Eldorado Gold Corporation (“Eldorado Gold”, the

“Company” or “We”) is pleased to provide new results from step-out

drilling at the Ormaque deposit in Quebec. The company is also

providing an overview of the 2023 global exploration program which

includes approximately 190,000 metres of discovery and resource

expansion drilling and over 55,000 metres of resource conversion

drilling focused mainly in Quebec and Turkiye.

Ormaque Drilling Highlights

Since our most recent resource update at the

Ormaque deposit, announced in February 2022 and published in the

Lamaque Technical Report on March 31, 2022, we have completed over

31,000 metres of resource expansion drilling and over 21,000 metres

of resource conversion drilling. Assay results received since our

October 2022 exploration news update include numerous high-grade

intercepts to the east of, and below the current resource area,

some representing extensions to known mineralized zones and some

related to newly identified mineralized zones. Notable intercepts

include:

- 2.8 metres at 14.86 g/t gold and 2.5

metres at 20.47 g/t gold (27.52 g/t gold uncapped) in drillhole

FOR-22-031, representing step-out intercepts approximately 200

metres east of the current resource;

- 1.2 metres at 22.31 g/t gold and 1.6

metres at 26.86 g/t gold (54.01 g/t gold uncapped) in drillhole

LS-22-089, representing step-out intercepts approximately 40 metres

east of the current resource;

- 3.5 metres at 10.48 g/t gold in

drillhole LS-20-024, representing a new zone approximately 125

metres below the current resource; and

- 1.75 metres at 39.37 g/t gold in

drillhole LS-22-090, representing a new zone approximately 150

metres below the current resource.

“Eldorado Gold is committed to investing in

organic growth opportunities through brownfields exploration

surrounding our current operations, and funding greenfield

exploration initiatives to strategically expand our global

footprint,” said George Burns, President and CEO of Eldorado Gold.

“In Eastern Canada, we have added over 3.2 million inferred

resource ounces since our acquisition of Integra Resources in 2017,

at a discovery cost of less than $18 per ounce. The new results at

Ormaque continue to demonstrate the potential to increase

resources, supporting future development plans beyond the Triangle

deposit.”

“In Turkiye, the team at Efemcukuru is focused

on resource conversion at the Kokarpinar and Bati vein systems and

adding new resources in the nearby West Vein system. In Greece, our

teams are shifting focus to supporting operational readiness at

Skouries, and we expect to ramp up our brownfields exploration

activities as we progress through the project build and near

commercial production.”

* Tables of intercepts from the drilling

referenced in this release are included in Appendix 1 and

associated drillhole collar coordinates and orientations are listed

in Appendix 2. Gold grades for drillhole intervals at the Ormaque

deposit listed in this release are capped at 70 g/t gold. Drillhole

intercepts are drillhole lengths; where sufficient geological

control exists, estimated true thicknesses of mineralized zones are

listed in Appendix 1.

Interactive VRIFY 3D Model

To view an interactive 3D model that includes

the results announced today use the following link or visit

Eldorado Gold's website:

https://vrify.com/decks/12959?auth=f8e46e53-a2c6-45ec-963e-ed217dcd726a

Quebec Exploration Results

Ormaque Deposit

Since the resource update at the Ormaque

deposit, as announced in February 2022, the Company has completed

over 31,000 metres of resource expansion drilling. This drilling

has targeted lateral extensions to the known ore lenses east of the

current resource area, and has tested for new mineralized zones at

depth. Significant intercepts received since the last exploration

update in October 2022 are included in Appendix 1, while Appendix 2

and Figure 1 provide information on locations and orientations of

new drillholes. The latest drill results have identified lateral

extensions to the Ormaque deposit well outside the current resource

model as well as new zones at depth. Lateral extensions include new

intercepts to the east, southeast, and south, most notably:

- 2.8 metres at

14.86 g/t gold, 2.5 metres at 20.47 g/t gold (27.52 g/t gold

uncapped), and 9.15 metres at 6.20 g/t gold (9.03 g/t gold

uncapped) in drillhole FOR-22-031, approximately 200 metres east of

the current resource; and

- 1.2 metres at

22.31 g/t gold and 1.6 metres at 26.86 g/t gold (54.01 g/t gold

uncapped) in drillhole LS-22-089, approximately 40 metres east of

the current resource.

Figure 1: Geological map of the Ormaque deposit

area, showing surface projection of mineralized zones (pink shaded

area), collar locations and surface traces of new drillholes

presented in this news release.

https://www.globenewswire.com/NewsRoom/AttachmentNg/dace114f-9a74-45b7-92ad-f1ae5c4ec161

Preliminary drilling has tested below parts of

the deposit to a depth of 850 metres, or approximately 300 metres

below the current resource. Despite still being sparsely drilled,

numerous intercepts have been identified in this lower area below

the current resource model, including:

- 5.4 metres at

14.31 g/t gold in drillhole LS-22-090W01, approximately 20 metres

below the current resource;

- 3.5 metres at

10.48 g/t gold in drillhole LS-20-024, approximately 125 metres

below the current resource;

- 1.75 metres at

39.37 g/t gold in drillhole LS-22-090, approximately 150 metres

below the current resource;

- 4.95 metres at

7.23 g/t gold in drillhole LS-22-091, approximately 120 metres

below the current resource; and

- 2.1 metres at

29.27 g/t gold and 3.0 metres at 14.72 g/t gold in drillhole

LS-22-091W01, approximately 45 metres and 120 metres below the

current resource respectively.

In 2022 and year-to-date 2023, 20,859 metres of

resource conversion drilling have been completed at the Ormaque

deposit.

Eldorado Gold’s 2023 Mineral Reserve and Mineral

Resource (“MRMR”) update, scheduled for the fourth quarter of this

year, will incorporate results of both the resource expansion and

resource conversion drilling programs completed in the first half

of 2023.

2023 Exploration Outlook

Eldorado Gold’s exploration activities in 2023

are focused on the regions in which we operate: Canada, Turkiye and

Greece, and include a range of brownfield and greenfield projects

and project generation initiatives. As per the guidance news

release published in February 2023, the global exploration

expenditures planned for 2023 are $35 million to $41 million and

include approximately 190,000 metres of pre-resource stage and

resource expansion drilling and over 55,000 metres of resource

conversion drilling. Approximately 26% relates to capitalized

programs and the remaining 74% to expensed programs. Included in

this total are $7 to $10 million of non-sustaining exploration

expenditures classified as growth capital.

Eastern Canada

Triangle Mine

The recent development of the 650-level

exploration drift at the Triangle Mine provides access to deeper

platforms for resource expansion and resource conversion drilling

of the lower Triangle deposit. Approximately 17,600 metres of

resource conversion drilling is planned for 2023, mainly targeting

areas of inferred resources in the C7 zone but also extending

locally to test more sparsely drilled areas of deeper mineralized

zones. There are also approximately 13,000 metres of underground

exploration drilling planned from platforms along the

Sigma-Triangle decline, testing multiple conceptual targets and

step-outs from previous high-grade drill intercepts.

Ormaque Deposit

The 2023 exploration program at Ormaque will

include approximately 27,000 metres of underground resource

conversion drilling within existing inferred resources, and

approximately 10,000 metres of surface drilling testing step-outs

to the east of and below the known deposit. Conversion drilling

during the year will test the upper two-thirds of the deposit (down

to lens E100) with piercing points spaced at 25 metres or less.

Sigma-Lamaque and Bourlamaque Brownfields

Exploration

Eldorado Gold is advancing multiple early- to

advanced-stage exploration projects in the Val-d’Or district that

provide opportunities for brownfield resource growth proximal to

the Sigma mill (Figure 2). Over 45,000 metres of drilling are

planned on targets that include:

-

Parallel deposit extensions:

Approximately 5,000 metres of drilling will test for the extension

of the historically mined Vein #13 at the Lamaque Mine into the

Parallel deposit area.

-

Herbin: Approximately 10,000 metres of drilling

will test several target areas adjacent to the previously mined

deposits at the Lac Herbin, Ferderber and Dumont mines, which

cumulatively produced approximately 1.1 million ounces of gold at a

grade of 6.1 g/t gold from shear hosted quartz-carbonate-tourmaline

veins that cut the Bourlamaque batholith.

-

Sigma-Lamaque early-stage targets: Approximately

12,000 metres of early-stage drilling are planned for the Vein #13,

Sector Nord, and Audet North and South targets, along with

fieldwork and analysis of historical mining and exploration data

directed towards new target definition.

-

Bourlamaque early-stage targets: 12,000 metres of

drilling will test various early-stage targets mainly within the

Bourlamaque Batholith which have been defined by a combination of

historical drilling results, geophysical anomalies, till

geochemistry, and geological mapping. The drilling will target

high-grade vein systems similar in geological setting and

mineralization style to those historically mined at the Beaufor

mine and the mines in the Herbin area.

-

Bruell: The Bruell property, located 40 kilometres

east of Val-d’Or, is being explored under an option agreement with

owner Sparton Resources. Approximately 7,000 metres of drilling are

planned in 2023 to follow up on positive results from the 2022

program and to test new targets.

Figure 2: Geological map

showing the locations of the Brownfields projects on the Lamaque

property.

https://www.globenewswire.com/NewsRoom/AttachmentNg/d7c42677-10c1-4656-99ce-f82e5c37521b

Eastern Canada Greenfields Exploration

Eldorado Gold’s greenfields exploration in

Canada is currently focused on target areas within the greater

Abitibi region that offer opportunities outside of the Lamaque

projects. The Company’s current greenfields portfolio includes the

Montgolfier project, comprising a 347 square kilometre license

package along the Harricana-Turgeon greenstone belt to the east of

the Casa Berardi mine, and a group of licenses in the Kirkland Lake

belt currently being explored under an option agreement with the

license holder Val-d’Or Mining Corp. At Montgolfier, a 5,000-metre

diamond drilling program is currently underway, testing for the

bedrock source of highly anomalous gold-in-till anomalies

identified in a previous sonic drilling program. The Kirkland Lake

licenses are at the target definition stage, and fieldwork

including soil sampling, outcrop stripping and sampling, and

geological mapping is planned for the 2023 season.

Turkiye

2023 exploration in Turkiye is focused on

resource expansion and resource conversion drilling at Efemcukuru

and advancing several early-stage greenfields projects in highly

prospective priority regions throughout Turkiye.

Efemcukuru

A 10,000-metre resource conversion drilling

program is currently underway at the Kokarpinar South vein system.

Results from this drilling, and the resource conversion drilling at

the Bati vein system during late 2022, will be included in the MRMR

update in the fourth quarter of 2023. The drilling focus for the

second half of 2023 will be on the West Vein system, which has a

mapped cumulative strike length of over three kilometres

distributed over the Volkan, Huseyinburnu, Dedabag, and Muhtar

veins. Approximately 43,000 metres of drilling are planned, testing

multiple previously undrilled targets with high-grade surface

samples.

Greenfields Projects

Eldorado Gold continues to explore regions of

Turkiye that offer strong exploration potential and attractive

social and political environments for resource exploration and

development. Current programs are focused on the Artvin/Hod Maden

and Aydogantepe areas, the Izmir-Ankara Suture Zone, and the

Central Anatolian Crystalline Complex (“CACC”). Project generation

activities and early-stage project work within the CACC are being

conducted with a Turkish joint venture partner. Approximately

14,000 metres of drilling are planned for 2023 to test early-stage

targets at the Hod Maden North, Atalan, Demirkoy, and Ozan

projects.

Qualified Persons

Dr. Peter Lewis P.Geo., Eldorado Gold’s

Vice President, Exploration, is the qualified person as defined by

National Instrument 43-101 Standards of Disclosure for Mineral

Projects (“NI 43-101”), and is responsible for and has verified and

approved the scientific and technical disclosure contained in this

press release for projects in Turkiye. Jacques Simoneau P.Geo., a

member in good standing of the Ordre des Géologues du Québec, is

the qualified person as defined in NI 43-101, and is responsible

for and has verified and approved the scientific and technical

disclosure contained in this press release for the Quebec projects.

Eldorado Gold operates its exploration programs according to

industry best practices and employs rigorous quality assurance and

quality control procedures. All results are based on half-core

samples of diamond drill core. Drill core samples for the

Ormaque deposit step-out drilling were prepared and analyzed

at Bourlamaque Laboratories in Val d’Or, Quebec. All gold assays

are based on fire assay analysis of a 30 gm charge, followed

by an atomic adsorption finish. Samples with gold grades above

5.0 g/t were re-assayed and completed with a gravimetric finish.

Certified standard reference materials, field duplicates and blank

samples were inserted regularly and were closely monitored to

ensure the quality of the data.

About Eldorado Gold

Eldorado Gold is a gold and base metals producer

with mining, development and exploration operations in Turkiye,

Canada, and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado Gold's common shares trade on the Toronto

Stock Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contacts

Investor Relations

Philip Yee, EVP and Chief Financial

Officer604.687 4018 or 1.888.353.8166

philip.yee@eldoradogold.com

Media

Louise McMahon, Director Communications &

Public Affairs604.757 5573 or 1.888.353.8166

louise.mcmahon@eldoradogold.com

Cautionary Note about Forward-looking

Statements and Information Certain of the statements

made and information provided in this press release are

forward-looking statements or information within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws. Often, these forward-looking

statements and forward-looking information can be identified by the

use of words such as “anticipates”, “believes”, “budgets”,

“continue”, “commitment”, “confident”, “estimates”, “expects”,

“focus”, “forecasts”, “future”, “guidance”, “intends”,

“opportunity”, “outlook”, “plans”, “possible”, “potential”,

“projected”, “prospective”, “schedule”, “target” or the negatives

thereof or variations of such words and phrases or statements that

certain actions, events or results “can”, “could”, “likely”, “may”,

“might”, “will” or “would” be taken, occur or be achieved.

Forward-looking statements or information

contained in this press release include, but are not limited to,

statements or information with respect to: growth opportunities;

exploration outlook, timing and targets; risk factors affecting our

business; our expectations as to our future financial and operating

performance, including future cash flow, estimated cash costs,

expected metallurgical recoveries and gold price outlook; and our

strategy, plans and goals, including our proposed exploration,

development, construction, permitting and operating plans and

priorities, related timelines and schedules. Forward-looking

statements and forward-looking information by their nature are

based on assumptions and involve known and unknown risks,

uncertainties and other factors, which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: production and cost expectations; the total funding required

to complete Skouries; our ability to meet our timing objectives for

drawdown of the Skouries project financing facility (the

“Facility”); our ability to execute our plans relating to Skouries,

including the timing thereof; our ability to obtain all required

approvals and permits; cost estimates in respect of Skouries; no

changes in input costs, exchange rates, development and gold; the

geopolitical, economic, permitting and legal climate that we

operate in, including at Skouries; how the worldwide economic and

social impact of COVID-19 is managed and the duration and extent of

the COVID-19 pandemic; timing, cost and results of our

construction, improvements and exploration; the future price of

gold and other commodities; the global concentrate market; exchange

rates; anticipated values, costs, expenses and working capital

requirements; production and metallurgical recoveries; mineral

reserves and resources; and the impact of acquisitions,

dispositions, suspensions or delays on our business and the ability

to achieve our goals. In addition, except where otherwise stated,

we have assumed a continuation of existing business operations on

substantially the same basis as exists at the time of this press

release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others,

the following: the outcome of planned technical studies, production

and exploration, development, optimization and expansion plans at

the Company’s projects; possible variations in ore grade or

recovery rates; changes in mineral resources and mineral reserves;

costs and timing of the development of new deposits; success of

exploration activities; increases in financing costs or adverse

changes to the Facility; failure or delays to receive necessary

approvals or otherwise satisfy the conditions to the drawdown of

the Facility; the proceeds of the Facility not being available to

the Company or Hellas Gold Single Member S.A.; ability to execute

on plans relating to Skouries, including the timing thereof,

ability to achieve the social impacts and benefits contemplated;

ability to meet production, expenditure and cost guidance; risks

relating to the ongoing COVID-19 pandemic and any future pandemic,

epidemic, endemic or similar public health threats; timing and cost

of construction, and the associated benefits; ability to achieve

expected benefits from improvements, recoveries of gold and other

metals; risks relating to our operations being located in foreign

jurisdictions; community relations and social license; climate

change; liquidity and financing risks; development risks;

indebtedness, including current and future operating restrictions,

implications of a change of control, ability to meet debt service

obligations, the implications of defaulting on obligations and

change in credit ratings; environmental matters; waste disposal;

the global economic environment; government regulation; reliance on

a limited number of smelters and off-takers; commodity price risk;

mineral tenure; permits; risks relating to environmental

sustainability and governance practices and performance;

non-governmental organizations; corruption, bribery and sanctions;

litigation and contracts; information technology systems;

estimation of mineral reserves and mineral resources; production

and processing estimates; credit risk; actions of activist

shareholders; price volatility, volume fluctuations and dilution

risk in respect of our shares; reliance on infrastructure,

commodities and consumables; currency risk; inflation risk;

interest rate risk; tax matters; dividends; financial reporting,

including relating to the carrying value of our assets and changes

in reporting standards; labour, including relating to

employee/union relations, employee misconduct, key personnel,

skilled workforce, expatriates and contractors; reclamation and

long-term obligations; regulated substances; necessary equipment;

co-ownership of our properties; acquisitions, including integration

risks, and dispositions; the unavailability of insurance; conflicts

of interest; compliance with privacy legislation; reputational

issues; competition, as well as those risk factors discussed in the

sections titled "Managing Risk" in our Management's Discussion and

Analysis for the three and twelve months ended December 31, 2022

and in the sections titled “Forward-looking information and risks”

and “Risk factors in our business” in our most recent Annual

Information Form & Form 40-F. The reader is directed to

carefully review the detailed risk discussion in our most recent

Annual Information Form & Form 40-F filed on SEDAR and EDGAR

under our Company name, which discussion is incorporated by

reference in this release, for a fuller understanding of the risks

and uncertainties that affect our business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change and you are referred to the full discussion of

the Company’s business contained in the Company’s reports filed

with the securities regulatory authorities in Canada and the United

States.

Mineral resources which are not mineral reserves

do not have demonstrated economic viability. With respect to

“indicated mineral resource” and “inferred mineral resource”, there

is a great amount of uncertainty as to their existence and a great

uncertainty as to their economic and legal feasibility. It cannot

be assumed that all or any part of a “measured mineral resource”,

“indicated mineral resource” or “inferred mineral resource” will

ever be upgraded to a higher category.

The potential quantity and grade of

mineralization described herein is conceptual in nature as there

has been insufficient exploration to define a mineral resource and

it is uncertain if further exploration will result in targets being

delineated as a mineral resource.

Appendix 1: Table of Assay Results

Table 1: Summary of resource

expansion drillhole assay results from the Ormaque Deposit.

Intercepts are only reported for those intervals above a 10 gram x

metre cut-off. Drillhole collar locations, collar orientations, and

total lengths are listed in Appendix 2.

|

Drillhole |

From (m) |

To (m) |

Interval |

True thickness |

Au (g/t) |

Aucapped at 70 g/t |

Zone / Location |

|

FOR-22-030 |

580.7 |

582.4 |

1.7 |

|

11.99 |

|

Step-out intercept, 310m SE of current resource |

|

599.55 |

607.2 |

7.65 |

|

3.54 |

|

Step-out intercept, 320m SE of current resource |

|

685.5 |

689.3 |

3.8 |

|

8.50 |

|

Step-out intercept, 360m SE of current resource |

|

FOR-22-031 |

37.6 |

40.4 |

2.8 |

2.76 |

14.86 |

|

Step-out intercepts, 220m east of current resource |

|

61.8 |

70.95 |

9.15 |

9.03 |

6.20 |

|

|

72.5 |

75.7 |

3.2 |

3.08 |

9.12 |

|

|

95.25 |

96.75 |

1.5 |

|

10.96 |

|

|

339.5 |

342 |

2.5 |

|

27.52 |

20.47 |

Step-out intercept, 190m east of current resource |

|

LS-19-009_R |

665 |

665.5 |

0.5 |

|

20.66 |

|

Intercept 25m above E210 |

|

709.5 |

712 |

2.5 |

|

16.93 |

|

Intercept 20m below E220 |

|

LS-20-024 |

833.9 |

835.6 |

1.7 |

|

9.61 |

|

Deep intercepts, 80-160m below current resource |

|

872.7 |

873.4 |

0.7 |

|

17.60 |

|

|

880.3 |

883.8 |

3.5 |

|

10.48 |

|

|

902 |

903.5 |

1.5 |

|

27.98 |

|

|

LS-21-077 |

131.4 |

132.9 |

1.5 |

|

11.70 |

|

Step-out intercept, 230m north of current resource |

|

240.5 |

243.2 |

2.7 |

|

6.28 |

|

Step-out intercept, 170m north of current resource |

|

LS-22-088 |

844.15 |

849.65 |

5.5 |

|

4.79 |

|

Deep intercept, 400m below current resource |

|

LS-22-089 |

173 |

174.2 |

1.2 |

|

22.31 |

|

Step-out intercepts, 40m east of current resource |

|

389.2 |

390.8 |

1.6 |

|

54.01 |

26.86 |

|

401.1 |

402.7 |

1.6 |

|

7.88 |

|

|

411.7 |

413 |

1.3 |

|

14.85 |

|

|

430.5 |

436 |

5.5 |

|

4.19 |

|

|

LS-22-090 |

230.6 |

231.1 |

0.5 |

0.47 |

26.36 |

|

Step-out intercept on E030, 35m south of current resource |

|

325.85 |

327.8 |

1.95 |

1.85 |

5.20 |

|

New lens E085, 20m above E090 |

|

382.5 |

383 |

0.5 |

0.47 |

61.19 |

|

Intercept 10m below E110 |

|

417.6 |

418.65 |

1.05 |

|

27.16 |

|

Intercept 10m above E130 |

|

455.7 |

456.7 |

1 |

0.95 |

24.25 |

|

New lens E145, 10m below E140 |

|

782.35 |

784.1 |

1.75 |

|

39.37 |

|

Deep intercept, 150m below current resource |

|

876.4 |

878.5 |

2.1 |

|

5.41 |

|

Deep intercept, 250m below current resource |

|

LS-22-090W01 |

377 |

377.75 |

0.75 |

0.7 |

14.46 |

|

Step-out intercept on E110, 10m south current resource |

|

657 |

662.4 |

5.4 |

4.82 |

16.77 |

14.31 |

New lens E235, 20m below current resource |

|

771 |

771.5 |

0.5 |

|

67.65 |

|

Intercept 120m below current resource |

|

LS-22-091 |

435.5 |

437 |

1.5 |

|

89.76 |

47.24 |

Intercept 15m above E130 |

|

454 |

454.7 |

0.7 |

0.64 |

47.34 |

|

New lens E135, 12m below E130 |

|

487.5 |

488 |

0.5 |

|

23.57 |

|

Intercept 15m above E150 |

|

516.3 |

516.8 |

0.5 |

0.45 |

29.62 |

|

New lens E165, 10m below E160 |

|

655.2 |

657.2 |

2 |

|

62.84 |

35.13 |

Intercept 15m below E220 |

|

691.9 |

693 |

1.1 |

0.95 |

33.40 |

|

New lens E235, 25m below current resource |

|

709.35 |

711.15 |

1.8 |

|

76.30 |

33.33 |

Intercept 40m below current resource |

|

716.95 |

722.15 |

5.2 |

|

4.07 |

|

Intercept 45m below current resource |

|

794.7 |

799.65 |

4.95 |

|

7.23 |

|

Intercept 120m below current resource |

|

825.2 |

828.4 |

3.2 |

|

3.44 |

|

Intercept 150m below current resource |

|

LS-22-091W01 |

686.5 |

688 |

1.5 |

1.29 |

35.89 |

|

New lens E235, 25m below current resource |

|

705.75 |

707 |

1.25 |

|

18.11 |

|

Intercept 40m below current resource |

|

715 |

717.1 |

2.1 |

|

29.49 |

29.27 |

Intercept 45m below current resource |

|

789 |

792 |

3.0 |

|

16.38 |

14.72 |

Intercepts 120m below current resource |

|

794.75 |

795.25 |

0.5 |

|

43.71 |

|

|

LS-22-092 |

788.5 |

793 |

4.5 |

|

2.40 |

|

Intercept 115m below current resource |

|

811 |

811.5 |

0.5 |

|

33.21 |

|

Intercept 130m below current resource |

|

LS-22-093A |

795 |

796.1 |

1.1 |

|

20.55 |

|

Intercept 125m below current resource |

|

LS-22-094 |

213.5 |

214 |

0.5 |

0.46 |

33.27 |

|

Step-out intercept on E030, 100m south of current resource |

|

381.9 |

383.9 |

2 |

1.81 |

6.68 |

|

Intercept 5 m below E110 |

|

387.7 |

388.7 |

1 |

|

12.56 |

|

Intercept 15m above E120 |

|

412.7 |

413.2 |

0.5 |

0.44 |

49.38 |

|

Step-out intercept on E130, 40m S-E of current resource |

|

422.2 |

425.3 |

3.1 |

2.82 |

18.13 |

13.93 |

Step-out intercept on E133, 30m S-E of current resource |

|

551.7 |

552.7 |

1 |

|

15.95 |

|

Intercept 50m above E180 |

|

LS-22-093, LS-22-093AM01 |

No significant intercepts |

Appendix 2: Collar locations

Table 1: Summary of drillhole collar locations

and collar orientations and total lengths from the Ormaque Deposit

listed in this news release. Assay results are listed in Appendix

1.

|

Hole ID |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Length (m) |

|

FOR-22-030 |

296078 |

5330212 |

317 |

184 |

-80 |

705.80 |

|

FOR-22-031 |

296078 |

5330212 |

317 |

4 |

-79 |

629.40 |

|

LS-19-009_R |

295726 |

5329967 |

324 |

359 |

-59 |

948.75 |

|

LS-20-024 |

295724 |

5329922 |

323 |

357 |

-60 |

1004.82 |

|

LS-21-077 |

295654 |

5330616 |

318 |

185 |

-57 |

489.05 |

|

LS-22-088 |

296175 |

5330718 |

326 |

175 |

-82 |

1334.20 |

|

LS-22-089 |

295976 |

5329982 |

324 |

346 |

-68 |

620.04 |

|

LS-22-090 |

295837 |

5330050 |

324 |

359 |

-66 |

938.22 |

|

LS-22-090W01 |

295837 |

5330050 |

324 |

359 |

-66 |

981.05 |

|

LS-22-091 |

295653 |

5330050 |

324 |

5 |

-62 |

1027.25 |

|

LS-22-091W01 |

295653 |

5330050 |

324 |

5 |

-62 |

1045.10 |

|

LS-22-092 |

295974 |

5329987 |

324 |

350 |

-62 |

985.55 |

|

LS-22-093 |

295533 |

5330084 |

325 |

350 |

-70 |

111.94 |

|

LS-22-093A |

295533 |

5330084 |

325 |

355 |

-68 |

1005.20 |

|

LS-22-093AM01 |

295533 |

5330084 |

325 |

355 |

-68 |

1448.90 |

|

LS-22-094 |

295887 |

5330066 |

324 |

5 |

-78 |

1034.27 |

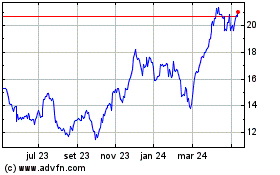

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

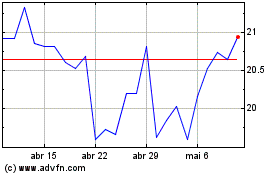

Eldorado Gold (TSX:ELD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025