Peyto Exploration & Development Corp. ("Peyto" or the

"Company") is pleased to announce that due to strong demand, it has

increased the size of the previously announced public offering of

subscription receipts ("Subscription Receipts") to 14,710,000

Subscription Receipts at a price of $11.90 per Subscription Receipt

(the “Offering Price”) for gross proceeds of

approximately $175 million (the “Equity Offering”). The

Company previously entered into an agreement with a syndicate of

underwriters (the "Underwriters") led by BMO Capital Markets, CIBC

Capital Markets and National Bank Financial. Peyto has also granted

the Underwriters an option, exercisable, in whole or in part, at

any time up to the earlier of 30 days following the closing of the

Equity Offering and the occurrence of certain termination events

with respect to the Subscription Receipts, to purchase up to an

additional 15% of the number of Subscription Receipts purchased by

the Underwriters under the Equity Offering at the Offering Price to

cover over-allotments, if any, and for market stabilization

purposes (the "Over-Allotment Option"). The gross proceeds from the

Equity Offering, less the portion of the underwriters’ fee that is

payable on the closing of the Equity Offering, will be held in

escrow and are intended to be used by Peyto to fund a portion of

the purchase price for the acquisition of Repsol Canada Energy

partnership, which holds the Canadian upstream oil and gas business

of Repsol Exploración, S.A.U., including all related midstream

facilities and infrastructure located predominantly in the Deep

Basin, for cash consideration of US$468 million (CDN$636 million)

(the “Acquisition") subject to closing adjustments.

Each Subscription Receipt will entitle the

holder to receive, without payment of additional consideration and

without further action, one common share of Peyto (a "Common

Share") upon the closing of the Acquisition.

Holders of the Subscription Receipts will be

entitled to receive payments per Subscription Receipt equal to the

cash dividends paid on Peyto's Common Shares (the "Dividend

Equivalent Payments"), if any, actually paid or payable to holders

of such Common Shares in respect of all record dates for such

dividends occurring from the closing date of the Equity Offering

to, but excluding, the last day on which the Subscription Receipts

remain outstanding, to be paid to holders of Subscription Receipts

concurrently with the payment date of each such dividend. The

Dividend Equivalent Payments will be made regardless of whether the

Acquisition is completed or not. If the Acquisition is not

completed on or before March 31, 2024, or in certain other events,

then the subscription price for the Subscription Receipts will be

returned to holders of Subscription Receipts, together with any

unpaid Dividend Equivalent Payments and any pro-rata interest on

such funds, if any.

The Subscription Receipts issued pursuant to the

Equity Offering have not been and will not be registered under the

U.S. Securities Act of 1933, as amended (the "Securities Act"), and

may not be offered or sold in the United States absent registration

under the Securities Act or an applicable exemption from

registration under the Securities Act. The Subscription Receipts

issued pursuant to the Equity Offering will be distributed by way

of a short form prospectus in all provinces of Canada (excluding

Québec) and may also be placed privately in the United States to

Qualified Institutional Buyers (as defined under Rule 144A under

the U.S. Securities Act) pursuant to the exemption provided by Rule

144A thereunder, and may be distributed outside Canada and the

United States on a basis which does not require the qualification

or registration of any of the Company's securities under domestic

or foreign securities laws. This news release is neither an offer

to sell nor the solicitation of an offer to buy any securities and

shall not constitute an offer to sell or solicitation of an offer

to buy, or a sale of, any securities in any jurisdiction in which

such offer, solicitation or sale is unlawful.

The Equity Offering is expected to close on or

about September 26, 2023 and is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals including the approval of the Toronto Stock Exchange.

Jean-Paul LachancePresident and Chief Executive

OfficerPhone: (403) 261-6081

Advisory:

This news release contains forward-looking

information (forward-looking statements). Words such as "guidance",

"may", "can", "would", "could", "should", "will", "intend", "plan",

"anticipate", "believe", "aim", "seek", "propose", "contemplate",

"estimate", "focus", "strive", "forecast", "expect", "project",

"target", "potential", "objective", "continue", "outlook",

"vision", "opportunity" and similar expressions suggesting future

events or future performance, as they relate to the Company or any

affiliate of the Company, are intended to identify forward-looking

statements. In particular, this news release contains

forward-looking statements with respect to, among other things,

timing for closing of the Equity Offering, the terms of the

Subscription Receipts and the use of equity proceeds to support the

purchase price for the Acquisition Such statements reflect Peyto's

current expectations, estimates and projections based on certain

material factors and assumptions at the time the statement was

made. Material assumptions include: closing of the Acquisition on

the terms presently contemplated, timing and receipt of regulatory

approvals and timing of closing of the Equity Offering. Peyto's

forward-looking statements are subject to certain risks and

uncertainties which could cause results or events to differ from

current expectations, including, without limitation: risks related

to the closing of the Acquisition and Equity Offering, and the

other factors discussed under the heading "Risk Factors" in the

Company's Annual Information Form for the year ended December 31,

2022 and set out in Peyto's other continuous disclosure documents.

Many factors could cause Peyto's or any particular business

segment's actual results, performance or achievements to vary from

those described in this press release, including, without

limitation, those listed above and the assumptions upon which they

are based proving incorrect. These factors should not be construed

as exhaustive. Should one or more of these risks or uncertainties

materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from

those described in this news release as intended, planned,

anticipated, believed, sought, proposed, estimated, forecasted,

expected, projected or targeted and such forward-looking statements

included in this news release, should not be unduly relied upon.

The impact of any one assumption, risk, uncertainty, or other

factor on a particular forward-looking statement cannot be

determined with certainty because they are inter-dependent and

Peyto's future decisions and actions will depend on management’s

assessment of all information at the relevant time. Such statements

speak only as of the date of this news release. Peyto does not

intend, and does not assume any obligation, to update these

forward-looking statements except as required by law. The

forward-looking statements contained in this news release are

expressly qualified by these cautionary statements.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy the securities in any

jurisdiction. The securities of Peyto will not be and have not been

registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States, or to

a U.S. person, absent registration or applicable exemption

therefrom.

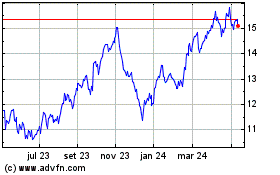

Peyto Exploration and De... (TSX:PEY)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

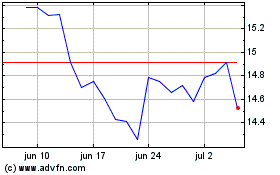

Peyto Exploration and De... (TSX:PEY)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025