Compagnie de l'Odet : Financial information for Q3 2023

19 Outubro 2023 - 12:50PM

Compagnie de l'Odet : Financial information for Q3 2023

COMPAGNIE DE L'ODET

| Financial

information for Q3 2023 |

19 October 2023 |

Revenue (at constant scope and exchange

rates):

-7% in third-quarter 2023

-4% at the end of September 2023

Revenue for Q3 2023

At constant scope and exchange rates, the

Group’s revenue for the third quarter of 2023 totalled 3,196

million euros, down 7%:

- Oil

Logistics: 668 million euros, -32% owing to the decrease

in oil product prices and the decline in volumes sold;

-

Communications (Vivendi): 2,425 million euros, +3%

benefiting from the strong performances of Groupe Canal+ (+5%) and

Havas (+6%);

-

Industry: 85 million euros,

+18% thanks to the completion of a storage

stationary project.

On a reported basis, revenue was down 6% (-217 million euros)

compared with the third quarter 2022, with negative foreign

exchange impacts (-26 million euros) and a favourable scope effect

(+46 million euros).

Revenue at the end of September 2023

At constant scope and exchange rates, the

Group’s revenue as of September 30, 2023 was down 4% at 9,426

million euros.

On a reported basis, revenue for the first nine

months of the year decreased 4%, taking into account +96 million

euros in changes in scope (in particular the integration of Sicarbu

acquired by Bolloré Energy, as well as initial consolidations at

Vivendi) and -26 million euros in foreign exchange impacts

resulting from the appreciation of the euro, mainly against the

pound sterling and the US dollar.

At constant scope and exchange rates, the main

sectors evolved as follows compared to the first nine months of

2022:

Bolloré Energy’s revenue came out at 2,022

million euros, down 22% due to lower oil product prices, which had

reached record levels after the outbreak of the war in Ukraine, and

lower volumes sold.

Revenue amounted to 7,121 million euros, up 3%

at constant scope and exchange rates compared to the same period in

2022. This increase can be attributed primarily to Groupe Canal+,

which posted significant growth of 3%, notably owing to the sharp

increase in Studiocanal and the increase in pay television in

France, and to growth at Havas (+5%), supported by the rise of all

its divisions.

Revenue from industrial activities amounted to

233 million euros (electricity storage, films, dedicated terminals

and systems), down 16% compared with the first nine months of

2022.

This decrease resulted mainly from a decline in

the sales of batteries and bus, as well as those of Films. However,

specialized Terminals and Polyconseil posted growth.

|

Evolution of revenue by activity |

|

(in millions of euros) |

Q3 |

9 months |

|

|

|

2023 (1) |

2022 (1) |

Reported growth |

Organic growth |

2023 (1) |

2022 (1) |

Reported growth |

Organic growth |

|

|

|

|

|

|

|

|

|

|

|

Bolloré Energy |

668 |

951 |

-30% |

-32% |

2,022 |

2,570 |

-21% |

-22% |

|

Communications |

2,425 |

2,366 |

+2% |

+3% |

7,121 |

6,892 |

+3% |

+3% |

|

Industry |

85 |

73 |

+16% |

+18% |

233 |

279 |

-16% |

-16% |

|

Other (Agricultural assets, Holdings) |

18 |

23 |

-24% |

-42% |

51 |

58 |

-13% |

-43% |

|

Total |

3,196 |

3,413 |

-6% |

-7% |

9,426 |

9,798 |

-4% |

-4% |

(1) Restated: in accordance with IFRS

5 and to ensure the comparability of results, reclassifications

into discontinued operations or held for sale include:

- All the Group’s Transport and

Logistics activities in Africa in fiscal 2022 (these activities

were disposed of on December 21, 2022).

- Editis for fiscal 2022 and 2023

(Editis was deconsolidated on June 21, 2023 as a result of the loss

of control);

- The rest of the Group’s Transport

and Logistics activities for fiscal 2022 and 2023 (these activities

are intended to be sold since May 8, 2023).

Recent highlights and events

- Communications

- Merger with

Lagardère: on June 9, 2023, Vivendi announced that it had obtained

authorisation from the European Commission to carry out its

proposed merger with Lagardère Group. This authorisation is subject

to the fulfilment of the two commitments proposed by Vivendi,

namely the sale of 100% of the capital of Editis and the full sale

of Gala magazine. Vivendi has signed an agreement with IMI to sell

Editis and Prisma Media has also entered into a deed of sale for

Gala’s business with Figaro Group. The European Commission must now

approve these two buyers. The Group is confident that the merger

with Lagardère will be finalised by the end of the year. It

reiterates its commitment to maintaining the integrity of the

Lagardère Group.

- Groupe Canal+

continued to expand internationally in the third quarter, acquiring

a 12% stake in the Viaplay Group, the pay-TV leader in the Nordic

countries, and increasing its stake in MultiChoice Group, of which

Groupe Canal+ held 32.93% as of September 30, 2023.

On July 11, 2023, the Bolloré Group signed a

contract to sell 100% of Bolloré Logistics to CMA CGM Group. The

process of obtaining antitrust and foreign investment control

clearances in the relevant jurisdictions is progressing according

to the provisional timetable and should enable the final completion

of the sale in the first quarter of 2024. Bolloré Logistics has

been restated in the Group’s financial statements under IFRS5.

| Change in

revenue per quarter |

|

|

(in millions of euros) |

Q1 |

Q2 |

Q3 |

|

|

2023 (1) |

2022 organic |

2022 reported (1) |

2023 (1) |

2022 organic |

2022 reported (1) |

2023 (1) |

2022 organic |

2022 reported (1) |

|

Bolloré Energy |

712 |

848 |

848 |

641 |

775 |

772 |

668 |

978 |

951 |

|

Communications |

2,290 |

2,244 |

2,216 |

2,407 |

2,307 |

2,310 |

2,425 |

2,352 |

2,366 |

|

Industry |

74 |

111 |

112 |

74 |

93 |

94 |

85 |

72 |

73 |

|

Other (Agricultural assets, Holdings) |

15 |

26 |

14 |

18 |

32 |

21 |

18 |

31 |

23 |

|

Total |

3,090 |

3,229 |

3,189 |

3,140 |

3,207 |

3,196 |

3,196 |

3,433 |

3,413 |

(1) Restated: in accordance with IFRS 5 and to

ensure the comparability of results, reclassifications into

discontinued operations or held for sale include:

- All the Group’s Transport and

Logistics activities in Africa in fiscal 2022 (these activities

were disposed of on December 21, 2022).

- Editis for fiscal 2022 and 2023

(Editis was deconsolidated on June 21, 2023 as a result of the loss

of control);

- The rest of the Group’s Transport

and Logistics activities for fiscal 2022 and 2023 (these activities

are intended to be sold since May 8, 2023).

All amounts are expressed in millions of euros and rounded to

the nearest decimal.As a result, the sum of the rounded amounts may

differ slightly from the reported total.

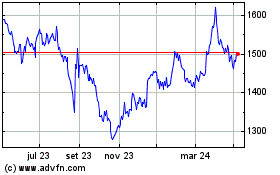

Compagnie de lOdet (EU:ODET)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

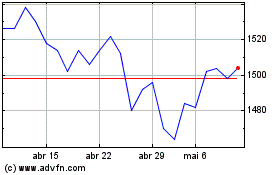

Compagnie de lOdet (EU:ODET)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025