SABRE GOLD ANNOUNCES FILING OF AMENDED OFFERING DOCUMENT

23 Janeiro 2023 - 11:54AM

THIS NEWS RELEASE IS INTENDED FOR DISTRIBUTION IN

CANADA ONLY AND IS NOT AUTHORIZED FOR DISTRIBUTION TO UNITED STATES

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

Sabre Gold Mines Corp. (TSX: SGLD, OTCQB: SGLDF)

(“Sabre Gold” or the “Company”)

announces today that it has filed an amended offering document

dated January 23, 2023 (the “Amended Offering

Document”) in connection with its previously announced

private placement offering under the “listed issuer financing

exemption” on December 13, 2022.

On December 13, 2022, the Company announced a

non-brokered private placement of units (the

“Units”) for aggregate gross proceeds of a minimum

of $680,000 and up to maximum of $1.5 million at a price of C$0.17

per Unit by way of the “listed issuer financing exemption” (the

“Offering”) under National Instrument 45-106 –

Prospectus Exemptions in all the provinces of Canada with the

exception of Quebec. The Company has filed the Amended Offering

Document to disclose that a portion of the Offering will now be

made available to certain persons purchasing Units under available

prospectus exemptions other than the listed issuer financing

exemption, in addition to persons purchasing Units under the listed

issuer financing exemption, as previously announced.

The terms of the Units, minimum and maximum

amounts to be raised under the Offering and closing date for the

final tranche of the Offering, being January 27, 2023, remain

unchanged. The Offering remains subject to the approval of the

Toronto Stock Exchange.

The Amended Offering Document related to the

Offering is accessible under the Company’s profile at www.sedar.com

and at the Company’s website at www.sabre.gold. Prospective

investors should read the Amended Offering Document before making

an investment decision.

The securities described herein have not been,

and will not be, registered under the United States Securities Act,

or any state securities laws, and accordingly, may not be offered

or sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

About Sabre Gold Mines

Corp.

Sabre Gold is a diversified, multi-asset

near-term gold producer in North America which holds 100-per-cent

ownership of both the fully licensed and permitted Copperstone gold

mine located in Arizona, United States, and the Brewery Creek gold

mine located in Yukon, Canada, both of which are former producers.

Management intends to restart production at Copperstone followed by

Brewery Creek in the near term. Sabre Gold also holds other

investments and projects at varying stages of development.

Sabre Gold’s two advanced projects have

approximately 1.5 million ounces of gold in the Measured and

Indicated categories, and approximately 1.2 million ounces of gold

in the Inferred category. Additionally, both Copperstone and

Brewery Creek have considerable exploration upside with a combined

land package of over 230 square kilometers that will be further

drill tested with high-priority targets currently identified. Sabre

Gold is led by an experienced team of mining professionals with

backgrounds in exploration, mine building and operations.

For further information please visit the Sabre

Gold Mines Corp. website: (www.sabre.gold).

Andrew ElineskyCEO and President416-904-2725

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

information under Canadian securities legislation including

statements concerning the Company’s expectations with respect to

the Offering; completion of the Offering and the date of such

completion. These forward-looking statements entail various risks

and uncertainties that could cause actual results to differ

materially from those reflected in these forward-looking

statements. Such statements are based on current expectations, are

subject to a number of uncertainties and risks, and actual results

may differ materially from those contained in such statements.

These uncertainties and risks include, but are not limited to:

regulatory approval for the Offering; completion of the Offering;

the strength of the Canadian economy; the price of gold;

operational, funding, and liquidity risks; reliance on third

parties, exploration risk, failure to upgrade resources, the degree

to which mineral resource and reserve estimates are

reflective of actual mineral resources and reserves; the degree to

which factors which would make a mineral deposit commercially

viable are present, and the risks and hazards associated with

underground operations and other risks involved in the mineral

exploration and development industry. Risks and uncertainties about

Sabre Gold’s business are more fully discussed in the Company’s

disclosure materials, including its annual information form and

MD&A, filed with the securities regulatory authorities in

Canada and available at www.sedar.com and readers are urged to read

these materials. Sabre Gold assumes no obligation to update any

forward-looking statement or to update the reasons why actual

results could differ from such statements unless required by

law.

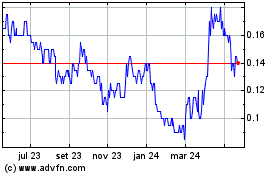

Sabre Gold Mines (TSX:SGLD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

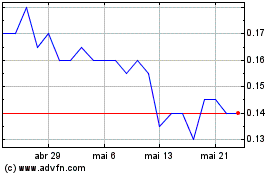

Sabre Gold Mines (TSX:SGLD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024