InnSuites Hospitality Trust (NYSE

American: IHT)

reported a continuation of strong improvement of results in the

First Fiscal Quarter of 2024, (February 1, 2023, to April 30,

2023), with Net Income Attributable to Controlling Interests

increasing by approximately 25%, to $236,608 as compared to

$188,115.

Total Consolidated Fiscal First Quarter Net

Income also increased approximately 25% to $465,445.

Total Trust Equity increased to $4,017,911 at

the end of Fiscal First Quarter 2024, up approximately 9%, or

$335,766.

Earnings Per Share based on this Net Income

Attributable to Controlling Interest amount was $0.03, up $0.01

from the prior year of $0.02.

Total Revenues increased to approximately $2.2

million, which is an approximate increase of 3% from the same prior

Fiscal Year total of $2.1 million.

Consolidated Net Income before non-cash

depreciation expense was $633,623 for the 2024 First Fiscal Quarter

ended April 30, 2023 (February 1, 2023, through April 30, 2023),

which was an increase of approximately 16% from the First Fiscal

Quarter of 2023 (February 1, 2022, through April 30, 2022).

InnSuites Hospitality Trust (IHT), in late 2019,

made a diversification investment in new development privately held

UniGen Power, Inc. (UniGen), developing a high risk, high profit

potential, efficient clean electricity energy generation

innovation. The UniGen design is fueled not only with abundant

relatively clean natural gas but also with other even cleaner fuels

such as ethanol and hydrogen (that emits only water). IHT holds

stock, convertible bonds, and warrants that, when fully

converted/exercised, could result in IHT holding an approximate 25%

ownership stake in UniGen. UniGen has confirmed that prototype

design engineering for the UPI 1000TA engine is now complete, with

a majority of parts and tooling having been ordered and arriving

daily.

Engineering work is complete on the prototype

and has been placed on hold, while UniGen concentrates on its next

round of capital raising, with promising initial response. IHT may

participate in the upcoming round of capital raising through the

exercise of existing warrants, which may or may not result in

further increase of IHT fully diluted ownership.

Said James Wirth President, CEO, and IHT Board

Chairman:

“With 2024 Fiscal First Quarter hospitality

revenues reaching record levels, combined with six consecutive

recently completed profitable quarters, and with continuing

progress on the UniGen diversification, IHT management believes

that due to real estate held at book values believed to be

significantly below current market value and due to the high risk,

but also high diversification UniGen profit potential ahead, the

IHT future looks bright, and in our opinion IHT stock is

undervalued. Accordingly, IHT continues its stock buyback

program.”

Fiscal Year 2023 extended IHT’s uninterrupted,

continuous annual dividends to 52 years, since 1971, with

semi-annual dividends paid February 1, 2023, and anticipated for

July 31, 2023.

For more information, visit

www.innsuitestrust.com and www.innsuites.com.

Forward-Looking Statements

With the exception of historical information,

matters discussed in this news release may include “forward-looking

statements” within the meaning of the federal securities laws. All

statements regarding IHT’s review and exploration of potential

strategic, operational, and structural alternative diversification

investments, and expected associated costs and benefits, as well as

statements related to continuation of its 52 years of uninterrupted

payment of annual dividends, are forward-looking. Actual

developments and business decisions may differ materially from

those expressed or implied by such forward-looking statements.

Important factors, among others, that could cause IHT’s actual

results and future actions to differ materially from those

described in forward-looking statements include the uncertain

outcome, impact, effects and results of IHT’s success in finding

potential qualified purchasers for its hospitality real estate, or

a reverse merger partner, continuation of growth of hospitality

revenues and/or profit growth, timely collection of receivables,

the success of and timing of the UniGen clean energy

diversification innovation, the continuation of semi-annual

dividends in the year(s) ahead, and other risks discussed in IHT’s

SEC filings. IHT expressly disclaims any obligation to update any

forward-looking statement contained in this news release to reflect

events or circumstances that may arise after the date hereof, all

of which are expressly qualified by the foregoing, other than as

required by applicable law.

FOR FURTHER INFORMATION:

Marc Berg, Executive Vice President 602-944-1500

email: mberg@innsuites.com

INNSUITES HOTEL CENTRE1730 E. NORTHERN AVENUE,

#122Phoenix, Arizona 85020Phone: 602-944-1500

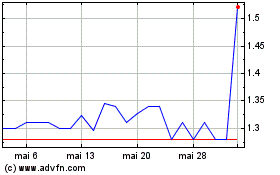

Innsuites Hospitality (AMEX:IHT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Innsuites Hospitality (AMEX:IHT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024