Landstar System, Inc. (NASDAQ: LSTR) (“Landstar” or the “Company”)

reported basic and diluted earnings per share (“EPS”) of $1.71 in

the 2023 third quarter on revenue of $1.289 billion. Landstar

reported EPS of $2.76 on revenue of $1.816 billion in the 2022

third quarter.

Gross profit in the 2023 third quarter was

$128.1 million and variable contribution (defined as revenue less

the cost of purchased transportation and commissions to agents) in

the 2023 third quarter was $187.4 million. Gross profit in the 2022

third quarter was $185.7 million and variable contribution in the

2022 third quarter was $245.7 million. Reconciliations of gross

profit to variable contribution and gross profit margin to variable

contribution margin for the 2023 and 2022 third quarters and

year-to-date periods are provided in the Company’s accompanying

financial disclosures.

Trailing twelve month return on average

shareholders’ equity was 32% and return on invested capital,

representing net income divided by the sum of average equity plus

average debt, was 29%. The Company is currently authorized to

purchase up to 2,910,339 shares of the Company’s common stock under

its previously announced share purchase programs. Landstar

announced today that its Board of Directors has declared a

quarterly dividend of $0.33 per share payable on December 1, 2023,

to stockholders of record as of the close of business on November

7, 2023. It is currently the intention of the Board to pay

dividends on a quarterly basis going forward.

Truck transportation revenue hauled by

independent business capacity owners (“BCOs”) and truck brokerage

carriers in the 2023 third quarter was $1,173.8 million, or 91% of

revenue, compared to $1,598.8 million, or 88% of revenue, in the

2022 third quarter. Truckload transportation revenue hauled via van

equipment in the 2023 third quarter was $665.6 million, compared to

$914.2 million in the 2022 third quarter. Truckload transportation

revenue hauled via unsided/platform equipment in the 2023 third

quarter was $378.1 million, compared to $453.9 million in the 2022

third quarter. Revenue from other truck transportation, which is

largely related to power-only services, in the 2023 third quarter

was $102.0 million, compared to $195.3 million in

the 2022 third quarter. Revenue hauled by rail, air and ocean cargo

carriers was $88.9 million, or 7% of revenue, in the 2023 third

quarter, compared to $191.9 million, or 11% of revenue, in the 2022

third quarter.

“The soft freight market fundamentals

experienced during the 2023 second quarter continued throughout the

2023 third quarter and made for challenging comparisons against our

record 2022 third quarter performance,” said Landstar President and

Chief Executive Officer Jim Gattoni. “Lackluster demand, driven by

continued weakness in the U.S. manufacturing sector and the ongoing

impact of an inflation-challenged consumer goods sector, plus the

continuation of a loose truck capacity market drove Landstar’s

truck revenue per load and volumes in the 2023 third quarter below

prior year levels. The number of loads hauled via truck declined

16% as compared to the 2022 third quarter, at the high end of the

Company’s guidance included as part of the Company’s 2023 second

quarter earnings release on July 26, 2023, while truck revenue per

load declined 12% as compared to the 2022 third quarter, at the low

end of the Company’s previously issued guidance.” Gattoni

continued, “The Company’s balance sheet continues to be very

strong, with cash and short term investments of approximately $497

million as of September 30, 2023. Cash flow from operations was

$304 million through the first three quarters of fiscal year

2023.”

Gattoni further commented, “Through the first

several weeks of October, the number of loads hauled via truck has

trended below historical, pre-pandemic end of third quarter to the

beginning of fourth quarter sequential patterns, while truck

revenue per load has thus far trended reasonably in-line with these

historical, pre-pandemic sequential patterns. As a reminder, the

2022 fourth quarter included 14 weeks of operations while the 2023

fourth quarter will include 13 weeks. Taking that extra week in

2022 into consideration and assuming a continuation of the October

trends coupled with our expectation of a muted peak season, I

expect revenue per load on loads hauled via truck to be in a range

of 6% to 8% below the 2022 fourth quarter and the number of loads

hauled via truck to be in a range of 20% to 22% below the 2022

fourth quarter. As such, I anticipate revenue for the 2023 fourth

quarter to be in a range of $1.225 billion to $1.275 billion.”

Gattoni concluded, “Based on the range of

revenue estimated for the 2023 fourth quarter, I would anticipate

EPS to be in a range of $1.60 to $1.70. The anticipated range of

EPS for the 2023 fourth quarter includes estimated insurance and

claims costs of approximately 5.5% of BCO revenue. These costs were

5.6% of BCO revenue over the first nine months of 2023. The

anticipated range of EPS for the 2023 fourth quarter also reflects

an estimated effective income tax rate of 24.5%.”

Landstar will provide a live webcast of its

quarterly earnings conference call tomorrow morning at 8:00 a.m.

ET. To access the webcast, visit the Company’s website at

www.landstar.com; click on “Investor Relations” and “Webcasts,”

then click on “Landstar’s Third Quarter 2023 Earnings Release

Conference Call.”

About Landstar:Landstar System,

Inc., a Fortune 500 company, is a worldwide, technology-enabled,

asset-light provider of integrated transportation management

solutions delivering safe, specialized transportation services to a

broad range of customers utilizing a network of agents, third-party

capacity providers and employees. Landstar transportation services

companies are certified to ISO 9001:2015 quality management system

standards and RC14001:2015 environmental, health, safety and

security management system standards. Landstar System, Inc. is

headquartered in Jacksonville, Florida. Its common stock trades on

The NASDAQ Stock Market® under the symbol LSTR.

Non-GAAP Financial Measures:In

this earnings release and accompanying financial disclosures, the

Company provides the following information that may be deemed a

non-GAAP financial measure: variable contribution and variable

contribution margin. The Company believes variable contribution and

variable contribution margin are useful measures of the variable

costs that we incur at a shipment-by-shipment level attributable to

our transportation network of third-party capacity providers and

independent agents in order to provide services to our customers.

The Company also believes that it is appropriate to present each of

the financial measures that may be deemed a non-GAAP financial

measure, as referred to above, for the following reasons: (1)

disclosure of these matters will allow investors to better

understand the underlying trends in the Company’s financial

condition and results of operations; (2) this information will

facilitate comparisons by investors of the Company’s results as

compared to the results of peer companies; and (3) management

considers this financial information in its decision making.

Forward Looking Statements

Disclaimer:The following is a “safe harbor” statement

under the Private Securities Litigation Reform Act of 1995.

Statements contained in this press release that are not based on

historical facts are “forward-looking statements”. This press

release contains forward-looking statements, such as statements

which relate to Landstar’s business objectives, plans, strategies

and expectations. Terms such as “anticipates,” “believes,”

“estimates,” “intention,” “expects,” “plans,” “predicts,” “may,”

“should,” “could,” “will,” the negative thereof and similar

expressions are intended to identify forward-looking statements.

Such statements are by nature subject to uncertainties and risks,

including but not limited to: the impact of the Russian conflict

with Ukraine on the operations of certain independent commission

sales agents, including the Company’s largest such agent by revenue

in the 2022 fiscal year; the impact of the coronavirus (COVID-19)

pandemic; an increase in the frequency or severity of accidents or

other claims; unfavorable development of existing accident claims;

dependence on third party insurance companies; dependence on

independent commission sales agents; dependence on third party

capacity providers; decreased demand for transportation services;

U.S. trade relationships; substantial industry competition;

disruptions or failures in the Company’s computer systems; cyber

and other information security incidents; dependence on key

vendors; potential changes in taxes; status of independent

contractors; regulatory and legislative changes; regulations

focused on diesel emissions and other air quality matters;

intellectual property; and other operational, financial or legal

risks or uncertainties detailed in Landstar’s Form 10-K for the

2022 fiscal year, described in Item 1A Risk Factors, Landstar’s

Form 10-Q for the 2023 first fiscal quarter, described in Item 1A

Risk Factors, and in other SEC filings from time to time. These

risks and uncertainties could cause actual results or events to

differ materially from historical results or those anticipated.

Investors should not place undue reliance on such forward-looking

statements, and the Company undertakes no obligation to publicly

update or revise any forward-looking statements.

| |

|

|

|

|

|

|

|

|

|

| Landstar

System, Inc. and Subsidiary |

| Consolidated

Statements of Income |

| (Dollars in

thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Thirty-Nine Weeks Ended |

|

Thirteen Weeks Ended |

| |

|

|

September 30, |

|

September 24, |

|

September 30, |

|

September 24, |

| |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

4,098,877 |

|

|

$ |

5,761,795 |

|

|

$ |

1,289,345 |

|

|

$ |

1,816,132 |

|

|

Investment income |

|

6,874 |

|

|

|

2,023 |

|

|

|

3,022 |

|

|

|

716 |

|

| |

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

| |

Purchased transportation |

|

3,141,234 |

|

|

|

4,512,341 |

|

|

|

986,743 |

|

|

|

1,416,323 |

|

| |

Commissions to agents |

|

363,397 |

|

|

|

465,759 |

|

|

|

115,244 |

|

|

|

154,125 |

|

| |

Other operating costs, net of gains on asset

sales/dispositions |

|

40,998 |

|

|

|

34,878 |

|

|

|

15,158 |

|

|

|

13,356 |

|

| |

Insurance and claims |

|

86,971 |

|

|

|

96,265 |

|

|

|

29,540 |

|

|

|

31,445 |

|

| |

Selling, general and administrative |

|

159,071 |

|

|

|

165,199 |

|

|

|

50,975 |

|

|

|

53,519 |

|

| |

Depreciation and amortization |

|

44,498 |

|

|

|

42,627 |

|

|

|

14,359 |

|

|

|

14,582 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

3,836,169 |

|

|

|

5,317,069 |

|

|

|

1,212,019 |

|

|

|

1,683,350 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating income |

|

269,582 |

|

|

|

446,749 |

|

|

|

80,348 |

|

|

|

133,498 |

|

|

Interest and debt (income) expense |

|

(2,079 |

) |

|

|

3,275 |

|

|

|

(1,046 |

) |

|

|

1,047 |

|

| |

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

271,661 |

|

|

|

443,474 |

|

|

|

81,394 |

|

|

|

132,451 |

|

|

Income taxes |

|

65,254 |

|

|

|

105,862 |

|

|

|

19,741 |

|

|

|

32,233 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

206,407 |

|

|

$ |

337,612 |

|

|

$ |

61,653 |

|

|

$ |

100,218 |

|

| |

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per share |

$ |

5.74 |

|

|

$ |

9.15 |

|

|

$ |

1.71 |

|

|

$ |

2.76 |

|

| |

|

|

|

|

|

|

|

|

|

|

Average basic and diluted shares outstanding |

|

35,958,000 |

|

|

|

36,886,000 |

|

|

|

35,951,000 |

|

|

|

36,334,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

Dividends per common share |

$ |

0.93 |

|

|

$ |

0.80 |

|

|

$ |

0.33 |

|

|

$ |

0.30 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Landstar

System, Inc. and Subsidiary |

| Consolidated

Balance Sheets |

| (Dollars in

thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

September 30, |

|

December 31, |

| |

|

|

|

2023 |

|

2022 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

| |

Cash and cash equivalents |

$ |

439,661 |

|

|

$ |

339,581 |

|

| |

Short-term investments |

|

57,099 |

|

|

|

53,955 |

|

| |

Trade accounts receivable, less allowance |

|

|

|

| |

|

of $12,054 and $12,121 |

|

810,801 |

|

|

|

967,793 |

|

| |

Other receivables, including advances to independent |

|

|

|

| |

|

contractors, less allowance of $14,405 and $10,579 |

|

57,063 |

|

|

|

56,235 |

|

| |

Other current assets |

|

30,918 |

|

|

|

21,826 |

|

| |

|

Total current assets |

|

1,395,542 |

|

|

|

1,439,390 |

|

| |

|

|

|

|

|

|

|

Operating property, less accumulated depreciation |

|

|

|

|

|

|

|

and amortization of $426,984 and $393,274 |

|

284,081 |

|

|

|

314,990 |

|

|

Goodwill |

|

41,934 |

|

|

|

41,220 |

|

|

Other assets |

|

130,970 |

|

|

|

136,279 |

|

|

Total assets |

$ |

1,852,527 |

|

|

$ |

1,931,879 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

| |

Cash overdraft |

$ |

48,067 |

|

|

$ |

92,953 |

|

| |

Accounts payable |

|

464,720 |

|

|

|

527,372 |

|

| |

Current maturities of long-term debt |

|

29,210 |

|

|

|

36,175 |

|

| |

Insurance claims |

|

45,518 |

|

|

|

50,836 |

|

| |

Dividends payable |

|

- |

|

|

|

71,854 |

|

| |

Other current liabilities |

|

82,550 |

|

|

|

98,945 |

|

| |

|

Total current liabilities |

|

670,065 |

|

|

|

878,135 |

|

| |

|

|

|

|

|

|

|

Long-term debt, excluding current maturities |

|

46,173 |

|

|

|

67,225 |

|

|

Insurance claims |

|

56,776 |

|

|

|

58,268 |

|

|

Deferred income taxes and other non-current liabilities |

|

36,359 |

|

|

|

41,030 |

|

| |

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

| |

Common stock, $0.01 par value, authorized 160,000,000 |

|

|

|

| |

|

shares, issued 68,497,324 and 68,382,310 |

|

685 |

|

|

|

684 |

|

| |

Additional paid-in capital |

|

254,630 |

|

|

|

258,487 |

|

| |

Retained earnings |

|

2,808,919 |

|

|

|

2,635,960 |

|

| |

Cost of 32,550,980 and 32,455,300 shares of common |

|

|

|

| |

|

stock in treasury |

|

(2,009,351 |

) |

|

|

(1,992,886 |

) |

| |

Accumulated other comprehensive loss |

|

(11,729 |

) |

|

|

(15,024 |

) |

| |

|

Total shareholders' equity |

|

1,043,154 |

|

|

|

887,221 |

|

|

Total liabilities and shareholders' equity |

$ |

1,852,527 |

|

|

$ |

1,931,879 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Landstar

System, Inc. and Subsidiary |

| Supplemental

Information |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Thirty-Nine Weeks Ended |

|

Thirteen Weeks Ended |

| |

|

|

|

|

September 30, |

|

September 24, |

|

September 30, |

|

September 24, |

| |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenue generated through (in thousands): |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Truck transportation |

|

|

|

|

|

|

|

|

| |

|

Truckload: |

|

|

|

|

|

|

|

|

|

|

|

|

Van equipment |

|

$ |

2,123,693 |

|

|

$ |

3,022,297 |

|

|

$ |

665,569 |

|

|

$ |

914,154 |

|

| |

|

|

Unsided/platform equipment |

|

|

1,150,483 |

|

|

|

1,336,956 |

|

|

|

378,147 |

|

|

|

453,924 |

|

| |

|

Less-than-truckload |

|

|

90,770 |

|

|

|

105,994 |

|

|

|

28,097 |

|

|

|

35,343 |

|

| |

|

Other truck transportation (1) |

|

|

379,471 |

|

|

|

632,001 |

|

|

|

101,951 |

|

|

|

195,345 |

|

| |

|

|

Total truck

transportation |

|

|

3,744,417 |

|

|

|

5,097,248 |

|

|

|

1,173,764 |

|

|

|

1,598,766 |

|

| |

Rail intermodal |

|

|

73,953 |

|

|

|

113,762 |

|

|

|

23,064 |

|

|

|

27,652 |

|

| |

Ocean and air cargo carriers |

|

|

202,358 |

|

|

|

475,156 |

|

|

|

65,824 |

|

|

|

164,252 |

|

| |

Other (2) |

|

|

78,149 |

|

|

|

75,629 |

|

|

|

26,693 |

|

|

|

25,462 |

|

| |

|

|

|

|

$ |

4,098,877 |

|

|

$ |

5,761,795 |

|

|

$ |

1,289,345 |

|

|

$ |

1,816,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Revenue on loads hauled via BCO Independent Contractors (3) |

|

|

|

|

|

|

|

|

| |

|

included in total truck transportation |

|

$ |

1,543,634 |

|

|

$ |

2,043,772 |

|

|

$ |

508,753 |

|

|

$ |

627,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Number of loads: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Truck transportation |

|

|

|

|

|

|

|

|

| |

|

Truckload: |

|

|

|

|

|

|

|

|

| |

|

|

Van

equipment |

|

|

966,867 |

|

|

|

1,130,263 |

|

|

|

311,831 |

|

|

|

366,513 |

|

| |

|

|

Unsided/platform equipment |

|

|

389,471 |

|

|

|

420,436 |

|

|

|

126,286 |

|

|

|

141,091 |

|

| |

|

Less-than-truckload |

|

|

134,580 |

|

|

|

142,740 |

|

|

|

41,514 |

|

|

|

45,912 |

|

| |

|

Other truck transportation (1) |

|

|

157,112 |

|

|

|

243,341 |

|

|

|

46,739 |

|

|

|

76,594 |

|

| |

|

|

Total truck

transportation |

|

|

1,648,030 |

|

|

|

1,936,780 |

|

|

|

526,370 |

|

|

|

630,110 |

|

| |

Rail intermodal |

|

|

22,150 |

|

|

|

31,940 |

|

|

|

6,760 |

|

|

|

7,720 |

|

| |

Ocean and air cargo carriers |

|

|

25,380 |

|

|

|

34,410 |

|

|

|

8,630 |

|

|

|

11,520 |

|

| |

|

|

|

|

|

1,695,560 |

|

|

|

2,003,130 |

|

|

|

541,760 |

|

|

|

649,350 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Loads hauled via BCO Independent Contractors (3) |

|

|

|

|

|

|

|

|

| |

|

included in total truck transportation |

|

|

689,260 |

|

|

|

777,250 |

|

|

|

225,350 |

|

|

|

249,420 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue per load: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Truck transportation |

|

|

|

|

|

|

|

|

| |

|

Truckload: |

|

|

|

|

|

|

|

|

| |

|

|

Van

equipment |

|

$ |

2,196 |

|

|

$ |

2,674 |

|

|

$ |

2,134 |

|

|

$ |

2,494 |

|

| |

|

|

Unsided/platform equipment |

|

|

2,954 |

|

|

|

3,180 |

|

|

|

2,994 |

|

|

|

3,217 |

|

| |

|

Less-than-truckload |

|

|

674 |

|

|

|

743 |

|

|

|

677 |

|

|

|

770 |

|

| |

|

Other truck transportation (1) |

|

|

2,415 |

|

|

|

2,597 |

|

|

|

2,181 |

|

|

|

2,550 |

|

| |

|

|

Total truck

transportation |

|

|

2,272 |

|

|

|

2,632 |

|

|

|

2,230 |

|

|

|

2,537 |

|

| |

Rail intermodal |

|

|

3,339 |

|

|

|

3,562 |

|

|

|

3,412 |

|

|

|

3,582 |

|

| |

Ocean and air cargo carriers |

|

|

7,973 |

|

|

|

13,809 |

|

|

|

7,627 |

|

|

|

14,258 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Revenue per load on loads hauled via BCO Independent Contractors

(3) |

|

$ |

2,240 |

|

|

$ |

2,629 |

|

|

$ |

2,258 |

|

|

$ |

2,517 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue by capacity type (as a % of total revenue): |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Truck capacity providers: |

|

|

|

|

|

|

|

|

| |

|

BCO Independent Contractors (3) |

|

|

38 |

% |

|

|

35 |

% |

|

|

39 |

% |

|

|

35 |

% |

| |

|

Truck Brokerage Carriers |

|

|

54 |

% |

|

|

53 |

% |

|

|

52 |

% |

|

|

53 |

% |

| |

Rail intermodal |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

| |

Ocean and air cargo carriers |

|

|

5 |

% |

|

|

8 |

% |

|

|

5 |

% |

|

|

9 |

% |

| |

Other |

|

|

2 |

% |

|

|

1 |

% |

|

|

2 |

% |

|

|

1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

September 30, |

|

September 24, |

| |

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

Truck Capacity Providers |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

BCO Independent Contractors (3) |

|

|

|

|

|

|

9,455 |

|

|

|

10,742 |

|

| |

Truck Brokerage Carriers: |

|

|

|

|

|

|

|

|

| |

|

Approved and active (4) |

|

|

|

|

|

|

51,717 |

|

|

|

71,207 |

|

| |

|

Other approved |

|

|

|

|

|

|

27,925 |

|

|

|

30,222 |

|

| |

|

|

|

|

|

|

|

|

|

79,642 |

|

|

|

101,429 |

|

| |

Total available truck capacity providers |

|

|

|

|

|

|

89,097 |

|

|

|

112,171 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Trucks provided by BCO Independent Contractors (3) |

|

|

|

|

|

|

10,253 |

|

|

|

11,644 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (1) Includes

power-only, expedited, straight truck, cargo van, and miscellaneous

other truck transportation revenue generated by the transportation

logistics segment. Power-only refers to shipments where the

Company furnishes a power unit and an operator but not trailing

equipment, which is typically provided by the shipper or

consignee. |

| |

|

|

|

|

|

|

|

|

|

|

|

| (2) Includes primarily

reinsurance premium revenue generated by the insurance segment and

intra-Mexico transportation services revenue generated by Landstar

Metro. |

| |

|

|

|

|

|

|

|

|

|

|

|

| (3) BCO Independent

Contractors are independent contractors who provide truck capacity

to the Company under exclusive lease arrangements. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (4) Active refers to

Truck Brokerage Carriers who moved at least one load in the 180

days immediately preceding the fiscal quarter end. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Landstar

System, Inc. and Subsidiary |

|

Reconciliation of Gross Profit to Variable

Contribution |

| (Dollars in

thousands) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Thirty-Nine Weeks Ended |

|

Thirteen Weeks Ended |

| |

|

|

September 30, |

|

September 24, |

|

September 30, |

|

September 24, |

| |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

4,098,877 |

|

|

$ |

5,761,795 |

|

|

$ |

1,289,345 |

|

|

$ |

1,816,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

Costs of revenue: |

|

|

|

|

|

|

|

|

|

|

Purchased transportation |

|

3,141,234 |

|

|

|

4,512,341 |

|

|

|

986,743 |

|

|

|

1,416,323 |

|

| |

|

Commissions

to agents |

|

363,397 |

|

|

|

465,759 |

|

|

|

115,244 |

|

|

|

154,125 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Variable costs of revenue |

|

3,504,631 |

|

|

|

4,978,100 |

|

|

|

1,101,987 |

|

|

|

1,570,448 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Trailing

equipment depreciation |

|

24,240 |

|

|

|

27,760 |

|

|

|

7,721 |

|

|

|

9,397 |

|

| |

|

Information

technology costs (1) |

|

19,791 |

|

|

|

13,868 |

|

|

|

6,298 |

|

|

|

4,829 |

|

| |

|

Insurance-related costs (2) |

|

88,484 |

|

|

|

98,821 |

|

|

|

30,102 |

|

|

|

32,380 |

|

| |

|

Other

operating costs |

|

40,998 |

|

|

|

34,878 |

|

|

|

15,158 |

|

|

|

13,356 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Other costs of revenue |

|

173,513 |

|

|

|

175,327 |

|

|

|

59,279 |

|

|

|

59,962 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Total costs of revenue |

|

3,678,144 |

|

|

|

5,153,427 |

|

|

|

1,161,266 |

|

|

|

1,630,410 |

|

| |

|

|

|

|

|

|

|

|

|

|

Gross profit |

$ |

420,733 |

|

|

$ |

608,368 |

|

|

$ |

128,079 |

|

|

$ |

185,722 |

|

| |

|

|

|

|

|

|

|

|

|

|

Gross profit margin |

|

10.3 |

% |

|

|

10.6 |

% |

|

|

9.9 |

% |

|

|

10.2 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Plus: other costs of revenue |

|

173,513 |

|

|

|

175,327 |

|

|

|

59,279 |

|

|

|

59,962 |

|

| |

|

|

|

|

|

|

|

|

|

|

Variable contribution |

$ |

594,246 |

|

|

$ |

783,695 |

|

|

$ |

187,358 |

|

|

$ |

245,684 |

|

| |

|

|

|

|

|

|

|

|

|

|

Variable contribution margin |

|

14.5 |

% |

|

|

13.6 |

% |

|

|

14.5 |

% |

|

|

13.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

(1) Includes costs of revenue incurred related to

internally developed software including ASC 350-40 amortization,

implementation costs, hosting costs and other support costs

utilized to support the Company’s independent commission sales

agents, third party capacity providers, and customers, included as

a portion of depreciation and amortization and of selling, general

and administrative in the Company's Consolidated Statements of

Income. |

| |

|

|

|

|

|

|

|

|

|

|

(2) Primarily includes (i) insurance premiums paid for

commercial auto liability, general liability, cargo and other lines

of coverage related to the transportation of freight; (ii) the

related cost of claims incurred under those programs; and (iii)

brokerage commissions and other fees incurred relating to the

administration of insurance programs available to BCO Independent

Contractors that are reinsured by the Company, which are included

in selling, general and administrative in the Company’s

Consolidated Statements of Income. |

| |

|

|

|

|

|

|

|

|

|

Contact: Jim Todd (CFO)

Landstar System, Inc.

www.landstar.com

904-398-9400

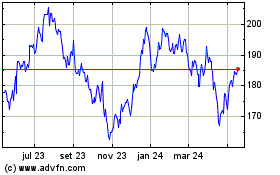

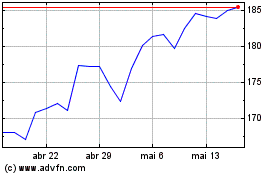

Landstar System (NASDAQ:LSTR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Landstar System (NASDAQ:LSTR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024