Hermès International: Third Quarter 2023 Revenue

Quarterly information report as at the end of

September 2023

Solid sales growth at the end of

September+22% at constant

exchange rates and +17% at current exchange rates

Paris, 24 October 2023

The group’s consolidated revenue amounted to

€10,063 million at the end of September 2023, up 22% at constant

exchange rates and 17% at current exchange rates compared to the

same period in 2022.

In the third quarter, sales continued their

increase and reached €3,365 million, up 16% at constant exchange

rates, despite a particularly high comparison base in Asia.

Axel Dumas, Executive Chairman of Hermès, said:

“The solid performance in the third quarter reflects the

desirability of our collections all over the world, with still a

sustained momentum in Asia and in the Americas. More than ever, in

an uncertain global environment, we are reinforcing our investments

and our teams to support growth.”

Sales by geographical area at the end of

September(at comparable exchange rates, unless otherwise

indicated)

At the end of September 2023, all the

geographical areas posted solid performances, with growth above

20%, despite a particularly high comparison basis in the third

quarter of 2022 in Asia. Activity increased both in the group’s

stores (+22%), which benefitted from the strong desirability of the

collections and the strengthening of the exclusive distribution

network, and in wholesale activities (+23%).

- Asia excluding Japan (+21%)

continued its strong momentum. Sales were robust in Greater China,

Singapore, Thailand, Australia and Korea. As a reminder, the third

quarter in 2022 was exceptional following the lifting of health

measures in China. A new store opened in July in the city of

Tianjin in northern China and petit h stopped over at the Beijing

China World store in September.

- Japan (+25%) confirmed its solid

growth thanks to its local customers. Hermès Japan greeted this

great performance by celebrating its 40 years in September.

- The Americas (+20%) continued to

rise in the third quarter, similarly to the two previous quarters.

In the United States, a new store was inaugurated in Topanga, Los

Angeles, in July, the 6th in California, after the store openings

in Naples in the Gulf of Mexico in February, and in Aspen,

Colorado, in June.

- Sales in Europe excluding France

(+20%) and France (+22%) were particularly robust thanks to the

loyalty of local clients and the dynamics of tourist flows. The

store in Vienna, Austria, reopened in September after renovation

and extension work. The Hermès in the Making event, an opportunity

for the public to meet the craftsmen, made a stopover in Lille in

July.

Sales by business line at the end of

September(at comparable exchange rates, unless otherwise

indicated)

At the end of September 2023, all the business

lines confirmed their solid momentum, underlining the tremendous

attractiveness of the house.

The Leather Goods and Saddlery business line

(+19%) benefitted from a very sustained demand and high

desirability. Two new models, Kelly Messenger and Maxi Kelly, are

attracting over our customers. The new models, Hermès Geta or the

R.M.S. suitcase with a high degree of know-how, are meeting with

great success. The increase in production capacities continues,

with four new leather workshop projects planned over the next four

years: Riom (Puy-de-Dôme) in 2024, L’Isle-d’Espagnac (Charente) in

2025, Loupes (Gironde) in 2026 and Charleville-Mézières (Ardennes)

scheduled for 2027. Hermès thus continues to strengthen its local

anchoring in France and to create jobs.

The Ready-to-Wear and Accessories business line

(+29%) achieved robust growth, thanks to the success of the

ready-to-wear, fashion accessories and footwear collections. The

men’s spring-summer 2024 fashion show, unveiled at the Palais

d’Iéna in June, was very well received, as was the women's

spring-summer 2024 collection, presented at the end of September at

the Garde républicaine. The fashion accessories and footwear

express the richness of the house’s know-how.

The Silk and Textiles business line (+17%)

recorded solid growth, supported by exceptional materials, the

diversity of formats and the reinforcement of production capacities

following the expansion of the Pierre-Bénite site in Lyon, which

has been expanded with a new printing line.

Perfume and Beauty (+8%) benefitted from the

successful launches of the company’s latest creations and classics.

The Twilly d'Hermès line welcomed the Tutti Twilly perfume at the

beginning of September. Beauty was enriched by a fifth chapter, the

Regard Hermès, launched at the end of September, inspired by the

house’s emblematic colours.

The Watches business line (+24%) confirmed its

strong performance thanks to the development of pieces combining

creativity and exceptional watch-making savoir-faire, both for the

complication models and Hermès’ classic models, Cape Cod and Heure

H. The Hermès H08 line, which includes several new products this

year, is meeting with great success.

The Other Hermès business lines (+26%) continued

their strong growth, both in Homeware and Jewellery, with creative

and unique collections.

A responsible, sustainable

model

True to its commitment to quality and the

development of sustainable materials for its 16 business lines,

Hermès is pursuing its certification process for its 44 sectors by

2024. The men’s ready-to-wear workshops in Pantin earned GOTS

(Global Organic Textile Standard) certification in July. This

certification guarantees the use of organic fibres, compliance with

environmental and social standards, and our commitment to

traceability, from the harvesting of raw materials to the finished

product.

The group is strengthening its environmental

ambitions, in particular with the finalisation of the first stages

of the Science Based Targets for Nature (SBTN) process by the end

of 2023, to set scientific targets for nature, in particular

regarding biodiversity, fresh water, forests, soils and oceans.

Hermès is part of the 120 companies which launched this approach on

a global scale.

Recruitments further accelerated in the third

quarter in all the business lines, while promoting commitments to

inclusion and diversity. An agreement aimed at supporting

caregivers and worklife balance was signed in July. In accordance

with its role as a responsible employer, and in order to involve

all employees in its development and success, the group deployed a

6th free share plan in July, enabling all employees around the

world to become shareholders.

Other highlights

At the end of September 2023, currency

fluctuations represented a negative impact of €420 million on

revenue.

During the first nine months, Hermès

International redeemed 38,812 shares for €72 million, excluding

transactions completed within the framework of the liquidity

contract.

Outlook

The group continues the year 2023 with

confidence, thanks to the highly integrated artisanal model, the

balanced distribution network, the creativity of collections and

the loyalty of clients.

In the medium-term, despite the economic,

geopolitical and monetary uncertainties around the world, the group

confirms an ambitious goal for revenue growth at constant exchange

rates.

Thanks to its unique business model, Hermès is

pursuing its long-term development strategy based on creativity,

maintaining control over know-how and singular communication.

Inspiration of the creation at Hermès,

Astonishment is the theme of the year. The ability to be surprised

is a constant source of innovation and dynamism for the house,

which will continue to accompany clients with enthusiasm and

creativity.

The press release on Revenue at the end of

September 2023 is availableon the group’s website:

https://finance.hermes.com.

Upcoming events:

- 9 February 2024: 2023 full-year

results publication

- 25 April 2024: Q1 2024 revenue

publication

- 30 April 2024: General Meeting of

Shareholders

REVENUE BY GEOGRAPHICAL AREA

(a)

|

|

|

At the end of September |

Evolution /2022 |

| In €m |

|

2023 |

2022 |

Published |

At constant exchange rates |

| France |

|

916 |

753 |

21.6% |

21.6% |

| Europe (excl.

France) |

|

1,327 |

1,123 |

18.2% |

20.0% |

| Total

Europe |

|

2,243 |

1,876 |

19.5% |

20.7% |

| Japan |

|

939 |

822 |

14.3% |

25.4% |

| Asia-Pacific

(excl. Japan) |

|

4,872 |

4,242 |

14.8% |

21.2% |

| Total

Asia |

|

5,811 |

5,064 |

14.8% |

21.9% |

| Americas |

|

1,785 |

1,518 |

17.6% |

20.1% |

| Other |

|

223 |

153 |

46.1% |

45.7% |

|

TOTAL |

|

10,063 |

8,611 |

16.9% |

21.7% |

|

|

|

3rd quarter |

Evolution /2022 |

| In €m |

|

2023 |

2022 |

Published |

At constant exchange rates |

| France |

|

323 |

273 |

18.3% |

18.3% |

| Europe (excl.

France) |

|

492 |

427 |

15.2% |

18.1% |

| Total

Europe |

|

814 |

700 |

16.4% |

18.1% |

| Japan |

|

304 |

276 |

10.0% |

24.1% |

| Asia-Pacific

(excl. Japan) |

|

1,575 |

1,577 |

(0.1%) |

10.2% |

| Total

Asia |

|

1,879 |

1,853 |

1.4% |

12.3% |

| Americas |

|

600 |

536 |

11.9% |

20.4% |

| Other |

|

72 |

47 |

53.2% |

53.1% |

|

TOTAL |

|

3,365 |

3,136 |

7.3% |

15.6% |

(a) Sales by destination.

REVENUE BY SECTOR

|

|

|

At the end of September |

Evolution /2022 |

| In €m |

|

2023 |

2022 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

4,176 |

3,663 |

14.0% |

19.0% |

| Ready-to-Wear

and Accessories (2) |

|

2,934 |

2,377 |

23.4% |

28.5% |

| Silk and

Textiles |

|

648 |

579 |

11.8% |

16.7% |

| Other Hermès

sectors (3) |

|

1,239 |

1,023 |

21.1% |

26.4% |

| Perfume and

Beauty |

|

367 |

344 |

6.7% |

8.4% |

| Watches |

|

473 |

401 |

17.9% |

23.5% |

| Other products

(4) |

|

226 |

224 |

1.0% |

3.9% |

|

TOTAL |

|

10,063 |

8,611 |

16.9% |

21.7% |

|

|

|

3rd

quarter |

Evolution /2022 |

| In €m |

|

2023 |

2022 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

1,396 |

1,305 |

7.0% |

15.8% |

| Ready-to-Wear

and Accessories (2) |

|

1,012 |

919 |

10.2% |

18.3% |

| Silk and

Textiles |

|

204 |

208 |

(1.7%) |

6.3% |

| Other Hermès

sectors (3) |

|

403 |

375 |

7.5% |

16.5% |

| Perfume and

Beauty |

|

117 |

113 |

3.5% |

6.3% |

| Watches |

|

155 |

139 |

12.1% |

22.0% |

| Other products

(4) |

|

76 |

77 |

(1.4%) |

3.4% |

|

TOTAL |

|

3,365 |

3,136 |

7.3% |

15.6% |

(1) The “Leather Goods and Saddlery” business

line includes bags, riding, memory holders and small leather

goods.(2) The “Ready-to-Wear and Accessories” business line

includes Hermès Ready-to-wear for men and women, belts, costume

jewellery, gloves, hats and shoes.(3) The “Other Hermès business

lines” include Jewellery and Hermès home products (Art of Living

and Hermès Tableware).(4) The “Other products” include the

production activities carried out on behalf of non-group brands

(textile printing, tanning…), as well as John Lobb, Saint-Louis and

Puiforcat.

REMINDER – FIRST HALF

2023 KEY FIGURES

|

In millions of euros |

H1 2023 |

2022 |

H1 2022 |

| |

|

|

|

|

Revenue |

6,698 |

11,602 |

5,475 |

|

Growth at current exchange rates vs. n-1 |

22.3% |

29.2% |

29.3% |

|

Growth at constant exchange rates vs. n-1 (1) |

25.2% |

23.4% |

23.2% |

|

|

|

|

|

|

Recurring operating income (2) |

2,947 |

4,697 |

2,304 |

|

As a % of revenue |

44.0% |

40.5% |

42.1% |

|

|

|

|

|

|

Operating income |

2,947 |

4,697 |

2,304 |

|

As a % of revenue |

44.0% |

40.5% |

42.1% |

|

|

|

|

|

|

Net profit – Group share |

2,226 |

3,367 |

1,641 |

|

As a % of revenue |

33.2% |

29.0% |

30.0% |

|

|

|

|

|

|

Operating cash flows |

2,615 |

4,111 |

2,001 |

|

|

|

|

|

|

Investments (excluding financial investments) |

249 |

518 |

190 |

|

|

|

|

|

|

Adjusted free cash flow (3) |

1,720 |

3,405 |

1,421 |

|

|

|

|

|

|

Equity – Group share |

13,249 |

12,440 |

10,259 |

|

|

|

|

|

|

Net cash position (4) |

9,326 |

9,223 |

7,280 |

|

|

|

|

|

|

Restated net cash position (5) |

9,848 |

9,742 |

7,685 |

|

|

|

|

|

|

Workforce (number of employees) |

20,607 |

19,686 |

18,428 |

(1) Growth at constant exchange

rates is calculated by applying the average exchange rates of the

previous period to the current period's revenue, for each

currency.

(2) Recurring operating income

is one of the main performance indicators monitored by the group's

General Management. It corresponds to the operating income

excluding non-recurring items having a significant impact likely to

affect the understanding of the group's economic performance.

(3) Adjusted free cash flow

corresponds to the sum of operating cash flows and change in

working capital requirement, less operating investments and

repayment of lease liabilities, as per IFRS cash flow

statement.

(4) The

net cash position includes cash and cash equivalents on the asset

side of the balance sheet, less bank overdrafts presented within

the short-term borrowings and financial liabilities on the

liability side of the balance sheet. It does not include lease

liabilities recognised in accordance with IFRS 16.

(5) The

restated net cash position corresponds to the net cash position,

plus cash investments that do not meet IFRS criteria for cash

equivalents as a result of their original maturity of more than

three months, minus borrowings and financial liabilities.

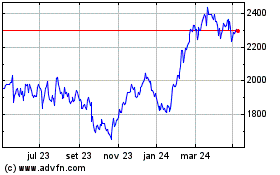

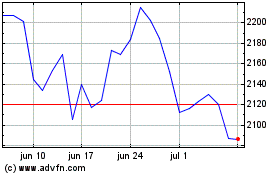

Hermes (TG:HMI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Hermes (TG:HMI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024