Atlas Salt (the “Company” or “Atlas” - TSXV: SALT; OTCQB:

REMRF), 100% owner of North America’s premier undeveloped

high-grade salt project, is pleased to announce that further to

its news releases dated January 12, 2023, and January 17, 2023, it

has successfully closed the second and final tranche (the “Second

Tranche”) of its $10 million non-brokered private placement (the

“Offering”).

Mr. Rowland Howe, Atlas Salt President,

commented: “This $10 million private placement with two large

institutional investors is very strategic at this stage of Great

Atlantic’s development. Atlas is blessed with a unique and highly

advantaged asset in the heart of a robust road salt market in

eastern North America facing a domestic production shortfall, the

result of only one new mine being built in the last 60 years. With

these ‘anchor’ investors, Atlas has added considerable leverage to

its strategy of maximizing the potential value of this asset and

opportunity for shareholders.”

Mr. Howe added, “The Great Atlantic independent

Preliminary Economic Assessment is on track to be released before

the end of January.”

Second Tranche Details

The Second Tranche consisted of an aggregate of

2,500,000 units (the “Units”) at a price of $2.00 per Unit for

gross proceeds of $5,000,000. Each Unit consisted of one common

share of the Company and one-half of one common share purchase

warrant for an aggregate of 2,500,000 common shares and 1,250,000

warrants. Each full warrant will entitle the holder thereof to

purchase one common share at a price of $2.40 per share at any

time on or before January 19, 2025.

In connection with the Second Tranche, the

Company paid cash finders’ fees of $350,000 and issued 175,000

finders’ warrants. Each finders’ warrant entitles the holder to

purchase one common share of the Company for a period of 24 months

from the date of issuance at a price of $2.40 per warrant.

Use of Proceeds

The Company intends to use the proceeds raised

from the Offering for general working capital purposes and the

advancement and initiation of the pre-production development of

the Great Atlantic Salt Project on the west coast of Newfoundland.

Atlas now has a current cash position of $18 million with no

debt.

Other Details

The Units were sold to purchasers resident in

Canada pursuant to the listed issuer financing exemption under Part

5A of National Instrument 45-106 - Prospectus Exemptions (the

“Listed Issuer Financing Exemption”). Since the Offering was

completed pursuant to the Listed Issuer Financing Exemption, the

securities issued in the Offering will not be subject to a hold

period pursuant to applicable Canadian securities laws. The Second

Tranche was conditionally approved by the TSX Venture Exchange (the

“Exchange”) on January 13, 2023. The Closing of the Offering

remains subject to final acceptance by the Exchange. The securities

described herein have not been, and will not be, registered under

the United States Securities Act of 1933, as amended (the "U.S.

Securities Act"), or any U.S. state securities laws, and may not be

offered or sold in the United States or to, or for the account or

benefit of, United States’ persons absent registration or an

applicable exemption from the registration requirements of the U.S.

Securities Act and applicable U.S. state securities laws. This

press release does not constitute an offer to sell or the

solicitation of an offer to buy securities in the United States,

nor in any other jurisdiction.

Atlas Salt Corporate Video

Click on the following link to view the Company’s latest

corporate video:https://youtu.be/RlH5--Q2Vu0

Project Map

About Atlas Salt

Bringing the Power of SALT to

Investors: Atlas Salt owns 100% of the Great Atlantic salt

deposit strategically located in western Newfoundland in the middle

of the robust eastern North America road salt market. The project

features a large homogeneous high-grade resource located

immediately next to a deep water port. Atlas is also the largest

shareholder in Triple Point Resources as it pursues development of

the Fischell’s Brook Salt Dome in the heart of an emerging Clean

Energy Hub on the west coast of Newfoundland.

We seek Safe Harbor.

For information, please contact:

Patrick J. Laracy, CEO(709)

754-3186Email: laracy@atlassalt.com

MarketSmart Communications Inc.Adrian

SydenhamToll-free: 1-877-261-4466Email: info@marketsmart.ca

Forward-Looking Statements

This press release includes certain

"forward-looking information" and "forward-looking statements"

(collectively "forward-looking statements") within the meaning of

applicable Canadian securities legislation. All statements, other

than statements of historical fact, included herein, without

limitation, statements relating to the future operating or

financial performance of the Company, are forward-looking

statements. Forward-looking statements are frequently, but not

always, identified by words such as "expects", "anticipates",

"believes", "intends", "estimates", "potential", "possible", and

similar expressions, or statements that events, conditions, or

results "will", "may", "could", or "should" occur or be achieved.

Forward-looking statements in this press release relate to, among

other things: statements relating to the successful closing of the

Offering, the timing for delivery of the Preliminary Economic

Assessment, anticipated timing thereof and the intended use of

proceeds. Actual future results may differ materially. There can be

no assurance that such statements will prove to be accurate, and

actual results and future events could differ materially from

those anticipated in such statements. Forward looking statements

reflect the beliefs, opinions and projections on the date the

statements are made and are based upon a number of assumptions and

estimates that, while considered reasonable by the respective

parties, are inherently subject to significant business,

technical, economic, and competitive uncertainties and

contingencies. Many factors, both known and unknown, could cause

actual results, performance or achievements to be materially

different from the results, performance or achievements that are

or may be expressed or implied by such forward-looking statements

and the parties have made assumptions and estimates based on or

related to many of these factors. Such factors include, without

limitation: the timing, completion and delivery of the referenced

assessments and analysis. Readers should not place undue reliance

on the forward-looking statements and information contained in

this news release concerning these times. Except as required by

law, the Company does not assume any obligation to update the

forward-looking statements of beliefs, opinions, projections, or

other factors, should they change, except as required by law.

TSX Venture Exchange

Disclaimer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

A photo accompanying this announcement is

available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/fd360187-ee59-41bf-adc3-45398cdc0c2f

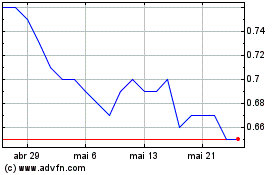

Atlas Salt (TSXV:SALT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Atlas Salt (TSXV:SALT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025