Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas” or the

“

Company”) is pleased to announce that the

separation of the Company into Lithium Americas (Argentina) Corp.

(“

Lithium Argentina”) and a new Lithium Americas

Corp. (“

Lithium Americas (NewCo)”) pursuant to a

statutory plan of arrangement (the “

Separation”)

is expected to be completed on Tuesday, October 3, 2023 (the

“

Effective Date”).

Under the terms of the Separation, holders of

Lithium Americas common shares (“Lithium Americas

Shares”) will be entitled to receive one Lithium Argentina

common share (each, a “Lithium Argentina Share”)

and one Lithium Americas (NewCo) common share (each, a

“Lithium Americas (NewCo) Share”) for every

Lithium Americas Share held immediately before the effective time

of the Separation.

The Company expects that “when-issued” public

trading markets for Lithium Argentina Shares under the ticker

symbol “LAAC WI” and Lithium Americas (NewCo) Shares under the

ticker symbol “LAC WI” will commence on the New York Stock Exchange

(“NYSE”) on or about Monday, October 2, 2023, and

will continue up to and including Tuesday, October 3, 2023. At the

close of trading on Tuesday, October 3, 2023, Lithium Americas

Shares are expected to conclude “regular-way” trading on the NYSE

and the Toronto Stock Exchange (the “TSX”) under

the ticker symbol “LAC,” and Lithium Argentina Shares and Lithium

Americas (NewCo) Shares are expected to conclude “when-issued”

trading on the NYSE. For clarity, there will be no “when-issued”

trading of Lithium Argentina Shares or Lithium Americas (NewCo)

Shares on the TSX.

Subject to confirmation of the NYSE and the TSX,

the Company also anticipates that “regular-way” trading of Lithium

Argentina Shares under the ticker symbol “LAAC” and Lithium

Americas (NewCo) Shares under the ticker symbol “LAC” will begin on

the NYSE and TSX at the start of trading on Wednesday, October 4,

2023.

Registered shareholders of Lithium Americas

(“LAC Registered Shareholders”) are reminded to

submit their certificates or direct registration statements

(“DR Statements”) representing their Lithium

Americas Shares with a duly completed letter of transmittal

(“Letter of Transmittal”) to Computershare

Investor Services Inc., as depository, in order to receive

certificates or DR Statements representing their Lithium Argentina

Shares and Lithium Americas (NewCo) Shares. New certificates or DR

Statement(s) representing Lithium Argentina Shares and Lithium

Americas (NewCo) Shares will be mailed to LAC Registered

Shareholders that have submitted a Letter of Transmittal together

with their certificates or DR Statements by the Effective Date on

or about October 6, 2023. Letters of Transmittal and certificates

or DR Statements received after the Effective Date will be

processed within 10 business days. The Letter of Transmittal is

available on the Company’s SEDAR profile at www.sedarplus.ca and

EDGAR profile at www.sec.gov. The Letter of Transmittal will

continue to be available on Lithium Argentina’s SEDAR profile and

EDGAR profile after the Effective Date.

There are currently 160,047,671 Lithium Americas

Shares outstanding, and it is anticipated that immediately upon the

Separation becoming effective the number of Lithium Argentina

Shares and Lithium Americas (NewCo) Shares outstanding shall be the

same or substantially the same as the number of Lithium Americas

Shares currently outstanding. Persons trading in the “when-issued”

market should be aware that the acquisition and beneficial

ownership reporting rules under Canadian securities laws will apply

to purchases of “when-issued” Lithium Argentina Shares and Lithium

Americas (NewCo) Shares.

Investors are

encouraged to consult with their own advisors regarding the

specific implications of buying or selling Lithium Americas Shares,

Lithium Argentina Shares and Lithium Americas (NewCo) Shares.

The registration

statement on Form 20-F of 1397468 B.C. Ltd., which will become

Lithium Americas (NewCo) upon completion of the Separation, was

declared effective by the U.S. Securities and Exchange Commission

on September 28, 2023 and is available at www.sec.gov.

ABOUT LITHIUM

AMERICAS

Lithium Americas is advancing a separation of

its U.S. and Argentine business units into two public independent

companies. Lithium Argentina will retain the Caucharí-Olaroz

project (44.8% owned), focused on advancing toward full production

capacity, and regional growth opportunities in the Pastos Grandes

basin with the Pastos Grandes and Sal de la Puna projects (100% and

65% owned, respectively). Lithium Americas (NewCo) will retain the

100% owned Thacker Pass project, focused on advancing construction

with the target to commence production in the second half of 2026.

The Company’s common shares currently trade on both the TSX and

NYSE under the ticker symbol “LAC.”

For further information about Lithium

Americas (NewCo) contact:Virginia Morgan, VP Investor

Relations and ESG Telephone: 778-726-4070

For further information about Lithium

Argentina contact:Kelly O’Brien, VP Investor Relations and

ESGTelephone: 585-269-2020

Email: ir@lithiumamericas.comWebsite:

www.lithiumamericas.com

FORWARD-LOOKING INFORMATION

Certain statements in this release constitute

“forward-looking statements” within the meaning of applicable

United States securities legislation and “forward-looking

information” under applicable Canadian securities legislation

(collectively, “forward-looking statements”). Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the actual results, events, performance or

achievements of the Separation and of Lithium Argentina / Lithium

Americas (NewCo) (collectively the “Entities” and individually, an

“Entity”), their projects, or industry results, to be materially

different from any future results, events, performance or

achievements expressed or implied by such forward-looking

statements. Such statements can be identified by the use of words

such as “may,” “would,” “could,” “will,” “intend,” “expect,”

“believe,” “plan,” “anticipate,” “estimate,” “schedule,”

“forecast,” “predict” and other similar terminology, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved. These statements reflect

the Company’s current expectations regarding future events,

financial or operating performance and results, and speak only as

of the date of this release. Such statements include without

limitation, statements with respect to the proposed Separation, the

ability of the Company to complete the Separation on the terms

described herein, or at all, the expected timetable for the

Separation, the expected timing for the commencement of

“when-issued” trading of the Lithium Argentina Shares and the

Lithium Americas (NewCo) Shares (the “Distribution Shares”) on

NYSE, the expected timing for the conclusion of “regular-way”

trading of Lithium Americas Shares on the TSX and NYSE and

“when-issued” trading of the Distribution Shares on NYSE, the

expected timing for commencement of “regular-way” trading of the

Distribution Shares on the TSX and NYSE and the expected timing for

the distribution of the Distribution Shares.

Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future

performance, events or results and will not necessarily be accurate

indicators of whether or not such events or results will be

achieved. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements or information, including, but not limited to, future

factors or events that may arise making it inadvisable to proceed

with, or advisable to delay or alter the structure of, the

Separation; the performance, the operations and financial condition

of Lithium Argentina and Lithium Americas (NewCo) as separately

traded public companies, including the reduced geographical and

property portfolio diversification resulting from the Separation;

the impact of the Separation on the trading prices for, and market

for trading in, the shares of the Company, Lithium Argentina or

Lithium Americas (NewCo); the potential for significant tax

liability for a violation of the tax-deferred spinoff rules

applicable in Canada and the United States; uncertainties with

realizing the potential benefits of the Separation; risks

associated with mining project development, achieving anticipated

milestones and budgets as planned, and meeting expected timelines;

risks inherent in litigation or rulings that are adverse for an

Entity or its projects; maintaining local community support in the

regions where an Entity’s projects are located; changing social

perceptions and their impact on project development and litigation;

ongoing global supply chain disruptions and their impact on

developing an Entity’s projects; availability of personnel,

supplies and equipment; the impact of inflation or changing

economic conditions on an Entity, its projects and their

feasibility; any impacts of COVID-19 or an escalation thereof on

the business of an Entity; unanticipated changes in market price

for an Entity’s shares; changes to an Entity’s current and future

business plans and the strategic alternatives available to the

Entity; industry and stock market conditions generally; demand,

supply and pricing for lithium; and general economic and political

conditions in Canada, the United States, Argentina and other

jurisdictions where an Entity conducts business. Additional

information about certain of these assumptions and risks and

uncertainties is contained in the Company’s filings with securities

regulators, including the Company’s management information circular

dated June 16, 2023 available on SEDAR at www.sedarplus.ca and

EDGAR at www.sec.gov.

Although the forward-looking statements

contained in this release are based upon what management of the

Company believes are reasonable assumptions as of the date hereof,

there can be no assurance that actual results will be consistent

with these forward-looking statements. These forward-looking

statements are made as of the date of this release and are

expressly qualified in their entirety by this cautionary statement.

Subject to applicable securities laws, the Company does not assume

any obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this release.

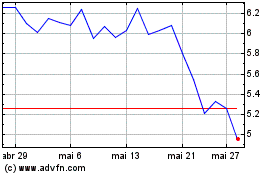

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Lithium Americas (TSX:LAC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025