Navios Maritime Holdings Inc. (“Navios Holdings” or the “Company”)

(NYSE: NM), today reported its financial results for the second

quarter and six months ended June 30, 2023. Navios Holdings owns

(i) a controlling equity stake in Navios South American Logistics

Inc. (“Navios Logistics”), one of the largest infrastructure and

logistics companies in the Hidrovia region of South America and

(ii) an interest in Navios Maritime Partners L.P. (“Navios

Partners”) (NYSE:NMM), an international shipping company, listed on

the New York Stock Exchange, that owns and operates dry cargo and

tanker vessels.

Angeliki Frangou, Chairwoman and Chief Executive

Officer, stated “I am pleased with the results for the second

quarter of 2023 during which we reported revenue of approximately

$82 million and net income of $15.5 million.”

Angeliki Frangou, continued, “We believe that

the global conditions support continued growth in the Hidrovia

region. As the world’s requirements evolve, whether for raw

materials for green technology, old world requirements for mineral

commodities or dynamically changing grain trade patterns, our

region will be providing solutions. We intend to play our part by

maximizing the return from our existing assets through innovative

logistics solutions that leverage our unique infrastructure

assets.”

HIGHLIGHTS

Navios Logistics

Navios Logistics generated revenue of $81.9

million during the three-month period ended June 30, 2023 compared

to $69.2 million in the respective period of 2022. For the

six-month period ended June 30, 2023 Navios Logistics generated

revenue of $147.3 million compared to $128.3 million in the

respective period of 2022.

Iron ore port transshipments for the six-month

period ended June 30, 2023 increased to 2.0 million tons,

compared to 308 thousand tons for the same period in 2022. In iron

ore transportation, Navios Logistics has fixed six dry barge

convoys under period contracts, for durations up to December 2024,

which are expected to generate revenues of $27.0 million.

Fleet utilization in cabotage vessels increased

to 83% in the six-month period ended June 30, 2023, a 9% increase

as compared to the same period in 2022. For the second half of

2023, Navios Logistics has fixed 90% of the available days of the

cabotage vessels, expecting to generate a time charter equivalent

of $27,143 per day per vessel.

In August 2023, Navios Logistics completed the

sale of a bunker vessel, the He Man H, to an unrelated third

party.

Discontinued Operations

In September 2022, the sale of our 36-vessel

drybulk fleet (the “Transaction”) was completed. Following the

closing of the Transaction, the results of the dry-bulk vessel

operations are reported as discontinued operations for all periods

presented.

Non-GAAP Measures

EBITDA attributable to Navios Holdings’ common

stockholders and EBITDA of Navios Logistics (on a stand-alone

basis) are non-U.S. GAAP financial measures and should not be used

in isolation or as substitute for results calculated in accordance

with U.S. GAAP.

See Exhibit I under the heading, “Disclosure of

Non-GAAP Financial Measures,” for a discussion of Navios Holdings’

and Navios Logistics’ EBITDA, and a reconciliation of such measures

to net income, the most comparable measure calculated under U.S.

GAAP.

Earnings

Highlights

Second Quarter 2023 and 2022 Results (in thousands of

U.S. dollars, except per share data and unless otherwise

stated):

The second quarter 2023 and 2022 information

presented below was derived from the unaudited condensed

consolidated financial statements for the respective periods.

|

|

|

Three Month Period EndedJune 30,

2023 |

|

|

|

Three Month Period EndedJune 30,

2022 |

|

| |

|

(unaudited) |

|

|

(unaudited) |

| Revenue (from continuing

operations) |

$ |

81,898 |

|

|

$ |

69,185 |

|

| Net Income attributable to

Navios Holdings’ common stockholders |

$ |

15,480 |

(1) |

|

$ |

44,960 |

|

| Net Income attributable to

Navios Holdings’ common stockholders from continuing

operations |

$ |

15,480 |

(1) |

|

$ |

16,027 |

|

| EBITDA |

$ |

42,305 |

(1) |

|

$ |

98,544 |

|

| EBITDA (from continuing

operations) |

$ |

42,305 |

(1) |

|

$ |

41,626 |

|

| Basic Earnings per share

attributable to Navios Holdings’ common stockholders |

$ |

0.27 |

(1) |

|

$ |

1.38 |

|

| Basic Earnings per share

attributable to Navios Holdings’ common stockholders from

continuing operations |

$ |

0.27 |

(1) |

|

$ |

0.47 |

|

| |

|

|

|

|

|

|

|

(1) Net Income attributable to Navios Holdings’

common stockholders, EBITDA, and Basic Earnings per share

attributable to Navios Holdings’ common stockholders for the

three-month ended June 30, 2023 include a $1.1 million loss

representing Navios Holdings’ portion of impairment losses incurred

by Navios Logistics in connection with the sale of He Man H.

Revenue from continuing operations was $81.9

million for the three-month period ended June 30, 2023, as compared

to $69.2 million for the same period in 2022. The increase was

mainly attributable to: (i) a $7.3 million increase in revenue from

the Barge Business, mainly attributable to time charter-out

contracts for iron ore transportation; and (ii) $6.7 million

attributable to the sale of fuel products in connection with the

bunkering services in the port of Nueva Palmira. The overall

increase was partially mitigated by: (i) a $1.1 million decrease in

Port Terminal Business, mainly coming from the Grain Port Terminal

due to lower grain throughput related to a decline in Uruguayan

exports, partially mitigated by higher tariffs and volumes

transshipped at the Iron Ore Port Terminal; and (ii) a $0.1 million

decrease in revenue from the Cabotage Business.

Net Income attributable to Navios Holdings’

common stockholders from continuing operations was $15.5 million

for the three month period ended June 30, 2023, as compared to a

$16.0 million for the same period in 2022. This decrease in net

income from continuing operations was mainly due to (i) a $0.8

million increase in income tax expense, (ii) a $0.5 million

increase in amortization of deferred drydock and special survey

costs; and (iii) a $0.2 million increase in interest expense and

finance cost, net; This overall decrease was partially mitigated

by: (i) a $0.7 million increase in EBITDA as discussed below; and

(ii) a $0.2 million decrease in depreciation and amortization. Net

Income attributable to Navios Holdings’ common stockholders from

discontinued operations was $28.9 million for the three-month

period ended June 30, 2022.

Net Income of Navios Logistics, on a standalone

basis, was $4.3 million for the three-month period ended June 30,

2023 as compared to $6.4 million for the same period in 2022.

EBITDA from continuing operations for the

three-month period ended June 30, 2023 increased by $0.7 million to

$42.3 million, as compared to $41.6 million for the same period in

2022. The increase in EBITDA was primarily due to: (i) a $12.7

million increase in revenue; (ii) a $2.1 million increase in equity

in net earnings from affiliate companies; and (iii) a $0.8 million

decrease in net income attributable to noncontrolling interest.

This overall increase was partially mitigated by: (i) a $5.2

million increase in time charter, voyage and logistics business

expenses; (ii) a $3.0 million increase in direct vessel expenses

(excluding the amortization of deferred drydock, special survey

costs and other capitalized items); (iii) a $2.8 million increase

in other expenses, net; (iv) a $2.2 million increase in general and

administrative expenses (excluding stock-based compensation

expenses); and (v) a $1.7 million impairment loss incurred as a

result of the sale of He Man H during the three month period ended

June 30, 2023. EBITDA of Navios Holdings from discontinued

operations was $56.9 million for the three-month period ended June

30, 2022.

EBITDA of Navios Logistics, on a standalone basis, was $29.9

million for the three-month period ended June 30, 2023 (which

includes $1.7 million in impairment losses incurred) as compared to

$31.4 million for the same period in 2022.

First Half 2023 and 2022 Results (in thousands of U.S.

dollars, except per share data and unless otherwise

stated):

The information for the six month period ended

June 30, 2023 and 2022 presented below was derived from the

unaudited condensed consolidated financial statements for the

respective periods.

|

|

|

Six Month Period EndedJune 30,

2023 |

|

|

|

Six Month Period EndedJune 30,

2022 |

|

|

| |

|

(unaudited) |

|

|

(unaudited) |

| Revenue (from continuing

operations) |

$ |

147,310 |

|

|

$ |

128,339 |

|

|

| Net Income attributable to

Navios Holdings’ common stockholders |

$ |

29,945 |

(1) |

|

$ |

39,960 |

|

(2) |

| Net Income attributable to

Navios Holdings’ common stockholders from continuing

operations |

$ |

29,945 |

(1) |

|

$ |

590 |

|

(2) |

| EBITDA |

$ |

82,771 |

(1) |

|

$ |

172,325 |

|

|

| EBITDA (from continuing

operations) |

$ |

82,771 |

(1) |

|

$ |

74,905 |

|

|

| Basic Earnings per share

attributable to Navios Holdings’ common stockholders |

$ |

0.53 |

(1) |

|

$ |

1.24 |

|

(2) |

| Basic Earnings/(loss) per

share attributable to Navios Holdings’ common stockholders from

continuing operations |

$ |

0.53 |

(1) |

|

$ |

(0.07 |

) |

(2) |

| |

|

|

|

|

|

|

|

|

(1) Net Income attributable to Navios Holdings’

common stockholders, EBITDA, and Basic Earnings per share

attributable to Navios Holdings’ common stockholders for the

six-month ended June 30, 2023 include a $1.1 million loss

representing Navios Holdings’ portion of impairment losses incurred

by Navios Logistics in connection with the sale of He Man H.

(2) Net Income attributable to Navios Holdings’

common stockholders and Basic Earnings per share attributable to

Navios Holdings’ common stockholders for the six-month period ended

June 30, 2022 include a $24.0 million upfront fee in the form

of a convertible debenture that was drawn in January 2022.

Revenue from continuing operations was $147.3

million for the six month period ended June 30, 2023, as compared

to $128.3 million for the same period in 2022. The increase was

mainly attributable to: (i) a $10.3 million increase in revenue

from the Barge Business, mainly attributable to time charter-out

contracts for iron ore transportation; (ii) $7.9 million

attributable to the sale of fuel products in connection with

the bunkering services in the port of Nueva Palmira; (iii) a $0.7

million increase in Port Terminal Business due to higher tariffs

and volumes transshipped at the Iron Ore Port Terminal partially

mitigated by the lower grain throughput in the Grain Port Terminal

related to a decline in Uruguayan exports; and (iv) a $0.1 million

increase in revenue from the Cabotage Business.

Net Income attributable to Navios Holdings’

common stockholders from continuing operations was $29.9 million

for the six month period ended June 30, 2023, as compared to $0.6

million for the same period in 2022. This increase in net income

from continuing operations was mainly due to: (i) a $24.0 million

upfront fee incurred in January 2022, in the form of a convertible

debenture; (ii) a $7.9 million increase in EBITDA as discussed

below; and (iii) a $0.4 million decrease in depreciation and

amortization. This overall increase was partially mitigated by: (i)

a $1.1 million increase in income tax expense; (ii) a $1.0 million

increase in interest expense and finance cost, net; and (iii) a

$0.9 million increase in amortization of deferred drydock and

special survey costs. Net Income attributable to Navios Holdings’

common stockholders from discontinued operations was $39.4 million

for the six-month period ended June 30, 2022.

Net Income of Navios Logistics, on a standalone

basis, was $5.4 million for the six-month period ended June 30,

2023 as compared to $6.1 million for the same period in 2022.

EBITDA from continuing operations for the six

month period ended June 30, 2023 increased by $7.9 million to $82.8

million, as compared to $74.9 million for the same period in 2022.

The increase in EBITDA was primarily due to: (i) a $19.0 million

increase in revenue; (ii) a $8.3 million increase in equity in net

earnings from affiliate companies; and (iii) a $0.2 million

decrease in net income attributable to noncontrolling interest.

This overall increase was partially mitigated by: (i) a $6.6

million increase in time charter, voyage and logistics business

expenses; (ii) a $4.4 million increase in other expenses, net;

(iii) a $3.6 million increase in general and administrative

expenses (excluding stock-based compensation expenses); (iv) a $3.4

million increase in direct vessel expenses (excluding the

amortization of deferred drydock, special survey costs and other

capitalized items); and (v) a $1.7 million impairment loss incurred

as a result of the sale of He Man H during the six-month

period ended June 30, 2023. EBITDA of Navios Holdings from

discontinued operations was $97.4 million for the six month period

ended June 30, 2022.

EBITDA of Navios Logistics, on a standalone

basis, was $55.9 million for the six month period ended June 30,

2023 (which includes $1.7 million in impairment losses incurred) as

compared to $55.3 million for the same period in 2022.

Conference Call:

As previously announced, Navios Holdings will

host a conference call today, August 24, 2023, at 8:30 am ET, at

which time Navios Holdings’ senior management will provide

highlights and commentary on earnings results for the second

quarter and six-month period ended June 30, 2023.

A supplemental slide presentation will be

available on the Navios Holdings website at

www.navios.com under the “Investors” section by 8:00 am ET on

the day of the call.

Conference Call details:

Call Date/Time: Thursday, August 24, 2023 at 8:30 am ETCall

Title: Navios Holdings Q2 2023 Financial Results

Conference CallUS Dial In: +1. 800.579.2543International Dial In:

+1.785.424.1789Conference ID: NMQ223

The conference call replay will be available

shortly after the live call and remain available for one week at

the following numbers:

US Replay Dial In: +1.888.562.2852International Replay Dial In:

+1.402.220.7360

This call will be simultaneously Webcast. The

Webcast will be available on the Navios Holdings website,

www.navios.com, under the “Investors” section. The Webcast will be

archived and available at the same Web address for two weeks

following the call.

About Navios

Maritime Holdings

Inc.

Navios Maritime Holdings Inc. (NYSE: NM) owns a

controlling equity stake in Navios South American Logistics Inc.,

one of the largest infrastructure and logistics companies in

the Hidrovia region of South America and an interest in Navios

Maritime Partners L.P., a US publicly listed shipping company which

owns and operates dry cargo and tanker vessels. For more

information about Navios Holdings, please visit our website:

www.navios.com.

About Navios

South American

Logistics Inc.

Navios South American Logistics Inc. is one of

the largest infrastructure and logistics companies in the Hidrovia

region of South America, focusing on the Hidrovia region river

system, the main navigable river system in the region, and on

cabotage trades along the southeastern coast of South America.

Navios Logistics serves the storage and marine transportation needs

of its petroleum, agricultural and mining customers through its

port terminals, river barge and coastal cabotage operations. For

more information about Navios Logistics, please visit its website:

www.navios-logistics.com.

About Navios

Maritime Partners

L.P.

Navios Maritime Partners L.P. (NYSE: NMM) is an

international owner and operator of dry cargo and tanker vessels.

For more information, please visit its website:

www.navios-mlp.com.

Forward

Looking Statements

- Safe

Harbor

This press release contains and our earnings

call will contain forward-looking statements (as defined in Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended) concerning future

events. Words such as “may,” “expects,” “intends,” “plans,”

“believes,” “anticipates,” “hopes,” “estimates,” and variations of

such words and similar expressions are intended to identify

forward-looking statements. Such statements include comments

regarding demand and/or charter and contract rates for our

affiliates’ vessels and port facilities. These forward-looking

statements are based on the information available to, and the

expectations and assumptions deemed reasonable by, Navios Holdings

at the time these statements were made. Although Navios Holdings

believes that the expectations reflected in such forward-looking

statements are reasonable, no assurance can be given that such

expectations will prove to have been correct. These statements

involve known and unknown risks and are based upon a number of

assumptions and estimates, which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Holdings. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to risks relating to:

global and regional economic and political conditions; changes in

production or demand for the transportation or storage of grain and

mineral commodities and petroleum products; the development of

Navios Logistics’ planned Port Murtinho Terminal and Nueva Palmira

Free Zone port terminal facilities; the ability and willingness of

charterers to fulfill their obligations to the affiliates in which

we are invested; prevailing charter rates; drydocking and repairs;

changing vessel crews and availability of financing; potential

disruption of shipping routes due to accidents, wars, diseases,

pandemics, political events, piracy or acts by terrorists,

including the impact of global pandemics; the aging of our

affiliates’ fleets and resultant increases in operations costs; our

affiliates’ loss of any customer or charter or vessel; the

financial condition of our affiliates’ customers; changes in the

availability and costs of funding due to conditions in the bank

market, capital markets and other factors; increases in costs and

expenses related to the operation of vessels, including but not

limited to: crew wages, insurance, provisions, port expenses, lube

oil, bunkers, repairs, maintenance, and general and administrative

expenses; the expected cost of, and the ability to comply with,

governmental regulations and maritime self-regulatory organization

standards, as well as standard regulations imposed by charterers;

competitive factors in the market in which Navios Holdings and its

affiliates operate; our affiliates’ ability to make distributions

and dividends to us; the value of our subsidiaries and affiliates;

risks associated with operations outside the United States; and

other factors listed from time to time in Navios Holdings’, Navios

Partners’ and Navios Logistics’ filings with the Securities and

Exchange Commission, including their respective Forms 20-F and

Forms 6-K. Navios Holdings expressly disclaims any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Navios Holdings’ expectations with respect thereto or any change

in events, conditions or circumstances on which any statement is

based. Navios Holdings makes no prediction or statement about the

performance of its common or preferred stock or Navios Logistics’

debt securities.

Contact:

Navios Maritime Holdings

Inc.+1-345-232-3067+1.212.906.8643investors@navios.com

EXHIBIT I

NAVIOS MARITIME HOLDINGS

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Expressed in thousands of U.S. dollars

— except share and per share data)

| |

Three MonthPeriod

EndedJune 30, 2023 |

|

Three MonthPeriod

EndedJune 30, 2022 |

|

Six MonthPeriod

EndedJune 30, 2023 |

|

Six MonthPeriod

EndedJune 30, 2022 |

| |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Revenue |

$ |

81,898 |

|

|

$ |

69,185 |

|

|

$ |

147,310 |

|

|

$ |

128,339 |

|

| Time

charter, voyage and logistics business expenses |

|

(23,896 |

) |

|

|

(18,705 |

) |

|

|

(39,768 |

) |

|

|

(33,146 |

) |

| Direct

vessel expenses |

|

(22,039 |

) |

|

|

(18,605 |

) |

|

|

(39,825 |

) |

|

|

(35,530 |

) |

| General

and administrative expenses |

|

(6,983 |

) |

|

|

(4,782 |

) |

|

|

(12,363 |

) |

|

|

(8,829 |

) |

|

Depreciation and amortization |

|

(7,916 |

) |

|

|

(8,127 |

) |

|

|

(15,657 |

) |

|

|

(16,073 |

) |

| Interest

expense and finance cost, net |

|

(16,293 |

) |

|

|

(16,060 |

) |

|

|

(32,807 |

) |

|

|

(31,842 |

) |

|

Impairment loss/loss on sale of vessel |

|

(1,651 |

) |

|

|

— |

|

|

|

(1,651 |

) |

|

|

— |

|

| Other

(expense)/income, net |

|

(169 |

) |

|

|

2,647 |

|

|

|

(3,237 |

) |

|

|

1,204 |

|

|

Non-operating other finance cost |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(24,000 |

) |

| Income/(loss) before

equity in net earnings of affiliate companies |

|

2,951 |

|

|

|

5,553 |

|

|

|

2,002 |

|

|

|

(19,877 |

) |

| Equity

in net earnings of affiliate companies |

|

15,210 |

|

|

|

13,160 |

|

|

|

31,297 |

|

|

|

22,958 |

|

| Income before

taxes |

$ |

18,161 |

|

|

$ |

18,713 |

|

|

$ |

33,299 |

|

|

$ |

3,081 |

|

| Income

tax expense |

|

(1,143 |

) |

|

|

(368 |

) |

|

|

(1,408 |

) |

|

|

(301 |

) |

| Net income from

continuing operations |

|

17,018 |

|

|

|

18,345 |

|

|

|

31,891 |

|

|

|

2,780 |

|

| Net income from discontinued

operations |

|

— |

|

|

|

28,933 |

|

|

|

— |

|

|

|

39,370 |

|

| Net

income |

$ |

17,018 |

|

|

$ |

47,278 |

|

|

$ |

31,891 |

|

|

$ |

42,150 |

|

| Less:

Net income attributable to the noncontrolling interest |

|

(1,538 |

) |

|

|

(2,318 |

) |

|

|

(1,946 |

) |

|

|

(2,190 |

) |

| Net income

attributable to Navios Holdings common stockholders |

$ |

15,480 |

|

|

$ |

44,960 |

|

|

$ |

29,945 |

|

|

$ |

39,960 |

|

| Net income

attributable to Navios Holdings from continuing and discontinued

operations: |

|

|

|

|

|

|

|

|

|

|

|

| Income attributable to

Navios Holdings, basic and diluted from continuing

operations |

$ |

15,480 |

|

|

$ |

16,027 |

|

|

$ |

29,945 |

|

|

$ |

590 |

|

| Income attributable to

Navios Holdings, basic and diluted from discontinued

operations |

|

— |

|

|

$ |

28,933 |

|

|

|

— |

|

|

$ |

39,370 |

|

| Income attributable to

Navios Holdings common stockholders, basic and

diluted |

$ |

6,207 |

|

|

$ |

31,225 |

|

|

$ |

12,018 |

|

|

$ |

28,115 |

|

| Basic earnings/(loss)

per share attributable to Navios Holdings common stockholders from

continuing operations |

$ |

0.27 |

|

|

$ |

0.47 |

|

|

$ |

0.53 |

|

|

$ |

(0.07 |

) |

| Basic earnings per

share attributable to Navios Holdings common stockholders from

discontinued operations |

|

— |

|

|

$ |

0.91 |

|

|

|

— |

|

|

$ |

1.31 |

|

| Basic earnings per

share attributable to Navios Holdings common

stockholders |

$ |

0.27 |

|

|

$ |

1.38 |

|

|

$ |

0.53 |

|

|

$ |

1.24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares, basic |

|

22,744,450 |

|

|

|

22,654,825 |

|

|

|

22,744,450 |

|

|

|

22,643,215 |

|

| Diluted

earnings/(loss) per share attributable to Navios Holdings common

stockholders from continuing operations |

$ |

0.27 |

|

|

$ |

0.46 |

|

|

$ |

0.53 |

|

|

$ |

(0.07 |

) |

| Diluted earnings per

share attributable to Navios Holdings common stockholders from

discontinued operations |

|

— |

|

|

$ |

0.91 |

|

|

|

— |

|

|

$ |

1.30 |

|

| Diluted earnings per

share attributable to Navios Holdings common

stockholders |

$ |

0.27 |

|

|

$ |

1.37 |

|

|

$ |

0.53 |

|

|

$ |

1.23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares, diluted |

|

22,850,450 |

|

|

|

22,848,328 |

|

|

|

22,850,450 |

|

|

|

22,845,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Month Period EndedJune 30,

2023 |

|

Three Month Period EndedJune 30,

2022 |

|

Six Month Period EndedJune 30,

2023 |

|

Six Month Period EndedJune 30,

2022 |

| Net income from

discontinued operations |

(unaudited) |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

(unaudited) |

|

Revenue |

$ |

— |

|

|

$ |

90,037 |

|

|

$ |

— |

|

|

$ |

158,672 |

|

| Time charter, voyage and

logistics business expenses |

|

— |

|

|

|

(17,210 |

) |

|

|

— |

|

|

|

(32,260 |

) |

| Direct vessel expenses |

|

— |

|

|

|

(11,246 |

) |

|

|

— |

|

|

|

(22,782 |

) |

| General and administrative

expenses |

|

— |

|

|

|

(4,607 |

) |

|

|

— |

|

|

|

(7,126 |

) |

| Depreciation and

amortization |

|

— |

|

|

|

(6,639 |

) |

|

|

— |

|

|

|

(13,071 |

) |

| Interest expense and finance

cost, net |

|

— |

|

|

|

(19,328 |

) |

|

|

— |

|

|

|

(41,111 |

) |

| Loss on bond extinguishment,

net |

|

— |

|

|

|

(106 |

) |

|

|

— |

|

|

|

(221 |

) |

| Other expense, net |

|

— |

|

|

|

(1,948 |

) |

|

|

— |

|

|

|

(2,692 |

) |

| Income tax expense |

|

— |

|

|

|

(20 |

) |

|

|

— |

|

|

|

(39 |

) |

| Net income from

discontinued operations |

$ |

— |

|

|

$ |

28,933 |

|

|

$ |

— |

|

|

$ |

39,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAVIOS MARITIME HOLDINGS

INC.Other Financial Data

| |

June 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

(unaudited) |

|

|

|

(unaudited) |

|

| Cash and

cash equivalents, including restricted cash |

$ |

68,900 |

|

|

$ |

78,851 |

|

| Vessels,

port terminals and other fixed assets, net |

|

488,642 |

|

|

|

495,919 |

|

| Goodwill

and other intangibles |

|

150,199 |

|

|

|

150,289 |

|

|

Operating lease assets |

|

20,573 |

|

|

|

11,787 |

|

| Other

current and non-current assets |

|

220,162 |

|

|

|

183,976 |

|

|

Total assets, continuing operations |

$ |

948,476 |

|

|

$ |

920,822 |

|

| Total

assets, discontinued operations |

|

— |

|

|

|

3,489 |

|

|

Total assets |

$ |

948,476 |

|

|

$ |

924,311 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

Long-term debt, net, including current portion |

$ |

166,497 |

|

|

$ |

178,146 |

|

| Senior

and ship mortgage notes, net, including current portion |

|

498,733 |

|

|

|

496,608 |

|

|

Operating lease liabilities, including current portion |

|

20,571 |

|

|

|

11,787 |

|

| Other

current and non-current liabilities |

|

88,650 |

|

|

|

89,597 |

|

| Total

stockholders’ equity |

|

174,025 |

|

|

|

142,091 |

|

|

Total liabilities, continuing operations |

$ |

948,476 |

|

|

$ |

918,229 |

|

| Total

liabilities, discontinued operations |

|

— |

|

|

|

6,082 |

|

| Total liabilities and

stockholders’ equity |

$ |

948,476 |

|

|

$ |

924,311 |

|

|

|

|

|

|

|

|

|

|

Disclosure of Non-GAAP Financial Measures

EBITDA and Navios Logistics’ EBITDA are

“non-U.S. GAAP financial measures” and should not be used in

isolation or considered substitutes for net income prepared in

accordance with generally accepted accounting principles in the

United States.

EBITDA represents net income attributable to

Navios Holdings’ common stockholders before interest and finance

costs, before depreciation and amortization, before income taxes

and before stock-based compensation. Navios Logistics’ EBITDA

represents net income/(loss) before depreciation and amortization,

amortization of deferred drydock and special survey costs, before

interest expense and finance cost, net and before income taxes.

EBITDA and Navios Logistics’ EBITDA are presented because they are

used by certain investors to measure a company’s operating

performance and are reconciled to net income, the most comparable

U.S. GAAP performance measure. EBITDA and Navios Logistics’ EBITDA

are calculated as follows: net income adding back, when applicable

and as the case may be, the effect of (i) depreciation and

amortization; (ii) amortization of deferred drydock and special

survey costs; (iii) stock-based compensation; (iv) interest expense

and finance cost, net; and (v) income tax benefit/(expense). Navios

Holdings and Navios Logistics believe that EBITDA are basis upon

which performance can be assessed and represents useful information

to investors regarding their ability to incur indebtedness and meet

working capital requirements. Navios Holdings and Navios Logistics

also believe that EBITDA are used (i) by prospective lessors as

well as potential lenders to evaluate potential transactions; (ii)

to evaluate and price potential acquisition candidates; and (iii)

by securities analysts, investors and other interested parties in

the evaluation of companies in our industry.

While EBITDA is frequently used as a measure of

operating results and the ability to meet debt service

requirements, the definition of EBITDA used here may not be

comparable to those used by other companies due to differences in

methods of calculation.

EBITDA has limitations as an analytical tool,

and therefore, should not be considered in isolation or as a

substitute for the analysis of results as reported under U.S. GAAP.

Some of these limitations are: (i) EBITDA does not reflect changes

in, or cash requirements for, working capital needs; (ii) EBITDA

does not reflect the amounts necessary to service interest or

principal payments on our debt and other financing arrangements;

and (iii) although depreciation and amortization are non-cash

charges, the assets being depreciated and amortized may have to be

replaced in the future. EBITDA does not reflect any cash

requirements for such capital expenditures. Because of these

limitations, among others, EBITDA should not be considered as an

indicator of Navios Holdings’ or Navios Logistics’ performance.

The following tables provide a reconciliation of

EBITDA of Navios Holdings (including Navios Logistics), as well as

EBITDA of Navios Logistics on a stand-alone basis:

Navios Holdings Reconciliation of EBITDA to Net

Income

| Three Month Period

Ended June 30, 2023 |

EBITDA from continuing operations |

|

EBITDA from discontinued operations |

|

EBITDA |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Net income |

$ |

15,480 |

|

|

$ |

— |

|

|

$ |

15,480 |

|

|

Depreciation and amortization |

|

7,916 |

|

|

|

— |

|

|

|

7,916 |

|

|

Amortization of deferred drydock and special survey costs |

|

1,451 |

|

|

|

— |

|

|

|

1,451 |

|

| Stock

based compensation |

|

22 |

|

|

|

— |

|

|

|

22 |

|

|

Interest expense and finance cost, net |

|

16,293 |

|

|

|

— |

|

|

|

16,293 |

|

|

Income tax expense |

|

1,143 |

|

|

|

— |

|

|

|

1,143 |

|

| EBITDA |

$ |

42,305 |

|

|

$ |

— |

|

|

$ |

42,305 |

|

| Three Month Period

Ended June 30, 2022 |

EBITDA from continuing operations |

|

EBITDA from discontinued operations |

|

EBITDA |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Net income |

$ |

16,027 |

|

|

$ |

28,933 |

|

|

$ |

44,960 |

|

|

Depreciation and amortization |

|

8,127 |

|

|

|

6,639 |

|

|

|

14,766 |

|

|

Amortization of deferred drydock and special survey costs |

|

1,000 |

|

|

|

1,998 |

|

|

|

2,998 |

|

| Stock

based compensation |

|

44 |

|

|

|

— |

|

|

|

44 |

|

|

Interest expense and finance cost, net |

|

16,060 |

|

|

|

19,328 |

|

|

|

35,388 |

|

|

Income tax expense |

|

368 |

|

|

|

20 |

|

|

|

388 |

|

| EBITDA |

$ |

41,626 |

|

|

$ |

56,918 |

|

|

$ |

98,544 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

EBITDA breakdown

|

|

June 30, |

|

June 30, |

|

Three Month Period Ended |

2023 |

|

2022 |

|

(in thousands of U.S. dollars) |

(unaudited) |

|

(unaudited) |

|

Navios Holdings (excluding Navios Logistics) |

$ |

13,940 |

|

|

$ |

69,463 |

|

|

Navios Logistics (including noncontrolling interest) |

|

28,365 |

|

|

|

29,081 |

|

|

EBITDA |

$ |

42,305 |

|

|

$ |

98,544 |

|

|

|

|

|

|

|

|

|

|

Navios Logistics EBITDA Reconciliation to Net

Income

|

|

June 30, |

|

June 30, |

| Three Month Period

Ended |

2023 |

|

2022 |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

Net income |

$ |

4,251 |

|

|

$ |

6,408 |

|

|

Depreciation and amortization |

|

7,916 |

|

|

|

8,127 |

|

|

Amortization of deferred drydock and special survey costs |

|

1,451 |

|

|

|

1,000 |

|

|

Interest expense and finance cost, net |

|

15,142 |

|

|

|

15,496 |

|

|

Income tax expense |

|

1,143 |

|

|

|

368 |

|

|

EBITDA |

$ |

29,903 |

|

|

$ |

31,399 |

|

|

|

|

|

|

|

|

|

|

Navios Holdings Reconciliation of EBITDA to Net

Income

| Six Month Period Ended

June 30, 2023 |

EBITDA from continuing operations |

|

EBITDA from discontinued operations |

|

EBITDA |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Net income |

$ |

29,945 |

|

|

$ |

— |

|

|

$ |

29,945 |

|

|

Depreciation and amortization |

|

15,657 |

|

|

|

— |

|

|

|

15,657 |

|

|

Amortization of deferred drydock and special survey costs |

|

2,911 |

|

|

|

— |

|

|

|

2,911 |

|

| Stock

based compensation |

|

43 |

|

|

|

— |

|

|

|

43 |

|

|

Interest expense and finance cost, net |

|

32,807 |

|

|

|

— |

|

|

|

32,807 |

|

|

Income tax expense |

|

1,408 |

|

|

|

— |

|

|

|

1,408 |

|

| EBITDA |

$ |

82,771 |

|

|

$ |

— |

|

|

$ |

82,771 |

|

| Six Month Period Ended

June 30, 2022 |

EBITDA from continuing operations |

|

EBITDA from discontinued operations |

|

EBITDA |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Net income |

$ |

590 |

|

|

$ |

39,370 |

|

|

$ |

39,960 |

|

|

Depreciation and amortization |

|

16,073 |

|

|

|

13,071 |

|

|

|

29,144 |

|

|

Amortization of deferred drydock and special survey costs |

|

2,009 |

|

|

|

3,829 |

|

|

|

5,838 |

|

| Stock

based compensation |

|

90 |

|

|

|

— |

|

|

|

90 |

|

|

Interest expense and finance cost, net |

|

55,842 |

|

|

|

41,111 |

|

|

|

96,953 |

|

|

Income tax expense |

|

301 |

|

|

|

39 |

|

|

|

340 |

|

| EBITDA |

$ |

74,905 |

|

|

$ |

97,420 |

|

|

$ |

172,325 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

EBITDA breakdown

|

|

June 30, |

|

June 30, |

|

Six Month Period Ended |

2023 |

|

2022 |

|

(in thousands of U.S. dollars) |

(unaudited) |

|

(unaudited) |

|

Navios Holdings (excluding Navios Logistics) |

$ |

28,781 |

|

|

$ |

119,240 |

|

|

Navios Logistics (including noncontrolling interest) |

|

53,990 |

|

|

|

53,085 |

|

|

EBITDA |

$ |

82,771 |

|

|

$ |

172,325 |

|

|

|

|

|

|

|

|

|

|

Navios Logistics EBITDA Reconciliation to Net

Income

|

|

June 30, |

|

June 30, |

| Six Month Period

Ended |

2023 |

|

2022 |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

Net income |

$ |

5,379 |

|

|

$ |

6,053 |

|

|

Depreciation and amortization |

|

15,657 |

|

|

|

16,073 |

|

|

Amortization of deferred drydock and special survey costs |

|

2,911 |

|

|

|

2,009 |

|

|

Interest expense and finance cost, net |

|

30,581 |

|

|

|

30,839 |

|

|

Income tax expense |

|

1,408 |

|

|

|

301 |

|

|

EBITDA |

$ |

55,936 |

|

|

$ |

55,275 |

|

|

|

|

|

|

|

|

|

|

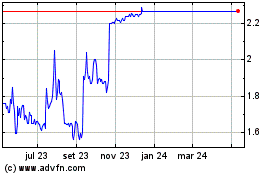

Navios Maritime (NYSE:NM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Navios Maritime (NYSE:NM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024