Consolidated Lithium Acquires Additional Lithium Mining Concessions in Quebec and Upsizes Flow-Through Financing

20 Julho 2023 - 11:32PM

Consolidated Lithium Metals Inc. (TSXV:

CLM | OTCQB:

JORFF | FRA:

Z36) (“

CLM” or the

“

Company“) is pleased to announce that it has

acquired 24 mineral claims representing 1,283.08 hectares of

concessions in the James Bay/Eeyou Istche region of Quebec (the

“

Claims”) from a wholly owned subsidiary

(“

Subco”) of AmmPower Corp. (CSE: AMMP)

(“

AmmPower”), subject to the terms and conditions

set out in the corresponding asset purchase agreement dated as of

July 20, 2023 (the “

Agreement”).

Pursuant to the Agreement, as consideration for

the acquisition of a 100% interest in the Claims (the

“Acquisition”), CLM paid aggregate consideration

of $60,000 in cash and granted to AmmPower a 1% net smelter return

royalty affecting the Claims, which CLM has the option to

repurchase at any time for $250,000. No finder fees are payable in

connection with, and no change of control of CLM will result from,

the Acquisition. Completion of the Acquisition remains subject to

final approval of the TSX Venture Exchange

(“TSXV”).

Rene Bharti, the chief executive officer and

president and a director of CLM, is the president and a minority

shareholder of AmmPower, and a director and officer of Subco, and

the three companies share office space. Further, Ryan Ptolemy

serves as the chief financial officer of both CLM and AmmPower.

Notwithstanding the shared directors and officers, the Acquisition

does not constitute a Related Party Transaction under Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions (“MI 61-101”) because

AmmPower and Subco are not Related Parties of CLM (as such terms

are defined in MI 61-101). However, the Acquisition does constitute

a Related Party Transaction, and was therefore characterized by the

TSXV as a Reviewable Transaction, under TSX Venture Exchange

Policies 1.1, 5.3, and 5.9 as a result of the shared officers and

directors between AmmPower, Subco, and CLM.

Flow-through Financing Extension and Upsize

The Company also announces today that it has

received approval from the TSXV to extend the closing of its

previously announced non-brokered private placement financing of

common shares of the Company issued on a flow-through basis (each,

a “Flow-Through Share”) at a price of $0.08 per

Flow-Through Share for proceeds of up to $1 million (the

“Offering”) to August 18, 2023. The Company closed

a first and second tranche of the Offering on June 12, 2023 and

June 26, 2023, respectively, and anticipates that the third and

final tranche closing will occur on or before August 18, 2023. For

more information on the Offering and the first and second tranches,

please see the Company’s press releases dated May 24, 2023, June

12, 2023, and June 26, 2023, respectively.

In addition, as a result of increased investor

demand, the Company is increasing the maximum size of the Offering

from $1 million to $2 million. The Company continues to intend to

use the proceeds of the upsized Offering to fund exploration

expenses on its Baillarge lithium mining property. Completion of

the Offering (including the first tranche, second tranche, and any

future tranche) is subject to receipt of final approval of the

TSXV.

About Consolidated Lithium Metals

Inc. Consolidated Lithium Metals Inc. (formerly known as

Jourdan Resources Inc.) is a Canadian junior mining exploration

company trading under the symbol “CLM” on the TSX Venture Exchange

and “2JR1” on the Stuttgart Stock Exchange. The Company is focused

on the acquisition, exploration, production, and development of

mining properties. The Company’s properties are in Quebec, Canada,

primarily in the spodumene-bearing pegmatites of the La Corne

Batholith, around North American Lithium’s Quebec lithium mine.

For more information:Rene

Bharti, Chief Executive Officer and PresidentEmail

| info@consolidatedlithium.comPhone | (416)

861-5800Website |www.jourdaninc.com

Cautionary Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, but is not

limited to, statements with respect to the Acquisition and the

Offering, including the timing of closing the final tranche.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “plans”, “expects” or “does

not expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved”.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including but not limited to: receipt

of the necessary TSXV approval for the Acquisition and the

Offering. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking information. The Company does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

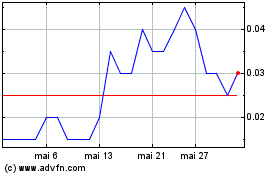

Consolidated Lithium Met... (TSXV:CLM)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Consolidated Lithium Met... (TSXV:CLM)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025