Terms of the implementation of Air France - KLM reverse share split

31 Julho 2023 - 3:00AM

Terms of the implementation of Air France - KLM reverse share split

Paris, 31 July 2023

Terms of the implementation of

Air France - KLM reverse share split

Air France - KLM (the

"Company") hereby gives details of the terms of

the reverse share split which starts today by means of an exchange

of 10 existing shares for 1 new share, as decided by the Board of

Directors at its meeting on 4 July 2023 in accordance with the

thirty-sixth extraordinary resolution of the Combined General

Meeting of 7 June 2023.

This reverse share split is a purely technical

exchange transaction with no direct impact on the total value of

the Company's shares held by each shareholder.

Terms of the implementation of the

reverse share split:

The terms of the reverse split were approved by

the Board of Directors at its meeting of 4 July 2023,and are set

out below and in the notice of reverse split published in the

Bulletin des Annonces Légales Obligatoires (BALO) on 12 July

2023.

- Date of the

beginning of the reverse share split: 31 July 2023.

- Basis of the

reverse share split: exchange of 10 ordinary shares in the Company

with a par value of 1 euro each for 1 new share with a par value of

1 euro (taking into account the concomitant capital reduction

reducing the par value of each new share from 10 euros to 1 euro,

i.e. a reduction of 9 euros per share allocated to the "share

premium" account) with current dividend rights.

- Number of

shares subject to the reverse split: 2,570,536,136 with a par value

of 1 euro.

- Number of

shares to be issued as a result of the reverse share split:

257,053,613 with a par value of 1 euro (taking into account the

concomitant capital reduction).

- Exchange

period: 30 (thirty) days from the start date of the reverse split,

i.e. from 31 July 2023 to 30 August 2023 inclusive.

- Whole shares:

the conversion of existing shares into new shares will be carried

out according to the automatic procedure (procédure d’office).

- Fractional

shares: shareholders who do not hold a number of existing shares

corresponding to a whole number of new shares must personally buy

or sell the fractional existing shares, in order to obtain a

multiple of 10, up to and including 30 August 2023. Existing shares

that have not been consolidated will be delisted at the end of the

reverse split period. After this date, shareholders who have not

been able to obtain a number of shares that is a multiple of 10

will be compensated by their financial intermediary within 30 days

of 31 August 2023.

- Centralisation:

all transactions relating to the reverse share split will be

carried out by Société Générale Securities Services, 32 rue du

Champ de Tir, CS 30812, 44308 Nantes Cedex 3, appointed as agent

for the centralisation of reverse share split transactions.

Pursuant to Articles

L. 228-6-1 and R. 228-12 of the French Commercial Code, at the

latest at the end of a period of 30 days from 31 August 2023, the

new shares that cannot be allocated individually and correspond to

fractional rights will be sold on the stock market by the account

holders and the proceeds of the sale will be allocated in

proportion to the fractional rights of the holders of these

rights.

The shares subject to

the reverse share split will be admitted to trading on the

regulated market of Euronext Paris under ISIN code FR0000031122,

until 30 August 2023, the last day of trading.

The shares resulting

from the reverse split will be admitted to trading on the regulated

market of Euronext Paris from 31 August 2023, the first day of

trading, and will be assigned ISIN code FR001400J770.

Adjustment of

the exchange, and/or conversion ratio of bonds convertible into

and/or exchangeable for new and/or existing shares

Following the reverse

share split, in order to preserve the rights of the holders of (i)

the deeply subordinated perpetual bonds convertible into new shares

and/or exchangeable for existing shares issued for a nominal amount

of 305.3 million through a placement with qualified investors on 16

November 2022 (the "Hybrid CBs") and of (ii) the

bonds convertible into and/or exchangeable for new or existing

shares issued in an amount of 500 million euros in March 2019 and

maturing in 2026 (the "OCEANE 2026"), the ratios

for conversion or exercise of the Hybrid CBs and the OCEANEs 2026

will be adjusted in proportion to the nominal value of the shares,

i.e. divided by 10.

Timetable:

|

31 July 2023 |

Start of reverse share split transaction |

|

From 31 July to 30 August 2023 (inclusive) |

Possibility for shareholders to buy and sell shares in order to

obtain a number of shares without fractional rights |

|

30 August 2023 |

Last trading day for existing shares |

|

31 August 2023 |

Effective date of reverse share split and capital reduction |

|

31 August 2023 |

Listing of the new shares |

|

From 31 August to 2 October 2023 |

Indemnity paid to shareholders with fractional rights by their

financial intermediary |

Investor

Relations

Michiel Klinkers

Marouane

Mami

michiel.klinkers@airfranceklm.com mamami@airfranceklm.com

Website: www.airfranceklm.com

- Terms of the implementation of Air France - KLM reverse share

split

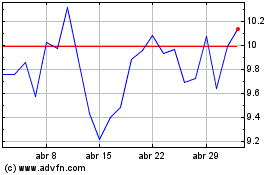

Air FranceKLM (EU:AF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Air FranceKLM (EU:AF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025