VANCOUVER, British Columbia, July 27, 2023

(GLOBE NEWSWIRE) -- Eldorado Gold Corporation (“Eldorado” or “the

Company”) today reports the Company’s financial and operational

results for the second quarter of 2023. For further information,

please see the Company’s Consolidated Financial Statements and

Management’s Discussion and Analysis ("MD&A") filed on SEDAR+

at www.sedarplus.com under the Company’s profile.

Second Quarter

2023 Highlights

Operations

- Gold production:

109,435 ounces, compared to 113,462 ounces in Q2 2022, a 4%

decrease from Q2 2022 as a result of lower throughput at Lamaque

due to the wildfires in the region and lower average gold grade and

recoveries at Olympias.

- Gold sales:

110,134 ounces at an average realized gold price per ounce

sold1 of $1,953, compared to 107,631 ounces at an

average realized gold price per ounce sold of $1,849 in Q2 2022.

Gold sales increased 2% from Q2 2022 primarily a result of an

increase in production at Kisladag.

- Production costs:

$117.0 million, compared to $109.3 million in Q2 2022. The increase

was primarily due to higher royalty expense and increased sales

volumes.

- Cash operating

costs1: $791 per ounce gold

sold, compared to $789 per ounce gold sold in Q2 2022. Cash

operating costs increased from Q2 2022 primarily as a result of

lower by-product credits.

- All-in sustaining costs

("AISC")1: $1,296 per ounce

sold, compared to $1,270 per ounce sold in Q2 2022, primarily

reflecting the increase in cash operating costs per ounce sold and

slightly offset by lower sustaining capital expenditures.

- Total capital

expenditures: $99.4 million, including $42.6 million of

growth capital1 invested at Skouries, with activity

focused on mobilization, procurement and advancement of contracts.

Growth capital invested at the operating mines totalled $29.0

million and was primarily related to Kisladag waste stripping to

support mine life extension and construction of the first phase of

the North Heap Leach Pad. Sustaining

capital1 totalled $26.1 million,

including $16.2 million at Lamaque for underground development,

equipment rebuilds, and the expansion of the tailing management

facility.

- Production and cost

outlook: The Company is maintaining its 2023 annual gold

production guidance and cost guidance. Gold production is expected

to be 475,000 - 515,000 ounces of gold. Cash operating costs per

ounce sold are expected to be $760 to $860, total operating costs

of $860 to $960 per ounce sold and AISC per ounce sold of $1,190 to

$1,290.

Financial

- Revenue: $229.9

million in Q2 2023, an increase of 8% from $213.4 million in Q2

2022, primarily due to higher sales volumes, and higher average

realized gold price.

- Net cash generated from

operating activities from continuing operations: $75.3

million compared to $27.0 million in Q2 2022, primarily as a

result of higher gold sales volumes and higher average realized

prices.

- Cash flow from operating

activities before changes in working

capital2:

$82.4 million in Q2 2023, compared to $49.2 million in Q2 2022,

primarily driven by higher sales volumes, lower finance costs and

lower income taxes paid.

- Cash, cash equivalents and

term deposits: $456.6 million, as at June 30, 2023.

Cash increased by $194.7 million from March 31, 2023, primarily as

a result of a strategic equity investment ($61.3 million) by the

European Bank for Reconstruction and Development ("EBRD") and a

bought deal financing ($101.1 million) that were both completed

during the quarter.

- Net earnings

(loss): Net earnings of $1.5 million, or $0.01 earnings

per share, compared to net loss of $22.9 million or $0.12 loss per

share in Q2 2022. Higher net earnings in Q2 2023, compared to Q2

2022, is primarily a result of higher gold sales, higher average

realized gold prices, foreign exchange gain and lower finance

costs.

- Adjusted net earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA")2: $106.8

million, compared to $88.5 million in Q2 2022. The increase was

primarily driven by increased gold sales, coupled with lower

finance costs.

- Adjusted net earnings

(loss)2:

$16.1 million or $0.09 earnings per share, compared to net earnings

of $13.6 million or $0.07 earnings per share in Q2 2022. Adjusted

net earnings in Q2 2023 added back a non-cash loss of $21.4 million

on foreign exchange translation of deferred tax balances and

removed a non-cash $8.4 million gain on derivative instruments,

primarily on gold collars entered into during this quarter.

- Free cash

flow2:

Negative $21.7 million compared to negative $62.7 million in Q2

2022. Free cash flow excluding Skouries was $13.2 million compared

to negative $56.9 million in Q2 2022, with the stronger figure this

quarter due primarily to both higher sales volumes and realized

gold price as well as lower tax installments and temporary working

capital movements.

- Project Facility

Drawdowns: Drawdowns on the Skouries Term Facility for Q2

2023 totalled €65.9 million, including the previously reported

initial drawdown of €32.3 million in April 2023.

_______________

1 These financial measures or ratios are non-IFRS

financial measures or ratios. Certain additional disclosure for

non-IFRS financial measures and ratios have been incorporated by

reference and additional detail can be found at the end of this

press release and in the section 'Non-IFRS and Other Financial

Measures and Ratios' in the Company's June 30, 2023

MD&A.

Corporate

- Strategic Investment by the

EBRD: On June 14, 2023, Eldorado completed a strategic

investment of CDN $81.5 million ($61.3 million) by the EBRD. In

June the funds were invested in the Skouries project in Northern

Greece, and were credited against the Company’s 20% equity funding

commitment per the terms of the project financing facility that

closed on April 5, 2023.

- Bought Deal: On

June 7, 2023, the Company completed a bought deal offering for

gross proceeds of CDN $135.2 million ($101.1 million). Proceeds

from the offering are expected to be used to fund growth

initiatives across Eldorado's portfolio, including some not

currently contemplated within the Company's five-year plan, as well

as for general corporate and working capital purposes.

- Gold Collar

Contracts: In May 2023, Eldorado entered into a series of

zero-cost gold collar contracts in order to manage potential cash

flow variability during the Skouries construction period.

- Sustainability: On

May 31, 2023, the Company published the 2022 Sustainability Report,

its 11th annual report, detailing our environmental,

social and governance performance.

- Appointed Vice President,

Legal: On July 24, 2023, Tamiko Ohta was appointed as Vice

President, Legal.

Skouries Highlights

- As at June 30, 2023, detailed

engineering is 48% complete and procurement is 62% complete.

- Growth capital invested of $42.6

million in Q2 2023, expected total investment of $240-$260 million

in 2023.

- Mobilized the first major earthwork

initiative for construction of the haul roads to build earthworks

structures.

- Commenced structural steel and

cladding of process plant and foundation construction of primary

crusher.

- On track for commissioning in

mid-2025 and commercial production at the end of 2025.

Transitioned to full construction in Q2 2023

with finalization of the project financing. Capital investment in

Q2 2023 continued to focus on early construction works, engineering

and procurement. Underground development advanced the west decline

while mobilization occurred related to the first major earthwork

initiative for construction haul roads to build earthworks

structures. Upcoming milestones in 2023 include the mobilization of

major construction contracts for concrete, finalizing the awards of

the remaining major procurement and contract packages to 90%

completion, and advancing detailed engineering to 90%

completion.

_______________

2 These financial measures or ratios are non-IFRS

financial measures or ratios. Certain additional disclosure for

non-IFRS financial measures and ratios have been incorporated by

reference and additional detail can be found at the end of this

press release and in the section 'Non-IFRS and Other Financial

Measures and Ratios' in the Company's June 30, 2023

MD&A.

“During the quarter, both Kisladag and Lamaque

demonstrated resiliency in the face of extraordinary

weather-related events,” said George Burns, Eldorado Gold’s

President and CEO. “Starting in late May, wildfires in the Abitibi

region impacted operations at Lamaque. The safety of our employees

and contractors is our top priority and a number of shifts were

suspended. Our team took the opportunity to re-sequence the

maintenance schedule and devised an alternative route to safely get

employees to the Triangle underground that has resulted in minimal

impact to expected production for the year. During the month of May

at Kisladag, the region experienced heavy rainfall, and despite the

impact, the team safely delivered on its key milestones during the

quarter which included successfully completing the commissioning of

the new agglomeration circuit and rotating the high-pressure

grinding rolls for the first time.”

“At Olympias, I am pleased to report that the

team delivered on a number of key productivity initiatives

including implementing ventilation on demand and bulk emulsion

blasting during the quarter,” continued Burns. “Further, the

substation is now energized, and in early July, the ventilation

fans were able to start, which is expected to not only improve our

energy efficiency and health and safety of our employees, but also

increase the number of development headings we can effectively work

in. I see this as the inflection point that we have been working

towards over the past several years through our transformation

efforts, which we expect will give us the ability to drive

increased tonnage and production going forward. During the quarter,

as we worked to finalize the implementation of these initiatives at

Olympias which were expected earlier in the year, our mine

sequencing was impacted which resulted in lower grades impacting

gold and by-product production. That, in combination with lower

realized zinc by-product prices and higher treatment charges,

resulted in much higher all-in sustaining costs. We expect these

costs to trend downwards as we realize the benefits of our

productivity initiatives and sequence back into higher grade stopes

in the second half of the year, consistent with our 2023 Olympias

guidance.”

“In sustainability, Eldorado released its

11th Annual Sustainability Report in late May

highlighting our environmental, social and governance performance

over the past year,” said Burns. “Further, our team in Greece

completed their first verification against the Mining Association

of Canada’s ‘Towards Sustainable Mining’ protocols. They achieved

“Triple A” ratings across all indicators for Tailings Management

and Biodiversity, underlining our commitment to responsible mining

practices. At Lamaque, despite the wildfires, we took delivery of

our first electric underground haul truck, marking the first of its

kind in Quebec. Once fully operational, we expect electric trucks

at Lamaque to both mitigate our GHG emissions and support lower

operating costs due to anticipated productivity improvements.”

Consolidated Financial and Operational

Highlights

|

|

3 months ended June 30,

|

|

|

6 months ended June 30,

|

|

|

Continuing operations

(4) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

$ |

229.9 |

|

|

$ |

213.4 |

|

|

$ |

459.2 |

|

|

$ |

408.1 |

|

|

Gold produced (oz) (5) |

|

109,435 |

|

|

|

113,462 |

|

|

|

220,944 |

|

|

|

206,671 |

|

|

Gold sold (oz) |

|

110,134 |

|

|

|

107,631 |

|

|

|

219,951 |

|

|

|

202,103 |

|

|

Average realized gold price ($/oz sold) (2) |

$ |

1,953 |

|

|

$ |

1,849 |

|

|

$ |

1,943 |

|

|

$ |

1,868 |

|

|

Production costs (5) |

|

117.0 |

|

|

|

109.3 |

|

|

|

228.2 |

|

|

|

213.9 |

|

|

Cash operating costs ($/oz sold) (2,3,5) |

|

791 |

|

|

|

789 |

|

|

|

784 |

|

|

|

810 |

|

|

Total cash costs ($/oz sold) (2,3,5) |

|

928 |

|

|

|

879 |

|

|

|

893 |

|

|

|

908 |

|

|

All-in sustaining costs ($/oz sold) (2,3,5) |

|

1,296 |

|

|

|

1,270 |

|

|

|

1,252 |

|

|

|

1,306 |

|

|

Net earnings (loss) for the period (1,5) |

|

0.9 |

|

|

|

(25.3 |

) |

|

|

20.2 |

|

|

|

(342.9 |

) |

|

Net earnings (loss) per share – basic ($/share)

(1,5) |

|

0.00 |

|

|

|

(0.14 |

) |

|

|

0.11 |

|

|

|

(1.88 |

) |

|

Net earnings (loss) per share – diluted ($/share)

(1,5) |

|

0.00 |

|

|

|

(0.14 |

) |

|

|

0.11 |

|

|

|

(1.88 |

) |

|

Net earnings (loss) for the period continuing operations

(1,5) |

|

1.5 |

|

|

|

(22.9 |

) |

|

|

20.9 |

|

|

|

(62.6 |

) |

|

Net earnings (loss) per share continuing operations – basic

($/share)(1,4,5) |

|

0.01 |

|

|

|

(0.12 |

) |

|

|

0.11 |

|

|

|

(0.34 |

) |

|

Net earnings (loss) per share continuing operations – diluted

($/share)(1,4,5) |

|

0.01 |

|

|

|

(0.12 |

) |

|

|

0.11 |

|

|

|

(0.34 |

) |

|

Adjusted net earnings (loss) continuing operations - basic

(1,2,4,5) |

|

16.1 |

|

|

|

13.6 |

|

|

|

34.6 |

|

|

|

(5.7 |

) |

|

Adjusted net earnings (loss) per share continuing operations

($/share)(1,2,4,5) |

|

0.09 |

|

|

|

0.07 |

|

|

|

0.19 |

|

|

|

(0.03 |

) |

|

Net cash generated from operating activities |

|

75.3 |

|

|

|

27.0 |

|

|

|

115.6 |

|

|

|

62.3 |

|

|

Cash flow from operating activities before changes in working

capital (2,5) |

|

82.4 |

|

|

|

49.2 |

|

|

|

175.6 |

|

|

|

98.5 |

|

|

Free cash flow (2) |

|

(21.7 |

) |

|

|

(62.7 |

) |

|

|

(56.7 |

) |

|

|

(89.5 |

) |

|

Free cash flow excluding Skouries (2) |

|

13.2 |

|

|

|

(56.9 |

) |

|

|

(6.7 |

) |

|

|

(79.1 |

) |

|

Cash, cash equivalents and term deposits |

|

456.6 |

|

|

|

370.0 |

|

|

|

456.6 |

|

|

|

370.0 |

|

|

Total assets |

|

4,742.1 |

|

|

|

4,504.8 |

|

|

|

4,742.1 |

|

|

|

4,504.8 |

|

|

Debt |

|

546.0 |

|

|

|

497.2 |

|

|

|

546.0 |

|

|

|

497.2 |

|

(1) Attributable to shareholders of the

Company.

(2) These financial measures or ratios are

non-IFRS financial measures or ratios. See the section 'Non-IFRS

and Other Financial Measures and Ratios' of our MD&A for

explanations and discussions of these non-IFRS financial measures

or ratios.

(3) Revenues from silver, lead and zinc sales are

off-set against cash operating costs.

(4) Amounts presented for 2023 and 2022 are from

continuing operations only and exclude the Romania segment.

See Note 4 of our condensed consolidated interim financial

statements for the three and six months ended June 30,

2023.

(5) A concentrate weight-scale calibration

correction at Olympias has resulted in an adjustment to ending

inventory as at March 31, 2023 of 1,024 gold ounces. Gold

production in Q1 2023 has been reduced by this amount, resulting in

additional production costs of $1.3 million and additional

depreciation expense of $0.7 million for Q1 2023.

Total revenue was $229.9 million in Q2 2023, an

increase of 8% from $213.4 million in Q2 2022 and was comparable to

$229.4 million earned in Q1 2023. Total revenue was $459.2 million

in the six months ended June 30, 2023, an increase from $408.1

million in the six months ended June 30, 2022. The increases

in both three and six-month periods were primarily due to higher

sales volumes, and higher average realized gold price.

Production costs increased to $117.0 million in

Q2 2023 from $109.3 million in Q2 2022 and to $228.2 million in the

six months ended June 30, 2023 from $213.9 million in the six

months ended June 30, 2022. Increases in both periods were

primarily due to higher royalty expense and increased sales

volumes.

Cash operating costs averaged $791 per ounce

sold in Q2 2023, an increase from $789 in Q2 2022, which is

primarily due to lower by-product credits. Cash operating costs per

ounce sold averaged $784 in the six months ended June 30,

2023, a decrease from $810 in the six months ended June 30,

2022, primarily due to an increase in volume sold.

AISC per ounce sold averaged $1,296 in Q2 2023,

an increase from $1,270 in Q2 2022, due to increases in royalties

and G&A costs per ounce sold, partially offset by lower

sustaining capital expenditures. AISC per ounce sold averaged

$1,252 in the six months ended June 30, 2023, a decrease from

$1,306 in the six months ended June 30, 2022, primarily

reflecting the decrease in cash operating costs per ounce sold and

lower sustaining capital expenditures.

We reported net earnings attributable to

shareholders from continuing operations of $1.5 million ($0.01

earnings per share) in Q2 2023 compared to net loss of $22.9

million ($0.12 loss per share) in Q2 2022 and net earnings of $20.9

million ($0.11 earnings per share) in the six months ended

June 30, 2023 compared to net loss of $62.6 million ($0.34

loss per share) in the six months ended June 30, 2022. The

higher net earnings this quarter, compared to Q2 2022, was driven

by gains on both derivative instruments and foreign exchange,

partially offset by higher income tax expense. The higher net

earnings in the six months ended June 30, 2023 was primarily

due to higher operating income from the increase in gold sales,

lower mine standby costs and writedown of assets, gains on

derivatives and foreign exchange, and lower income tax expense.

Adjusted net earnings was $16.1 million ($0.09

earnings per share) in Q2 2023 compared to adjusted net earnings of

$13.6 million ($0.07 per share) in Q2 2022. Adjusted net earnings

in Q2 2023 removed a $8.4 million gain on derivative instruments,

primarily on gold collars entered into during this quarter, while

adjusted net earnings in Q2 2022 added back a $14.4 million loss on

redemption option derivative for the senior

notes .

Quarterly Operations Update

|

|

3 months ended June 30,

|

|

|

6 months ended June 30,

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ounces produced |

|

109,435 |

|

|

|

113,462 |

|

|

|

220,944 |

|

|

|

206,671 |

|

|

Ounces sold |

|

110,134 |

|

|

|

107,631 |

|

|

|

219,951 |

|

|

|

202,103 |

|

|

Production costs |

$ |

117.0 |

|

|

$ |

109.3 |

|

|

$ |

228.2 |

|

|

$ |

213.9 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

791 |

|

|

$ |

789 |

|

|

$ |

784 |

|

|

$ |

810 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

1,296 |

|

|

$ |

1,270 |

|

|

$ |

1,252 |

|

|

$ |

1,306 |

|

|

Sustaining capital expenditures (2) |

$ |

26.1 |

|

|

$ |

32.3 |

|

|

$ |

52.1 |

|

|

$ |

56.8 |

|

|

Kisladag |

|

|

|

|

|

Ounces produced |

|

34,180 |

|

|

|

27,974 |

|

|

|

71,340 |

|

|

|

57,753 |

|

|

Ounces sold |

|

32,280 |

|

|

|

26,881 |

|

|

|

69,673 |

|

|

|

56,659 |

|

|

Production costs |

$ |

27.5 |

|

|

$ |

25.1 |

|

|

$ |

58.0 |

|

|

$ |

55.2 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

687 |

|

|

$ |

798 |

|

|

$ |

699 |

|

|

$ |

831 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

937 |

|

|

$ |

1,090 |

|

|

$ |

904 |

|

|

$ |

1,087 |

|

|

Sustaining capital expenditures (2) |

$ |

2.8 |

|

|

$ |

4.3 |

|

|

$ |

5.0 |

|

|

$ |

6.8 |

|

|

Lamaque |

|

|

|

|

|

Ounces produced |

|

38,745 |

|

|

|

46,917 |

|

|

|

76,629 |

|

|

|

80,294 |

|

|

Ounces sold |

|

39,904 |

|

|

|

45,655 |

|

|

|

78,547 |

|

|

|

79,780 |

|

|

Production costs |

$ |

28.3 |

|

|

$ |

31.4 |

|

|

$ |

57.5 |

|

|

$ |

58.7 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

676 |

|

|

$ |

657 |

|

|

$ |

698 |

|

|

$ |

703 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

1,117 |

|

|

$ |

985 |

|

|

$ |

1,166 |

|

|

$ |

1,069 |

|

|

Sustaining capital expenditures (2) |

$ |

16.2 |

|

|

$ |

13.5 |

|

|

$ |

34.1 |

|

|

$ |

26.5 |

|

|

Efemcukuru |

|

|

|

|

|

Ounces produced |

|

22,644 |

|

|

|

22,792 |

|

|

|

42,572 |

|

|

|

43,849 |

|

|

Ounces sold |

|

22,466 |

|

|

|

23,428 |

|

|

|

42,217 |

|

|

|

44,810 |

|

|

Production costs |

$ |

20.4 |

|

|

$ |

20.6 |

|

|

$ |

38.1 |

|

|

$ |

37.5 |

|

|

Cash operating costs ($/oz sold) (1,2) |

$ |

697 |

|

|

$ |

706 |

|

|

$ |

777 |

|

|

$ |

678 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

$ |

1,111 |

|

|

$ |

1,180 |

|

|

$ |

1,103 |

|

|

$ |

1,093 |

|

|

Sustaining capital expenditures (2) |

$ |

3.7 |

|

|

$ |

5.9 |

|

|

$ |

5.9 |

|

|

$ |

9.4 |

|

|

Olympias |

|

|

|

|

|

Ounces produced (3) |

|

13,866 |

|

|

|

15,779 |

|

|

|

30,403 |

|

|

|

24,775 |

|

|

Ounces sold |

|

15,484 |

|

|

|

11,667 |

|

|

|

29,514 |

|

|

|

20,854 |

|

|

Production costs (3) |

$ |

40.8 |

|

|

$ |

32.1 |

|

|

$ |

74.6 |

|

|

$ |

62.4 |

|

|

Cash operating costs ($/oz sold) (1,2,3) |

$ |

1,439 |

|

|

$ |

1,446 |

|

|

$ |

1,227 |

|

|

$ |

1,447 |

|

|

All-in sustaining costs ($/oz sold) (1,2,3) |

$ |

2,036 |

|

|

$ |

2,346 |

|

|

$ |

1,797 |

|

|

$ |

2,369 |

|

|

Sustaining capital expenditures (2) |

$ |

3.4 |

|

|

$ |

8.5 |

|

|

$ |

7.1 |

|

|

$ |

14.1 |

|

(1) Revenues from silver, lead and zinc sales are

off-set against cash operating costs.

(2) These financial measures or ratios are

non-IFRS financial measures or ratios. See the section 'Non-IFRS

and Other Financial Measures and Ratios' of our MD&A for

explanations and discussions of these non-IFRS financial measures

or ratios.

(3) A concentrate weight-scale calibration

correction at Olympias has resulted in an adjustment to ending

inventory as at March 31, 2023 of 1,024 gold ounces. Gold

production in Q1 2023 has been reduced by this amount, resulting in

additional production costs of $1.3 million and additional

depreciation expense of $0.7 million for Q1 2023.

Kisladag

Kisladag produced 34,180 ounces of gold in Q2

2023, a 22% increase from 27,974 ounces produced in Q2 2022. The

increase was primarily due to increased tonnes stacked as compared

to Q2 2022, despite challenging adverse weather conditions. Average

grade remained consistent at 0.76 grams per tonne during Q2 2023

and Q2 2022.

Tonnes placed on the heap leach pad in the

quarter continued to benefit from the installation of larger,

higher- capacity conveyors, improving material handling capacity

and belt agglomeration. Improvements in throughput were also due to

the success of a fine ore agglomeration drum added to the crushing

circuit and commissioned during the quarter, which improved

materials handling on the conveying system. These initiatives have

enabled increased recoverable ounces placed on the pad.

Extraordinary rainfall through May and early

June had marginal impact on tonnage stacked however, the excess

water affects the leach kinetics and results in a higher volume of

lower tenor solution to process. It is expected that this

additional solution will be extracted in the third quarter.

Revenue increased to $64.7 million in Q2 2023

from $51.0 million in Q2 2022, reflecting higher sales in the

quarter, and to a lesser extent, an increase in the average

realized gold price.

Production costs increased to $27.5 million in

Q2 2023 from $25.1 million in Q2 2022 primarily due to an increase

in tonnes processed and ounces sold in line with higher production.

Royalty expense was also higher as a result of higher sales volume

and higher average realized gold prices. Compared to prior year, we

saw decreases in unit costs of fuel and electricity in Turkiye, and

coupled with higher sales volumes, the resulting cash operating

costs per ounce decreased to $687 in Q2 2023 from $798 in Q2

2022.

Depreciation expense increased to $18.1 million

in Q2 2023 from $15.5 million in Q2 2022 in line with higher gold

sales in the quarter and due to the shorter remaining useful life

of the existing heap leach pad and adsorption-desorption and

recovery ("ADR") plant.

AISC per ounce sold decreased to $937 in Q2 2023

from $1,090 in Q2 2022, primarily due to the decrease in cash

operating costs per ounce sold and a decrease in sustaining capital

expenditures.

Sustaining capital expenditures of $2.8 million

in Q2 2023 and $5.0 million in the six months ended June 30,

2023 primarily included equipment rebuilds and mine equipment

purchases. Growth capital investments of $18.7 million and $37.3

million in the three and six months ended June 30, 2023

included waste stripping to support the mine life extension and

construction of the first phase of the North heap leach pad, which

was commissioned in July 2023.

For 2023, production guidance at Kisladag is

forecasted to be 160,000 to 170,000 ounces of gold. Production is

expected to improve over the course of the second half of the year

as we realize full effectiveness from the upgraded materials

handling equipment. Our optimization efforts are expected to drive

increased stacking rates. In addition, we expect to recover the

ounces that were delayed as a result of the extraordinary rainfall

in May and early June.

Lamaque

Lamaque produced 38,745 ounces of gold in Q2

2023, a decrease of 17% from 46,917 ounces in Q2 2022. The decrease

was primarily due to lower ore throughput and slightly lower grade.

Tonnes processed were reduced as a result of forest fires in the

region which caused poor air quality resulting in a number of

suspended shifts in the Triangle underground in June. The

processing facility was able to keep operating on stockpile

material and then brought forward scheduled maintenance from July

into June to minimize unplanned downtime. Average grade decreased

to 6.43 grams per tonne in Q2 2023 from 6.63 grams per tonne in Q2

2022. Underground development of high-grade stopes progressed well

during the quarter.

Revenue decreased to $78.6 million in Q2 2023

from $85.0 million in Q2 2022 primarily due to lower ounces sold as

a result of lower production, partially offset by higher average

realized gold prices.

Production costs decreased to $28.3 million in

Q2 2023 from $31.4 million in Q2 2022, primarily due to lower

volume sold in the quarter. Cash operating costs per ounce sold

rose to $676 in Q2 2023 from $657 in Q2 2022 as a result of lower

gold sold, partially offset by cost savings from a weaker Canadian

dollar as compared to prior year.

AISC per ounce sold increased to $1,117 in Q2

2023 from $985 in Q2 2022 primarily due to higher cash operating

cost per ounce, lower gold sold, and higher sustaining capital

expenditure in the quarter.

Sustaining capital expenditures of $16.2 million

in Q2 2023 and $34.1 million in the six months ended June 30, 2023

primarily included underground development, equipment rebuilds, and

expansion of the tailings management facility. Growth capital

investment of $4.9 million in Q2 2023 and $7.6 million in the six

months ended June 30, 2023 were primarily related to resource

conversion drilling at Ormaque and spending on other exploration

projects.

The second half of the year is expected to be

stronger as both processing rates and grade increase. In 2023,

production guidance at Lamaque is forecasted to be 170,000 to

180,000 ounces of gold.

Efemcukuru

Efemcukuru produced 22,644 payable ounces of

gold in Q2 2023, a 1% decrease from 22,792 payable ounces in Q2

2022. The decrease was primarily due to a slight decrease in grade

to 5.85 grams per tonne in Q2 2023 from 5.96 grams per tonne in Q2

2022. This impact was almost entirely offset by higher throughput

in the quarter due to increased mill availability, further

demonstrating consistency in mill utilization.

Revenue increased to $44.1 million in Q2 2023

from $41.4 million in Q2 2022. Lower payable ounces sold was offset

by a higher average realized gold price recorded during Q2

2023.

Production costs decreased slightly to $20.4

million in Q2 2023 from $20.6 million in Q2 2022 primarily due to

lower sales in the quarter and decreasing unit costs of

consumables, and partially offset by higher royalty expense due to

higher average realized gold prices. Lower unit costs of fuel and

electricity resulted in a decrease in cash operating costs per

ounce sold to $697 in Q2 2023 from $706 in Q2 2022.

AISC per ounce sold decreased to $1,111 in Q2

2023 from $1,180 in Q2 2022. The decrease was primarily due to the

increase in cash operating costs per ounce sold and was partly

offset by lower sustaining capital expenditure.

Sustaining capital expenditures of $3.7 million

in Q2 2023 and $5.9 million in the six months ended June 30, 2023

were primarily underground development and equipment rebuilds. The

development of the Mine Rock Storage Facility ("MRSF") southern

expansion commenced this quarter. Growth capital investment of $3.5

million in the six months ended June 30, 2023 included capital

development, resource conversion drilling at Kokarpinar and

resource expansion at Bati.

Production for the third and fourth quarter are

expected to increase slightly over the second quarter as processing

rates increase. For 2023, production guidance at Efemcukuru is

forecast to be 80,000 to 90,000 ounces of gold.

Olympias

Olympias produced 13,866 ounces of gold in Q2

2023, a 12% decrease from 15,779 ounces in Q2 2022 and primarily

reflected lower average gold grade due to changes in stope

sequencing in the quarter as we await benefits of transformation

initiatives that were completed in early July. This was partially

offset by higher mill throughput that was achieved this quarter as

we continue to ramp up productivity. Q2 2023 production of

by-product metals, while lower than planned, increased as compared

to Q2 2022 and Q1 2023 across silver, lead, and zinc as a result of

higher average grades as planned in both the three and six months

ended periods as well as higher throughput.

In line with our 2023 guidance, key

transformation initiatives are on-going as the mine continues to

ramp up productivity. Bulk emulsion blasting was commissioned in

June, which we expect will allow for further efficiencies

underground. Additionally, the newly constructed electrical

substation was energized in June and commissioned in early July,

following a successful shutdown to tie-in the expanded ventilation

system. Increased ventilation capacity is expected to support

productivity improvements in the lower parts of the mine and

increase access to stopes with higher grades of base metals. These

initiatives, while positive, were delayed from planned early Q1

implementation. These delays are the primary cause for mine plan

sequencing and lower mine or Flats Zone development which have

contributed to lower by-product volumes than planned. Stoping

sequence and Flats development are expected to gradually recover

over the balance of 2023.

Due to a scale calibration correction that was

identified during this quarter, we made a one-time adjustment

lowering Q1 2023 gold production by 1,024 ounces.

Revenue increased to $42.4 million in Q2 2023

from $36.3 million in Q2 2022 primarily as a result of higher gold

sales and higher average realized gold price, which includes the

impacts of upward revaluations of provisional pricing in Q2 2023

due to increases in gold price during the quarter. Sales of base

metals were slightly lower in Q2 2023 due to the timing of silver

and lead concentrate shipments in early July.

Production costs increased to $40.8 million in

Q2 2023 from $32.1 million in Q2 2022 reflecting increased volumes

of gold sales, combined with higher treatment and refining costs

from higher zinc sales. Cash operating costs per ounce sold

decreased to $1,439 in Q2 2023 from $1,446 in Q2 2022, with lower

mining and operating costs per ounce sold nearly offset by lower

revenue from silver and base metal sales (which reduce cash

operating costs as by-product credits). The unit prices of major

consumables continue to fluctuate, with electricity prices

benefiting from subsidies and fuel costs lower as compared to the

prior year, while explosives and cement prices rose slightly.

AISC per ounce sold decreased to $2,036 in Q2

2023 from $2,346 in Q2 2022 primarily due lower sustaining capital

expenditures and direct operating costs per ounce sold, partially

offset by lower by-product credits and higher royalty costs per

ounce sold.

Both cash operating costs and AISC were

unfavorably affected in Q2 2023 by reduced by-product volumes

resulting from the delayed initiatives outlined above, as well as

by lower zinc pricing, high zinc treatment charges, and lower gold

payability for the pyrite concentrates due to concentrate quality,

the latter driven by lower recovery from lower quality ores. The

lower zinc price and payability increased cash costs by

approximately $435 per ounce gold sold in Q2 and the lower silver

grade impacted by-product volume, increased cash costs by

approximately $230 per ounce of gold sold, meanwhile pyrite

concentrate revenue, driven by a higher gold price, slightly offset

the impact on cash costs.

Sustaining capital expenditures of $3.4 million

in Q2 2023 and $7.1 million in the six months ended June 30,

2023 primarily included underground development, expansion of

tailings facilities, the newly commissioned substation, and

underground ventilation fans. Growth capital investment of $3.7

million in Q2 2023 and $3.5 million in the six months ended

June 30, 2023 were primarily related to underground

development.

Gold production is expected to improve over the

second quarter as the productivity initiatives deliver increased

tonnage and higher grades. For 2023, production guidance at

Olympias is forecast to be 60,000 to 75,000 ounces of gold.

Development Project

Skouries

The Skouries project, part of the Kassandra

Mines Complex, is located within the Halkidiki Peninsula of

Northern Greece and is a high-grade gold-copper asset. In December

2021, we published the results of the Skouries Project Feasibility

Study with a 23-year mine life and expected average annual

production of 140,000 ounces of gold and 67 million pounds of

copper. The project is expected to provide an after-tax IRR of 19%

and an NPV (5%) of $1.3 billion with capital costs to complete the

project estimated at $845 million.

Economic activity in Greece is increasing, so

moving efficiently through the commitment phase of the project is

important to continue mitigating cost and schedule pressures. While

we have yet to see material impacts from this economic activity

thus far, we see the keys to ongoing success as maintaining or

improving the pace of contracts awards and continuing to meet the

labour productivity levels estimated in the Feasibility Study Plan

("FS") as construction ramps up. With several major contract awards

expected during Q3 2023, the FS Estimate will update to the Project

Control Budget based on executed contracts and other new

information. We expect to provide updated disclosure by the end of

Q3 2023.

For further information on the Company's

operating results for the second quarter of 2023, please see the

Company’s MD&A filed on SEDAR+ at www.sedarplus.com under

the Company’s profile.

Conference Call

A conference call to discuss the details of the

Company’s Second Quarter 2023 Results will be held by senior

management on Friday, July 28, 2023 at 11:30 AM ET (8:30 AM PT).

The call will be webcast and can be accessed at Eldorado’s website:

www.eldoradogold.com or

via this link:

https://services.choruscall.ca/links/eldoradogold2023q2.html.

|

Conference Call Details |

|

Replay (available until Sept. 1,

2023) |

|

Date: |

July 28, 2023 |

|

Vancouver: |

+1 604 638 9010 |

|

Time: |

11:30 AM ET (8:30 AM PT) |

|

Toll Free: |

1 800 319 6413 |

|

Dial in: |

+1 604 638 5340 |

|

Access code: |

0279 |

|

Toll free: |

1 800 319 4610 |

|

|

|

|

|

|

|

|

|

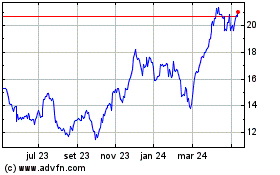

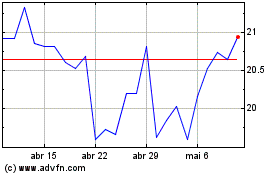

About Eldorado

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada,

Greece and Romania. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lynette Gould, VP, Investor Relations

647 271 2827 or 1 888 353 8166

lynette.gould@eldoradogold.com

Media

Chad Pederson, Director, Communications

236 885 6251 or 1 888 353 8166

chad.pederson@eldoradogold.com

Non-IFRS and Other Financial Measures and

Ratios

Certain non-IFRS financial measures and ratios

are included in this press release, including cash operating costs

and cash operating costs per ounce sold, total cash costs and total

cash costs per ounce sold, all-in sustaining costs ("AISC") and

AISC per ounce sold, sustaining and growth capital, average

realized gold price per ounce sold, adjusted net earnings/(loss)

attributable to shareholders, adjusted net earnings/(loss) per

share attributable to shareholders, earnings before interest,

taxes, depreciation and amortization (“EBITDA”), adjusted earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA"), free cash flow, free cash flow excluding Skouries,

working capital and cash flow from operating activities before

changes in working capital.

Please see the June 30, 2023 MD&A for

explanations and discussion of these non-IFRS and other financial

measures and ratios. The Company believes that these measures and

ratios, in addition to conventional measures and ratios prepared in

accordance with International Financial Reporting Standards

(“IFRS”), provide investors an improved ability to evaluate the

underlying performance of the Company. The non-IFRS and other

financial measures and ratios are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures or ratios of performance prepared in

accordance with IFRS. These measures and ratios do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to other issuers. Certain additional disclosures for

these and other financial measures and ratios have been

incorporated by reference and can be found in the section 'Non-IFRS

and Other Financial Measures and Ratios' in the June 30, 2023

MD&A available on SEDAR+ at www.sedarplus.com and on the

Company's website under the 'Investors' section.

Reconciliation of Production Costs to Cash

Operating Costs and Cash Operating Costs per ounce sold:

|

|

|

Q2 2023 |

|

|

|

Q2 2022 |

|

|

|

YTD 2023 |

|

|

|

YTD 2022 |

|

|

Production costs |

$ |

117.0 |

|

|

$ |

109.3 |

|

|

$ |

228.2 |

|

|

$ |

213.9 |

|

|

By-product credits (1) |

|

(17.5 |

) |

|

|

(19.4 |

) |

|

|

(37.8 |

) |

|

|

(37.7 |

) |

|

Royalty expense (2) |

|

(15.1 |

) |

|

|

(9.8 |

) |

|

|

(23.8 |

) |

|

|

(19.8 |

) |

|

Concentrate deductions (3) |

$ |

2.7 |

|

|

$ |

4.8 |

|

|

$ |

5.9 |

|

|

$ |

7.5 |

|

|

Cash operating costs |

$ |

87.1 |

|

|

$ |

84.9 |

|

|

$ |

172.5 |

|

|

$ |

163.7 |

|

|

Gold ounces sold |

|

110,134 |

|

|

|

107,631 |

|

|

|

219,951 |

|

|

|

202,103 |

|

|

Cash operating cost per ounce sold |

$ |

791 |

|

|

$ |

789 |

|

|

$ |

784 |

|

|

$ |

810 |

|

(1) Revenue from silver, lead and zinc

sales.

(2) Included in production costs.

(3) Included in revenue.

Reconciliation of Cash Operating Costs and

Cash Operating Cost per ounce sold, by asset, for the

three months ended June 30,

2023:

|

|

|

Direct operating costs |

|

|

|

By-product credits |

|

|

|

Refining and selling costs |

|

|

|

Inventory change

(1) |

|

|

|

Cash operating costs |

|

|

|

Gold oz sold |

|

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$ |

27.8 |

|

|

$ |

(0.8 |

) |

|

$ |

0.2 |

|

|

$ |

(4.9 |

) |

|

$ |

22.2 |

|

|

|

32,280 |

|

|

$ |

687 |

|

|

Lamaque |

|

26.8 |

|

|

|

(0.3 |

) |

|

|

0.1 |

|

|

|

0.5 |

|

|

|

27.0 |

|

|

|

39,904 |

|

|

|

676 |

|

|

Efemcukuru |

|

13.5 |

|

|

|

(1.4 |

) |

|

|

3.4 |

|

|

|

0.1 |

|

|

|

15.7 |

|

|

|

22,466 |

|

|

|

697 |

|

|

Olympias |

|

31.8 |

|

|

|

(15.0 |

) |

|

|

6.5 |

|

|

|

(1.0 |

) |

|

|

22.3 |

|

|

|

15,484 |

|

|

|

1,439 |

|

|

Total consolidated |

$ |

99.9 |

|

|

$ |

(17.5 |

) |

|

$ |

10.1 |

|

|

$ |

(5.4 |

) |

|

$ |

87.1 |

|

|

|

110,134 |

|

|

$ |

791 |

|

(1) Inventory change adjustments result from

timing differences between when inventory is produced and when it

is sold.

Reconciliation of Cash Operating Costs and

Cash Operating Cost per ounce sold, by asset, for the six

months ended June 30, 2023:

|

|

|

Direct operating costs |

|

|

|

By-product credits |

|

|

|

Refining and selling costs |

|

|

|

Inventory change

(1) |

|

|

|

Cash operating costs |

|

|

|

Gold oz sold |

|

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$ |

57.9 |

|

|

$ |

(1.6 |

) |

|

$ |

0.3 |

|

|

$ |

(7.9 |

) |

|

$ |

48.7 |

|

|

|

69,673 |

|

|

$ |

699 |

|

|

Lamaque |

|

56.6 |

|

|

|

(0.8 |

) |

|

|

0.2 |

|

|

|

(1.1 |

) |

|

|

54.8 |

|

|

|

78,547 |

|

|

|

698 |

|

|

Efemcukuru |

|

28.8 |

|

|

|

(2.3 |

) |

|

|

6.5 |

|

|

|

(0.1 |

) |

|

|

32.8 |

|

|

|

42,217 |

|

|

|

777 |

|

|

Olympias |

|

58.7 |

|

|

|

(33.1 |

) |

|

|

12.2 |

|

|

|

(1.6 |

) |

|

|

36.2 |

|

|

|

29,514 |

|

|

|

1,227 |

|

|

Total consolidated |

$ |

201.9 |

|

|

$ |

(37.8 |

) |

|

$ |

19.1 |

|

|

$ |

(10.7 |

) |

|

$ |

172.5 |

|

|

|

219,951 |

|

|

$ |

784 |

|

(1) Inventory change adjustments result from

timing differences between when inventory is produced and when it

is sold.

Reconciliation of Cash Operating Costs and

Cash Operating Cost per ounce sold, by asset, for the

three months ended June 30,

2022:

|

|

|

Direct operating costs |

|

|

|

By-product credits |

|

|

|

Refining and selling costs |

|

|

|

Inventory change

(1) |

|

|

|

Cash operating costs |

|

|

|

Gold oz sold |

|

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$ |

26.1 |

|

|

$ |

(0.7 |

) |

|

$ |

0.2 |

|

|

$ |

(4.1 |

) |

|

$ |

21.5 |

|

|

|

26,881 |

|

|

$ |

798 |

|

|

Lamaque |

|

29.3 |

|

|

|

(0.4 |

) |

|

|

0.1 |

|

|

|

1.0 |

|

|

|

30.0 |

|

|

|

45,655 |

|

|

|

657 |

|

|

Efemcukuru |

|

13.4 |

|

|

|

(0.8 |

) |

|

|

3.5 |

|

|

|

0.5 |

|

|

|

16.5 |

|

|

|

23,428 |

|

|

|

706 |

|

|

Olympias |

|

29.3 |

|

|

|

(17.5 |

) |

|

|

7.3 |

|

|

|

(2.2 |

) |

|

|

16.9 |

|

|

|

11,667 |

|

|

|

1,446 |

|

|

Total consolidated |

$ |

98.1 |

|

|

$ |

(19.4 |

) |

|

$ |

11.0 |

|

|

$ |

(4.8 |

) |

|

$ |

84.9 |

|

|

|

107,631 |

|

|

$ |

789 |

|

(1) Inventory change adjustments result from

timing differences between when inventory is produced and when it

is sold.

Reconciliation of Cash Operating Costs and

Cash Operating Cost per ounce sold, by asset, for the six

months ended June 30, 2022:

|

|

|

Direct operating costs |

|

|

|

By-product credits |

|

|

|

Refining and selling costs |

|

|

|

Inventory change

(1) |

|

|

|

Cash operating costs |

|

|

|

Gold oz sold |

|

|

|

Cash operating cost/oz sold |

|

|

Kisladag |

$ |

47.4 |

|

|

$ |

(1.5 |

) |

|

$ |

0.7 |

|

|

$ |

0.5 |

|

|

$ |

47.1 |

|

|

|

56,659 |

|

|

$ |

831 |

|

|

Lamaque |

|

55.8 |

|

|

|

(0.7 |

) |

|

|

0.1 |

|

|

|

0.9 |

|

|

|

56.1 |

|

|

|

79,780 |

|

|

|

703 |

|

|

Efemcukuru |

|

25.9 |

|

|

|

(1.7 |

) |

|

|

5.9 |

|

|

|

0.3 |

|

|

|

30.4 |

|

|

|

44,810 |

|

|

|

678 |

|

|

Olympias |

|

55.2 |

|

|

|

(33.8 |

) |

|

|

12.5 |

|

|

|

(3.9 |

) |

|

|

30.2 |

|

|

|

20,854 |

|

|

|

1,447 |

|

|

Total consolidated |

$ |

184.3 |

|

|

$ |

(37.7 |

) |

|

$ |

19.3 |

|

|

$ |

(2.1 |

) |

|

$ |

163.7 |

|

|

|

202,103 |

|

|

$ |

810 |

|

(1) Inventory change adjustments result from

timing differences between when inventory is produced and when it

is sold.

Reconciliation of Cash Operating Costs to Total

Cash Costs and Total Cash Costs per ounce sold:

|

|

|

Q2 2023 |

|

|

Q2 2022 |

|

|

YTD 2023 |

|

|

YTD 2022 |

|

|

Cash operating costs |

$ |

87.1 |

|

$ |

84.9 |

|

$ |

172.5 |

|

$ |

163.7 |

|

|

Royalty expense (1) |

|

15.1 |

|

|

9.8 |

|

|

23.8 |

|

|

19.8 |

|

|

Total cash costs |

$ |

102.2 |

|

$ |

94.7 |

|

$ |

196.3 |

|

$ |

183.6 |

|

|

Gold ounces sold |

|

110,134 |

|

|

107,631 |

|

|

219,951 |

|

|

202,103 |

|

|

Total cash costs per ounce sold |

$ |

928 |

|

$ |

879 |

|

$ |

893 |

|

$ |

908 |

|

(1) Included in revenue.

Reconciliation of Total Cash Costs to All-in

Sustaining Costs and All-in Sustaining Costs per ounce

sold:

|

|

|

Q2 2023 |

|

|

Q2 2022 |

|

|

YTD 2023 |

|

|

YTD 2022 |

|

|

Total cash costs |

$ |

102.2 |

|

$ |

94.7 |

|

$ |

196.3 |

|

$ |

183.6 |

|

|

Corporate and allocated G&A |

|

11.3 |

|

|

7.4 |

|

|

21.2 |

|

|

18.8 |

|

|

Exploration and evaluation costs |

|

0.7 |

|

|

0.6 |

|

|

1.0 |

|

|

1.3 |

|

|

Reclamation costs and amortization |

|

2.4 |

|

|

1.8 |

|

|

4.7 |

|

|

3.4 |

|

|

Sustaining capital expenditure |

|

26.1 |

|

|

32.3 |

|

|

52.1 |

|

|

56.8 |

|

|

AISC |

$ |

142.7 |

|

$ |

136.7 |

|

$ |

275.3 |

|

$ |

263.9 |

|

|

Gold ounces sold |

|

110,134 |

|

|

107,631 |

|

|

219,951 |

|

|

202,103 |

|

|

AISC per ounce sold |

$ |

1,296 |

|

$ |

1,270 |

|

$ |

1,252 |

|

$ |

1,306 |

|

Reconciliation of general and administrative

expenses included in All-in Sustaining Costs:

|

|

|

Q2 2023 |

|

|

Q2 2022 |

|

|

YTD 2023 |

|

|

YTD 2022 |

|

|

General and administrative expenses (from

consolidated statement of operations) |

$ |

9.4 |

|

$ |

8.5 |

|

$ |

20.0 |

|

$ |

16.5 |

|

|

Add: |

|

|

|

|

|

Share-based payments expense |

|

2.7 |

|

|

0.3 |

|

|

3.5 |

|

|

4.0 |

|

|

Employee benefit plan expense from corporate and operating gold

mines |

|

0.7 |

|

|

0.8 |

|

|

2.2 |

|

|

2.7 |

|

|

Less: |

|

|

|

|

|

General and administrative expenses related to non-gold mines and

in-country offices |

|

(0.1 |

) |

|

(0.1 |

) |

|

(0.5 |

) |

|

(0.3 |

) |

|

Depreciation in G&A |

|

(0.8 |

) |

|

(0.7 |

) |

|

(1.6 |

) |

|

(1.1 |

) |

|

Business development |

|

(0.4 |

) |

|

(0.5 |

) |

|

(2.3 |

) |

|

(1.0 |

) |

|

Development projects |

|

(0.1 |

) |

|

(1.0 |

) |

|

(0.3 |

) |

|

(2.1 |

) |

|

Adjusted corporate general and administrative

expenses |

$ |

11.4 |

|

$ |

7.4 |

|

$ |

21.1 |

|

$ |

18.6 |

|

|

Regional general and administrative costs allocated to gold

mines |

|

(0.1 |

) |

|

— |

|

|

0.1 |

|

|

0.2 |

|

|

Corporate and allocated general and administrative expenses

per AISC |

$ |

11.3 |

|

$ |

7.4 |

|

$ |

21.2 |

|

$ |

18.8 |

|

Reconciliation of exploration costs included

in All-in Sustaining Costs:

|

|

|

Q2 2023 |

|

|

Q2 2022 |

|

|

YTD 2023 |

|

|

YTD 2022 |

|

|

Exploration and evaluation expense (from

consolidated statement of operations)(1) |

$ |

4.6 |

|

$ |

3.4 |

|

$ |

10.5 |

|

$ |

8.4 |

|

|

Add: |

|

|

|

|

|

Capitalized sustaining exploration cost related to operating gold

mines |

|

0.7 |

|

|

0.6 |

|

|

1.0 |

|

|

1.3 |

|

|

Less: |

|

|

|

|

|

Exploration and evaluation expenses related to non-gold mines and

other sites |

|

(4.6 |

) |

|

(3.4 |

) |

|

(10.5 |

) |

|

(8.4 |

) |

|

Exploration and evaluation costs per AISC |

$ |

0.7 |

|

$ |

0.6 |

|

$ |

1.0 |

|

$ |

1.3 |

|

(1) Amounts presented for 2023 and 2022 are from

continuing operations only and exclude the Romania segment.

See Note 4 of our condensed consolidated interim financial

statements for the three and six months ended June 30,

2023.

Reconciliation of reclamation costs and

amortization included in All-in Sustaining Costs:

|

|

|

Q2 2023 |

|

|

Q2 2022 |

|

|

YTD 2023 |

|

|

YTD 2022 |

|

|

Asset retirement obligation accretion (from notes

to the condensed consolidated interim financial statements) |

$ |

1.1 |

|

$ |

0.5 |

|

$ |

2.1 |

|

$ |

1.0 |

|

|

Add: |

|

|

|

|

|

Depreciation related to asset retirement obligation assets |

|

1.5 |

|

|

1.4 |

|

|

2.9 |

|

|

2.6 |

|

|

Less: |

|

|

|

|

|

Asset retirement obligation accretion related to non-gold mines and

other sites |

|

(0.2 |

) |

|

(0.1 |

) |

|

(0.4 |

) |

|

(0.1 |

) |

|

Reclamation costs and amortization per AISC |

$ |

2.4 |

|

$ |

1.8 |

|

$ |

4.7 |

|

$ |

3.4 |

|

Reconciliation of All-in Sustaining Costs

and All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the three months ended June 30,

2023:

|

|

Cash operating costs |

Royalties |

Total cash costs |

|

Corporate & allocated G&A |

|

Exploration costs |

Reclamation costs and amortization |

Sustaining capital |

Total

AISC |

Gold oz sold |

Total AISC/

oz sold |

|

Kisladag |

$ |

22.2 |

$ |

4.5 |

$ |

26.7 |

$ |

— |

|

$ |

— |

$ |

0.8 |

$ |

2.8 |

$ |

30.3 |

32,280 |

$ |

937 |

|

Lamaque |

|

27.0 |

|

1.0 |

|

28.0 |

|

— |

|

|

0.3 |

|

0.1 |

|

16.2 |

|

44.6 |

39,904 |

|

1,117 |

|

Efemcukuru |

|

15.7 |

|

4.9 |

|

20.5 |

|

(0.1 |

) |

|

— |

|

0.8 |

|

3.7 |

|

25.0 |

22,466 |

|

1,111 |

|

Olympias |

|

22.3 |

|

4.8 |

|

27.0 |

|

— |

|

|

0.4 |

|

0.7 |

|

3.4 |

|

31.5 |

15,484 |

|

2,036 |

|

Corporate (1) |

|

— |

|

— |

|

— |

|

11.4 |

|

|

— |

|

— |

|

— |

|

11.4 |

— |

|

104 |

|

Total consolidated |

$ |

87.1 |

$ |

15.1 |

$ |

102.2 |

$ |

11.3 |

|

$ |

0.7 |

$ |

2.4 |

$ |

26.1 |

$ |

142.7 |

110,134 |

$ |

1,296 |

(1) Excludes general and administrative expenses

related to business development activities and projects. Includes

share based payments expense and defined benefit pension plan

expense. AISC per ounce sold has been calculated using total

consolidated gold ounces sold.

Reconciliation of All-in Sustaining Costs and

All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the six months ended

June 30, 2023

|

|

Cash operating costs |

Royalties |

Total cash costs |

Corporate & allocated G&A |

Exploration costs |

Reclamation costs and amortization |

Sustaining capital |

Total

AISC |

Gold oz sold |

Total AISC/

oz sold |

|

Kisladag |

$ |

48.7 |

$ |

7.7 |

$ |

56.4 |

$ |

— |

$ |

— |

$ |

1.6 |

$ |

5.0 |

$ |

63.0 |

69,673 |

$ |

904 |

|

Lamaque |

|

54.8 |

|

1.9 |

|

56.7 |

|

— |

|

0.6 |

|

0.3 |

|

34.1 |

|

91.6 |

78,547 |

|

1,166 |

|

Efemcukuru |

|

32.8 |

|

6.2 |

|

39.0 |

|

0.1 |

|

— |

|

1.6 |

|

5.9 |

|

46.6 |

42,217 |

|

1,103 |

|

Olympias |

|

36.2 |

|

8.0 |

|

44.2 |

|

— |

|

0.4 |

|

1.3 |

|

7.1 |

|

53.0 |

29,514 |

|

1,797 |

|

Corporate (1) |

|

— |

|

— |

|

— |

|

21.1 |

|

— |

|

— |

|

— |

|

21.1 |

— |

|

96 |

|

Total consolidated |

$ |

172.5 |

$ |

23.8 |

$ |

196.3 |

$ |

21.2 |

$ |

1.0 |

$ |

4.7 |

$ |

52.1 |

$ |

275.3 |

219,951 |

$ |

1,252 |

(1) Excludes general and administrative expenses

related to business development activities and projects. Includes

share based payments expense and defined benefit pension plan

expense. AISC per ounce sold has been calculated using total

consolidated gold ounces sold.

Reconciliation of All-in Sustaining Costs

and All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the three months ended June 30,

2022:

|

|

Cash operating costs |

Royalties |

Total cash costs |

Corporate & allocated G&A |

Exploration costs |

Reclamation costs and amortization |

Sustaining capital |

Total

AISC |

Gold oz sold |

Total AISC/

oz sold |

|

Kisladag |

$ |

21.5 |

$ |

2.9 |

$ |

24.4 |

$ |

— |

$ |

— |

$ |

0.6 |

$ |

4.3 |

$ |

29.3 |

26,881 |

$ |

1,090 |

|

Lamaque |

|

30.0 |

|

1.1 |

|

31.1 |

|

— |

|

0.3 |

|

0.1 |

|

13.5 |

|

45.0 |

45,655 |

|

985 |

|

Efemcukuru |

|

16.5 |

|

4.5 |

|

21.0 |

|

— |

|

— |

|

0.6 |

|

5.9 |

|

27.6 |

23,428 |

|

1,180 |

|

Olympias |

|

16.9 |

|

1.3 |

|

18.2 |

|

— |

|

0.3 |

|

0.4 |

|

8.5 |

|

27.4 |

11,667 |

|

2,346 |

|

Corporate (1) |

|

— |

|

— |

|

— |

|

7.4 |

|

— |

|

— |

|

— |

|

7.4 |

— |

|

69 |

|

Total consolidated |

$ |

84.9 |

$ |

9.8 |

$ |

94.7 |

$ |

7.4 |

$ |

0.6 |

$ |

1.8 |

$ |

32.3 |

$ |

136.7 |

107,631 |

$ |

1,270 |

(1) Excludes general and administrative expenses

related to business development activities and projects. Includes

share based payments expense and defined benefit pension plan

expense. AISC per ounce sold has been calculated using total

consolidated gold ounces sold.

Reconciliation of All-in Sustaining Costs

and All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the six months ended

June 30, 2022:

|

|

Cash operating costs |

Royalties |

Total cash costs |

Corporate & allocated G&A |

Exploration costs |

Reclamation costs and amortization |

Sustaining capital |

Total

AISC |

Gold oz sold |

Total AISC/

oz sold |

|

Kisladag |

$ |

47.1 |

$ |

6.6 |

$ |

53.7 |

$ |

— |

$ |

— |

$ |

1.0 |

$ |

6.8 |

$ |

61.6 |

56,659 |

$ |

1,087 |

|

Lamaque |

|

56.1 |

|

1.9 |

|

58.0 |

|

— |

|

0.6 |

|

0.2 |

|

26.5 |

|

85.3 |

79,780 |

|

1,069 |

|

Efemcukuru |

|

30.4 |

|

7.6 |

|

38.0 |

|

0.2 |

|

0.2 |

|

1.3 |

|

9.4 |

|

49.0 |

44,810 |

|

1,093 |

|

Olympias |

|

30.2 |

|

3.8 |

|

33.9 |

|

— |

|

0.5 |

|

0.9 |

|

14.1 |

|

49.4 |

20,854 |

|

2,369 |

|

Corporate (1) |

|

— |

|

— |

|

— |

|

18.6 |

|

— |

|

— |

|

— |

|

18.6 |

— |

|

92 |

|

Total consolidated |

$ |

163.7 |

$ |

19.8 |

$ |

183.6 |

$ |

18.8 |

$ |

1.3 |

$ |

3.4 |

$ |

56.8 |

$ |

263.9 |

202,103 |

$ |

1,306 |

(1) Excludes general and administrative expenses

related to business development activities and projects. Includes

share based payments expense and defined benefit pension plan

expense. AISC per ounce sold has been calculated using total

consolidated gold ounces sold.

Reconciliation of Sustaining and Growth

Capital

|

|

|

Q2 2023 |

|

|

Q2 2022 |

|

|

YTD 2023 |

|

|

YTD 2022 |

|

Additions to property, plant and equipment

(1)

(from segment note in the condensed consolidated interim financial

statements) |

$ |

99.4 |

|

$ |

87.1 |

|

$ |

182.8 |

|

$ |

147.9 |

|

|

Growth and development project capital investment - gold mines |

|

(29.0 |

) |

|

(31.9 |

) |

|

(51.9 |

) |

|

(59.3 |

) |

|

Growth and development project capital investment - other

(2) |

|

(44.8 |

) |

|

(22.5 |

) |

|

(79.7 |

) |

|

(31.3 |

) |

|

Less: Sustaining capital expenditure equipment leases

(3) |

|

0.5 |

|

|

(0.4 |

) |

|

0.9 |

|

|

(0.4 |

) |

|

Less: Corporate leases |

|

— |

|

|

— |

|

|

— |

|

|

(0.1 |

) |

|

Sustaining capital expenditure at operating gold

mines |

$ |

26.1 |

|

$ |

32.3 |

|

$ |

52.1 |

|

$ |

56.8 |

|

(1) Amounts presented for 2023 and 2022 are from

continuing operations only and exclude the Romania segment.

See Note 4 of our condensed consolidated interim financial

statements for the three and six months ended June 30,

2023.

(2) Includes growth capital investment and

capital expenditures relating to Skouries, Stratoni and Other

Projects, excluding non-cash sustaining lease additions.

(3) Non-cash sustaining lease additions, net of

sustaining lease principal and interest payments.

Average realized gold price per ounce sold

is reconciled for the periods presented as follows:

For the three months ended

June 30, 2023:

|

|

Revenue |

Add concentrate deductions

(1) |

|

Less non-gold revenue |

|

Gold revenue (2) |

Gold oz sold |

Average realized gold price per ounce sold |

|

Kisladag |

$ |

64.7 |

$ |

— |

$ |

(0.8 |

) |

$ |

63.9 |

32,280 |

$ |

1,980 |

|

Lamaque |

|

78.6 |

|

— |

|

(0.3 |

) |

|

78.3 |

39,904 |

|

1,962 |

|

Efemcukuru |

|

44.1 |

|

1.5 |

|

(1.4 |

) |

|

44.3 |

22,466 |

|

1,971 |

|

Olympias |

|

42.4 |

|

1.2 |

|

(15.0 |

) |

|

28.6 |

15,484 |

|

1,850 |

|

Total consolidated |

$ |

229.9 |

$ |

2.7 |

$ |

(17.5 |

) |

$ |

215.1 |

110,134 |

$ |