EDENRED : Third-quarter 2022 revenue - Edenred upgrades its

full-year 2022 outlook after another quarter of strong growth

Third-quarter 2022 revenue

Edenred upgrades its full-year 2022 outlook

after another quarter of strong growth

Edenred records another quarter of strong growth,

reflecting the relevance of its solutions and the strength of

its go-to-market:

- Third-quarter operating revenue of

€484 million, up 23.0% as reported (+19.1% like-for-like)

versus third-quarter 2021

- Double-digit like-for-like revenue

growth in all regions and all business lines

- Driven by strong business volume and

higher interest rates in all regions, other revenue more than

doubled, from €11 million to €23 million

- Total revenue of €506 million, up

25.2% as reported (+21.4% like-for-like)

- For the nine months ended

September 30, 2022, the Group’s total revenue stood at

€1,428 million, up 22.9% as reported (+19.2% like-for-like)

versus the same period in 2021

Edenred’s ESG commitments

recognized once again:

- Edenred was

included in the Euronext CAC 40 ESG index on

September 19 – recognition of the Group’s commitment to

sustainable development

- Moody’s ESG

Solutions increased Edenred’s score by 5 points, raising its

status from “Robust” to “Advanced”

Edenred is well positioned to benefit from the

increasing scale effect of its platform and generate sustainable

and profitable growth in 2022 and beyond:

- Accelerated

investments in technology and product innovation to provide

corporates, users and merchants with best-in-class experiences and

value-added services

- Powerful

go-to-market strategy to further penetrate markets, and in

particular tackle the SME segment

- Continued expansion

of the product portfolio with the rollout of Beyond Food, Beyond

Fuel and Beyond Payment solutions, fostering cross-selling and

unlocking new growth opportunities

- Buoyant market

trends (lasting post-Covid structural changes, increased

attractiveness of solutions to support employee purchasing power)

and favorable economic conditions (higher interest rates generating

additional revenue)

Thanks to its steady growth quarter after quarter,

and to the increased attractiveness of its solutions,

Edenred is upgrading its 2022 EBITDA

outlook to between

€810 million and

€840 million1 (compared with

a target range of between €770 million and €820 million

announced on July 26, 2022). ***

Bertrand Dumazy,

Chairman and Chief Executive Officer of Edenred, said:

“Edenred’s strong growth momentum continues, quarter after quarter.

By enhancing our portfolio of solutions and accelerating our

technology investments, we continue to increase the efficiency of

our digital platform, providing our clients with best-in-class

experiences increasingly tailored to their needs. Our solutions,

which are synonymous with higher purchasing power for employees and

greater efficiency for fleet managers, are even more relevant in

today’s inflationary environment. In these circumstances, our

powerful go-to-market enables us to speed up our market

penetration, notably in the SME segment. We are confident as the

year draws to an end and are upgrading our EBITDA outlook. We will

present our strategic plan and prospects for the coming three years

next week.” |

Turkey is now qualified as a hyperinflationary

economy. The Group has therefore applied IAS 29 – Financial

Reporting in Hyperinflationary Economies to its operations in this

country since January 1, 2022.THIRD-QUARTER

AND NINE-MONTH 2022 TOTAL REVENUE

|

(in € millions) |

Third-quarter 2022 |

Third-quarter 2021 |

% change

(reported) |

% change

(like-for-like) |

| Operating

revenue |

484 |

393 |

+23.0% |

+19.1% |

|

Other revenue |

23 |

11 |

+100.1% |

+99.7% |

|

Total revenue |

506 |

405 |

+25.2% |

+21.4% |

|

(in € millions) |

First nine months 2022 |

First nine months 2021 |

% change

(reported) |

% change

(like-for-like) |

| Operating

revenue |

1,375 |

1,130 |

+21.7% |

+17.9% |

|

Other revenue |

53 |

32 |

+67.3% |

+65.4% |

|

Total revenue |

1,428 |

1,162 |

+22.9% |

+19.2% |

For the third quarter of 2022, total revenue

amounted to €506 million, up 25.2% as reported compared with

third-quarter 2021. This year-on-year increase includes a favorable

currency effect (+3.8%) and a slightly negative scope effect

(-0.1%). On a like-for-like basis, total revenue was up 21.4%.

For the first nine months of the year, total

revenue came to €1,428 million, up 22.9% as reported and up

19.2% like-for-like compared with the same period in 2021. Reported

growth includes a favorable currency effect (+4.0%) and a slightly

negative scope effect (-0.3%).

Operating revenue increased by 23.0% as reported

to €484 million in the third quarter of 2022. The currency

effect was a favorable 4.1% and the scope effect was a negative

0.2%. On a like-for-like basis, operating revenue rose by 19.1%

year-on-year.

Following on from the results achieved in the

first half of the year, Edenred delivered double-digit

like-for-like operating revenue growth in the third quarter in each

of its business lines and in each of the regions where the Group

operates. This solid performance reflects the dynamism of Edenred’s

sales teams as well as the Group’s ability to continuously enhance

its portfolio and offer its clients innovative and attractive

digital solutions.

Operating revenue for the first nine months of

2022 was up by 21.7% as reported and by 17.9% like-for-like

compared with the same period in 2021, including a positive

currency effect (+4.1%) and a slightly negative scope effect

(-0.4%).

- Operating revenue by

business line

|

(in € millions) |

Third-quarter 2022 |

Third-quarter 2021 |

% change

(reported) |

% change

(like-for-like) |

|

Employee Benefits |

275 |

233 |

+17.7% |

+15.5% |

| Fleet &

Mobility Solutions |

143 |

110 |

+30.6% |

+23.6% |

|

Complementary Solutions |

65 |

50 |

+31.3% |

+26.4% |

|

Total |

484 |

393 |

+23.0% |

+19.1% |

|

(in € millions) |

First nine months 2022 |

First nine months 2021 |

% change

(reported) |

% change

(like-for-like) |

|

Employee Benefits |

802 |

682 |

+17.7% |

+15.6% |

| Fleet &

Mobility Solutions |

395 |

300 |

+31.7% |

+23.9% |

|

Complementary Solutions |

177 |

148 |

+19.6% |

+16.5% |

|

Total |

1,375 |

1,130 |

+21.7% |

+17.9% |

Operating revenue for the Employee

Benefits business line, which accounts for 57% of the

Group’s total operating revenue, was €275 million in

third-quarter 2022, a 17.7% year-on-year increase as reported

(+15.5% like-for-like).

This growth is in line with the Group’s

first-half performance and confirms the strong sales momentum

gained by Ticket Restaurant® meal benefits, notably among SMEs. It

also reflects the progressive impact of clients’ greater use of

higher face values to protect their employees’ purchasing power,

particularly in countries where the maximum face value by law has

been raised. Lastly, Beyond Food solutions, notably designed for

companies seeking to enhance their employer brand and boost

employee engagement, met with strong commercial success. These

solutions are all the more relevant amid today’s structural changes

in the workplace and rising inflation.

For the nine months ended September 30,

2022, operating revenue for Employee Benefits came to

€802 million, up 17.7% as reported (+15.6% like-for-like)

compared with the same period in 2021.

In the Fleet & Mobility

Solutions business line, which represents 30% of

the Group’s total operating revenue, operating revenue for

third-quarter 2022 amounted to €143 million, up 30.6%

year-on-year as reported (+23.6% like-for-like).

This strong growth reflects the continued

rollout of the Beyond Fuel strategy, notably through the

maintenance and toll offering, which is proving highly successful

in both Latin America and in Europe. The business also enjoyed

strong sales momentum once again, driven by the relevance of its

digital, multi-product offering for fleet managers.

For the nine months to September 30,

operating revenue for Fleet & Mobility Solutions totaled

€395 million, up 31.7% as reported (+23.9% like-for-like)

compared with the first nine months of 2021.

The Complementary Solutions

business line, which includes Corporate Payment Services, Incentive

& Rewards and Public Social Programs, generated operating

revenue of €65 million in third-quarter 2022, representing 13%

of the Group total. This figure was up 31.3% as reported (+26.4%

like-for-like) compared with the third quarter of 2021.

Corporate Payment Services in North America,

operated through Edenred CSI, delivered a solid performance, driven

by new contract wins, particularly in segments into which the

company has recently expanded such as property management and

energy, as well as by the ramp-up of its commercial partnerships

with several banks and software companies, including Sage. The

strong growth in Complementary Solutions also reflects the success

of the Group’s innovative programs, such as the fully digital

Benefit Xpress offering in Taiwan and the new value-added services

accessible via the C3Pay mobile app in the United Arab Emirates

(salary advances, for example).

In the first nine months of the year, operating

revenue for Complementary Solutions came to €177 million, up

19.6% as reported (+16.5% like-for-like) compared with the same

period in 2021.

- Operating revenue by

region

|

(in € millions) |

Third-quarter 2022 |

Third-quarter 2021 |

% change

(reported) |

% change

(like-for-like) |

| Europe |

283 |

241 |

+17.5% |

+17.6% |

| Latin

America |

161 |

120 |

+34.6% |

+19.9% |

|

Rest of the World |

40 |

33 |

+21.1% |

+27.7% |

|

Total |

484 |

393 |

+23.0% |

+19.1% |

|

(in € millions) |

First nine months 2022 |

First nine months 2021 |

% change

(reported) |

% change

(like-for-like) |

| Europe |

834 |

716 |

+16.5% |

+16.3% |

| Latin

America |

432 |

324 |

+33.3% |

+18.0% |

|

Rest of the World |

109 |

90 |

+20.7% |

+30.0% |

|

Total |

1,375 |

1,130 |

+21.7% |

+17.9% |

In Europe, operating revenue

amounted to €283 million in the third quarter, a year-on-year

increase of 17.5% as reported (+17.6% like-for-like). Europe

represented 59% of total consolidated operating revenue in

third-quarter 2022.

In the nine months to September 30, 2022,

operating revenue in the region totaled €834 million up 16.5% as

reported (+16.3% like-for-like) compared with the first nine months

of 2021.

In France, operating revenue

came to €71 million for the third quarter, up 8.7% both as

reported and like-for-like. This growth reflects the success of the

Employee Benefits and Fleet & Mobility Solutions businesses,

notably in the SME segment, which remains largely underpenetrated.

In particular, it is the result of a very good sales performance by

the digital Ticket Restaurant® solution. This performance was also

partially offset by the impact of the daily spending cap being

lowered back to its pre-Covid level of €19 as from July 1, 2022

(versus €38 since June 12, 2020) and by an unfavorable basis

of comparison with third-quarter 2021, when users spent funds they

had accumulated while restaurants and certain retailers were shut.

Lastly, solutions rolled out under the Beyond Food strategy,

including the ProwebCE employee engagement platform and the remote

working platform, continued to deliver robust growth, benefiting

from continuous, innovation-driven improvements to the user

experience.

Operating revenue for France in the first nine

months of the year amounted to €220 million, up 10.4% as

reported and like-for-like compared with the first nine months of

2021. Operating revenue in Europe excluding France

totaled €212 million in third-quarter 2022, an increase of

20.8% as reported and like-for-like versus the prior-year period.

Employee Benefits enjoyed strong momentum across the region. Ticket

Restaurant® meal benefits once again delivered robust growth,

boosted by an increase in face values introduced by clients in the

current inflationary context, and the Beyond Food strategy

continued to be a success. In Fleet & Mobility Solutions,

further solid growth in the third quarter was driven by the success

of the Beyond Fuel strategy and good sales momentum in the SME

segment.

For the first nine months of 2022, operating

revenue for Europe excluding France came to €613 million, up

18.8% year-on-year as reported (+18.6% like-for-like).

Operating revenue in Latin

America came to €161 million for the third quarter, a

rise of 34.6% as reported (+19.9% like-for-like) compared with the

third quarter of 2021. Latin America represented 33% of

consolidated operating revenue in third-quarter 2022.

For the nine months ended September 30, 2022,

operating revenue came to €432 million, up 33.3% as reported

(+18.0% like-for-like).

In Brazil, operating revenue

rose by 16.2% like-for-like in third-quarter 2022 versus

third-quarter 2021. Fleet & Mobility Solutions continued to be

driven by the success of the Beyond Fuel offering in maintenance

and toll services. Employee Benefits delivered a good sales

performance thanks to the continued penetration of the SME segment,

supported notably by the growing contribution of the partnership

with Itaú Unibanco and the success of the virtual canteen

solution.

For the first nine months of the year, operating

revenue in Brazil grew by 16.8% like-for-like.

In Hispanic Latin America,

third-quarter 2022 operating revenue was up 27.9% like-for-like

versus the same period in 2021. This robust performance reflects a

sharp acceleration in the Employee Benefits business, as well as

further strong growth in Fleet & Mobility Solutions.

For the first nine months of the year, operating

revenue in Hispanic Latin America rose by 20.6% like-for-like.

In the Rest of the

World, operating revenue came to

€40 million for the third quarter, up 21.1% as reported

(+27.7% like-for-like). This region represents 8% of consolidated

operating revenue in third-quarter 2022.This performance was

notably driven by the success of innovative programs proposed in

countries such as the United Arab Emirates and Taiwan. In North

America, Edenred CSI’s Corporate Payment Services continued to

build on the strong momentum seen in the second quarter, thanks in

particular to the ramp-up of its commercial partnerships with

several banks and software companies.

For the first nine months of the year, operating

revenue in the Rest of the World totaled €109 million, up 20.7% as

reported (+30.0% like-for-like) compared with the first nine months

of 2021.

Other revenue for the third quarter of 2022

totaled €23 million, up 100.1% as reported (+99.7%

like-for-like). This significant increase reflects the impact of

strong business growth on the float2, as well as favorable changes

in interest rates in all regions where the Group operates. The

gradual acceleration in other revenue growth period after period

can be attributed to the steady rise in interest rates observed for

several quarters now in Europe (outside the euro zone) and Latin

America, as well as to the first effects of interest rate increases

in the euro zone. For the nine months ended September 30,

2022, other revenue came to €53 million, representing an

increase of 67.3% as reported (+65.4% like-for-like).

OUTLOOK

After achieving record results in the first

half, Edenred confirmed its very good business momentum in the

third quarter.

Thanks to its segmented sales approach, Edenred

continues to penetrate its core markets, with the economic

environment further enhancing the attractiveness of its solutions,

which notably enable employers to effectively boost their

employees’ purchasing power.

Edenred is also unlocking new growth

opportunities by expanding its portfolio of solutions to more fully

meet clients’ needs. In Employee Benefits, Beyond Food solutions

enable companies to enhance their employer brand and boost employee

engagement in a fast-changing working world. In Fleet &

Mobility Solutions, the Beyond Fuel offering (including maintenance

and toll management and VAT refund solutions) helps fleet managers

control their expenses. And in Complementary Solutions, the Beyond

Payment strategy to enhance the value proposition, as illustrated

by the acquisition of IPS, a leading invoice automation vendor, is

moving Edenred CSI up the accounts payable value chain.

Lastly, Edenred is accelerating its investments

in product and technology innovation to seize opportunities arising

from secular trends, such as remote working as a permanent feature

in the workplace, green commuting, the consumption of eco-friendly

products and the transition of fleets to electric or plug-in hybrid

vehicles.

Thanks to its ability to leverage the increasing

scale effect of its platform, in an environment where its solutions

are increasingly attractive and amid favorable economic conditions,

the Group is upgrading its 2022 EBITDA outlook to between

€810 million and €840 million3 (compared with a target

range of between €770 million and €820 million euros

announced on July 26, 2022).

SIGNIFICANT EVENTS IN THE THIRD

QUARTER

- Edenred joins the Euronext

CAC 40 ESG®

index

On September 19, 2022, the Group joined the

Paris stock exchange’s Euronext CAC 40 ESG index, taking its

place alongside other companies demonstrating outstanding

environmental, social and governance (ESG) practices.

SUBSEQUENT EVENTS

- Edenred expands its

Corporate Payment invoice automation capabilities in the US, with

the acquisition of IPS

On October 17, 2022, Edenred announced the

acquisition of IPS, a leading invoice automation vendor, through

its corporate payment subsidiary Edenred CSI.This acquisition

enhances Edenred CSI’s value proposition by expanding along the

procure-to-pay value chain and integrating a turnkey invoice

automation solution into its digital platform. By combining

suppliers’ invoice processing and payment automation, Edenred CSI

clients will have access to an end-to-end integrated solution that

further simplifies and streamlines the management of the entire

accounts payable process.

UPCOMING EVENTS

October 25, 2022: Capital Markets Day in

LondonFebruary 21, 2023: Full-year 2022 resultsApril 20,

2023: First-quarter 2023 revenueMay 11, 2023: General

Meeting

▬▬

About Edenred

Edenred is a leading digital platform for

services and payments and the everyday companion for people at

work, connecting 52 million users and more than 2 million

partner merchants in 45 countries via 950,000 corporate

clients.

Edenred offers specific-purpose payment

solutions for food (such as meal benefits), incentives (such as

gift cards, employee engagement platforms), mobility (such as

multi-energy, maintenance, toll, parking and commuter solutions)

and corporate payments (such as virtual cards).

True to the Group’s purpose, “Enrich

connections. For good.”, these solutions enhance users’

well-being and purchasing power. They improve companies’

attractiveness and efficiency, and vitalize the employment market

and the local economy. They also foster access to healthier food,

more environmentally friendly products and softer mobility.

Edenred’s 10,000 employees are committed to

making the world of work a connected ecosystem that is safer, more

efficient and more responsible every day.

In 2021, thanks to its global technology assets,

the Group managed close to €30 billion in business volume,

primarily carried out via mobile applications, online platforms and

cards.

Edenred is listed on the Euronext Paris stock

exchange and included in the following indices: CAC 40 ESG, CAC

Next 20, CAC Large 60, Euronext 100, FTSE4Good and MSCI

Europe.

The logos and other trademarks mentioned and

featured in this press release are registered trademarks of

Edenred S.E., its subsidiaries or third parties. They may not

be used for commercial purposes without prior written consent from

their owners.

▬▬

CONTACTS

|

Communications Department

Emmanuelle Châtelain +33 (0)1 86 67 24 36

emmanuelle.chatelain@edenred.com Media

Relations Matthieu Santalucia+33 (0)1 86 67 22

63matthieu.santalucia@edenred.com |

Investor

Relations Cédric Appert+33 (0)1 86 67 24

99cedric.appert@edenred.com Baptiste Fournier+33 (0)1 86 67

20 73baptiste.fournier@edenred.com |

APPENDICES

Operating revenue

| |

Q1 |

Q2 |

Q3 |

|

Year to date |

|

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

2022 |

2021 |

|

(in € millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

270 |

237 |

281 |

238 |

283 |

241 |

|

834 |

716 |

|

France |

76 |

69 |

74 |

66 |

71 |

65 |

|

220 |

200 |

|

Rest of Europe |

194 |

168 |

207 |

172 |

212 |

176 |

|

613 |

516 |

|

Latin America |

123 |

97 |

148 |

107 |

161 |

120 |

|

432 |

324 |

|

Rest of the world |

33 |

29 |

36 |

28 |

40 |

33 |

|

109 |

90 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

426 |

363 |

465 |

373 |

484 |

393 |

|

1,375 |

1,130 |

| |

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

|

Year to date |

|

|

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

|

In % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

+13.8% |

+13.4% |

+18.1% |

+18.0% |

+17.5% |

+17.6% |

|

+16.5% |

+16.3% |

|

France |

+10.3% |

+10.3% |

+12.2% |

+12.2% |

+8.7% |

+8.7% |

|

+10.4% |

+10.4% |

|

Rest of Europe |

+15.3% |

+14.8% |

+20.3% |

+20.2% |

+20.8% |

+20.8% |

|

+18.8% |

+18.6% |

|

Latin America |

+26.5% |

+16.5% |

+38.0% |

+17.2% |

+34.6% |

+19.9% |

|

+33.3% |

+18.0% |

|

Rest of the world |

+14.3% |

+26.0% |

+26.9% |

+36.7% |

+21.1% |

+27.7% |

|

+20.7% |

+30.0% |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

+17.3% |

+15.3% |

+24.5% |

+19.2% |

+23.0% |

+19.1% |

|

+21.7% |

+17.9% |

Other revenue

| |

Q1 |

Q2 |

Q3 |

|

Year to date |

|

(in € millions) |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

2022 |

2021 |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

5 |

3 |

6 |

3 |

9 |

3 |

|

20 |

10 |

|

France |

2 |

1 |

1 |

1 |

1 |

1 |

|

4 |

4 |

|

Rest of Europe |

3 |

2 |

5 |

2 |

8 |

2 |

|

16 |

6 |

|

Latin America |

7 |

6 |

10 |

6 |

11 |

6 |

|

28 |

18 |

|

Rest of the world |

1 |

1 |

2 |

1 |

2 |

1 |

|

5 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

13 |

10 |

18 |

10 |

23 |

11 |

|

53 |

32 |

| |

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

|

Year to date |

|

|

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

|

In % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

+40.5% |

+39.1% |

+89.8% |

+88.9% |

+165.4% |

+165.3% |

|

+99.3% |

+98.5% |

|

France |

+5.6% |

+5.6% |

-2.0% |

-2.0% |

+4.0% |

+4.0% |

|

+2.5% |

+2.5% |

|

Rest of Europe |

+66.0% |

+63.5% |

+159.5% |

+158.0% |

+281.4% |

+281.2% |

|

+170.5% |

+169.1% |

|

Latin America |

+33.5% |

+22.8% |

+71.1% |

+44.1% |

+74.7% |

+54.0% |

|

+60.6% |

+41.0% |

|

Rest of the world |

-18.9% |

+35.3% |

+10.1% |

+78.4% |

+60.0% |

+149.1% |

|

+18.2% |

+89.2% |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

+28.9% |

+29.7% |

+69.1% |

+63.0% |

+100.1% |

+99.7% |

|

+67.3% |

+65.4% |

Total revenue

| |

Q1 |

Q2 |

Q3 |

|

Year to date |

|

(in € millions) |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|

2022 |

2021 |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

275 |

240 |

287 |

241 |

292 |

244 |

|

854 |

726 |

|

France |

78 |

70 |

75 |

67 |

72 |

67 |

|

225 |

204 |

|

Rest of Europe |

197 |

170 |

212 |

174 |

220 |

178 |

|

629 |

522 |

|

Latin America |

130 |

103 |

158 |

113 |

172 |

126 |

|

460 |

342 |

|

Rest of the world |

34 |

30 |

38 |

30 |

42 |

34 |

|

114 |

95 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

439 |

373 |

482 |

384 |

506 |

405 |

|

1 428 |

1 162 |

| |

|

|

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

Q3 |

|

Year to date |

|

|

Change reported |

Change L/L |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

|

In % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

+14.2% |

+13.8% |

+19.1% |

+19.0% |

+19.6% |

+19.6% |

|

+17.6% |

+17.5% |

|

France |

+10.2% |

+10.2% |

+11.9% |

+11.9% |

+8.6% |

+8.6% |

|

+10.2% |

+10.2% |

|

Rest of Europe |

+15.9% |

+15.3% |

+21.9% |

+21.7% |

+23.7% |

+23.8% |

|

+20.5% |

+20.3% |

|

Latin America |

+26.9% |

+16.8% |

+39.6% |

+18.6% |

+36.7% |

+21.7% |

|

+34.7% |

+19.2% |

|

Rest of the world |

+12.9% |

+26.5% |

+26.1% |

+38.6% |

+22.8% |

+32.9% |

|

+20.6% |

+32.6% |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

+17.6% |

+15.7% |

+25.7% |

+20.4% |

+25.2% |

+21.4% |

|

+22.9% |

+19.2% |

1 Calculated based on an assumption of an average euro/Brazilian

real exchange rate for the fourth quarter of 2022 equal to the

closing spot rate on September 30, 2022.2 The float

corresponds to a portion of the operating working capital from the

preloading of funds by corporate clients.3 Calculated based on an

assumption of an average euro/Brazilian real exchange rate for the

fourth quarter of 2022 equal to the closing spot rate on

September 30, 2022.

- 2022 10 20 - Edenred - PR - Q3 2022 revenue

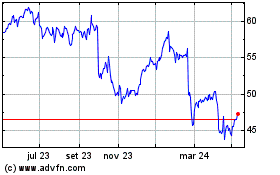

Edenred (EU:EDEN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

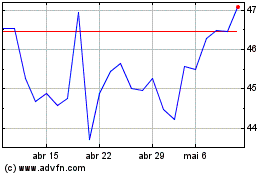

Edenred (EU:EDEN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024