total

stockholders’ equity |

|

|

53,236 |

|

|

|

61,207 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

56,221 |

|

|

$ |

65,633 |

|

| |

|

|

|

|

|

|

|

|

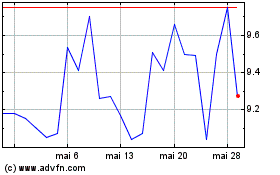

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025