Western Potash Corp. Announces Signing of Subscription Agreement with Vantage Chance Limited for Exchangeable Debenture

15 Agosto 2023 - 7:25PM

Western Resources Corp. (the “Company” or “WRX”) (TSX:

WRX) is pleased to announce today that Western Potash

Corp. (“Western Potash”), the Company’s 100% owned subsidiary, has

signed an exchangeable debenture subscription agreement with

Vantage Chance Limited (“Vantage”), pursuant to which Vantage will

subscribe for a CAD$10 million exchangeable debenture (the

“Exchangeable Debenture”) issued by Western Potash (the

"Transaction").

Pursuant to the Exchangeable Debenture, within

one year from the date of final operational completion date of

Milestone Phase 1 Project, Vantage may choose to exercise an option

to assign all or a portion of the outstanding principal amount,

together with any accrued and unpaid interest (the “Exchangeable

Amount”), to the Company, in exchange for such number of the

Company’s common shares (the “Exchange Shares”) equal to the

Exchangeable Amount divided by the Exchange Price then in effect,

subject to a maximum number of 40,868,047 Exchange Shares

(representing 10% of the total issued and outstanding WRX common

shares on a non-diluted basis on the issue date) being issuable to

Vantage. The Exchange Price is a price per common share of the

Company equal to the 5-day volume weighted average trading price of

the common shares of the Company immediately preceding the date

that the exchange occurs. To the extent that the 40,868,047

Exchange Shares are insufficient to satisfy the entire Exchangeable

Amount based on the then Exchange Price, any remaining Exchangeable

Amount will be paid by Western Potash in cash.

The Transaction is expected to close by the end

of September 2023. The purpose of the Transaction is to allow

Western Potash to further enhance the production readiness of its

Milestone Phase 1 Project. Vantage is a Hong Kong based private

investment company that currently owns 53.76% of the issued and

outstanding common shares of the Company. The Transaction will not

materially affect control of the Company.

Other key terms of the Exchangeable Debenture

include:

- Maturity date is

set for the later of (a) the date of repayment in full of the

principal amount together with all accrued and unpaid Interest; and

(b) the date on which the Exchangeable Amount has been exchanged by

Vantage pursuant to the Exchangeable Debenture, provided that in no

event shall the maturity date occur prior to the date that Appian

Capital Advisory LLP is repaid under the April 2022 term loan

facility agreement (as amended) between Appian and Western Potash

(the “Appian Repayment Date”).

- Interest rate is

set at 12.5% per annum. Interest payable is calculated quarterly on

an accrual basis, but no actual payment is made until the Appian

Repayment Date, provided that Western Potash may make one or more

cash payments to Vantage as Western Potash’s financial condition

permits.

The Exchangeable Debenture certificate and other

material documents relating to the Transaction described in this

news release will be filed and available under the Company’s

profile on SEDAR at www.sedarplus.ca.

At present, the Project is transitioning from

the construction phase to the commissioning phase, after which it

is expected to proceed to the start-up phase. Construction handover

is expected to be completed this month, and the plant is expected

to be ready for production by the end of September.

ON BEHALF OF THE BOARD OF DIRECTORS

Bill XueChairman and CEO

Cautions Regarding Forward-Looking Statements

Certain statements contained in this news

release constitute forward-looking information within the meaning

of applicable Canadian securities laws. Forward-looking statements

are statements that are not historical facts and are generally, but

not always, identified by words such as "anticipate", "continue",

"estimate", "expect", "expected", "intend", "may", "will",

"project", "plan", "should", "believe" and similar expressions

(including negative variations), or that events or conditions

"will", "would", "may", "could" or "should" occur. Forward-looking

statements are based on the opinions and estimates of management as

of the date such statements are made and they are subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results of the Company to be materially different from

those expressed or implied by such forward-looking statements or

forward-looking information. Although management of the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

does not undertake to update any forward-looking information that

is set out herein, except in accordance with applicable securities

laws.

For more information on the contents of this

release please contact Jack Xue, Corporate Secretary, at

306-924-9378.

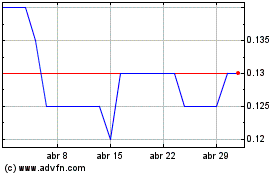

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Western Resources (TSX:WRX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024