Avalo Therapeutics, Inc. (Nasdaq: AVTX), today announced business

updates and financial results for the second quarter of 2023.

“Although the PEAK trial did not meet its

primary endpoint, mechanistically I believe AVTX-002 has promise in

other inflammatory driven diseases including IBD and other diseases

of the lung, gut and skin. Additionally, we believe an opportunity

remains in asthma, particularly in a subset of patients with higher

baseline LIGHT levels. We also have high confidence in our

preclinical stage fully human BTLA agonist fusion protein

(AVTX-008) to potentially treat a wide range of autoimmune diseases

and are excited by the drug’s novel mechanism of action and

potential usage in patients not responsive to anti-TNF therapy,”

said Dr. Garry Neil, Chief Executive Officer and Chairman of the

Board. “The team is working tirelessly to determine the best path

forward for these assets, including indication selection and

funding to support development.”

Corporate Updates:

- In June of 2023, Avalo prepaid $6

million of principal under its loan and security agreement. As of

June 30, 2023, the remaining principal payments were $15.2

million.

- On July 20, 2023, Avalo entered

into a forbearance agreement with its debt lenders, pursuant to

which the parties agreed that an event of default had occurred due

to a material adverse change in the Company’s business and the

lenders agreed to forbear from enforcing its full remedies,

including acceleration of the amounts due, until August 15, 2023 or

earlier triggering event.

- Avalo is considering out-licensing

or sale of its non-core and potentially its core assets to increase

focus and reduce future expenses. In July of 2023, Avalo entered

into a non-binding letter of intent for the potential sale of

AVTX-801 (D-galactose), AVTX-802 (D-mannose) and AVTX-803

(L-fucose).

Program Updates:

- AVTX-002: Anti-LIGHT

monoclonal antibody (mAb) targeting immune-inflammatory

diseases.

- Avalo announced that its Phase 2

PEAK trial in patients with NEA did not meet its primary endpoint,

measured by the proportion of patients who experienced an

asthma-related event (ARE), however AVTX-002 demonstrated a

significant and sustained reduction in LIGHT levels and a favorable

safety and tolerability profile. Further, a preliminary post-hoc

analyses for a sub-population of patients with baseline LIGHT

levels over 125 pg/mL, which represented over 50% of patients,

showed an approximately 50% reduction in AREs for patients treated

with AVTX-002 compared to placebo.

- Previously demonstrated AVTX-002

was statistically significant in reducing respiratory failure and

mortality in patients hospitalized with COVID-19 ARDS in a

randomized placebo-controlled trial. AVTX-002 also demonstrated

positive trends in an open-label study in Crohn’s Disease.

- AVTX-002 showed a rapid and

sustained reduction of LIGHT levels in all indications studied

including COVID-19 ARDS, Crohn’s Disease and NEA.

- Avalo will continue to evaluate the

topline results of the Phase 2 PEAK trial, while also pursuing

funding for the program, to inform future development plans.

- AVTX-008: B and T

Lymphocyte Attenuator (BTLA) agonist fusion protein targeting

immune dysregulation disorders.

- Avalo previously identified a lead

molecule, is evaluating several immune dysregulation disorders to

pursue and plans to rapidly progress the asset to IND, subject to

funding.

- AVTX-803: Fucose

replacement for leukocyte adhesion deficiency type II (LAD II, also

known as SLC35C1-CDG), a congenital disorder of glycosylation

(CDG).

- In July of 2023, Avalo entered into

a non-binding letter of intent for the potential sale of AVTX-801

(D-galactose), AVTX-802 (D-mannose) and AVTX-803 (L-fucose).

Second Quarter 2023 Financial Update:

Avalo had $6.3 million in cash and cash

equivalents as of June 30, 2023, representing a $6.9 million

decrease compared to December 31, 2022. The decrease was driven by

operating expenditures to fund pipeline development and a $6

million partial prepayment under the loan and security agreement

and were partially offset by $20.3 million of net proceeds from

equity financings.

Total operating expenses decreased $17.8 million

for the six months ended June 30, 2023 as compared to the same

period in 2022. This decrease was primarily driven by decreases to

both selling, general and administrative and research and

development expenses as a result of cost savings initiatives

implemented in the first quarter of 2022 and fewer programs ongoing

in the current year.

The net loss and net loss per share for the

three months ended June 30, 2023 was largely driven by operating

expenses.

Consolidated Balance Sheets(In

thousands, except share and per share data)

| |

June 30, 2023 |

|

December 31, 2022 |

| |

(unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

6,307 |

|

|

$ |

13,172 |

|

|

Accounts receivable |

|

38 |

|

|

|

— |

|

|

Other receivables |

|

6 |

|

|

|

1,919 |

|

|

Inventory, net |

|

18 |

|

|

|

20 |

|

|

Prepaid expenses and other current assets |

|

1,135 |

|

|

|

1,290 |

|

|

Restricted cash, current portion |

|

15 |

|

|

|

15 |

|

| Total current assets |

|

7,519 |

|

|

|

16,416 |

|

| Property and equipment,

net |

|

2,176 |

|

|

|

2,411 |

|

| Goodwill |

|

14,409 |

|

|

|

14,409 |

|

| Restricted cash, net of

current portion |

|

131 |

|

|

|

131 |

|

| Total assets |

$ |

24,235 |

|

|

$ |

33,367 |

|

| Liabilities and

stockholders’ deficit |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

751 |

|

|

$ |

2,882 |

|

|

Deferred revenue |

|

— |

|

|

|

88 |

|

|

Accrued expenses and other current liabilities |

|

7,588 |

|

|

|

13,214 |

|

|

Notes payable, current |

|

14,115 |

|

|

|

5,930 |

|

| Total current liabilities |

|

22,454 |

|

|

|

22,114 |

|

| Notes payable,

non-current |

|

— |

|

|

|

13,486 |

|

| Royalty obligation |

|

2,000 |

|

|

|

2,000 |

|

| Deferred tax liability,

net |

|

156 |

|

|

|

141 |

|

| Derivative liability |

|

5,050 |

|

|

|

4,830 |

|

| Other long-term

liabilities |

|

1,544 |

|

|

|

1,711 |

|

| Total liabilities |

|

31,204 |

|

|

|

44,282 |

|

| Stockholders’ deficit: |

|

|

|

|

Common stock—$0.001 par value; 200,000,000 shares authorized at

June 30, 2023 and December 31, 2022; 14,036,940 and 9,430,535

shares issued and outstanding at June 30, 2023 and December 31,

2022, respectively |

|

14 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

314,755 |

|

|

|

292,900 |

|

|

Accumulated deficit |

|

(321,738 |

) |

|

|

(303,824 |

) |

| Total stockholders’

deficit |

|

(6,969 |

) |

|

|

(10,915 |

) |

| Total liabilities and

stockholders’ deficit |

$ |

24,235 |

|

|

$ |

33,367 |

|

The condensed consolidated balance sheets as of

June 30, 2023 and December 31, 2022 have been derived from the

reviewed and audited financial statements, respectively, but do not

include all of the information and footnotes required by accounting

principles accepted in the United States for complete financial

statements.

Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share data)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenues: |

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

643 |

|

|

$ |

1,033 |

|

|

$ |

1,117 |

|

|

$ |

2,206 |

|

|

Total revenues, net |

|

643 |

|

|

|

1,033 |

|

|

|

1,117 |

|

|

|

2,206 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of product sales |

|

708 |

|

|

|

1,567 |

|

|

|

1,259 |

|

|

|

2,286 |

|

|

Research and development |

|

4,658 |

|

|

|

8,510 |

|

|

|

10,667 |

|

|

|

18,094 |

|

|

Selling, general and administrative |

|

2,427 |

|

|

|

2,784 |

|

|

|

5,134 |

|

|

|

14,468 |

|

|

Amortization expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

38 |

|

|

Total operating expenses |

|

7,793 |

|

|

|

12,861 |

|

|

|

17,060 |

|

|

|

34,886 |

|

| |

|

(7,150 |

) |

|

|

(11,828 |

) |

|

|

(15,943 |

) |

|

|

(32,680 |

) |

| Other expense: |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(996 |

) |

|

|

(1,154 |

) |

|

|

(1,945 |

) |

|

|

(2,323 |

) |

|

Change in fair value of derivative liability |

|

(40 |

) |

|

|

— |

|

|

|

(220 |

) |

|

|

— |

|

|

Other expense, net |

|

— |

|

|

|

— |

|

|

|

(25 |

) |

|

|

(20 |

) |

| Total other expense, net |

|

(1,036 |

) |

|

|

(1,154 |

) |

|

|

(2,190 |

) |

|

|

(2,343 |

) |

| Loss before taxes |

|

(8,186 |

) |

|

|

(12,982 |

) |

|

|

(18,133 |

) |

|

|

(35,023 |

) |

| Income tax expense |

|

7 |

|

|

|

5 |

|

|

|

15 |

|

|

|

15 |

|

| Net loss and comprehensive

loss |

$ |

(8,193 |

) |

|

$ |

(12,987 |

) |

|

$ |

(18,148 |

) |

|

$ |

(35,038 |

) |

| Net loss per share of common

stock, basic and diluted1 |

$ |

(0.59 |

) |

|

$ |

(1.38 |

) |

|

$ |

(1.41 |

) |

|

$ |

(3.73 |

) |

1 Amounts for prior periods presented have been

retroactively adjusted to reflect the 1-for-12 reverse stock split

effected on July 7, 2022.

The unaudited condensed consolidated statements

of operations for the three and six months ended June 30, 2023 and

2022 have been derived from the reviewed financial statements but

do not include all of the information and footnotes required by

accounting principles generally accepted in the United States for

complete financial statements.

About AVTX-002

(quisovalimab)

AVTX-002 is a fully human monoclonal antibody

(mAb), directed against human LIGHT

(Lymphotoxin-like, exhibits

Inducible expression, and competes with Herpes

Virus Glycoprotein D for

Herpesvirus Entry Mediator (HVEM), a receptor

expressed by T lymphocytes). There is increasing

evidence that the dysregulation of the LIGHT-signaling network

which includes LIGHT, its receptors HVEM and LTβR and the

downstream checkpoint BTLA, is a disease-driving mechanism in

autoimmune and inflammatory reactions in barrier organs. Therefore,

we believe reducing LIGHT levels can moderate immune dysregulation

in many acute and chronic inflammatory disorders. AVTX-002

previously demonstrated proof of concept in COVID-19 induced acute

respiratory distress syndrome including reduction in mortality and

respiratory failure, as well as a positive signal in Crohn’s

Disease.

About AVTX-008

AVTX-008 is a fully human B and T Lymphocyte

Attenuator (BTLA) agonist fusion protein in the IND-enabling

stage.

About Avalo Therapeutics

Avalo Therapeutics is a clinical stage

biotechnology company focused on the treatment of immune

dysregulation by developing therapies that target the

LIGHT-signaling network.

LIGHT and its signaling receptors, HVEM

(TNFRSF14), and lymphotoxin β receptor (TNFRSF3), form an immune

regulatory network with two co-receptors of herpesvirus entry

mediator, checkpoint inhibitor B and T Lymphocyte Attenuator

(BTLA), and CD160 (the LIGHT-signaling network). Accumulating

evidence points to the dysregulation of the LIGHT network as a

disease-driving mechanism in autoimmune and inflammatory reactions

in barrier organs. Therefore, we believe reducing LIGHT levels can

moderate immune dysregulation in many acute and chronic

inflammatory disorders.

For more information about Avalo, please

visit www.avalotx.com.

Forward-Looking Statements

This press release may include forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are statements that

are not historical facts. Such forward-looking statements are

subject to significant risks and uncertainties that are subject to

change based on various factors (many of which are beyond Avalo’s

control), which could cause actual results to differ from the

forward-looking statements. Such statements may include, without

limitation, statements with respect to Avalo’s plans, objectives,

projections, expectations and intentions and other statements

identified by words such as “projects,” “may,” “might,” “will,”

“could,” “would,” “should,” “continue,” “seeks,” “aims,”

“predicts,” “believes,” “expects,” “anticipates,” “estimates,”

“intends,” “plans,” “potential,” or similar expressions (including

their use in the negative), or by discussions of future matters

such as: the future financial and operational outlook; timing and

success of trial results and regulatory review; potential

attributes and benefits of product candidates; the development of

product candidates or products; and other statements that are not

historical. These statements are based upon the current beliefs and

expectations of Avalo’s management but are subject to significant

risks and uncertainties, including: Avalo's debt and cash position

and the need for it to raise additional capital in the near future,

including the risk that its lender will call the debt on or before

the August 15, 2023 end of the current forbearance agreement; the

results of our clinical and pre-clinical studies; drug development

costs, timing and other risks, including reliance on investigators

and enrollment of patients in clinical trials, which might be

slowed by the COVID-19 pandemic; reliance on key personnel;

regulatory risks; general economic and market risks and

uncertainties, including those caused by the COVID-19 pandemic and

the war in Ukraine; and those other risks detailed in Avalo’s

filings with the SEC. Actual results may differ from those set

forth in the forward-looking statements. Except as required by

applicable law, Avalo expressly disclaims any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Avalo’s expectations with respect thereto or any change in

events, conditions or circumstances on which any statement is

based.

For media and investor inquiries

Christopher Sullivan, CFO Avalo Therapeutics,

Inc. ir@avalotx.com 410-803-6793

or

Chris BrinzeyICR

WestwickeChris.brinzey@westwicke.com 339-970-2843

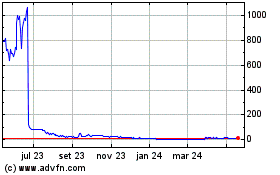

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

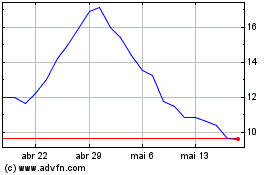

Avalo Therapeutics (NASDAQ:AVTX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024