Disc Medicine, Inc. (NASDAQ:IRON), a clinical-stage

biopharmaceutical company focused on the discovery, development,

and commercialization of novel treatments for patients suffering

from serious hematologic diseases, today reported financial results

for the second quarter ending June 30, 2023, and provided an update

on recent program and corporate developments.

“This was a landmark quarter for our company, as

we presented positive initial data from the BEACON study at EHA,

which showed the promise of bitopertin as a potential treatment for

EPP. The BEACON data catalyzed the successful completion of an

upsized public offering, which provides runway well beyond key

read-outs across our portfolio and positions us to advance

bitopertin into late-stage development,” said John Quisel, J.D.,

Ph.D., President and Chief Executive Officer of Disc. “We continue

to make excellent progress across our portfolio and look forward to

providing updated results from BEACON and our other studies at the

end of the year.”

Recent Business Highlights and Upcoming

Milestones:

Bitopertin: GlyT1 Inhibitor (Heme

Synthesis Modulator)

Bitopertin is an investigational,

clinical-stage, orally-administered inhibitor of glycine

transporter 1 (GlyT1) that is designed to modulate heme

biosynthesis. GlyT1 is a membrane transporter expressed on

developing red blood cells and is required to supply sufficient

glycine for heme biosynthesis and support erythropoiesis. Disc is

planning to develop bitopertin as a potential treatment for a range

of hematologic diseases including erythropoietic porphyrias, where

it has potential to be the first disease-modifying therapy.

- Presented

positive initial data from BEACON, an open-label Phase 2 clinical

study of bitopertin in patients with EPP and X-linked

protoporphyria (XLP), demonstrating:

- Consistent and

dose-dependent reductions of protoporphyrin IX (PPIX), the

disease-causing metabolite in EPP

- Marked

improvements in sunlight tolerance and quality of life

- Bitopertin was

well-tolerated, with no meaningful changes in hemoglobin

- Continued

enrollment for AURORA, a Phase 2 randomized, placebo-controlled

clinical study of bitopertin in adults with EPP. Disc expects to

have data by year-end 2023, to be presented in early 2024.

- Initiated and

enrolled first patient in an NIH-sponsored Phase 1/2 study of

bitopertin in patients with Diamond-Blackfan Anemia in July

2023

DISC-0974: Anti-Hemojuvelin Antibody

(Hepcidin Suppression)

DISC-0974 is an investigational anti-hemojuvelin

monoclonal antibody (mAb) and is designed to suppress hepcidin

production and increase serum iron levels in patients suffering

from anemia of inflammation.

- Enrollment ongoing for a Phase 1b/2

clinical study of patients with anemia of chronic kidney disease

who are not receiving dialysis (NDD-CKD); initial data expected by

year-end 2023

- Continued enrollment in a Phase

1b/2 clinical study in MF patients with severe anemia on stable

background therapy; initial data expected by year-end 2023

MWTX-003: Anti-TMPRSS6 Antibody

(Hepcidin Induction)

MWTX-003 is an investigational, anti-TMPRSS6

(Transmembrane Serine Protease 6, also known as Matriptase-2)

monoclonal antibody designed to increase hepcidin production and

suppress serum iron.

- Continued

technology transfer and study preparation activities for MWTX-003.

Disc plans to initiate a Phase 1 study in healthy volunteers during

the second half of 2023.

- Disc plans to

develop MWTX-003 initially as a treatment for polycythemia vera as

well as other indications.

Corporate:

- Completed an upsized public

offering of common stock and pre-funded warrants in June 2023 for

$157.8 million in gross proceeds.

Second Quarter 2023 Financial

Results:

- Cash Position:

Cash and cash equivalents were $377.6 million as of June 30, 2023,

which are expected to fund our operational plans well into

2026.

- Research and Development

Expenses: R&D expenses were $12.1 million for the

quarter ended June 30, 2023, as compared to $7.7 million for the

quarter ended June 30, 2022. The increase in R&D expenses were

primarily driven by the progression of Disc’s portfolio, including

bitopertin’s ongoing two Phase 2 clinical studies, increased

headcount, and costs related to technology transfer and study

preparations for MWTX-003.

- General and Administrative

Expenses: G&A expenses were $5.2 million for the

quarter ended June 30, 2023, as compared to $4.3 million for the

same period in 2022. The increase in G&A expenses was primarily

due to increased headcount.

- Net Loss: Net loss

was $15.9 million for the quarter ended June 30, 2023, as compared

to $9.6 million for the second quarter of 2022. The increase was

primarily due to higher operating costs in the current period to

support the continued advancement of our pipeline.

About Disc Medicine

Disc Medicine (NASDAQ:IRON) is a clinical-stage

biopharmaceutical company committed to discovering, developing, and

commercializing novel treatments for patients who suffer from

serious hematologic diseases. We are building a portfolio of

innovative, potentially first-in-class therapeutic candidates that

aim to address a wide spectrum of hematologic diseases by targeting

fundamental biological pathways of red blood cell biology,

specifically heme biosynthesis and iron homeostasis. For more

information, please visit www.discmedicine.com.

Available Information

Disc announces material information to the

public about the Company, its products and services, and other

matters through a variety of means, including filings with the U.S.

Securities and Exchange Commission (SEC), press releases, public

conference calls, webcasts and the investor relations section of

the Company website at ir.discmedicine.com in order to achieve

broad, non-exclusionary distribution of information to the public

and for complying with its disclosure obligations under Regulation

FD.

Disc Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including, but not limited to, express or

implied statements regarding Disc’s expectations with respect to

its AURORA Phase 2 and BEACON Phase 2 clinical studies of

bitopertin, and its Phase 1b/2 study of bitopertin in

Diamond-Blackfan Anemia, its Phase 1b/2 clinical study of DISC-0974

in NDD-CKD patients with anemia, its anticipated Phase 1 study of

MWTX-003 and potential development of MWTX-003 as a treatment for

polycythemia vera and other indications, projected timelines for

the initiation and completion of its clinical trials, anticipated

timing of release of data, and other clinical activities; Disc’s

business plans and objectives; and Disc’s beliefs about operating

expenses and that it will have capital to fund Disc well into 2026.

The use of words such as, but not limited to, “believe,” “expect,”

“estimate,” “project,” “intend,” “future,” “potential,” “continue,”

“may,” “might,” “plan,” “will,” “should,” “seek,” “anticipate,” or

“could” or the negative of these terms and other similar words or

expressions that are intended to identify forward-looking

statements. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based on

Disc’s current beliefs, expectations and assumptions regarding the

future of Disc’s business, future plans and strategies, clinical

results and other future conditions. New risks and uncertainties

may emerge from time to time, and it is not possible to predict all

risks and uncertainties. No representations or warranties

(expressed or implied) are made about the accuracy of any such

forward-looking statements.

Disc may not actually achieve the plans,

intentions or expectations disclosed in these forward-looking

statements, and investors should not place undue reliance on these

forward-looking statements. Actual results or events could differ

materially from the plans, intentions and expectations disclosed in

the forward-looking statements as a result of a number of material

risks and uncertainties including but not limited to: the adequacy

of Disc’s capital to support its future operations and its ability

to successfully initiate and complete clinical trials; the nature,

strategy and focus of Disc; the difficulty in predicting the time

and cost of development of Disc’s product candidates; Disc’s plans

to research, develop and commercialize its current and future

product candidates; the timing of initiation of Disc’s planned

preclinical studies and clinical trials; the timing of the

availability of data from Disc’s clinical trials; Disc’s ability to

identify additional product candidates with significant commercial

potential and to expand its pipeline in hematological diseases; the

timing and anticipated results of Disc’s preclinical studies and

clinical trials and the risk that the results of Disc’s preclinical

studies and clinical trials may not be predictive of future results

in connection with future studies or clinical trials and may not

support further development and marketing approval; the other risks

and uncertainties described in the “Risk Factors” section of our

Annual Report on Form 10-K for the year ended December 31, 2022,

Quarterly Reports on Form 10-Q for the quarters ended March 31,

2023 and June 30, 2023, and other documents filed by Disc from time

to time with the SEC, as well as discussions of potential risks,

uncertainties, and other important factors in Disc’s subsequent

filings with the SEC. Any forward-looking statement speaks only as

of the date on which it was made. None of Disc, nor its affiliates,

advisors or representatives, undertake any obligation to publicly

update or revise any forward-looking statement, whether as result

of new information, future events or otherwise, except as required

by law.

|

DISC MEDICINE, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In thousands, except share and per share

amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Research and

development |

$ |

12,100 |

|

|

$ |

7,714 |

|

|

$ |

32,280 |

|

|

$ |

15,535 |

|

| General and

administrative |

|

5,228 |

|

|

|

4,301 |

|

|

|

10,173 |

|

|

|

6,440 |

|

| Total operating

expenses |

|

17,328 |

|

|

|

12,015 |

|

|

|

42,453 |

|

|

|

21,975 |

|

| Loss from

operations |

|

(17,328 |

) |

|

|

(12,015 |

) |

|

|

(42,453 |

) |

|

|

(21,975 |

) |

| Other income

(expense), net |

|

1,405 |

|

|

|

2,435 |

|

|

|

3,772 |

|

|

|

2,542 |

|

| Income tax

expense |

|

(24 |

) |

|

|

— |

|

|

(47 |

) |

|

|

— |

|

| Net loss |

$ |

(15,947 |

) |

|

$ |

(9,580 |

) |

|

$ |

(38,728 |

) |

|

$ |

(19,433 |

) |

| Weighted-average

common shares outstanding-basic and diluted |

|

21,484,955 |

|

|

|

944,706 |

|

|

|

20,226,923 |

|

|

|

934,286 |

|

| Net loss per

share-basic and diluted |

$ |

(0.74 |

) |

|

$ |

(10.14 |

) |

|

$ |

(1.91 |

) |

|

$ |

(20.80 |

) |

|

|

|

|

|

|

|

|

|

|

DISC MEDICINE, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands) |

|

(Unaudited) |

| |

|

June 30, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

377,602 |

|

$ |

194,611 |

| Other

current assets |

|

|

4,131 |

|

|

3,880 |

| Total

current assets |

|

|

381,733 |

|

|

198,491 |

|

Non-current assets |

|

|

2,441 |

|

|

1,714 |

| Total

assets |

|

$ |

384,174 |

|

$ |

200,205 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

| Current

liabilities |

|

$ |

9,683 |

|

$ |

22,578 |

|

Non-current liabilities |

|

|

3,272 |

|

|

1,027 |

| Total

liabilities |

|

|

12,955 |

|

|

23,605 |

| Total

stockholders’ equity |

|

|

371,219 |

|

|

176,600 |

| Total

liabilities and stockholders’ equity |

|

$ |

384,174 |

|

$ |

200,205 |

Media Contact

Peg Rusconi

Verge Scientific Communications

prusconi@vergescientific.com

Investor Relations Contact

Christina Tartaglia

Stern Investor Relations

christina.tartaglia@sternir.com

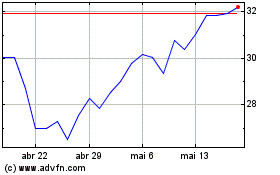

Disc Medicine (NASDAQ:IRON)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Disc Medicine (NASDAQ:IRON)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024