February 28, 2023This release includes business

and financial updates for the quarter and twelve months ended

December 31, 2022. The formation and funding of Cool Company Ltd.

(“CoolCo” or the “Company”) and the phased acquisition of the

Company’s initial eight TFDE vessels, The Cool Pool Limited, and

the shipping and FSRU management organization from Golar LNG

Limited commenced in January 2022 and concluded on June 30, 2022.

As a result of these acquisitions, results for the year ended

December 31, 2022 ("FY 2022") include consolidated successor period

and combined carve-out predecessor period results which on an

aggregate basis represent the full year results for 2022. The three

months ended December 31, 2022 ("Q4" or the "Quarter") only include

a consolidated successor period. The subsequent acquisition of four

LNG carriers on November 10, 2022 from an affiliate of EPS Ventures

Ltd ("EPS"), has been treated as asset acquisitions, so the results

for these four vessels are included within the successor period

from the acquisition date.

Q4 Highlights and Subsequent

Events

- Generated total operating revenues of $90.3 million for the

Quarter, compared to $65.8 million for the third quarter 2022

("Q3") with net income of $33.1 million and earnings per share of

$0.68 for Q4;

- Achieved average Time Charter Equivalent Earnings ("TCE")1 of

$83,600 per day for Q4, compared to $73,200 per day for Q3;

- Adjusted EBITDA1 of $58.6 million for Q4, compared to $42.4

million for Q3;

- Commenced previously announced three-year charter from October

2022 at approximately $120,000 per day;

- Agreed another three-year charter that commenced in February

2023 at a rate that averages $120,000 per day over the charter

period;

- Raised approximately $170 million in a primary equity offering

on November 2, 2022 to fund the equity consideration for the

acquisition of four special purpose vehicles ("SPVs"), each holding

one contracted LNG carrier, for an aggregate purchase consideration

of approximately $660 million on November 10, 2022 (the balance was

funded through the assumption of a $520 million term loan facility

of which a principal repayment of approximately $20 million was

made on November 14, 2022);

- Entered into an option agreement expiring June 30, 2023 to

acquire two Hyundai Samho LNG carrier newbuild contracts (the

"newbuild option") with scheduled deliveries in second half of

2024;

- Announced the sale of the Golar Seal in February 2023, the

oldest vessel in the fleet for $184.3 million (with the buyer

assuming all costs associated with the vessel’s forthcoming

scheduled dry-dock), releasing approximately $94 million, after

repayment of its associated debt, that will be available to fund

the acquisition of the two Hyundai Samho LNG carriers in the event

the Company decides to exercise the newbuild option;

- Publicly filed a registration statement for direct listing of

the Company's shares on the New York Stock Exchange (“NYSE”),

subject to the registration statement being declared effective,

with the intention of listing around mid-March 2023 under the

ticker of “CLCO” (which would be the common ticker for NYSE and

Euronext Growth Oslo); and

- In accordance with its dividend policy announced in the

Quarter, the Company declared a dividend for Q4 of $0.40 per share,

to be paid on March 10, 2023 to all shareholders of record on March

3, 2023.

Richard Tyrrell, CEO,

commented:

“At its IPO a year ago, CoolCo outlined its

intention to target growth by consolidation and to focus on

shareholder returns by allocating its free cash-flow to equity

primarily to dividends. I am pleased to see us deliver on both as a

result of steps taken during and subsequent to the fourth quarter.

We acquired four high-spec, in-service vessels on attractive terms,

placed two of our existing vessels on highly attractive charters,

and on the back of a strong set of Q4 results were able to declare

our first quarterly dividend. Through the sale of the Golar Seal,

the earliest vessel in our fleet to be built, we are demonstrating

our disciplined approach to locking in shareholder value. The

valuation highlights the re-pricing of the LNG carrier market and

strategic value of such LNG infrastructure assets in providing

crucial energy security. A 2.5x cash-on-cash return in little more

than 12 months since CoolCo’s formation shows the considerable

upside potential in our fleet.

With our recently announced planned NYSE

listing, we are also delivering on our intention to provide

expanded access to CoolCo for US investors, broaden the investor

base and drive trading liquidity in our shares. Despite seasonal

market softness in the spot market for LNG carriers, the 12-month

market remains strong and 2023 looks fundamentally tighter than

2022. Freeport LNG's export terminal in the US Gulf is now well

into the process of restarting after several months offline, Europe

will not have access to the same level of Russian pipeline gas as

it previously relied upon, and Asia could soon outbid Europe for

spot volumes, potentially pushing up ton miles. As one of the few

listed LNG shipping companies with open tonnage this year and next,

we look forward to securing additional contracts that reflect the

re-priced LNG carrier charter market and realize significant value

for shareholders, including for the two highly sought-after Hyundai

Samho newbuildings on which we hold an option.”

Financial Highlights

The table below sets forth certain key financial

information for Q4 2022 and FY 2022, split between Successor and

Predecessor periods (as defined below).

|

|

Q4 |

Twelve Months ended December 31, 2022 |

|

(in thousands of $, except TCE) |

Successor |

Successor |

Predecessor |

Total |

|

Time and voyage charter revenues |

79,032 |

183,567 |

37,289 |

220,856 |

| Total

operating revenues |

90,255 |

212,978 |

43,456 |

256,434 |

|

Operating income |

48,881 |

110,936 |

27,728 |

138,664 |

| Net

income |

33,069 |

87,500 |

23,244 |

110,744 |

| Adjusted

EBITDA1 |

58,621 |

134,585 |

33,473 |

168,058 |

|

Average daily TCE1 (to the closest $100) |

83,600 |

73,000 |

57,100 |

69,800 |

Note: The commencement of

operations and funding of CoolCo and the acquisition of its initial

eight TFDE LNG carriers, The Cool Pool Limited and the shipping and

FSRU management organization from Golar LNG Limited ("Golar") was

completed in a phased process. It commenced with the funding of

CoolCo on January 27, 2022 and concluded with the acquisition of

the LNG carrier and FSRU management organization on June 30, 2022,

with vessel acquisitions taking place on different dates over that

period. Results for the twelve months that commenced January 1,

2022 and ended December 31, 2022 have therefore been split between

the period prior to the funding of CoolCo and various phased

acquisitions (the "Predecessor" period) and the period subsequent

to the various phased acquisitions of such vessels and management

entities (the "Successor" period). The combined results are not in

accordance with U.S. GAAP and consists of the aggregate of selected

financial data of the Successor and Predecessor periods. No other

adjustments have been made to the combined presentation.

LNG Market Review

The Quarter commenced with the Japan/Korea

Marker gas price ("JKM") at $40/MMBtu, the Dutch Title Transfer

Facility gas price ("TTF") at $54/MMBtu and quoted TFDE headline

spot rates of $226,000 per day. The freight market tightened

seasonally early driven by cargo values, congestion at European

terminals, and traders and portfolio players using vessels as

storage to profit from a winter price contango. Virtually every

modern carrier was under charterer control, resulting in an

illiquid market dominated by the occasional sublet. Spot rates for

a TFDE vessel reached as high as around $450,000 in late October.

CoolCo took this opportunity to re-charter two of its available

carriers, both on three-year charters: one charter commencing at

the end of October at approximately $120,000 per day, and another

commencing in Q1 2023 at a rate that steps down from a high level

to a lower level and averages approximately $120,000 per day over

the period of the charter.

By late November, an unwinding of vessels

waiting to discharge in Europe, further delays to the restart of

Freeport, and no arbitrage to pull cargoes east saw available

vessels increase and spot rates declined from unprecedented

heights, halving within two weeks. The year concluded with JKM at

$28/MMBtu, TTF at $23/MMBtu and quoted TFDE headline spot rates of

$148,000 per day. Sentiment in term rates remained strong despite

spot rates coming under pressure.

Operational Review

CoolCo's fleet continued to perform well with no

technical off-hire incurred during the Quarter. No idle time ahead

of the vessel contract starting in late October meant that Q4 fleet

utilization was 100%.

Business Development

During the Quarter, CoolCo completed the

acquisition of four contracted LNG carriers, the 2021 built

2-stroke Kool Orca, 2020 built 2-stroke Kool Firn, and 2015 built

TFDE vessels Kool Boreas and Kool Baltic. The four LNG carriers

collectively add revenue backlog1 of approximately $370 million

excluding options and $1.2 billion including options. The estimated

2023 Adjusted EBITDA1 attributable to these four vessels is

expected to be approximately $80 million. Revenue backlog1 as of

December 31, 2022, from shipping fixtures to date amounts to

approximately $950 million excluding options and approximately

$1.68 billion including options, if exercised for the maximum

duration.

CoolCo has also entered into an attractive

option agreement to acquire newbuild contracts for two 2-stroke LNG

carriers scheduled to deliver in second half of 2024. The exercise

price for each carrier is $234 million and the option is

exercisable until June 30, 2023. Only four to six uncontracted

newbuilds deliver ahead of these two vessels and CoolCo is

receiving significant interest from potential charterers seeking

long-term contracts. The Company expects to agree accretive

contracts and secure attractive financing prior to exercising the

option.

Financing and Liquidity

As of December 31, 2022, CoolCo had cash and

cash equivalents of $129.1 million and total short and long-term

debt, net of deferred finance charges, of $1,138.3 million. Total

CoolCo Contractual Debt1 comprised of $540.4 million in respect of

the six vessel bank financing facility maturing in March 2027 (the

"$570 million bank facility"), $500.6 million in respect of the

four vessel bank financing facility maturing in May 2029 (the “$520

million bank facility”), and $210.3 million in respect of the two

sale and leaseback facilities maturing in January 2025 (Ice and

Kelvin). Total CoolCo Contractual Debt1 stood at $1,251.3

million.

During Q4, we entered into further floating

interest rate (SOFR) swap agreements for an additional notional

amount of $167.2 million, resulting in the $570 million bank

facility being fully hedged at an average fixed rate of 3.37% and

an average all-in rate of 6.12%. The swap agreements started in

October 2022, maturing in February 2027, and follow the

amortization profile of the $570 million bank facility.

Following the announcement in February 2023 of

the sale of Golar Seal, to be completed in March 2023, cash and

cash equivalents will be augmented by approximately $94.0 million

of released cash, after the repayment of its associated debt of

approximately $88.0 million. This provides a substantial pool of

funding that can be used for the equity portion of the newbuild

option, if we exercise the option, and the pursuit of other

potential business development opportunities.

Corporate and Other Matters

As of December 31, 2022, CoolCo had 53,688,462

shares issued and outstanding. Of these, 26,790,545 (49.9%) were

owned by EPS, 4,463,846 (8.3%) were owned by Golar LNG Limited and

22,434,071 (41.8%) were publicly owned.

On February 14, 2023, CoolCo publicly filed a

registration statement with the U.S. Securities and Exchange

Commission (“SEC”), with the intention of directly listing its

shares on the NYSE. Subject to the registration statement being

declared effective by the SEC, the Company’s shares are expected to

be listed for trading on the NYSE from around mid-March 2023

onwards under the ticker "CLCO". The ticker on the Euronext Growth

Oslo will therefore be changed from “COOL” to “CLCO”. No CoolCo

securities will be issued in connection with the share listing on

the NYSE.

In line with the Company’s variable dividend

policy, the Board has declared a Q4 dividend of $0.40 per ordinary

share. The record date is March 3, 2023 and the dividend will

be paid on March 10, 2023.

Outlook

Although the short-term market has been

negatively impacted by an unwinding of the winter storage play and

an easing of congestion, new developments are expected to

strengthen an already tight underlying market in 2023. An

increasing share of Europe’s LNG imports will be received by FSRUs

where cargoes take longer to discharge. The carbon intensity

indicator (“CII”) rules that came into effect on January 1 will

likely reduce the trading flexibility of steam turbine vessels. A

re-opening China is expected to compete for more spot traded LNG,

adding ton miles as it does. Freeport is returning to market and

will re-employ up to 30 vessels once fully ramped up, and there are

no uncommitted newbuilds delivering this year. With two vessel

openings in 2023, at a seasonally strong time of year, CoolCo is

one of the only publicly listed vessel owners exposed to this

market.

Approximately 160 million tons of new

liquefaction is scheduled to deliver between now and 2026 that will

require around 200 new carriers. With around 250 LNG carriers

scheduled to deliver over the same timeframe, the market at first

glance looks oversupplied. There is, however, a further 175 million

tons of liquefaction in the US alone progressing through the Front

End Engineering and Design process, supported by a government

increasingly keen to fast-track development. This, together with

the replacement of older, considerably less efficient steam vessels

that come off contract over the same timeframe, could absorb a

further 300 new vessels. A standard spec newbuild costs around $250

million and a vessel ordered today will most likely be delivered in

2027. Limited speculative ordering and high newbuild prices mean

that long-term charter rates have increased from around $75,000/day

to above $90,000/day, with premiums being paid for near-term

availability. Reports indicate that a 10-year charter at a rate in

the region of $105,000 per day has been agreed upon for a newbuild

vessel delivering early in 2024. These are both positive datapoints

for the second half of 2024 when the two vessels subject to the

newbuild option are scheduled to be delivered.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking

statements which reflect management’s current expectations,

estimates and projections about its operations. All statements,

other than statements of historical facts, that address activities

and events that will, should, could or may occur in the future are

forward-looking statements. Words such as “believe,” “anticipate,”

“intend,” “estimate,” “forecast,” “project,” “plan,” “potential,”

“will,” “may,” “should,” “expect,” “could,” “would,” “predict,”

“propose,” “continue,” or the negative of these terms and similar

expressions are intended to identify such forward-looking

statements. These statements include statements relating to

outlook, expected results and performance including expected

Adjusted EBITDA, statements with respect to the newbuilds option,

dividends, expected industry and business trends including expected

trends in LNG demand, LNG vessel supply and demand, backlog,

charter and spot rates, contracting, utilization, LNG vessel

newbuild order-book and other non-historical matters. Our unaudited

condensed consolidated financial statements are preliminary and

subject to independent audit which may impact the condensed

consolidated financial information included in this release. These

statements are not guarantees of future performance and are subject

to certain risks, uncertainties and other factors, some of which

are beyond our control and are difficult to predict and actual

outcomes and results may differ materially from what is expressed

or forecasted in such forward-looking statements. Among the

important factors that could cause actual results to differ

materially from those in the forward-looking statements are:

- general economic, political and business conditions including

sanctions and other measures;

- general LNG market conditions, including fluctuations in

charter hire rates and vessel values;

- changes in demand in the LNG shipping industry, including the

market for our vessels;

- changes in the supply of LNG vessels;

- our ability to successfully employ our vessels;

- changes in our operating expenses due to inflationary pressures

and volatility of supply and maintenance costs, including fuel or

cooling down prices and lay-up costs when vessels are not on

charter, drydocking and insurance costs;

- compliance with, our liabilities under, and changes in

governmental, tax, environmental and safety laws and

regulations;

- changes in governmental regulation, tax and trade matters and

actions taken by regulatory authorities;

- potential disruption of shipping routes and demand due to

accidents, piracy or political events;

- vessel breakdowns and instances of loss of hire;

- vessel underperformance and related warranty claims;

- our expectations regarding the availability of vessel

acquisitions and our ability to complete the acquisition of the

newbuild vessels;

- our ability to procure or have access to financing and

refinancing; including financing for the newbuild vessels if such

option is exercised;

- our continued borrowing availability under our credit

facilities and compliance with the financial covenants

therein;

- fluctuations in foreign currency exchange and interest

rates;

- the continuing impact of the COVID-19 pandemic;

- potential conflicts of interest involving our significant

shareholders;

- our ability to pay dividends;

- our limited operating history under the CoolCo name; and

- other factors that may affect our financial condition,

liquidity and results of operations.

Moreover, we operate in a very competitive and

rapidly changing environment. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all

risks and uncertainties that could have an impact on the

forward-looking statements contained in this press release. The

results, events and circumstances reflected in the forward-looking

statements may not be achieved or occur, and actual results, events

or circumstances could differ materially from those described in

the forward-looking statements.

As a result, you are cautioned not to place

undue reliance on any forward-looking statements which speak only

as of the date of this press release. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise unless required by law.

Responsibility Statement

We confirm that, to the best of our knowledge,

the unaudited condensed consolidated financial statements for the

year ended December 31, 2022, which have been prepared in

accordance with accounting principles generally accepted in the

United States (US GAAP) give a true and fair view of the Company’s

consolidated assets, liabilities, financial position and results of

operations. To the best of our knowledge, the financial report for

the year ended December 31, 2022 includes a fair review of

important events that have occurred during the period and their

impact on the unaudited condensed consolidated financial

statements, the principal risks and uncertainties, and major

related party transactions.

February 28, 2023Cool Company Ltd.Hamilton,

Bermuda

Questions should be directed to:c/o Cool Company

Ltd - +44 207 659 1111

|

Richard Tyrrell - Chief Executive Officer |

Cyril Ducau (Chairman of the Board) |

|

John Boots - Chief Financial Officer |

Antoine Bonnier (Director) |

| |

Mi Hong Yoon (Director) |

| |

Neil Glass (Director) |

| |

Peter Anker (Director) |

- Cool Company Ltd. Q4 2022 Business Update

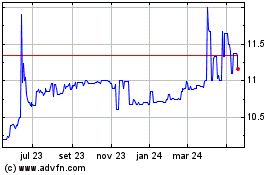

Corner Growth Acquisition (NASDAQ:COOL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

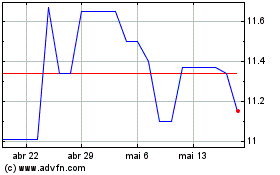

Corner Growth Acquisition (NASDAQ:COOL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025