Ahold Delhaize delivers increased cost savings, supporting strong

Q4 financial results; 2023 outlook reinforces commitment to Leading

Together ambitions

- With double-digit food inflation levels in Q4, our brands

intensified efforts to deliver customers great value and access to

affordable and healthy food options. A key component of our efforts

has been our Save for Our Customers cost savings program, which

yielded 15% more savings than originally expected in 2022.

- Group net sales were €23.4 billion, up 8.1% in Q4 and 6.9% in

2022 at constant exchange rates and up 15.9% in Q4 and 15.1% in

2022 at actual exchange rates.

- Q4 comparable sales excluding gas increased by 9.3% in the U.S.

and 5.7% in Europe. This sales growth was underpinned by the

introduction of more entry-priced products, expanded high-quality

own-brand assortments and further rollout of personalized value

through our digital omnichannel loyalty programs.

- Net consumer online sales increased by 5.0% in Q4 and 4.9% in

2022 at constant exchange rates. Excluding bol.com, grocery online

sales increased 14.4% in Q4 and 11.8% in 2022 at constant

rates.

- Q4 underlying operating margin was 4.4%, an increase of 0.2

percentage points at constant and actual exchange rates. Underlying

operating margin for 2022 was 4.3%, a decrease of 0.1 percentage

points. Positive benefits in our Global Support Office partly

offset margin declines in Europe. The latter was mainly due to

intense cost inflation, particularly in energy, as well as

investments in our European customer value proposition to support

customers in the challenging macro environment.

- IFRS-reported operating income was €1,167 million in Q4

and €3,768 million in 2022. IFRS-reported diluted EPS was

€0.82 in Q4 and €2.54 in 2022.

- Q4 diluted underlying EPS was €0.72, an increase of 22.6% over

the prior year at actual rates. Our 2022 diluted underlying EPS was

€2.55, up 16.5% at actual rates compared to the prior year.

- 2022 free cash flow was €2.2 billion compared to the most

recent guidance of approximately €2 billion.

- We propose a cash dividend of €1.05 for fiscal year 2022, which

is a 10.5% increase compared to 2021.

- Ahold Delhaize introduces “Accelerate” initiative to bolster

Save For Our Customer cost savings program and provide additional

stimulus to key Leading Together strategic priorities.

- 2023 outlook: underlying operating margin of ≥4.0%; underlying

EPS to be around 2022 levels; free cash flow of approximately €2.0

billion; net capital expenditures of approximately €2.5

billion.

Zaandam, the Netherlands, February 15, 2023 – Ahold Delhaize,

one of the world’s largest food retail groups and a leader in both

supermarkets and e-commerce, reports fourth quarter results

today.

The summary report for the fourth quarter 2022 can be viewed and

downloaded at www.aholddelhaize.com.

Summary of key financial data

|

|

Ahold Delhaize Group |

The United States |

Europe |

|

€ million, except per share data |

Q4 2022 |

% change |

% changeconstantrates |

Q4 2022 |

% changeconstantrates |

Q4 2022 |

% changeconstantrates |

|

13 weeks 2022 vs. 13 weeks 2021 |

| Net sales |

23,359 |

15.9 % |

8.1 % |

14,782 |

9.2 % |

8,576 |

6.2 % |

| Comparable sales growth excluding

gasoline |

7.9 % |

|

|

9.3 % |

|

5.7 % |

|

| Online sales |

2,446 |

12.4 % |

7.4 % |

1,132 |

17.3 % |

1,314 |

— % |

| Net

consumer online sales |

3,237 |

8.6 % |

5.0 % |

1,132 |

17.3 % |

2,105 |

(0.6) % |

| Operating income |

1,167 |

30.5 % |

20.6 % |

857 |

16.0 % |

326 |

29.5 % |

| Operating margin |

5.0 % |

0.6 pp |

0.5 pp |

5.8 % |

0.3 pp |

3.8 % |

0.7 pp |

| Underlying operating income |

1,026 |

22.4 % |

13.8 % |

701 |

18.9 % |

340 |

1.4 % |

|

Underlying operating margin |

4.4 % |

0.2 pp |

0.2 pp |

4.7 % |

0.4 pp |

4.0 % |

(0.2) pp |

| Diluted EPS |

0.82 |

32.4 % |

22.5 % |

|

|

|

|

| Diluted underlying EPS |

0.72 |

22.6 % |

14.2 % |

|

|

|

|

| Free cash

flow |

1,481 |

290.4 % |

277.3 % |

|

|

|

|

|

|

Ahold Delhaize Group |

The United States |

Europe |

|

€ million, except per share data |

2022 |

% change |

% changeconstantrates |

2022 |

% changeconstantrates |

2022 |

% changeconstantrates |

|

52 weeks 2022 vs. 52 weeks 2021 |

| Net sales |

86,984 |

15.1 % |

6.9 % |

55,218 |

7.9 % |

31,767 |

5.0 % |

| Comparable sales growth excluding

gasoline |

5.4 % |

|

|

6.8 % |

|

2.9 % |

|

| Online sales |

8,618 |

11.9 % |

6.4 % |

4,157 |

14.5 % |

4,461 |

(0.3) % |

| Net

consumer online sales |

11,323 |

8.9 % |

4.9 % |

4,157 |

14.5 % |

7,166 |

(0.1) % |

| Operating income |

3,768 |

13.5 % |

4.9 % |

2,605 |

3.9 % |

1,173 |

(3.3) % |

| Operating margin |

4.3 % |

(0.1) pp |

(0.1) pp |

4.7 % |

(0.2) pp |

3.7 % |

(0.3) pp |

| Underlying operating income |

3,728 |

11.9 % |

3.5 % |

2,603 |

7.2 % |

1,131 |

(13.7) % |

|

Underlying operating margin |

4.3 % |

(0.1) pp |

(0.1) pp |

4.7 % |

— pp |

3.6 % |

(0.8) pp |

| Diluted EPS |

2.54 |

17.2 % |

8.4 % |

|

|

|

|

| Diluted underlying EPS |

2.55 |

16.5 % |

7.9 % |

|

|

|

|

| Free cash

flow |

2,188 |

35.2 % |

22.5 % |

|

|

|

|

Comments from Frans Muller, President and CEO of Ahold

Delhaize

“I am pleased to report a solid end to the year for Ahold

Delhaize. Our strong international portfolio of local brands has

continued to provide distinct competitive and societal advantages,

particularly from our scale and solid financial position. In this

challenging year, we have seen double-digit inflation levels not

witnessed in 40 years, an energy crisis created by war and the

ongoing effects of the global pandemic on people's lives. Our role

during this time has been clear: keeping shelf prices as low as

possible to support our customers and make healthy food options

accessible to all.

“During 2022, our family of great local brands also contributed

€218 million of charitable cash, products and food donations to

local and regional food banks and non-profit organizations. The

Food Lion Feeds program achieved an important milestone with its

one billionth meal donated, and is well on the way to reaching its

goal of 1.5 billion meals donated by 2025. Delhaize Belgium donated

emergency generators to the Ukrainian Red Cross, ensuring 95,000

Ukrainians continue to have access to clean water and heating.

Hannaford launched its "Eat Well, Be Well – A Path to Better

Health" initiative, which will provide $1.5 million in funding to

non-profit organizations for hosting programs that increase access

to healthy, fresh food tailored to the specific needs of an

individual's health conditions, and provide nutrition

education.

"In Q4, we again rallied our organization around our core

strengths – operational excellence, tight cost control and

disciplined capital allocation. This was critical to provide fuel

for reinvesting in our customer value proposition to offset the

impact of inflation wherever possible. To that end, we

significantly exceeded our original Save for Our Customers goals in

2022, generating €979 million in cost savings, which is over €100

million more than we had originally planned. I am proud of our

associates across Ahold Delhaize and our local brands who left no

stone unturned. As many of the sames challenges persist and may

even intensify in 2023, this formula will continue to play an

important role as we look for further opportunities to improve our

brands' operations.

"As our brands adapted their assortments and omnichannel

customer journeys to rising consumer price sensitivity, the

positive impact from our focus on providing great value without

compromising on quality was clearly reflected in our Q4 sales

figures. Comparable store sales ex gas grew 7.9% in Q4. Net

consumer online sales increased by 5.0%, and our online grocery

sales were up 14.4%. Leveraging these strong sales, we delivered an

underlying operating margin of 4.4% and diluted underlying EPS

growth of 22.6% in Q4. Our earnings were positively influenced by a

strong operating performance in the U.S., as well as foreign

exchange and interest rate changes, which offset higher margin

pressures in Europe.

"In the U.S., comparable sales accelerated at all the brands

versus Q3, resulting in a growth rate of 9.3%.This was driven by

strong holiday season activations. For example, the U.S. brands'

sales from loyalty programs and online orders reached all-time

highs. This has been a trend we have seen building throughout the

year, as our consistent investment in growing these capabilities

continues to pay off. Our brands' customer relationship management

campaigns are a good example, now reaching around 30 million

households and delivering over 10 billion personalized offers

annually. We are also increasingly encouraged by the progress we

see at Stop & Shop, where the brand's remodeled New York City

stores are delivering double-digit sales growth and exceeding

expectations. We plan to remodel a further eight stores in NYC in

Q1 2023, and roll out key learnings to 40 other stores in the fleet

throughout the year.

"In Europe, comparable store sales were up 5.7% in Q4. Excluding

bol.com, which continued to trade against the backdrop of a

challenging e-commerce market in the Benelux, comparable store

sales increased 6.9%. In the Central and Southeastern Europe (CSE)

region, we have now harmonized over 700 own brand products, and

continue to benefit from increased collaboration, harmonization of

processes and best-practice sharing. In the Netherlands, Albert

Heijn introduced dynamic digital discounting in all its stores,

enabling customers to purchase products nearing the end of their

shelf life with discounts ranging from 25% to 70%. In addition,

Albert Heijn entered into a partnership with Jan Linders

Supermarkets, with the vast majority of stores to be converted into

Albert Heijn franchisees on receiving the requisite approvals. The

agreement allows Albert Heijn to expand its regional coverage in

the south of the Netherlands. Underlying operating margins in

Europe decreased to 4.0% in Q4, as sharp increases in energy costs,

in particular, impacted our profitability by 0.5 percentage points.

While I am particularly proud of the mitigating actions and cost

savings delivered by the region in Q4 and throughout the year,

striking the right balance between savings and investments in 2023

will be even more important.

"At bol.com, for the full year, Gross Merchandise Value (GMV)

excluding VAT was €5.5 billion, down 1.9%, against a market which

declined around 6%. As you will remember, during the year, we made

some significant adjustments to bol.com’s medium term plans to

adapt to the current environment. As a result, despite higher

investments in the business, cost increases and sales deleverage,

bol.com remained profitable and delivered €125 million in

underlying EBITDA.

“At Ahold Delhaize, we believe that it is important that we

continue to make investments in our Healthy and Sustainable

strategy. In our own operations, in 2022 we achieved reductions in

CO2 emissions of 32% compared to our 2018 baseline (30% in 2021)

and tonnes of food waste per food sales of 33% against our 2016

baseline (20% in 2021). Our brands also continued to increase the

percentage of own brand healthy food sales to 54.4% in 2022, up one

percentage point compared to 2021. In November, we announced

updated interim CO2 emissions-reduction targets for the entire

value chain (scope 3) to at least 37% by 2030.

"We also reconfirmed our commitment to become net zero in our

own operations by 2040 and across the entire value chain by 2050.

The updated targets were the result of extensive review and are in

line with the UN's goal of keeping global warming below 1.5°C. For

Ahold Delhaize, the main drivers of emissions reduction in scope 3

fall under three categories: suppliers and farmers; low-carbon

products; and customer engagement. Encouraging and supporting our

suppliers to set their own emissions-reduction targets in line with

the latest scientific evidence, and signing up to the Science Based

Targets initiative is a key element of our decarbonization efforts.

Ahold Delhaize aims to play a leading role in this. We are

proactively engaging with our supplier base and are leveraging our

position in the world of food retail to create a positive movement

towards the reduction of greenhouse gas emissions.

"Despite increasing macro-economic and geopolitical challenges,

we expect to deliver consistent results in 2023, with a strong

focus on cash-flow generation. I am particularly excited about our

plans around monetization, mechanization and our digital ecosystem,

which I am convinced will drive long-term competitive advantage and

benefits for our customers. In the short term, with inflation

remaining high, we will also continue to lean in and explore new

opportunities to lower our costs. To that end, we are introducing a

new Group-wide initiative called "Accelerate".

"This initiative builds on our existing Leading Together efforts

to create more agile organizations, to capture more scale and

empower our people to take action to drive efficiency. In

particular, we will continue to evaluate additional savings and

efficiency levers to streamline organizational structures and

processes, optimize go-to-market propositions, increase joint

sourcing and consolidate IT - with a clear priority to unlock

resources to accelerate our Save for Our Customers program and

focus investments on high return projects. I am confident this

proactive approach will make our organization stronger and ensure

we can continue to deliver on our track record of driving

consistent long-term value creation for all stakeholders.

Q4 Financial highlights

Group highlights

Group net sales were €23.4 billion, an increase of 8.1% at

constant exchange rates, and up 15.9% at actual exchange rates.

Group net sales were driven by comparable sales growth excluding

gasoline of 7.9%, and, to a lesser extent, by foreign currency

translation benefits and higher gasoline sales. Q4 Group comparable

sales benefited by approximately 0.4 percentage points from the net

impact of calendar shifts and weather.

In Q4, Group net consumer online sales increased by 5.0% at

constant exchange rates, led by robust performance in the U.S.,

which increased 17.3% compared to the prior year. Net consumer

online sales decreased 0.6% in Europe as the prior year benefited

from a COVID-19 lockdown in the Netherlands. Online sales in

grocery increased 14.4% at constant exchange rates.

In Q4, Group underlying operating margin was 4.4%, an increase

of 0.2 percentage points at constant exchange rates, as strong cost

savings were partially offset by higher labor, distribution and

energy costs. In Q4, Group IFRS-reported operating income was

€1,167 million, representing an IFRS-reported operating margin

of 5.0%, mainly impacted by the gains on sale of investment

properties in the U.S. in the amount of €158 million.

Underlying income from continuing operations was

€707 million, an increase of 18.2% in the quarter at actual

rates. Ahold Delhaize's IFRS-reported net income in the quarter was

€809 million. Diluted EPS was €0.82 and diluted underlying EPS was

€0.72, up 22.6% at actual currency rates compared to last year's

results and up 14.2% at constant currency rates. In the quarter,

10.5 million own shares were purchased for €286 million,

bringing the total year-to-date amount to €1 billion.

2022 diluted underlying EPS of €2.55 increased 16.5% at actual

rates compared to 2021, exceeding the Company's original guidance

of low- to mid-single-digit decline versus 2021. The

higher-than-expected earnings were driven by strong comparable

sales growth excluding gasoline as well as favorable foreign

currency and interest rates. This drove strong cash generation with

free cash flow of €2,188 million, up €570 million

compared to the prior year. The difference is primarily related to

decisions in 2021 to pay a $190 million (~€170 million) pension

liability in the U.S. following 2020 U.S. MEP withdrawals, ahead of

schedule, and fund the Company's decision to pay approximately €380

million related to a disputed tax claim in Belgium.

U.S. highlights

U.S. net sales were €14.8 billion, an increase of 9.2% at

constant exchange rates and up 22.2% at actual exchange rates. U.S.

comparable sales excluding gasoline increased by 9.3%, benefiting

by approximately 0.5 percentage points from the net impact of

weather and calendar shifts. Food Lion and Hannaford led brand

performance with double-digit comparable sales growth at both

brands during the quarter.

In Q4, online sales in the segment were up 17.3% in constant

currency. This builds on top of 30.5% constant currency growth in

the same quarter last year.

Underlying operating margin in the U.S. was 4.7%, up 0.4

percentage points at constant exchange rates from the prior year

period. In Q4, U.S. IFRS-reported operating margin was 5.8%, mainly

impacted by the gains on sale of investment properties in the

amount of €158 million.

Europe highlights

European net sales were €8.6 billion, an increase of 6.2%

at constant exchange rates and 6.6% at actual exchange rates.

Europe's comparable sales excluding gasoline increased by 5.7%. Q4

Europe comparable sales were positively impacted by approximately

0.1 percentage points from calendar shifts.

In Q4, net consumer online sales in the segment decreased by

0.6%, following 7.4% growth in the same period last year. Grocery

online sales increased by 8.0%. Despite challenging non-food

e-commerce market conditions in the Benelux and the cycling of

lockdown restrictions, bol.com was able to limit net consumer

online sales decline to 2.9% after growing 7.8% in the same quarter

last year. Bol.com's net consumer online sales from its more than

51,000 third-party sellers declined 1.6% in Q4 and represented 57%

of sales.

Underlying operating margin in Europe was 4.0% in Q4, down 0.2

percentage points from the prior year due to escalating energy and

volume deleveraging offset by disciplined cost-management measures.

Europe's Q4 IFRS-reported operating margin was 3.8%.

Outlook 2023

The macro environment has become increasingly difficult for

consumers, who contended with inflation levels during 2022 not seen

in four decades. Inflation levels are expected to remain elevated

particularly through the first half of 2023. Our brands are working

hard to reduce costs and create additional efficiencies in order to

keep prices as low as possible for our customers. In this context,

the Company's brands continue to offer consumers a strong shopping

proposition and are well-positioned to maintain profitability in

the current inflationary environment. Ahold Delhaize's Group

underlying operating margin is expected to be ≥4.0%, in line with

the Company's historical profile. Margins will be supported by Save

for Our Customers programs of ≥€1 billion in savings in 2023.

This should help to offset cost pressures related to inflation and

supply chain issues, along with the negative impact to margins from

increased online sales penetration.

Underlying EPS is expected to be around 2022 levels at current

exchange rates. Our earnings guidance implies further growth and a

strong underlying operating performance, which will offset the

non-recurrence of one-off gains in 2022 related to interest

rates.

Free cash flow is expected to be approximately €2.0 billion. Net

capital expenditures are expected to total around €2.5 billion,

with increased investments in our digital and online capabilities

as well as our healthy and sustainable initiatives. In addition,

Ahold Delhaize remains committed to its dividend policy and share

buyback program in 2023, as previously stated. We are proposing a

full-year dividend for 2022 of €1.05 per share, and have previously

announced a €1 billion share purchase program for 2023.

A detailed Outlook will be provided in the Annual Report 2022,

which will be published on March 1, 2023.

|

|

Full-year outlook |

|

Underlying operating margin |

Underlying EPS |

Save for Our Customers |

|

Net capital expenditures |

Free cash flow1 |

|

Dividend payout ratio2.3 |

Share buyback3 |

|

Outlook |

2023 |

|

≥ 4.0% |

Around 2022 levels |

≥ €1 billion |

|

~ €2.5 billion |

~ €2.0 billion |

|

40-50% payout;YOY growth in dividend per

share |

€1 billion |

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing

operations.

- Management remains committed to our share buyback and dividend

programs, but, given the uncertainty caused by the wider

macro-economic consequences of the war in Ukraine, will continue to

monitor macro-economic developments. The program is also subject to

changes resulting from corporate activities, such as material

M&A activity.

- Ahold Delhaize Q4 2022 Press Release

- Ahold Delhaize Q4 2022 Interim Report

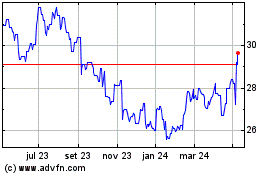

Koninklijke Ahold Delhai... (BIT:1AD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

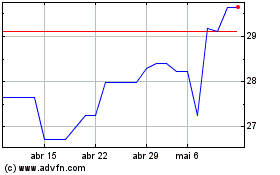

Koninklijke Ahold Delhai... (BIT:1AD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024