Without domestic clean hydrogen, the U.S. will not meet its climate

and economic goals. That is why today

Plug

Power Inc. (NASDAQ: PLUG), a global leader in comprehensive

hydrogen solutions for the green hydrogen economy, the U.S.

Chamber of Commerce, and 31 other organizations submitted a

letter to Biden Administration officials addressing Section 45V

Clean Hydrogen Production Tax Credit (PTC) implementation. Congress

created the PTC to spur investments in clean hydrogen, and poorly

devised PTC rules could hamper this vital industry and broader

U.S. policy goals.

The letter underscores the Clean Hydrogen PTC’s importance in

driving energy security, job creation, and decarbonization of the

most difficult-to-abate sectors. In addition, the letter cautions

the Administration to avoid unworkable and inequitable PTC

requirements that could shift clean hydrogen investments overseas

and allow other countries to undercut U.S. clean hydrogen

manufacturing. Congress’ intent of enacting the PTC and Inflation

Reduction Act was to rapidly scale clean hydrogen production in the

United States and accelerate the Biden Administration’s greenhouse

gas pollution reduction targets.

In addition, Plug has developed a technical and policy impact

analysis, “The Road to Clean Hydrogen: Getting the Rules

Right,” about PTC implementation.

If overly strict restrictions are placed upon tax credit

qualifying rules, the analysis projects a significant negative

impact on the development of the green hydrogen industry, including

domestic investment reductions of 65 percent by 2032, the loss of

over 500,000 jobs over the next seven years, and energy security

risks from the failure to develop hydrogen manufacturing and

infrastructure.

“The fact is clean domestic hydrogen is essential to meeting

America’s climate and economic goals,” said Plug CEO Andy Marsh.

“If PTC rules are too restrictive, we risk forgoing hundreds of

thousands of jobs, conceding hydrogen leadership overseas,

compromising our energy security, and failing to achieve

decarbonization goals – especially in hard-to-abate sectors like

steel and chemical production.”

“The section 45V hydrogen PTC holds enormous potential to help

the Administration meet its ambitious climate targets, but we must

get the details right. Plug’s technical analysis demonstrates that

stringent restrictions on 45V PTC eligibility could cripple

investment in the hydrogen economy and deprive hard-to-abate

sectors of adequate and affordable hydrogen supplies. If the

Administration pursues a flexible and balanced approach

to the implementation of this tax credit, we are

confident U.S. businesses will respond with historic levels of

investment in hydrogen projects that will power our clean energy

future,” said Marty Durbin, President, Global Energy Institute,

U.S. Chamber of Commerce.

Well-established organizations and companies with decades of

experience in clean energy implementation signed the letter

encouraging the Administration to advance pragmatic,

forward-looking guidance for the Section 45V Clean Hydrogen

PTC.

“For hydrogen infrastructure developers in support of the future

fuel of domestic long-haul transportation, the onerous requirements

of additional renewable energy resources for hydrogen production,

hourly time matching and deliverability in an already constrained

interconnection environment, which exists across the country, will

stymie the establishment of the clean hydrogen industry,” added

Salim Rahemtulla, President and CEO of PowerTap Hydrogen Fueling

Corp.

“We believe a pragmatic approach to the PTC rules is essential

to delivering on the Administration’s vision for combatting the

climate crisis and driving job growth here in the U.S.,” added Jill

Evanko, CEO and President, Chart Industries, Inc.

"In order to accelerate the shift to a sustainable future,

effective collaboration between the public and private sector is

mandatory. The IRA and its Section 45V Clean Hydrogen PTC is an

important step in encouraging the development of the green hydrogen

economy in the U.S. Accelera by Cummins is proud to join with the

signers of this letter to urge the Administration to make the

credit as easy to access as possible, promoting effective

deployment and ensuring American competitiveness in the growing

zero-emissions market,“ noted Amy Davis, President, Accelera by

Cummins.

About PlugPlug is building an end-to-end green

hydrogen ecosystem, from production, storage and delivery to energy

generation, to help its customers meet their business goals and

decarbonize the economy. In creating the first commercially viable

market for hydrogen fuel cell technology, the company has deployed

more than 60,000 fuel cell systems and over 180 fueling stations,

more than anyone else in the world, and is the largest buyer of

liquid hydrogen. With plans to build and operate a green hydrogen

highway across North America and Europe, Plug is operating a

state-of-the-art Gigafactory to produce electrolyzers and fuel

cells, and is commissioning multiple green hydrogen production

plants that will yield 500 tons of liquid green hydrogen daily by

year end 2025. Plug will deliver its green hydrogen solutions

directly to its customers and through joint venture partners into

multiple environments, including material handling, e-mobility,

power generation, and industrial applications. For more

information, visit www.plugpower.com.

Plug Power Safe Harbor Statement

This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve significant risks and uncertainties

about Plug Power Inc. (“PLUG”), including but not limited to

statements about: Plug’s technical and policy impact analysis

predicting that overly strict restrictions placed upon tax credit

qualifying rules will have a significant negative impact on the

development of the green hydrogen industry, including domestic

investment reductions of 65 percent by 2032, the loss of over

500,000 jobs over the next seven years, and energy security risks

from the failure to develop hydrogen manufacturing and

infrastructure. Mr. Marsh’s statement that If PTC rules are too

restrictive, the USA risks forgoing hundreds of thousands of jobs,

conceding hydrogen leadership overseas, compromising national

energy security, and failing to achieve decarbonization goals –

especially in hard-to-abate sectors like steel and chemical

production. Marty Durbin’s statement around the U.S. Chamber of

Commerce’s confidence that if the Administration pursues a flexible

and balanced approach to the implementation of this tax

credit, U.S. businesses will respond with historic levels of

investment in hydrogen projects. Mr. Rahemtulla’s statement that

onerous requirements of additional renewable energy resources for

hydrogen production, hourly time matching and deliverability in an

already constrained interconnection environment, which exists

across the country, will stymie the establishment of the clean

hydrogen industry. Plug’s plans to be commissioning multiple green

hydrogen production plants that will yield 500 tons of liquid green

hydrogen daily by year end 2025. Such statements are subject to

risks and uncertainties that could cause actual performance or

results to differ materially from those expressed in these

statements. For a further description of the risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of PLUG in general, see PLUG’s public

filings with the Securities and Exchange Commission (the “SEC”),

including the “Risk Factors” section of PLUG’s Annual Report on

Form 10-K for the year ended December 31, 2022 and any subsequent

filings with the SEC. Readers are cautioned not to place undue

reliance on these forward-looking statements. The forward-looking

statements are made as of the date hereof, and PLUG undertakes no

obligation to update such statements as a result of new

information.

MEDIA CONTACT

Kristin

Monroe Allison+PartnersplugPR@allisonpr.com

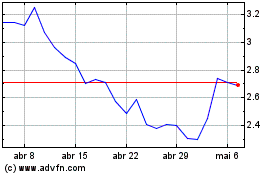

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024