CNOVA N.V. Preliminary 1H23 Financial Performance Press Release

CNOVA N.V.Preliminary

financial performance at the end of June

AMSTERDAM – July 26, 2023, 21:30 CEST Cnova N.V.

(Euronext Paris: CNV; ISIN: NL0010949392) (“Cnova”), in the context

of the conciliation procedure in which the Company’s controlling

shareholder Casino, Guichard-Perrachon S.A. (“Casino”) is engaged1

and is currently negotiating a term sheet with the Consortium,

today provides an update on its GMV, net sales, EBITDA and EBIT

performance in the first half of 20232.

Cnova accelerated its

shift towards a more profitable model, as

illustrated by the sharp increase in gross margin

rate which stands at

29.7% in 1H23

(+7pts vs. 22)

and the doubling of its EBITDA:

-

Overall GMV

decreased by -14% like-for-like3

in a still challenging

market environment marked by a decreasing trend in High

Tech and Domestic Appliances categories

-

Growing Marketplace

revenues at €91m in 1H23 (+2% vs. 22, +28% vs. 19) with a

slightly decreasing GMV by -3.1% compared to last year, along with

a record high GMV share in 1H23 at 58% (+9pts vs. 22, +20pts vs.

19)

-

Growing Advertising

revenues at €35m in 1H23 with a regular growth (+5% vs.

22, x2.1 vs. 19) and an increase in GMV take rate standing at 3.8%

for 1H23 (+0.8pt vs. 22, +2.4pts vs. 19)

- B2C

Services GMV at €80m (+21% vs. 22) mostly driven by Travel

activities (+16% vs. 22)

- Octopia

B2B revenues at €9m (+43% vs. 22) with 6 clients launched

for Marketplace solutions and increasing number of parcels shipped

for Fulfilment clients such as Adeo and Too Good to Go

- C-Logistics

B2B revenues at €6m in 1H23 (x8 vs. 22), with the launch

of two new clients and an increase in the number of shipped parcels

for external clients (x6 vs. 22)

Doubling EBITDA in 1H23

amounting to €34m (+€19m vs. 22)

thanks to our focus on profitable sales for the direct sales

business, growing Advertising and Marketplace revenues along with

cost saving plan. Efficiency plan to recalibrate SG&A

and CAPEX by the end of 2023 is on track to reach

the July 2022 guidance (€75m savings target vs. 21) reinforced by a

€15m ad-on savings plan announced in April 2023 |

|

Preliminary GMV

performance(€m)

|

|

2023Half year |

2022Half year4 |

|

Change vs. 2022 |

| |

|

Reported |

L-f-L5 |

| Total

GMV |

|

1,380 |

1,785 |

|

-23% |

-14% |

|

Ecommerce platform |

|

1,337 |

1,734 |

|

-23% |

-14% |

|

o/w Direct sales |

|

464 |

679 |

|

-32% |

|

o/w Marketplace |

|

647 |

668 |

|

-3% |

| Marketplace

share |

|

58.3% |

49.6% |

|

+8.7pts |

|

o/w B2C services |

|

80 |

150 |

|

-46% |

+21% |

|

o/w Other revenues |

|

146 |

237 |

|

-39% |

+1% |

| B2B

activities |

|

43 |

50 |

|

-14% |

|

o/w Octopia B2B revenues |

|

11 |

8 |

|

+43% |

|

o/w Octopia Retail & others |

|

25 |

41 |

|

-39% |

|

o/w C-Logistics |

|

7 |

1 |

|

x8 |

Preliminary financial performance at the

end of June - unaudited

|

Cnova N.V.(€m) |

Half Year |

Change |

|

2023 |

20226 |

vs. 2022 |

|

GMV |

1,380.2 |

1,784.7 |

-22.7% |

| Net sales |

612.5 |

874.3 |

-29.9% |

| Gross

margin |

181.7 |

197.7 |

-8.1% |

| As a %

of Net sales |

29.7% |

22.6% |

+7.0pts |

| As a % of

GMV |

13.2% |

11.1% |

+2.1pts |

| SG&A

(excl. D&A) |

147.8 |

-183.1 |

-19.3% |

| As a %

of Net sales |

-24.1% |

-20.9% |

-3.2pts |

| As a % of

GMV |

-10.7% |

-10.3% |

-0.4pts |

|

EBITDA |

33.9 |

14.6 |

+131.8% |

| As a %

of Net sales |

5.5% |

1.7% |

+3.9pts |

| As a % of

GMV |

2.5% |

0.8% |

+1.6pts |

|

Operating EBIT |

-14.3 |

-33.5 |

-57.4% |

Net sales amounted to €612m in

the 1st half 2023, a -30% decrease compared to 2022 and a -23%

like-for-like7 decrease compared to 2022. Net sales evolution has

been impacted by the product mix shift from direct sales towards

commission-based activities, leading to an improvement of

profitability: Marketplace revenues have increased by +1.8% vs. 22

and B2C services8 revenues showed a record performance (+27.2% vs.

22), mostly driven by Travel activities. Octopia B2B revenues have

grown by +43%, mainly with 6 clients launched for its

Marketplace-as-Service solutions and an increase in the number of

parcels shipped by +30% vs. 22 for Fulfilment-as-a-Service clients

such as Adeo and Too Good to Go. C-Logistics B2B revenues have

increased by x8 vs. 22, driven by the launch of 2 new clients and

the increase in the number of shipped parcels. Advertising services

revenues have increased by +5% vs. 22, amounting to €35m in the 1st

semester 2023.

Gross margin was €182m in the

1st half 2023, representing 29.7% of net sales, increasing by +7pts

vs. 22 and by +12pts compared to the pre-pandemic level (1st half

of 2019). This gross margin increase over the past years

demonstrates the success of the implementation of the strategic

plan, with Marketplace revenues growing by +2% compared to last

year (+28% vs. 19) and Advertising revenues increasing by +5%

compared to last year (x2 vs. 19). Compared to 2022, direct sales

margin was negatively impacted by an additional destocking

initiative focused on SKUs with the highest inventory turnover to

adjust inventories to current level of activity. Destocking

initiatives on direct sales had an impact of -4.4pts on gross

margin.

SG&A (excluding

D&A) costs amounted to €-148m in the 1st semester

2023, representing 24.1% of net sales, decreasing by -3pts vs. 22.

During the 2nd quarter 2022, an Efficiency plan to recalibrate

SG&A structure to current level of activity was launched.

-

Fulfilment costs (excluding

D&A) stood at 7.7% of net sales (-0.6pt vs. 22),

decreasing by €15m compared to last year. Variable fulfilment costs

(logistics, after sales and payment processing) were favourably

impacted by lower volumes in the 1st semester 2023 compared to the

1st semester 2022. Fixed fulfilment costs benefited from the

Efficiency Plan launched during the 2nd quarter 2022. Fulfilment

costs are also positively impacted by initiatives aiming at

optimizing costs associated to warehouses: improvement of

warehouses productivity, simplification of warehouses network and

close monitoring of warehouses capacity to adapt to business

levels. Approximatively 50k sqm of warehouses were closed in June

2023, with further capacity optimization planned for the 2nd half

2023

-

Marketing costs (excluding

D&A) represented 5.6% of net sales (+0.1pt vs. 22),

decreasing by €16m compared to last year, mostly due to lower

volumes in the 1st semester 2023 driving down variable acquisition

marketing costs along with benefits from the Efficiency Plan,

notably savings on media campaigns and tools

-

Technology & Content costs (excluding

D&A) stood at 6.9% of net sales (-1.4pt vs. 22),

decreasing by €6m compared to last year, mainly impacted by the

Efficiency Plan launched in the 2nd quarter 2022 to slow down

Octopia’s commercial ramp-up and associated staff costs incurred,

rationalize the Direct Sales dedicated FTEs while continuing to

reinforce marketplace workforce, notably teams dedicated to

sellers’ care and support

-

General & Administrative expenses

(excluding D&A) represented 3.9% of net sales

(-1.3pt vs. 22) and 2.2% of e-commerce GMV9 (-0.5pt vs. 22). The

1st semester 2022 was impacted by positive non-recurring items.

Adjusted from these impacts, General & Administrative costs

would amount to €2m vs. 22 (-8%) despite inflation

Consequently, EBITDA amounted

to €34m, increasing by €19m compared to last year, representing

5.5% of net sales (+3.9pts vs. 22).

Depreciation & Amortization

(D&A) amounted to €-48m in the 1st semester 2023. In accordance

with IFRS 16, Depreciation & Amortization include the

amortization of the right-of-use asset which represents lessees’

right to exploit leased elements over the duration of a lease

agreement, which were impacted by the rationalization of

warehousing capacities to adapt to business levels, with

significant impacts expected in the 2nd half of 2023 and full

impacts expected in 2024.

Operating EBIT amounted to

€-14m, increasing by €19m vs. 22, with steady Depreciation &

Amortization compared to last year.

***

This press release was prepared solely for

information purposes and should not be construed as a solicitation

or an offer to buy or sell securities or related financial

instruments. Likewise, it does not provide and should not be

treated as providing investment advice. It has no connection with

the specific investment objectives, financial situation or needs of

any receiver. No representation or warranty, either express or

implied, is provided in relation to the accuracy, completeness or

reliability of the information contained herein. Recipients should

not consider it as a substitute for the exercise of their own

judgement. All the opinions expressed herein are subject to change

without notice.

Forward-looking statements

This press release may include forward-looking

statements. These forward-looking statements can be identified by

the use of forward-looking terminology, including the terms as

“believe”, “expect”, “anticipate”, “may”, “assume”, “plan”,

“intend”, “will”, “should”, “estimate”, “risk” and or, in each

case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts and include statements regarding

Cnova’s and/ or the Casino Group’s intentions, beliefs or current

expectations concerning, among other things, Cnova’s and/or the

Casino Group’s plans, objectives, assumptions, expectations,

prospects and beliefs and statements regarding other future events

or prospects. By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

These forward-looking statements reflect Cnova’s

and/or the Casino Group’s current expectations, intentions or

forecasts of future events, which are based on the information

currently available and on assumptions made by Cnova and/or the

Casino Group. The forward-looking statements and information

contained in this announcement are made as of the date hereof and

Cnova and/or the Casino Group is under no obligation to update

publicly or revise any forward-looking statements or information,

whether as a result of new information, future events or otherwise,

unless so required by applicable laws. All subsequent written or

oral forward-looking statements attributable to Cnova and/or the

Casino Group, or persons acting on Cnova’s and/or the Casino

Group’s behalf, included in but not limited to press releases

(including on Cnova’s and/or the Casino Group’s website), reports

and other communications, are expressly qualified in their entirety

by the cautionary statements contained throughout this press

release.

***

About Cnova

N.V.

Cnova N.V., the French ecommerce leader, serves

8.0 million active customers via its state-of-the-art website,

Cdiscount. Cnova N.V.’s product offering provides its B2C clients

with a wide variety of very competitively priced goods, fast and

customer-convenient delivery options, practical and innovative

payment solutions as well as travel, entertainment and domestic

energy services. Cnova N.V. also serves B2B clients internationally

through Octopia (Marketplace-as-a-Service solutions), Cdiscount

Advertising (advertising services for sellers and brands) and

C-logistics (end-to-end logistic ecommerce solution). Cnova N.V. is

part of Groupe Casino, a global diversified retailer. Cnova N.V.'s

news releases are available at www.cnova.com. Information available

on, or accessible through, the sites referenced above is not part

of this press release.

This press release contains regulated

information (gereglementeerde informatie) within the meaning of the

Dutch Financial Supervision Act (Wet op het financieel toezicht)

which must be made publicly available pursuant to Dutch and French

law. This press release is intended for information purposes

only.

|

Cnova Investor Relations

Contact:investor@cnovagroup.comTel : +33 6 79 74 30

94 |

Media

contact:directiondelacommunication@cdiscount.comTel: +33 6

18 33 17 86cdiscount@vae-solis.comTel: +33 6 17 76 79 71 |

***

1 Refer for more context to

https://www.groupe-casino.fr/en/announcements/ and

https://www.cnova.com/investor-relations/press-releases/ ,

especially the press release & associated presentation

published by Cnova and Casino on June 26th, 2023

https://www.cnova.com/wp-content/uploads/2023/06/2023-06-26_Cnova-NV_PR_Information-re-Conciliation-and-Activity.pdf

https://www.groupe-casino.fr/wp-content/uploads/2023/06/2023-06-26-CP-Communication-Groupe-Casino.pdf

2 All figures contained herein are unaudited and

may differ from the figures that will be presented in our 2023

half-year report. The Company intends to update these figures in

the course of its ordinary quarterly and (semi) annual reporting.3

Like-for-like figures exclude CChezvous, Géant and Cdiscount Energy

for 1H224 2022 figures have been restated to consider CChezVous

disposal (discontinued operations)5 Like-for-like figures exclude

CChezvous, Géant and Cdiscount Energy for 1H226 2022 figures have

been restated to consider CChezVous disposal (discontinued

operations)7 Like-for-like figures exclude CChezvous, Géant and

Cdiscount Energy for 1H228 Excluding Energy9 E-commerce GMV is

equal to direct sales GMV combined to marketplace GMV

- Cnova Preliminary 1H23 Financial Performance Press Release

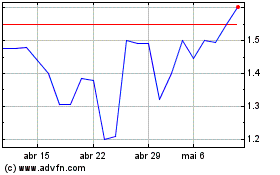

Cnova NV (EU:CNV)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Cnova NV (EU:CNV)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024