Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas”

or the

“

Company”) is pleased to announce that

shareholders have voted in favor of the separation of the Company

into Lithium Americas (Argentina) Corp. (“

Lithium

Argentina”) and a new Lithium Americas Corp.

(“

Lithium Americas (NewCo)”) pursuant to a

statutory plan of arrangement (the “

Separation”)

at the Company’s annual general and special meeting of shareholders

held today (the “

Meeting”). The Separation was

approved by 98.85% of the votes cast by shareholders present or

represented by proxy at the Meeting, as well as 98.78% of the votes

cast excluding those of such shareholders who are required to be

excluded pursuant to Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions.

“We are delighted to

see our shareholders’ overwhelming support for the Separation,”

said Jonathan Evans, Lithium Americas’ President and CEO.

“Following the Separation, the Lithium Americas (NewCo) team is

committed to advancing the Thacker Pass project toward production

to support the critical North American lithium supply chain.

Meanwhile, the Lithium Argentina team will advance Caucharí-Olaroz

toward full commercial production and pursue development

opportunities in its significant growth pipeline in Argentina.”

The Separation is targeted to become effective

in early October 2023. Completion of the Separation remains subject

to certain regulatory approvals and closing conditions, including

without limitation, having a registration statement to register

Lithium Americas (NewCo) common shares under the U.S. Securities

Exchange Act of 1934 become effective, and the receipt of final

approvals by the Supreme Court of British Columbia, the Toronto

Stock Exchange (“TSX”) and the New York Stock

Exchange (“NYSE”). The Company received advanced

tax rulings from both the Canada Revenue Agency and the Internal

Revenue Service in July, and the final court hearing is scheduled

to be held on August 4, 2023.

In connection with the approval of the

Separation, the Company’s shareholders also passed the resolution

approving a new equity incentive plan for Lithium Americas (NewCo)

with 90.17% of the votes cast at the Meeting in favor of the

resolution.

Additionally, in connection with the second

tranche (“Tranche 2”) of the previously announced

US$650 million investment (the “Investment”) by

General Motors Holdings LLC (NYSE: GM) (“GM”), the

Company’s shareholders passed two resolutions approving: (a) the

ownership by GM and its affiliates of more than 20% of the issued

and outstanding shares of the Company (or following the Separation,

Lithium Americas (NewCo)); and (b) US$27.74 per share (as adjusted

for the Separation) as the maximum subscription price at which

Tranche 2 would be made. 98.42% of the votes cast by disinterested

shareholders were in favor of the resolution in respect of GM’s

maximum ownership in the Company and, following the Separation,

Lithium Americas (NewCo), as applicable, and 98.40% of the

votes cast by disinterested shareholders were in favor of the

resolution in respect of the maximum pricing limitation for Tranche

2.

Following the Separation, Tranche 2 will be

conducted by way of a subscription by GM for shares of Lithium

Americas (NewCo) having an aggregate subscription price of

approximately US$330 million pursuant to the terms of a

subscription agreement. Completion of Tranche 2 will be subject to

the satisfaction of customary closing conditions, including the

receipt of conditional approval from the TSX and authorization from

the NYSE. GM’s ownership interest in the Company and, following the

Separation, Lithium Americas (NewCo) is subject to a maximum of 30%

pursuant to the terms of the definitive agreements governing the

Investment.

At the Meeting, the eight director nominees

listed in the Company's management information circular dated June

16, 2023 (the “Circular”) were also reelected as

directors to serve until the close of the next annual meeting of

shareholders, subject to the completion of the Separation. The

detailed results of the vote are set out below:

|

Director Nominees |

Votes For |

Votes Withheld |

|

George Ireland |

62,801,435 (97.71%) |

1,469,043 (2.29%) |

|

Fabiana Chubbs |

60,922,953 (94.79%) |

3,347,525 (5.21%) |

|

Kelvin Dushnisky |

62,502,979 (97.25%) |

1,767,499 (2.75%) |

|

Jonathan Evans |

61,847,254 (96.23%) |

2,424,108 (3.77%) |

|

Dr. Yuan Gao |

56,314,295 (87.62%) |

7,955,299 (12.38%) |

|

John Kanellitsas |

62,609,332 (97.42%) |

1,661,146 (2.58%) |

|

Jinhee Magie |

60,863,141 (94.70%) |

3,407,337 (5.30%) |

|

Franco Mignacco |

63,101,272 (98.18%) |

1,169,206 (1.82%) |

Mr. Xiaoshen Wang did not stand for

re-election to the Board of Directors of the Company. The Company

thanks Mr. Wang for his valuable contributions and wishes him every

success in his future endeavors.

“On behalf of the board and management, I would

like to thank Mr. Xiaoshen Wang for his dedication and commitment

for the past six years. Mr. Wang has provided invaluable knowledge

and experience and has played an instrumental role in the success

of the Company to date,” said George Ireland, Chairman of the Board

of Directors.

In addition to the election of directors,

shareholders also set the size of the Board of Directors at eight,

re-appointed PricewaterhouseCoopers LLP as the Company’s auditor

and approved a non-binding advisory vote on executive

compensation.

Detailed voting results on all matters

considered at the Meeting are reported in the Report of Voting

Results as filed on SEDAR (www.sedar.com). Please refer to the

Circular for more detailed information, available on the Company’s

website (www.lithiumamericas.com) and on SEDAR (www.sedar.com).

ABOUT LITHIUM

AMERICAS

Lithium Americas is advancing a separation of

its U.S. and Argentine business units into two public independent

companies. Lithium Argentina will retain Caucharí-Olaroz

(44.8%-interest), focused on advancing toward full production

capacity, and regional growth opportunities in the Pastos Grandes

basin with Pastos Grandes and Sal de la Puna projects (100%-owned

and 65%-interest, respectively). Lithium Americas (NewCo) will

retain the 100%-owned Thacker Pass, focused on advancing

construction with the target to commence production in the second

half of 2026. The Company currently trades on both the TSX and NYSE

under the ticker symbol “LAC.”

For further information contact:Investor

RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

FORWARD-LOOKING INFORMATION

Certain statements in this release constitute

“forward-looking statements” within the meaning of applicable

United States securities legislation and “forward-looking

information” under applicable Canadian securities legislation

(collectively, “forward-looking statements”). Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the actual results, events, performance or

achievements of the proposed Separation and of the Company (Lithium

Americas (NewCo)’s / Lithium Argentina’s), its projects, or

industry results, to be materially different from any future

results, events, performance or achievements expressed or implied

by such forward-looking statements. Such statements can be

identified by the use of words such as “may,” “would,” “could,”

“will,” “intend,” “expect,” “believe,” “plan,” “anticipate,”

“estimate,” “schedule,” “forecast,” “predict” and other similar

terminology, or state that certain actions, events or results

“may,” “could,” “would,” “might” or “will” be taken, occur or be

achieved. These statements reflect the Company’s current

expectations regarding future events, financial or operating

performance and results, and speak only as of the date of this

release. Such statements include without limitation, statements

with respect to the proposed Separation, the expected timetable for

the Separation, the ability of the Company to complete the

Separation on the terms described herein, or at all, the receipt of

required third party, court, tax, stock exchange and regulatory

approvals required for the Separation, the expected composition of

the board of directors and management of each entity, the expected

holdings and assets of the entities resulting from the Separation,

the expected benefits of the Separation for each business and to

the Company’s shareholders and other stakeholders, the strategic

advantages, future opportunities and focus of each business and

expectations regarding the status of development of the Company’s

projects.

Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future

performance, events or results and will not necessarily be accurate

indicators of whether or not such events or results will be

achieved. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements or information, including, but not limited to,

uncertainties with obtaining required approvals, rulings, court

orders and consents, or satisfying other requirements, necessary or

desirable to permit or facilitate completion of the Separation

(including tax, regulatory and shareholder approvals); there being

no assurance that Lithium Americas (NewCo) will meet all the

requirements to list its common shares on the TSX and/or the NYSE,

future factors or events that may arise making it inadvisable to

proceed with, or advisable to delay or alter the structure of the

Separation; the performance, the operations and financial condition

of Lithium Americas (NewCo) and Lithium Argentina as separately

traded public companies, including the reduced geographical and

property portfolio diversification resulting from the Separation;

the impact of the Separation on the trading prices for, and market

for trading in, the shares of the Company, Lithium Americas (NewCo)

and Lithium Argentina (collectively the “Entities” and

individually, an “Entity”); the potential for significant tax

liability for a violation of the tax-deferred spinoff rules

applicable in Canada and the United States; uncertainties with

realizing the potential benefits of the Separation; risks

associated with mining project development, achieving anticipated

milestones and budgets as planned, and meeting expected timelines;

risks inherent in litigation that could result in additional

unanticipated delays or rulings that are adverse for an Entity or

its projects; maintaining local community support in the regions

where an Entity’s projects are located; changing social perceptions

and their impact on project development and litigation; ongoing

global supply chain disruptions and their impact on developing an

Entity’s projects; availability of personnel, supplies and

equipment; the impact of inflation or changing economic conditions

on an Entity, its projects and their feasibility; any impacts of

COVID-19 or an escalation thereof on the business of an Entity;

unanticipated changes in market price for an Entity’s shares;

changes to an Entity’s current and future business plans and the

strategic alternatives available to the Entity; industry and stock

market conditions generally; demand, supply and pricing for

lithium; and general economic and political conditions in Canada,

the United States, Argentina and other jurisdictions where an

Entity conducts business. Additional information about certain of

these assumptions and risks and uncertainties is contained in the

Company’s filings with securities regulators, including the

Company’s most recent annual information form and most recent

management’s discussion and analysis for the Company’s most

recently completed financial year and interim financial period,

which are available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov.

Although the forward-looking statements

contained in this release are based upon what management of the

Company believes are reasonable assumptions as of the date hereof,

there can be no assurance that actual results will be consistent

with these forward-looking statements. These forward-looking

statements are made as of the date of this release and are

expressly qualified in their entirety by this cautionary statement.

Subject to applicable securities laws, the Company does not assume

any obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this release.

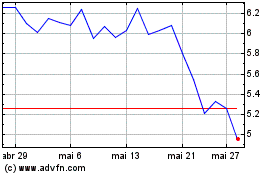

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025