Astrotech Reports First Quarter of Fiscal Year 2023 Financial Results

10 Novembro 2022 - 10:00AM

Astrotech Corporation (Nasdaq: ASTC) (the “Company” or “Astrotech”)

reported its financial results for the first quarter of fiscal year

2023, which ended September 30, 2022.

Financial Highlights & Recent

Developments

- Astrotech’s consolidated balance

sheet remains strong with $48.9 million in cash and liquid

investments, which are anticipated to support our research and

development, organic growth, and potential synergistic acquisition

targets.

- Field trials continue with our AgLAB

subsidiary with promising results for the AgLAB-1000-D2™. We

believe hemp and cannabis distillers can gain significant

improvement on their processing yields by utilizing the

AgLAB-1000-D2 system with their existing short path-molecular

distillation systems.

- We began our first

production run of the AgLAB-1000-D2 and sales efforts are currently

underway.

- Our BreathTech subsidiary recently

contracted with a clinical research firm to assist in procuring

breath samples collected from patients. These samples are being

used to further develop the library of the BreathTest-1000™, a

breath analysis tool to screen for volatile organic compound (VOC)

metabolites found in a person’s breath that could indicate they

have a bacterial or viral infection. Preliminary results have shown

that our BreathTest-1000 can discriminate between background breath

and the disease VOCs.

- Revenue for the quarter totaled $38

thousand and was mainly related to ongoing maintenance services and

sales of consumables for the TRACER 1000™ explosive trace detector

(ETD). The decrease in revenue from the first quarter of fiscal

2021 is primarily the result of Astrotech shifting focus from the

volatile ETD market to commercialization and sales of the

AgLAB-1000-D2.

- Astrotech’s Board of Directors

authorized a $1 million dollar share repurchase program on November

9, 2022.

“The start of fiscal year 2023 has brought exciting progress to

the Company,” stated Thomas B. Pickens, III, Astrotech’s Chairman

and Chief Executive Officer. “Our field trials have validated that

the AgLAB-1000-D2 represents a significant technological

advancement by using a mass-spectrometer to control in-situ

chemical processing. We also continue to make strides in our

R&D efforts at BreathTech, as we are now processing breath

samples from patients and building a library of VOC metabolites

that will be integrated into our BreathTest-1000. This library is

important to the detection abilities of our mass spectrometer

technology, and we’re encouraged at the progress we’re making.

Lastly, our Board has authorized a share repurchase program to

opportunistically invest in our business as a means to remain

committed to enhancing long-term shareholder value,” concluded Mr.

Pickens.

Share Repurchase Program

On November 9, 2022, Astrotech’s Board of Directors authorized a

share repurchase program that allows the Company to repurchase up

to $1 million of the Company’s common stock beginning November 17,

2022, and continuing through and including November 17, 2023. The

shares may be repurchased from time to time in open market

transactions, through block trades, in privately negotiated

transactions, through derivative transactions or by other means in

accordance with federal securities laws, including Rule 10b5-1

programs. The timing, as well as the number and value of shares

repurchased under the program, will be determined by the Company at

its discretion and will depend on a variety of factors, including

management’s assessment of the intrinsic value of the Company’s

common stock, the market price of the Company’s common stock,

general market and economic conditions, available liquidity,

compliance with the Company’s agreements, applicable legal

requirements, and other considerations. The share repurchase plan

does not obligate the Company to repurchase any specific number of

shares and may be suspended, modified, or discontinued at any time

without prior notice. The Company expects to fund the repurchases

with available working capital.

About Astrotech Corporation

Astrotech (Nasdaq: ASTC) is a mass spectrometry company

that launches, manages, and commercializes scalable companies based

on its innovative core technology through its wholly-owned

subsidiaries. 1st Detect develops,

manufactures, and sells trace detectors for use in the security and

detection market. AgLAB is developing chemical

analyzers for use in the agriculture

market. BreathTech is developing a breath

analysis tool to provide early detection of lung diseases.

Astrotech is headquartered in Austin, Texas. For information,

please visit www.astrotechcorp.com.

About the AgLAB-1000™ and the

BreathTest-1000™

This press release contains information about our new products

under development, AgLAB-1000 and BreathTest-1000. Product

development involves a high degree of risk and uncertainty, and

there can be no assurance that our new products will be

successfully developed, achieve their intended benefits, receive

full market authorization, or be commercially successful. In

addition, FDA approval will be required to market BreathTest-1000

in the United States. Obtaining FDA approval is a complex and

lengthy process, and there can be no assurance that FDA approval

for BreathTest-1000 will be granted on a timely basis or at

all.

Forward-Looking Statements

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, the severity and duration of the COVID-19 pandemic and

its impact on the U.S. and worldwide economy, the timing, scope and

effect of further U.S. and international governmental, regulatory,

fiscal, monetary and public health responses to the COVID-19

pandemic, the Company’s use of proceeds from the common stock

offerings, whether we can successfully complete the development of

our new products and proprietary technologies, whether we can

obtain the FDA and other regulatory approvals required to market

our products under development in the United States or abroad,

whether the market will accept our products and services and

whether we are successful in identifying, completing and

integrating acquisitions, as well as other risk factors and

business considerations described in the Company’s Securities and

Exchange Commission filings including the Company’s most recent

Annual Report on Form 10-K. Any forward-looking statements in this

document should be evaluated in light of these important risk

factors. Although the Company believes the expectations reflected

in its forward-looking statements are reasonable and are based on

reasonable assumptions, no assurance can be given that these

assumptions are accurate or that any of these expectations will be

achieved (in full or at all) or will prove to have been correct.

Moreover, such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

the Company, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements.

In addition, any forward-looking statements included in this press

release represent the Company’s views only as of the date of its

publication and should not be relied upon as representing its views

as of any subsequent date. The Company assumes no obligation to

correct or update these forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

Company Contact: Jaime

Hinojosa, Chief Financial Officer, Astrotech Corporation, (512)

485-9530

Tables follow

ASTROTECH

CORPORATIONConsolidated Statements of Operations and

Comprehensive Loss(In thousands, except per share data)

| |

Three Months Ended |

|

| |

September 30, |

|

| |

2022 |

|

|

2021 |

|

|

Revenue |

$ |

38 |

|

|

$ |

187 |

|

| Cost of revenue |

|

32 |

|

|

|

175 |

|

| Gross

profit |

|

6 |

|

|

|

12 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

1,642 |

|

|

|

1,426 |

|

|

Research and development |

|

1,129 |

|

|

|

639 |

|

| Total operating expenses |

|

2,771 |

|

|

|

2,065 |

|

| Loss from

operations |

|

(2,765 |

) |

|

|

(2,053 |

) |

|

Other income and (expense), net |

|

235 |

|

|

|

24 |

|

| Loss from operations

before income taxes |

|

(2,530 |

) |

|

|

(2,029 |

) |

|

Income tax benefit |

|

— |

|

|

|

— |

|

| Net loss |

$ |

(2,530 |

) |

|

$ |

(2,029 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

48,355 |

|

|

|

47,428 |

|

| Basic and diluted net

loss per common share: |

|

|

|

|

|

|

|

| Net loss |

$ |

(0.05 |

) |

|

$ |

(0.04 |

) |

| Other comprehensive

loss, net of tax: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(2,530 |

) |

|

$ |

(2,029 |

) |

|

Available-for-sale securities: |

|

|

|

|

|

|

|

|

Net unrealized losses, net of zero tax expense |

|

(368 |

) |

|

|

(48 |

) |

| Total comprehensive

loss |

$ |

(2,898 |

) |

|

$ |

(2,077 |

) |

ASTROTECH

CORPORATIONConsolidated Balance Sheets(In thousands,

except share and per share data)

| |

September 30, |

|

|

June 30, |

|

| |

2022 |

|

|

2022 |

|

| |

(Unaudited) |

|

|

(Note) |

|

|

Assets |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

18,273 |

|

|

$ |

26,453 |

|

|

Short-term investments |

|

30,675 |

|

|

|

26,173 |

|

|

Accounts receivable |

|

38 |

|

|

|

56 |

|

|

Cost and estimated revenue in excess of billings |

|

— |

|

|

|

2 |

|

|

Inventory, net: |

|

|

|

|

|

|

|

|

Raw materials |

|

925 |

|

|

|

864 |

|

|

Work-in-process |

|

76 |

|

|

|

136 |

|

|

Finished goods |

|

465 |

|

|

|

518 |

|

|

Prepaid expenses and other current assets |

|

901 |

|

|

|

748 |

|

| Total current

assets |

|

51,353 |

|

|

|

54,950 |

|

|

Property and equipment, net |

|

1,350 |

|

|

|

1,098 |

|

|

Operating leases, right-of-use assets, net |

|

140 |

|

|

|

162 |

|

|

Other assets |

|

11 |

|

|

|

11 |

|

| Total

assets |

$ |

52,854 |

|

|

$ |

56,221 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

|

287 |

|

|

|

169 |

|

|

Payroll related accruals |

|

478 |

|

|

|

816 |

|

|

Accrued expenses and other liabilities |

|

883 |

|

|

|

961 |

|

|

Income tax payable |

|

1 |

|

|

|

2 |

|

|

Term note payable - related party |

|

— |

|

|

|

500 |

|

|

Lease liabilities, current |

|

239 |

|

|

|

234 |

|

| Total current

liabilities |

|

1,888 |

|

|

|

2,682 |

|

|

Lease liabilities, net of current portion |

|

241 |

|

|

|

303 |

|

| Total

liabilities |

|

2,129 |

|

|

|

2,985 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

Convertible preferred stock, $0.001 par value, 2,500,000 shares

authorized; 280,898 shares of Series D issued and outstanding at

September 30, 2022 and June 30, 2022 |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 250,000,000 shares authorized at

September 30, 2022 and June 30, 2022; 50,629,183 and 50,567,864

shares issued and outstanding at September 30, 2022 and June 30,

2022, respectively |

|

190,642 |

|

|

|

190,642 |

|

|

Additional paid-in capital |

|

79,892 |

|

|

|

79,505 |

|

|

Accumulated deficit |

|

(218,242 |

) |

|

|

(215,712 |

) |

|

Accumulated other comprehensive loss |

|

(1,567 |

) |

|

|

(1,199 |

) |

| Total stockholders’

equity |

|

50,725 |

|

|

|

53,236 |

|

| Total liabilities and

stockholders’ equity |

$ |

52,854 |

|

|

$ |

56,221 |

|

Note: The balance sheet at June 30, 2022, has

been derived from the audited consolidated financial statements at

that date but does not include all of the information and footnotes

required by the United States generally accepted accounting

principles for complete financial statements.

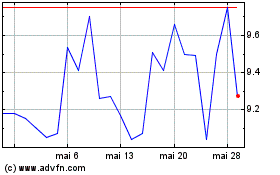

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025