Grupo Aeroportuario del Pacifico Announces Issuance of Sustainability-Linked Bond Certificates in Mexico for Ps. 2.8 Billion

26 Setembro 2022 - 6:51PM

Grupo Aeroportuario del Pacífico, S.A.B. de C.V., (NYSE: PAC; BMV:

GAP) (the “Company” or “GAP”) announced today that it successfully

completed the issuance of 27,575,876 long-term bond certificates in

Mexico (Certificados Bursátiles) at a nominal value of Ps. 100 each

(One hundred pesos 00/100), for a total value of Ps. 2,757,587,600

(Two billion seven hundred fifty-seven million five hundred

eighty-seven thousand six hundred pesos 00/100 M.N.).

The bond certificates were issued in accordance

with the following terms:

- 27,575,876 bond certificates were

issued under the ticker symbol “GAP 22L”, at a nominal value of Ps.

100 (One hundred pesos 00/100) each, for a total value of Ps.

2,757,587,600 (Two billion seven hundred fifty-seven million five

hundred eighty-seven thousand six hundred pesos 00/100 M.N.)

- Interest will be payable every 28

days at a variable rate of TIIE-28 plus 26 basis points; and

- Principal will be due at maturity

on September 21, 2026, with an early payment option.

In accordance with the Sustainability-Linked

Bond Framework, GAP will annually publish, within its Annual

Sustainability Report, an update on the Sustainability-Linked Bond,

which will include information regarding the Key Performance

Indicator.

The Key Performance Indicator is the reduction

of absolute scope 1 and 2 greenhouse gas emissions and will be

verified by December 31, 2025 and audited by an external party, in

case the target is not met, there will be an upward adjustment of

0.2% to the nominal value of the bond certificates at the

expiration date.

The issuance obtained the highest credit ratings

in Mexico, “Aaa.mx” by Moody’s and “mxAAA” by S&P, both on a

national scale with a stable outlook. Additionally, the Company

obtained a Second Party Opinion by Sustainalytics, in accordance

with the best practices in the industry.

The proceeds from this issuance will be

allocated to the payment of the bond certificates under the ticker

symbol “GAP 17-2” issued in November 2017 and maturing on November

3, 2022, for an amount of Ps. 2.3 billion and the remainder will be

used for capital investments.

Company Description

Grupo Aeroportuario del Pacífico, S.A.B. de C.V.

(GAP) operates 12 airports throughout Mexico’s Pacific region,

including the major cities of Guadalajara and Tijuana, the four

tourist destinations of Puerto Vallarta, Los Cabos, La Paz and

Manzanillo, and six other mid-sized cities: Hermosillo, Guanajuato,

Morelia, Aguascalientes, Mexicali and Los Mochis. In February 2006,

GAP’s shares were listed on the New York Stock Exchange under the

ticker symbol “PAC” and on the Mexican Stock Exchange under the

ticker symbol “GAP”. In April 2015, GAP acquired 100% of Desarrollo

de Concessioner Aeroportuarias, S.L., which owns a majority stake

in MBJ Airports Limited, a company operating Sangster International

Airport in Montego Bay, Jamaica. In October 2018, GAP entered into

a concession agreement for the operation of the Norman Manley

International Airport in Kingston, Jamaica and took control of the

operation in October 2019.

This press release may contain forward-looking

statements. These statements are statements that are not historical

facts and are based on management’s current view and estimates of

future economic circumstances, industry conditions, company

performance and financial results. The words “anticipates”,

“believes”, “estimates”, “expects”, “plans” and similar

expressions, as they relate to the company, are intended to

identify forward-looking statements. Statements regarding the

declaration or payment of dividends, the implementation of

principal operating and financing strategies and capital

expenditure plans, the direction of future operations and the

factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are

subject to a number of risks and uncertainties. There is no

guarantee that the expected events, trends or results will actually

occur. The statements are based on many assumptions and factors,

including general economic and market conditions, industry

conditions, and operating factors. Any changes in such assumptions

or factors could cause actual results to differ materially from

current expectations.

In accordance with Section 806 of the

Sarbanes-Oxley Act of 2002 and article 42 of the “Ley del Mercado

de Valores”, GAP has implemented a “whistleblower”

program, which allows complainants to anonymously and

confidentially report suspected activities that June involve

criminal conduct or violations. The telephone number in Mexico,

facilitated by a third party that is in charge of collecting these

complaints, is 01 800 563 00 47. The web site is

www.lineadedenuncia.com/gap. GAP’s Audit Committee will be notified

of all complaints for immediate investigation.

|

IR Contacts: |

|

| Saúl Villarreal, Chief Financial

Officer |

svillarreal@aeropuertosgap.com.mx |

| Alejandra Soto, IRO and Corporate

Finance Director |

asoto@aeropuertosgap.com.mx |

| Gisela Murillo, Investor

Relations |

gmurillo@aeropuertosgap.com.mx /

+52-33-3880-1100 ext.20294 |

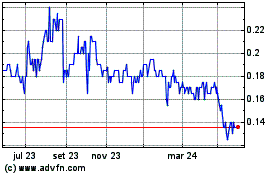

Gale Pacific (ASX:GAP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

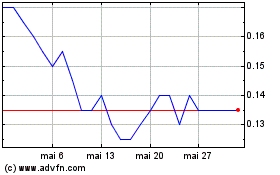

Gale Pacific (ASX:GAP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025