Augusta Gold Corp. (TSX:G; OTCQB:AUGG; FSE:11B) (“

Augusta

Gold” or the “

Company”) is pleased to

announce that it has entered into an agreement with Eight Capital,

to act as the lead underwriter and sole bookrunner on its own

behalf and, if applicable, on behalf of a syndicate of underwriters

(collectively, the “

Underwriters”), pursuant to

which the Underwriters have agreed to purchase, on a bought deal

underwritten basis, 5,847,954 units of Augusta Gold (the

“

Units”) at a price of C$1.71 per Unit for

aggregate gross proceeds of approximately C$10 million (the

“

Offering”). Each Unit will be comprised of one

share of the Company’s common stock and one-half of one common

stock purchase warrant (each whole common stock purchase warrant, a

“

Warrant”). Each Warrant will entitle the holder

to acquire one share of the Company’s common stock for a period of

36 months following the closing of the Offering at a price of

C$2.30.

In addition, Augusta Gold has agreed to grant

the Underwriters an option (the “Over-Allotment

Option”), exercisable at any time, in whole or in part,

until the date that is 30 days following the closing of the

Offering, to purchase up to an additional 15% of the number of

Units. The Over-Allotment Option may be exercised for the purpose

of covering over-allotments made in connection with the Offering

and for market stabilization purposes. The Offering is expected to

close on or about January 18, 2023, subject to customary closing

conditions, including the approval of the Toronto Stock

Exchange.

Augusta Gold intends to use the net proceeds of

the Offering for the advancement of the Bullfrog Project, and for

working capital and general corporate purposes.

The Offering is being made in the United States

pursuant to a preliminary prospectus supplement to the base

prospectus contained in the shelf registration statement on Form

S-3 (No. 333-266055) that was filed by Augusta Gold with the

Securities and Exchange Commission (the “SEC”) on

July 8, 2022 and declared effective by the SEC on August 18, 2022,

and in Canada pursuant to the final northbound multijurisdictional

disclosure system base shelf prospectus dated August 18, 2022 that

was filed with the securities regulators in each of the provinces

and territories of Canada other than Québec (collectively, the

“Canadian Regulators”). The Offering is being made

only by means of a U.S. and Canadian preliminary prospectus and

accompanying base prospectus. Prospective investors should

carefully read the preliminary prospectus supplement, the final

prospectus supplement, when available, the accompanying base

prospectus and related registration statement.

An underwriting agreement, as well as the U.S.

or Canadian preliminary prospectus supplements, the final

prospectus supplements, when available, and accompanying base

prospectus relating to and describing the terms of the Offering

have been or will be filed with the SEC and the Canadian

Regulators, and will be available on the SEC’s website at

www.sec.gov and at www.sedar.com under Augusta Gold’s profile.

Copies of the underwriting agreement, the U.S. or Canadian

preliminary prospectus supplements, the final prospectus

supplements, when available, and the accompanying base prospectus

relating to the offering may also be obtained, when available, by

contacting Eight Capital Attention: Enoch Lee at 647-265-8217 or

email: elee@viiicapital.com.

This news release shall not constitute an offer

to sell or a solicitation of an offer to buy these or any other

securities. There shall not be any sale of these securities in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Enquiries

Telephone: 604-638-1468Email:

info@augustagold.com

About Augusta Gold

Augusta Gold is an exploration and development

company focused on building a long-term business that delivers

stakeholder value through developing the Reward and Bullfrog gold

projects and pursuing accretive M&A opportunities. The Reward

and Bullfrog gold projects are located in the prolific Bullfrog

mining district approximately 120 miles north-west of Las Vegas,

Nevada and just outside of Beatty, Nevada. The Company is led by a

management team and board of directors with a proven track record

of success in financing and developing mining assets and delivering

shareholder value.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements and information contained in

this new release constitute “forward-looking statements”, and

“forward-looking information” within the meaning of applicable

securities laws (collectively, “forward-looking statements”). These

statements appear in a number of places in this news release and

include statements regarding our intent, or the beliefs or current

expectations of our officers and directors, including the

anticipated closing date of the Offering, the anticipated use of

proceeds of the Offering and our focus on building a long-term

business that delivers stakeholder value through developing the

Reward and Bullfrog gold projects and pursuing accretive M&A

opportunities. When used in this news release words such as “to

be”, "will", "planned", "expected", "potential", “anticipated” and

similar expressions are intended to identify these forward-looking

statements. Although the Company believes that the expectations

reflected in such forward-looking statements and/or information are

reasonable, undue reliance should not be placed on forward-looking

statements since the Company can give no assurance that such

expectations will prove to be correct. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to vary materially from those

anticipated in such forward-looking statements, including the

risks, uncertainties and other factors identified in the Company's

periodic filings with Canadian Regulators and the SEC. Such

forward-looking statements are based on various assumptions,

including assumptions made with regard to assumptions about future

prices of gold, and other metal prices, currency exchange rates and

interest rates, favourable operating conditions, political

stability, obtaining governmental approvals and financing on time,

obtaining renewals for existing licenses and permits and obtaining

required licenses and permits, labour stability, stability in

market conditions, the impact from the pandemic of the novel

coronavirus (COVID-19), availability of equipment, the availability

of drill rigs, the timing of the publication of any updated mineral

resource estimates. While the Company considers these assumptions

to be reasonable, based on information currently available, they

may prove to be incorrect. Except as required by applicable law, we

assume no obligation to update or to publicly announce the results

of any change to any forward-looking statement contained herein to

reflect actual results, future events or developments, changes in

assumptions or changes in other factors affecting the

forward-looking statements. If we update any one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements. You should not place undue importance

on forward-looking statements and should not rely upon these

statements as of any other date. All forward-looking statements

contained in this news release are expressly qualified in their

entirety by this cautionary note.

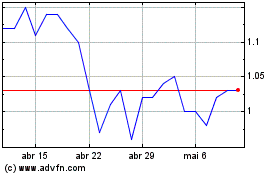

Augusta Gold (TSX:G)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Augusta Gold (TSX:G)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024