AMA has completed its fund raising of €7.99 million

AMA has

completed its fund raising

of €7.99

million

AMA CORPORATION PLC

(“AMA”),

pioneer in assisted reality solutions, editor and integrator of B2B

software solutions for the smart workplace, announces today the

completion of its capital increase with cancellation of the

subscription right in the context of a public offering, of an

amount of €7.99 million (the “Offer”).

Rationale for the Offer

The Company plans to use the proceeds of the

Offering to continue its strong financial position with reinforced

shareholders’ equity while maintaining a high pace of innovation

and an international sales strategy.

Following the Offer, the Company would have a

cash position in excess of 12 months, excluding the activation of

financing lines already granted, amounting to €12 million at the

date of this press release.

Terms and conditions of

the Offer

Structure of the

Offer

The Offer was carried out by issuing 30,769,230

new ordinary shares with a nominal value of £0.125 (the

“New Shares”) in the context of a

capital increase with cancellation of the preferential subscription

right of the shareholders, at the price of €0.26 per share,

implying gross proceeds of € 7,999,999.80 million. The gross

proceeds of the Offer amount to €7,999,999.80 million. The net

proceeds of the Offer are approximately €7.8 million.

Guillemot Brother SAS, a shareholder with 34.38%

of the Company's capital and voting rights, which had undertaken to

subscribe for 100% of the Offer, subscribed for 30,682,640 new

shares (i.e. 7.98 million euros).

The offering price, determined by the board of

directors, was €0.26 per new share, which represents a discount of

10.3% compared to the closing share price the day it was set on

12th June 2023 (€0.29).

Settlement and delivery of the new shares issued

in connection with the Transaction will take place on Friday 30

June 2023 and their admission to trading on the Euronext Growth

market under ISIN code GB00BNKGZC51 (ticker: ALAMA) will take place

on Friday 30 June 2023. They will be treated in the same way as

existing shares as soon as they are issued and will confer the same

rights as existing shares in circulation.

Pursuant to Article 3 of the Regulation (EU)

2017/1129 of the European Parliament and Council of 14 June 2017

and article 211-2 of the General regulation of the French financial

markets authority (Autorité des marchés financiers,

“AMF”), the Offer will not be subject to the

preparation of a prospectus submitted to the approval of the

AMF.

Lock-up

agreements

Guillemot Brothers committed towards TP ICAP

Midcap to a lock-up of 180 calendar days following the settlement

date of the New Shares covering the entirety of the shares held as

well as the entirety of the New Shares.

Undertaking not to initiate a

squeeze-out

The Guillemot family and Guillemot Brothers have

undertaken not to initiate a squeeze-out procedure during the

twelve months following the settlement of the Offer.

The Guillemot family and the Company would like

the free float of the Company to remain as large as possible and to

be maintained within a range of 10% to 15%. They will consider the

various means available to them to increase the free float.

Financial intermediaries

TP ICAP (Midcap) acts as Global Coordinator,

Lead Manager and Bookrunner of the Offer.

Impact of the issuance of the shares on

the interest of the shareholders

The impact of the issuance of the New Shares

described above on the interest of the shareholders (calculations

based on 22,455,815 composing the share capital as of 31 December

2022 and 24,496,315 shares on a fully diluted basis at the same

date, including shares that may be issued on exercise of stock

options), would be as follows:

|

|

Shareholders’ interest

(in %) |

|

Non fully diluted basis |

Fully diluted basis |

|

Before issuance of the New Shares |

1.00% |

0.92% |

|

After issuance of the 30,769,230 New Shares |

0.42% |

0.41% |

Impact of the issuance of the equity

per share of the shareholders

The impact of the issuance of the New Shares

described above on the equity per share of the shareholders

(calculations based on 22,455,815 composing the share capital as of

31 December 2022 and 24,496,315 shares on a fully diluted basis at

the same date, including shares that may be issued on exercise of

stock options), would be as follows:

|

|

Equity per share as of 31

December

2022 |

|

Non fully diluted basis |

Fully diluted basis |

|

Before issuance of the New Shares |

0.26€ |

0.25€ |

|

After issuance of the 30,769,230 New Shares |

0.26€ |

0.26€ |

Impact of the issuance on the

ownership structure

AMA's share capital will consist of 53,225,045

shares following settlement.

To the best of the Company's knowledge, the

ownership structure (on a non-diluted basis) before and after

completion of the Offer is as follows:

|

|

Prior to the transaction |

After the transaction |

|

Theoretical number of shares and voting

rights |

Theoretical % of share capital and voting

rights |

Theoretical number of shares and voting

rights |

Theoretical % of share capital and voting

rights |

|

Guillemot Brothers SAS |

7,721,212 |

34.38% |

38,403,852 |

72.15% |

|

Guillemot family |

10,178,375 |

45.33% |

10,208,375 |

19.18% |

|

Free float |

4,556,228 |

20.29% |

4,612,818 |

8.67% |

|

Total |

22,455,815 |

100.00% |

53,225,045 |

100.00% |

Risk factors

Risks associated with the business of

the Company

Detailed information concerning AMA,

particularly on its activity, its results and its risk factors are

available in its annual report and financial statements relating to

the year ended on 31 December 2022. They are available as well as

other regulated information and press releases, on the website of

the Company (www.amaxperteye.com/investors).

The materialisation of all or part of the risks

may have an adverse effect on the business, the financial position,

the results, or the prospective outlooks of the Company. The risk

factors exposed in the annual financial report remain unchanged at

the date of the present press release.

The Company reviewed its liquidity risk and

considers that it is not subject to any such risk.

Risks associated with the

Offer

In addition, investors are invited to consider

the following risks related to the issuance of new shares:

- the market price of

the shares could fluctuate and decrease below the subscription

price of the shares issued in the context of the Offer,

- the volatility and

liquidity of the shares of the Company could significantly

fluctuate,

- sales of shares of

the Company could take place on the market and have a negative

impact on the share price of the Company, and

- the shareholders of

the Company could be significantly diluted in case of future

capital increases.

Partners in the operation

| |

|

|

|

Global Coordinator, Lead Manager and Bookrunner of the

Offer |

Legal advisors on the Offer |

Financial communication agency |

Next financial press

release2023 second-quarter revenues: 28 July 2023 (before

start of trading)

About AMASince 2015, AMA, a

software developer and integrator, is helping industry and service

providers of all sizes, as well as medical establishments, to

accelerate their digital transformation. AMA’s XpertEye suite of

applications addresses a wide range of use cases, from remote

diagnostics to inspection, planning, and workflow management. These

unequaled remote interactive collaboration solutions empower

customers to improve productivity, speed up resolution time, and

maximize uptime while reducing their carbon footprint. With offices

in France, Germany, Spain, the United States, China and Japan, AMA

has a global presence and works across all time zones to forge

close relationships with its clients wherever they are. AMA is

listed on Euronext Growth Paris (GB00BNKGZC51 – ALAMA). Learn more

at www.amaxperteye.com.

Contacts

| Investor Relations

& Financial Media Perrine Fromont, CFO -

+33 223 441 339 – investors@ama.bzh Marie

Calleux, Calyptus - +33 609 685 538 - ama@calyptus.net |

Corporate media:

Esther Duval+33 689 182 343 esther.duval@ama.bzh |

Disclaimer

This press release and the information it

contains does not constitute a sale offer or an offer to subscribe,

nor a solicitation to purchase or subscribe shares of AMA Corporate

PLC in any country.

This press release is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and the Council of 14 June 2017 (the

“Prospectus Regulation”).

With respect to the member States of the

European Economic Area, other than France (the “Member

States”), no action has been undertaken or will be

undertaken to make an offer to the public of the shares requiring a

publication of a prospectus in one of these Member States.

Consequently, the securities cannot be offered and will not be

offered in any Member State (other than France) except in

accordance with the exemptions set out in Article 1(4) of the

Prospectus Regulation, or in other cases which does not require the

publication by AMA Corporation PLC of a prospectus pursuant to the

Prospectus Regulation and/or applicable regulation in these Member

States.

This press release does not constitute or form a

part of any offer or solicitation to purchase or subscribe for

securities in the United States or any other jurisdiction (other

than France). Securities may not be offered or sold in the United

States unless they have been registered under the U.S. Securities

Act of 1933, as amended (the “U.S. Securities

Act”), or are exempt from registration. The shares of AMA

Corporation PLC have not been and will not be registered under the

U.S. Securities Act and AMA Corporation PLC does not intend to make

a public offer of its shares in the United States.

This press release does not constitute an offer

of the securities to the public in the United Kingdom. The

distribution of this press release is not made, and has not been

approved, by an authorised person within the meaning of Article

21(1) of the Financial Services and Markets Act 2000. Consequently,

this press release is directed only at persons who (i) are located

outside the United Kingdom, (ii) have professional experience in

matters relating to investments and fall within Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotions)

Order 2005, as amended and (iii) (iii) are persons falling within

Article 49(2)(a) to (d) (high net worth companies, unincorporated

associations, etc.) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the persons mentioned under (i),

(ii) and (iii) referred together as “Relevant

Persons”). The securities of AMA Corporation PLC are

directed only at Relevant Persons and no invitation, offer or

agreements to subscribe, purchase or otherwise acquire the

securities of AMA Corporation PLC may be proposed or made other

than with Relevant Persons. Any person other than a Relevant Person

may not act or rely on this document or any provision thereof. This

press release is not a prospectus which has been approved by the

Financial Conduct Authority or any other United Kingdom regulatory

authority for the purposes of Section 85 of the Financial Services

and Markets Act 2000.

This press release contains indications on the

targets of AMA Corporation PLC as well as forward-looking

statements. This information is not historical data and shall not

be interpreted as a guarantee that the facts and data announced

will occur. Such information is based on data, hypothesis and

assumptions considered to be reasonable by AMA Corporation PLC. The

Company operates in a constantly changing competitive environment.

Therefore, it cannot anticipate all risks, uncertainties or other

factors that may have an impact on its business, nor the extent to

which the occurrence of a risk or combination of risks may have

materially different outcomes to those referred to in any

forward-looking information. Such information is valid only at the

date of the present press release. AMA Corporation PLC does not

commit, in any way, to publish updates on the information nor on

the hypothesis on which they are based except in cases where it has

a legal or regulatory requirement to do so.

The distribution of this press release in

certain countries may be subject to a specific regulation.

Consequently, persons present in such countries and in which the

press release is disseminated, published, or distributed shall

comply to such laws and regulations.

The information contained in this document does

not constitute an offer of securities for sale in the United States

of America, Canada, Australia or Japan. This press release may not

be published, forwarded, or distributed, directly or indirectly, in

the United States, Canada, Australia or Japan.

Finally, this press release may be drafted both

in French and in English. The French version of this press release

shall prevail over the English version in the event of a

discrepancy.

- AMA_CP_resultat_augmentation_de_ capital_EN_27062023_DEF

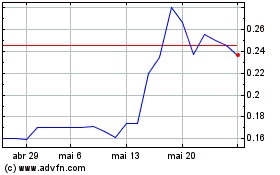

AMA (EU:ALAMA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

AMA (EU:ALAMA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024