Essential Energy Services Ltd. (“Essential” or the “Company”) (TSX:

ESN) announced today that the Company has received a positive

recommendation from Institutional Shareholder Services (“ISS”) in

support of the proposed acquisition of Essential by Element

Technical Services Inc. (the “Acquisition”) announced on September

15, 2023. ISS is a leading independent, third-party proxy advisory

firm who provides proxy voting recommendations to pension funds,

investment managers, mutual funds and other institutional

shareholders.

In making their recommendation, ISS

commented:

“Vote FOR this resolution. Even though the cash

offer provides a modest 9.6 percent premium to the unaffected

price, it stands just below the twelve-month trading high and

provides both certain and immediate value.”

The special meeting of Essential shareholders to

approve the Acquisition will be held on November 7, 2023 at the

Calgary Petroleum Club, Viking Room, 319 – 5th Avenue SW, Calgary,

Alberta, at 10:30 a.m. (Calgary time).

For further information regarding the

Acquisition, readers are strongly encouraged to review Essential’s

news releases dated September 15, 2023, and October 5, 2023, all of

which are available under Essential’s profile on SEDAR+ at

www.sedarplus.ca.

Essential shareholders requiring assistance may

contact:

| Odyssey Trust

Company, the Company’s proxy solicitation & information

agent: |

| |

|

| Phone: |

1-587-885-0960 |

| Toll-free North America: |

1-888-290-1175 |

| E-mail: |

proxy@odysseytrust.com |

| |

|

| Or Essential: |

|

| |

|

| Phone: |

403-513-7272 |

| E-mail: |

service@essentialenergy.ca |

| |

|

FORWARD-LOOKING STATEMENTS AND

INFORMATION

This news release contains “forward‐looking

statements” and “forward‐looking information” (collectively

referred to herein as “forward-looking statements”) within the

meaning of applicable securities legislation. Such forward‐looking

statements include, without limitation, expectations and objectives

for future operations that are subject to a number of material

factors, assumptions, risks and uncertainties, many of which are

beyond the control of Essential.

Forward‐looking statements are statements that

are not historical facts and are generally, but not always,

identified by the word “will” and similar expressions or are events

or conditions that “will” occur or be achieved. This news release

contains forward‐looking statements pertaining to, among other

things, the following: the special meeting of Essential

shareholders to approve the Acquisition and the timing thereof.

The forward‐looking statements contained in this

news release reflect several material factors and expectations and

assumptions of Essential including, without limitation: the ability

of the parties to receive, in a timely manner, the necessary

regulatory, securityholder, stock exchange and other third-party

approvals; the ability of Essential and Element to satisfy, in a

timely manner, the other conditions to the closing of the

Acquisition; the ability to complete the Acquisition on the terms

contemplated by the amalgamation agreement dated September 15, 2023

among Essential, Element Technical Services Inc. and 2544592

Alberta Ltd. (the “Amalgamation Agreement”), or at all; that

Essential will continue to conduct its operations in a manner

consistent with past operations; and the general continuance of

current or, where applicable, assumed industry conditions.

Although Essential believes that the material

factors, expectations and assumptions expressed in such

forward‐looking statements are reasonable based on information

available to it on the date such statements are made, undue

reliance should not be placed on the forward‐looking statements

because Essential can give no assurances that such statements and

information will prove to be correct and such statements are not

guarantees of future performance. Since forward‐looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties.

Actual performance and results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, known and

unknown risks, including: the completion and the timing of the

Acquisition; the ability of Essential and Element to receive, in a

timely manner, the necessary regulatory, securityholder, stock

exchange and other third-party approvals; the ability of Essential

and Element to satisfy, in a timely manner, the other conditions to

the closing of the Acquisition; interloper risk; the ability to

complete the Acquisition on the terms contemplated by the

Amalgamation Agreement, or at all; the consequences of not

completing the Acquisition, including the volatility of the share

price of Essential, negative reactions from the investment

community and the required payment of certain costs related to the

Acquisition; actions taken by government entities or others seeking

to prevent or alter the terms of the Acquisition; potential

undisclosed liabilities unidentified during the due diligence

process; the focus of management's time and attention on the

Acquisition and other disruptions arising from the Acquisition;

general economic, market or business conditions including those in

the event of an epidemic, natural disaster or other event; global

economic events; changes to Essential’s financial position and cash

flow and the uncertainty related to the estimates and judgements

made in the preparation of financial statements; potential industry

developments; and other unforeseen conditions which could impact

the use of services supplied by Essential. Accordingly, readers

should not place undue importance or reliance on the

forward‐looking statements. Readers are cautioned that the

foregoing list of factors is not exhaustive and should refer to the

“Risk Factors” section set out in Essential’s most recent annual

information form (a copy of which can be found under Essential’s

profile on SEDAR+ at www.sedarplus.ca).

Statements, including forward‐looking

statements, contained in this news release are made as of the date

they are given and Essential disclaims any intention or obligation

to publicly update or revise any forward‐looking statements,

whether as a result of new information, future events or otherwise,

unless so required by applicable securities laws. The

forward‐looking statements contained in this news release are

expressly qualified by this cautionary statement.

Additional information on these and other

factors that could affect Essential’s operations and financial

results are included in reports on file with applicable securities

regulatory authorities and may be accessed under Essential’s

profile on SEDAR+ at www.sedarplus.ca.

ABOUT ESSENTIAL

Essential provides oilfield services to oil and

natural gas producers, primarily in western Canada. Essential

offers completion, production and wellsite restoration services to

a diverse customer base. Services are offered with coiled tubing,

fluid and nitrogen pumping and the sale and rental of downhole

tools and equipment. Essential offers one of the largest active

coiled tubing fleets in Canada. Further information can be found at

www.essentialenergy.ca

For further information, please contact:

Garnet K. AmundsonPresident and CEO Phone: (403)

513-7272service@essentialenergy.ca

The TSX has neither approved nor disapproved the

contents of this press release.

PDF

Available: http://ml.globenewswire.com/Resource/Download/ad5c3755-2440-411d-8605-d82b4a7dade2

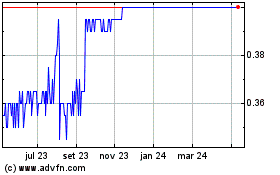

Essential Energy Services (TSX:ESN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Essential Energy Services (TSX:ESN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024