Astrotech Reports Third Quarter of Fiscal Year 2023 Financial Results

11 Maio 2023 - 9:00AM

Astrotech Corporation (Nasdaq: ASTC) (the “Company” or “Astrotech”)

reported its financial results for its third quarter of fiscal year

2023, which ended March 31, 2023.

Financial Highlights & Recent

Developments

- Astrotech’s consolidated balance

sheet remains strong with $44.1 million in cash and liquid

investments.

- Year-to-date revenue totaled $336

thousand and was generated by sales of TRACER 1000™ explosive trace

detector (ETD), as well as recurring maintenance services and sales

of consumables for the TRACER 1000. The decrease in revenue from

the prior fiscal year is primarily the result of the long sales

cycle for many of the ETD orders.

- Year-to-date gross margin increased

to 37% from 22%, an increase of 68%, for fiscal year 2023, compared

to fiscal year 2022, due to the higher margins provided by

recurring maintenance services and consumables sales.

- Our 1st Detect subsidiary recently

announced that it secured a 17-unit order for its TRACER 1000™

explosives trace detector, which represents the largest single

order to date for the TRACER 1000 and is expected to expand 1st

Detect’s footprint to 22 sites across 14 countries in Europe and

Asia. The systems are scheduled to be delivered over the remainder

of this calendar year.

- Our AgLAB subsidiary released

results from the ongoing field trials of the AgLAB Maximum Value

Process™ method (AgLAB MVP), which uses the Company’s proprietary

AgLAB 1000-D2™ mass spectrometer to improve distillation oil yields

and profitability for cannabis and hemp producers. During our field

trials, we were able to improve ending-weight yields by an average

of 30%.

- Our BreathTech subsidiary continues

to collect breath samples from both COVID-19 positive and negative

patients as part of the ongoing development of the library for the

BreathTest-1000™ lung disease screening instrument. The

BreathTest-1000 is a breath analysis tool designed to screen for

volatile organic compounds found in a person’s breath that could

indicate bodily infections and critical conditions.

- On December 5, 2022, the Company

effected a reverse stock split primarily intended to bring the

Company into compliance with the minimum bid price requirements for

maintaining its listing on The Nasdaq Stock Market LLC. On

December 19, 2022, the Company received written notice from the

Listing Qualifications Department of Nasdaq stating that the

Company had regained compliance with the

minimum bid price requirement of $1.00 per share for continued

listing on The Nasdaq Capital Market. Numbers presented in the

financial statements presented below have been adjusted to reflect

the reverse stock split.

“We are thrilled to further expand into the airport security

checkpoint market in Europe with receipt of a purchase order for 17

TRACER 1000 systems. We believe that mass spectrometry-based ETDs

are a superior technology for the detection of explosives,

providing benefits to both airports and travelers. In addition, our

AgLAB 1000-D2 field trials with potential customers have shown that

the AgLAB MVP solution is an effective tool to improve potency

yields and ending-weights for cannabis and hemp oil processors.

This technology has the ability to increase customer

profitability,” stated Thomas B. Pickens, III, Astrotech’s

Chairman, Chief Executive Officer and Chief Technical Officer.

About Astrotech Corporation

Astrotech (Nasdaq: ASTC) is a mass spectrometry company

that launches, manages, and commercializes scalable companies based

on its innovative core technology through its wholly-owned

subsidiaries. 1st Detect develops,

manufactures, and sells trace detectors for use in the security and

detection market. AgLAB develops and sells

chemical analyzers for use in the agriculture

market. BreathTech is developing a breath

analysis tool to screen for volatile organic compounds that could

indicate bodily infections and critical conditions. Astrotech is

headquartered in Austin, Texas. For information, please visit

www.astrotechcorp.com.

About the AgLAB 1000™ and the

BreathTest-1000™

This press release contains information about our new products

under development, AgLAB 1000 and BreathTest-1000. Product

development involves a high degree of risk and uncertainty, and

there can be no assurance that our new products will be

successfully developed, achieve their intended benefits, receive

full market authorization, or be commercially successful. In

addition, FDA approval will be required to market BreathTest-1000

in the United States. Obtaining FDA approval is a complex and

lengthy process, and there can be no assurance that FDA approval

for BreathTest-1000 will be granted on a timely basis or at

all.

Forward-Looking Statements

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, the adverse impact of recent inflationary pressures,

including significant increases in fuel costs, global economic

conditions and events related to these conditions, including the

ongoing war in Ukraine and the COVID-19 pandemic, the Company’s use

of proceeds from the common stock offerings, whether we can

successfully complete the development of our new products and

proprietary technologies, whether we can obtain the FDA and other

regulatory approvals required to market our products under

development in the United States or abroad, whether the market will

accept our products and services and whether we are successful in

identifying, completing and integrating acquisitions, as well as

other risk factors and business considerations described in the

Company’s Securities and Exchange Commission filings including the

Company’s most recent Annual Report on Form 10-K. Any

forward-looking statements in this document should be evaluated in

light of these important risk factors. Although the Company

believes the expectations reflected in its forward-looking

statements are reasonable and are based on reasonable assumptions,

no assurance can be given that these assumptions are accurate or

that any of these expectations will be achieved (in full or at all)

or will prove to have been correct. Moreover, such statements are

subject to a number of assumptions, risks and uncertainties, many

of which are beyond the control of the Company, which may cause

actual results to differ materially from those implied or expressed

by the forward-looking statements. In addition, any forward-looking

statements included in this press release represent the Company’s

views only as of the date of its publication and should not be

relied upon as representing its views as of any subsequent date.

The Company assumes no obligation to correct or update these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Company Contact: Jaime

Hinojosa, Chief Financial Officer, Astrotech Corporation, (512)

485-9530

Tables follow

ASTROTECH

CORPORATIONCondensed Consolidated Statements of

Operations and Comprehensive Loss(In thousands, except per

share data)(Unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue |

$ |

35 |

|

|

$ |

97 |

|

|

$ |

336 |

|

|

$ |

845 |

|

| Cost of revenue |

|

24 |

|

|

|

46 |

|

|

|

211 |

|

|

|

662 |

|

| Gross

profit |

|

11 |

|

|

|

51 |

|

|

|

125 |

|

|

|

183 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

1,406 |

|

|

|

1,476 |

|

|

|

4,606 |

|

|

|

4,630 |

|

|

Research and development |

|

1,355 |

|

|

|

722 |

|

|

|

3,847 |

|

|

|

2,013 |

|

| Total operating

expenses |

|

2,761 |

|

|

|

2,198 |

|

|

|

8,453 |

|

|

|

6,643 |

|

| Loss from

operations |

|

(2,750 |

) |

|

|

(2,147 |

) |

|

|

(8,328 |

) |

|

|

(6,460 |

) |

|

Other income and expense, net |

|

375 |

|

|

|

47 |

|

|

|

1,006 |

|

|

|

151 |

|

| Net loss |

$ |

(2,375 |

) |

|

$ |

(2,100 |

) |

|

$ |

(7,322 |

) |

|

$ |

(6,309 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

1,616 |

|

|

|

1,587 |

|

|

|

1,614 |

|

|

|

1,584 |

|

| Basic and diluted net

loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share |

$ |

(1.47 |

) |

|

$ |

(1.32 |

) |

|

$ |

(4.54 |

) |

|

$ |

(3.98 |

) |

| Other comprehensive

loss, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(2,375 |

) |

|

$ |

(2,100 |

) |

|

$ |

(7,322 |

) |

|

$ |

(6,309 |

) |

|

Available-for-sale securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gain/(losses) |

|

181 |

|

|

|

(524 |

) |

|

|

(189 |

) |

|

|

(769 |

) |

| Total comprehensive

loss |

$ |

(2,194 |

) |

|

$ |

(2,624 |

) |

|

$ |

(7,511 |

) |

|

$ |

(7,078 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASTROTECH

CORPORATIONCondensed Consolidated Balance

Sheets(In thousands, except share and per share

data)

| |

|

March 31, |

|

June 30, |

| |

|

2023 |

|

2022 |

| |

|

(Unaudited) |

|

(Note) |

|

Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,435 |

|

|

$ |

26,453 |

|

|

Short-term investments |

|

|

29,714 |

|

|

|

26,173 |

|

|

Accounts receivable |

|

|

74 |

|

|

|

56 |

|

|

Cost and estimated revenue in excess of billings |

|

|

— |

|

|

|

2 |

|

|

Inventory, net: |

|

|

|

|

|

|

|

|

|

Raw materials |

|

|

1,242 |

|

|

|

864 |

|

|

Work-in-process |

|

|

63 |

|

|

|

136 |

|

|

Finished goods |

|

|

452 |

|

|

|

518 |

|

|

Prepaid expenses and other current assets |

|

|

929 |

|

|

|

748 |

|

| Total current

assets |

|

|

46,909 |

|

|

|

54,950 |

|

|

Property and equipment, net |

|

|

2,170 |

|

|

|

1,098 |

|

|

Operating leases, right-of-use assets, net |

|

|

299 |

|

|

|

162 |

|

|

Other assets, net |

|

|

30 |

|

|

|

11 |

|

| Total

assets |

|

$ |

49,408 |

|

|

$ |

56,221 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

274 |

|

|

|

169 |

|

|

Payroll related accruals |

|

|

922 |

|

|

|

816 |

|

|

Accrued expenses and other liabilities |

|

|

833 |

|

|

|

961 |

|

|

Income tax payable |

|

|

— |

|

|

|

2 |

|

|

Term note payable - related party |

|

|

— |

|

|

|

500 |

|

|

Lease liabilities, current |

|

|

295 |

|

|

|

234 |

|

| Total current

liabilities |

|

|

2,324 |

|

|

|

2,682 |

|

|

Lease liabilities, net of current portion |

|

|

281 |

|

|

|

303 |

|

| Total

liabilities |

|

|

2,605 |

|

|

|

2,985 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Convertible preferred stock, $0.001 par value, 2,500,000 shares

authorized; 280,898 shares of Series D issued and outstanding at

March 31, 2023 and June 30, 2022 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 250,000,000 shares authorized at

March 31, 2023 and June 30, 2022; 1,692,600 and 1,685,595 shares

issued at March 31, 2023 and June 30, 2022, respectively; 1,686,723

and 1,685,595 outstanding at March 31, 2023 and June 30, 2022,

respectively |

|

|

190,643 |

|

|

|

190,642 |

|

|

Treasury stock, 5,821 and no shares at March 31, 2023 and June 30,

2022, respectively |

|

|

(69 |

) |

|

|

— |

|

|

Additional paid-in capital |

|

|

80,651 |

|

|

|

79,505 |

|

|

Accumulated deficit |

|

|

(223,034 |

) |

|

|

(215,712 |

) |

|

Accumulated other comprehensive loss |

|

|

(1,388 |

) |

|

|

(1,199 |

) |

| Total stockholders’

equity |

|

|

46,803 |

|

|

|

53,236 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

49,408 |

|

|

$ |

56,221 |

|

| |

|

|

|

|

|

|

|

|

Note: The balance sheet at June 30, 2022, has

been derived from the audited consolidated financial statements at

that date but does not include all of the information and footnotes

required by the United States generally accepted accounting

principles for complete financial statements.

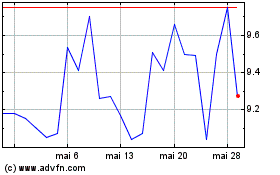

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025