Aritzia Inc. ("

Aritzia" or the

"

Company") (TSX: ATZ ), a vertically integrated,

innovative design house offering Everyday Luxury online and in its

boutiques, today announced that certain entities owned and/or

controlled, directly or indirectly, by Brian Hill, Founder and

Executive Chair of Aritzia, or Brian Hill and his immediate family

(collectively, the “

Selling Shareholders”), have

entered into an agreement with CIBC Capital Markets (the

“

Underwriter”), pursuant to which the Underwriter

has agreed to purchase on a bought deal basis an aggregate of

1,360,000 subordinate voting shares of the Company

(“

Shares”) held by the Selling Shareholders at an

offering price of $51.60 per Share (the “

Offering

Price”) for total gross proceeds to the Selling

Shareholders of $70,176,000 (the “

Offering”).

Proceeds from the Offering will be paid to the Selling Shareholders

and the Company will not receive any proceeds from the Offering.

The Selling Shareholders have granted the Underwriter an

over-allotment option, exercisable at the Offering Price for a

period of 30 days following the closing of the Offering, to

purchase up to an additional 140,000 Shares to cover

over-allotments, if any, and for market stabilization purposes.

Following the Offering, Mr. Hill will remain the

Company’s largest shareholder with an approximately 18.7% equity

interest. “I am incredibly proud of our people and our performance

as Aritzia continues to grow at a remarkable pace. As I look

forward, I am excited to work alongside Jennifer Wong to deliver

Everyday Luxury to our clients,” said Mr. Hill. The proceeds from

the Offering are intended for estate planning, investment

diversification and charitable giving purposes (including through

the ARON Charitable Foundation, the Hill family’s charitable

foundation).

Pursuant to the Offering, the Selling

Shareholders will be selling a total of 1,360,000 Shares (assuming

no exercise of the over-allotment option). Following completion of

the Offering (assuming no exercise of the over-allotment option),

there will be 89,446,185 subordinate voting shares outstanding and

20,577,349 multiple voting shares outstanding of the Company.

The Shares will be offered by way of a short

form prospectus in all of the provinces and territories of Canada,

excluding Quebec, and may also be offered by way of private

placement in the United States and internationally as permitted. A

preliminary short form prospectus relating to the Offering will be

filed by no later than November 18, 2022 with the Canadian

securities regulatory authorities and closing of the Offering is

expected to occur on or about November 30, 2022.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

Shares have not been registered under the United States Securities

Act of 1933, as amended (the “U.S. Securities

Act”) or any state securities laws. Accordingly, the

Shares may not be offered or sold within the United States unless

registered under the U.S. Securities Act and applicable state

securities laws or pursuant to exemptions from the registration

requirements of the U.S. Securities Act and applicable state

securities laws. This news release does not constitute an offer to

sell or a solicitation of an offer to buy any securities of Aritzia

in any jurisdiction in which such offer, solicitation or sale would

be unlawful.

About Aritzia

Aritzia is a vertically integrated design house

with an innovative global platform, home to an extensive portfolio

of exclusive brands for every function and individual aesthetic.

We're about good design, quality materials, and timeless style that

endures and inspires — all with the wellbeing of our People and

Planet in mind. We call this Everyday Luxury.

Founded in 1984, in Vancouver, Canada, we create

and curate products that are both beautiful and beautifully made,

cultivate aspirational environments, offer engaging service that

delights, and connect through captivating communications. We pride

ourselves on providing immersive and highly personal shopping

experiences at aritzia.com and in our 100+ boutiques throughout

North America to everyone, everywhere.Everyday Luxury. To

Elevate Your World.™

Required Early Warning

Disclosure

This additional disclosure is being provided

pursuant to National Instrument 62-103 – The Early Warning

System and Related Take-Over Bid and Insider Reporting Issues,

which also requires a report to be filed by the Hill Entities (as

defined below) with the regulatory authorities in each jurisdiction

in which the Company is a reporting issuer containing information

with respect to the foregoing matters (the “Early Warning

Report”).

Mr. Hill, through entities owned and/or

controlled, directly or indirectly, by him or by him and his

immediate family, including AHI (C2) Investment Limited Partnership

and the ARON Charitable Foundation (the “Hill

Entities”), currently holds 21,937,349 multiple voting

shares representing an equity interest of approximately 19.9% and a

voting interest of approximately 71.4%, in each case, on a

non-diluted basis. The multiple voting shares represent

approximately 100.0% of the outstanding multiple voting shares, in

each case, on a non-diluted basis. In addition, Mr. Hill holds

536,210 options to acquire subordinate voting shares (each an

“Option”) and 166,319 performance share units

(each a “PSU”).

Following closing of the Offering (assuming no

exercise of the over-allotment option), the Hill Entities will hold

no subordinate voting shares and 20,577,349 multiple voting shares

representing an equity interest of approximately 18.7%, and a

voting interest of approximately 69.7%, in each case, on a

non-diluted basis. The multiple voting shares will represent

approximately 100.0% of the outstanding multiple voting shares. Mr.

Hill will continue to hold 536,210 Options and 166,319 PSU’s

following closing of the Offering. Each multiple voting share

represents ten votes on all matters upon which holders of shares in

the capital of Aritzia are entitled to vote and is convertible into

one subordinate voting share at any time at the sole option of the

holder.

The Hill Entities may, depending on market

conditions, acquire additional subordinate voting shares or dispose

of multiple voting shares or subordinate voting shares in the

future whether in transactions over the open market or through

privately negotiated arrangements or otherwise, subject to a number

of factors, including general market conditions and estate

planning, investment diversification and charitable giving purposes

(including through the ARON Charitable Foundation, the Hill

family’s charitable foundation).

Aritzia’s head office is located at 611

Alexander St., Suite 118, Vancouver, BC, Canada, V6A 1E1.

A copy of the Early Warning Report will be filed

under Aritzia’s profile on the System for Electronic Document

Analysis and Retrieval ("SEDAR") and further

information and/or a copy of the Early Warning Report may be

obtained by contacting David Pfeifer at (604) 404-0443. The

head office of each of AHI (C2) Investment Limited Partnership

and the ARON Charitable Foundation is located at 611 Alexander St.,

Suite 408, Vancouver, BC, Canada, V6A 1E1.

Forward-Looking Information

Certain statements made in this press release

may constitute forward-looking information under applicable

securities laws. These statements may relate to the closing date of

the Offering, the completion of the Offering, the exercise by the

Underwriter of the over-allotment option, the Company’s future

prospects and opportunities and potential future acquisitions or

dispositions by the Hill Entities of securities of the Company.

Particularly, information regarding our expectations of future

results, targets, performance achievements, prospects or

opportunities is forward-looking information. Often but not always,

forward-looking statements can be identified by the use of

forward-looking terminology such as "may", "will", "expect",

"believe", "estimate", "plan", "could", "should", "would",

"outlook", "forecast", "anticipate", "foresee", "continue" or the

negative of these terms or variations of them or similar

terminology.

Given this unprecedented period of uncertainty,

there can be no assurances regarding: (a) the limitations or

restrictions that may be placed on servicing our clients in

reopened boutiques or potential re-closing of boutiques; (b) the

COVID-19-related impacts on Aritzia's business, operations, supply

chain performance and growth strategies, (c) Aritzia's ability to

mitigate such impacts, including ongoing measures to enhance

short-term liquidity, contain costs and safeguard the business; (d)

general economic conditions related to COVID-19 and impacts to

consumer discretionary spending and shopping habits; (e) credit,

market, currency, interest rates, operational, and liquidity risks

generally; (f) geopolitical events; and (g) other risks

inherent to Aritzia's business and/or factors beyond its control

which could have a material adverse effect on the Company.

Many factors could cause our actual results,

level of activity, performance or achievements or future events or

developments to differ materially from those expressed or implied

by the forward-looking statements, including, without limitation,

the factors discussed in the "Risk Factors" section of the

Company's annual information form dated May 5, 2022 for the fiscal

year ended February 27, 2022 (the "AIF"). A copy of the AIF and the

Company's other publicly filed documents can be accessed under the

Company's profile on the System for Electronic Document Analysis

and Retrieval ("SEDAR") at www.sedar.com.

The Company cautions that the list of risk

factors and uncertainties described in the AIF is not exhaustive

and other factors could also adversely affect its results. Readers

are urged to consider the risks, uncertainties and assumptions

carefully in evaluating the forward-looking information and are

cautioned not to place undue reliance on such information. The

forward-looking information contained in this press release

represents our expectations as of the date of this press release

(or as the date they are otherwise stated to be made), and are

subject to change after such date. However, we disclaim any

intention or obligation or undertaking to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

For more information:Beth Reed

Vice President, Investor Relations 646-603-9844

breed@aritzia.com

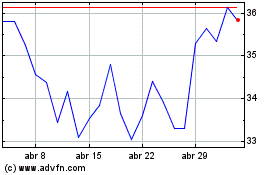

Aritzia (TSX:ATZ)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Aritzia (TSX:ATZ)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025