Crescent Point Energy Corp. ("Crescent Point" or the "Company")

(TSX and NYSE: CPG) is pleased to announce that it has entered into

an arrangement agreement (the “Agreement”) to acquire Hammerhead

Energy Inc. (“Hammerhead”), an oil and liquids-rich Alberta Montney

producer, for total consideration of approximately $2.55 billion,

including approximately $455 million in assumed net debt,

consisting of cash and common shares of the Company (the

“Transaction”).

“This strategic consolidation is an integral part of our overall

portfolio transformation,” said Craig Bryksa, President and CEO of

Crescent Point. “The acquired assets, which are situated in the

volatile oil window in the Alberta Montney and adjacent to our

existing lands, provide significant value with premium drilling

inventory, infrastructure ownership and scalable market access.

This transaction is expected to be immediately accretive to our per

share metrics and to enhance our return of capital profile for

shareholders. Upon completion of the transaction, Crescent Point

will have a dominant position in both the Alberta Montney and

Kaybob Duvernay plays, which are complemented by our low-decline,

long-cycle assets in Saskatchewan. Moving forward, our strategic

priorities will focus on continued operational execution, balance

sheet strength and increasing our return of capital to

shareholders.”

KEY HIGHLIGHTS

- Transforms Company into a Montney

and Kaybob Duvernay focused E&P with complementary long-cycle

assets in Saskatchewan.

- Adds approximately 800 net Montney

drilling locations and increases estimated total corporate premium

inventory to over 20 years.

- Accretive to 2024 metrics and

enhances excess cash flow per share by over 15 percent, on average,

throughout the five-year plan.

- Creates the seventh-largest Canadian

E&P by production volume and largest land owner in the Alberta

Montney’s volatile oil fairway.

- Plan to increase base dividend by 15

percent to $0.46 per share on an annual basis, subject to closing

of the Transaction.

- Leverage ratio of 1.1 times net debt

to adjusted funds flow expected at year-end 2024 at US$80/bbl

WTI.

STRATEGIC RATIONALE

- Establishes Dominant

Position in the Alberta Montney with 350,000 Net Acres of

Contiguous Land Providing Synergies: The Transaction is

accretive to Crescent Point’s portfolio and allows the Company to

consolidate approximately 105,000 net acres of land with Montney

rights, directly adjacent to its existing Alberta Montney position

at Gold Creek and Karr. The acquired assets are highly attractive

with favourable royalty rates on Crown lands and include a high

working interest rate of primarily 100 percent with limited expiry

concerns. The acquired lands also have attractive geological

characteristics with significant net pay, similar to Crescent

Point’s Gold Creek assets, and higher than normal pressure. The

Company expects to be able to drive significant operational

synergies across the combined asset base with respect to drilling

and completion design, shared infrastructure, well-pad development

continuity and supply chain management efficiencies. A detailed map

of the acquired assets in relation to Crescent Point’s existing

land position is provided later in the release.

- Increases Premium Drilling

Inventory to Over 20 Years: Adds approximately 800 net

Montney drilling locations, further bolstering Crescent Point’s

short-cycle asset portfolio. This Transaction provides decades of

inventory with highly attractive returns, capital efficiencies and

finding and development costs, which all rank in the top quartile

within the Company’s portfolio. Crescent Point’s inventory of

premium drilling locations is estimated to exceed 20 years on a pro

forma basis, providing an attractive growth profile.

- Significant Infrastructure

Ownership and Market Access: Enhances the Company’s

ownership of significant infrastructure within the Alberta Montney,

including oil batteries, compressors, water disposal and gathering

lines to third party processing plants. Cumulative capital

investment made by Hammerhead on major infrastructure since

inception is expected to total approximately $500 million by the

end of 2023. This infrastructure will support the acquired assets

as they grow from approximately 56,000 boe/d (50% oil and liquids)

expected in 2024 to over an estimated 80,000 boe/d within Crescent

Point’s five-year business plan. Crescent Point also expects to

benefit from long-term contracts already in place to ensure the

Company has adequate market access for future scalability.

- Expected Accretion of Over

15 Percent Per-Share to Excess Cash Flow and Return of

Capital: The Transaction is expected to be accretive to

Crescent Point’s 2024 metrics, including adjusted funds flow and

excess cash flow per share. Over the Company’s five-year business

plan, the Transaction is expected to further strengthen Crescent

Point’s excess cash flow and return of capital profile by over 15

percent per share, on average, in addition to its current outlook

for mid-single digit organic growth. Crescent Point expects to

generate significant financial and operational synergies in the

near-term through lower general and administrative expenses and

capital costs. The Company will focus on realizing additional value

over time, including the efficient development of the acquired

assets by optimizing the number of wells drilled per section. The

Transaction also provides Crescent Point with an estimated $1.3

billion of tax pools.

- Creates

Seventh-Largest E&P in Canada by Production Volume (Weighted

65% to Oil and Liquids): Pro-forma production is expected

to total over 200,000 boe/d, with significant drilling inventory in

place to deliver additional long-term organic growth. Crescent

Point is expected to immediately become the largest owner of land

in the Alberta Montney’s volatile oil fairway, in addition to

already controlling the largest amount of land in the

condensate-rich Kaybob Duvernay play. This increased scale is

expected to allow the Company to continue to improve its cost of

capital.

All financial figures are approximate and in Canadian dollars

unless otherwise noted. This press release contains forward-looking

information and references to specified financial measures

including: excess cash flow, excess cash flow per share, adjusted

funds flow, leverage ratio, recycle ratio, base dividend and net

debt. Refer to the Specified Financial Measures section in this

press release for further information. Significant related

assumptions and risk factors, and reconciliations are described

under the Specified Financial Measures and Forward-Looking

Statements sections of this press release.

UPDATED PRELIMINARY 2024 GUIDANCE

Crescent Point’s revised 2024 preliminary guidance, which

incorporates the Transaction, includes estimated annual production

of 200,000 to 208,000 boe/d (65% oil and liquids) based on

development capital expenditures of $1.45 to $1.55 billion. This

budget is expected to generate over $1.2 billion of excess cash

flow at US$80/bbl WTI.

Approximately 80 percent of Crescent Point's 2024 budget is

expected to be allocated to its Alberta Montney and Kaybob

Duvernay plays, with the remaining capital allocated to the

Company's low-decline, long-cycle assets in Saskatchewan.

The revised capital expenditures budget incorporates

approximately $400 million of development capital associated with

the newly acquired assets, which are forecast to grow from

approximately 56,000 boe/d in 2024 to approximately 80,000 boe/d

within the Company’s five-year business plan. In addition to this

long-term growth, capital expenditures for the acquired assets are

expected to moderate subsequent to 2024, resulting in significant

excess cash flow generation.

The Company plans to release its formal 2024 guidance upon

closing of the Transaction, which is expected in December

2023.

FOCUS ON OPERATIONAL EXECUTION, BALANCE SHEET, AND

INCREASING RETURN OF CAPITAL

Crescent Point’s strategic priorities will continue to focus on

operational execution, balance sheet strength and increasing return

of capital to shareholders.

This Transaction builds on the operational momentum achieved by

the Company since its initial entry into the Kaybob Duvernay and

Alberta Montney. Crescent Point’s execution to date in these plays

has resulted in enhanced returns for shareholders through a

combination of realized efficiencies and enhanced productivity

through drilling and completion optimization. The Company plans to

build on this success with the announced Transaction.

Given the expected accretion from this Transaction, the Company

plans to increase its quarterly base dividend by 15 percent to

$0.115 per share, or to $0.46 per share annually, up from $0.40 per

share currently. This base dividend increase is subject to approval

from Crescent Point’s Board of Directors, the successful closing of

the Transaction and market conditions. It is expected to be

effective in connection with the first quarter 2024 dividend, which

is anticipated to be declared in early 2024.

Crescent Point’s net debt is expected to total approximately

$3.7 billion following the Transaction, or 1.4 times adjusted funds

flow. This leverage ratio is expected to improve to approximately

1.1 times by year-end 2024, at US$80/bbl WTI. As part of its

commitment to balance sheet strength, the Company has established a

near-term net debt target of $2.2 billion, or approximately 1.0

times adjusted funds flow at mid-cycle pricing.

The Company plans to continue to allocate approximately 60

percent of its excess cash flow to dividends and share repurchases

in the interim and plans to increase this allocation over time as

it further strengthens its balance sheet.

Over the long-term, Crescent Point continues to target a

leverage ratio of less than 1.0 times in a low commodity price

environment. To protect against commodity price volatility, the

Company will continue to hedge a portion of its production,

including approximately a third of its anticipated production in

2024, net of royalty interest.

TRANSACTION METRICS

Based on estimated production for the acquired assets of

approximately 56,000 boe/d in 2024, the Transaction metrics are as

follows, assuming US$80/bbl WTI, $3.50/mcf AECO, and $0.73 US$/CDN

exchange rate:

- 3.4 times annual net operating

income;

- $45,500 per flowing boe; and

- $8.25 per boe of Proved plus

Probable (“2P”) reserves of 308.7 MMboe, as estimated by the

independent evaluator McDaniel & Associates Consultants Ltd.,

as at November 1, 2023. Including approximately $2.7 billion of

undiscounted future development capital, the Transaction equates to

$16.93 per boe of 2P reserves, resulting in a recycle ratio of

approximately 2.2 times.

The net present value (“NPV”) of the Proved (“1P”) and 2P

reserves of the acquired assets total approximately $2.1 billion

and $3.4 billion respectively, based on independent engineering

evaluation and pricing as of fourth quarter 2023. The reserves

attributed to the acquired assets are based on 252 net booked

locations, or approximately a third of the total 800 internally

identified net premium drilling locations.

TRANSACTION FINANCING AND FINANCIAL

ADVISORS

Total consideration for the Transaction is approximately $2.55

billion, including approximately $455 million of Hammerhead’s net

debt. Hammerhead shareholders will receive $21.00 per fully diluted

common share of Hammerhead, through a combination of approximately

$1.5 billion in cash and 53.2 million common shares of

Crescent Point (approximately $548 million).

The Company plans to fund the cash portion of the Transaction

through its existing credit facilities, a new three-year term loan

totaling $750 million and approximately $500 million of gross cash

proceeds from an equity offering, as announced separately. The

closing of the Transaction is not conditional upon closing of the

term loan financing or the equity offering.

The Boards of Directors of both Crescent Point and Hammerhead

have unanimously approved the Transaction, which is subject to

court, Toronto Stock Exchange and other stock exchange and

regulatory approvals and other customary closing conditions.

The Agreement provides for mutual non-completion fees of $85

million in the event the Transaction is not completed or is

terminated by either party in certain circumstances.

Hammerhead shareholders, including certain directors and all of

the officers, holding an aggregate of approximately 82 percent of

Hammerhead shares outstanding, have entered into voting support

agreements with Crescent Point to vote in favour of the Transaction

and against any alternative or competing transaction.

Certain affiliates of Riverstone Holdings, LLC (collectively

“Riverstone”), Hammerhead’s largest shareholder, will own

approximately seven percent of Crescent Point’s pro forma issued

and outstanding common shares upon closing of the Transaction.

Riverstone has agreed to enter into a lock-up agreement upon the

closing of the Transaction whereby it will hold 50 percent of the

Crescent Point shares it receives pursuant to the Transaction for a

period of at least three months following the closing thereof and

hold the remaining 50 percent of the Crescent Point shares that it

receives pursuant to the Transaction for a period of at least six

months following the closing, subject to the provisions of such

lock-up agreement.

BMO Capital Markets and RBC Capital Markets are acting as

financial advisors to Crescent Point on the Transaction and have

each provided a verbal opinion to Crescent Point's Board of

Directors to the effect that, as of the date of each such opinion

and based upon and subject to the assumptions, limitations and

qualifications set forth therein, the consideration to be paid by

Crescent Point under the Agreement is fair from a financial point

of view to Crescent Point. Scotiabank is acting as strategic

advisor to Crescent Point.

The Bank of Nova Scotia, BMO Capital Markets and Royal Bank of

Canada are acting as co-lead arrangers and joint bookrunners on the

Company’s new term loan facility.

Norton Rose Fulbright Canada LLP is acting as legal advisor to

Crescent Point on the Transaction.

CONFERENCE CALL DETAILS

Crescent Point management will host a pre-recorded conference

call today, Monday, November 6, 2023, starting at 2:30 p.m. MT

(4:30 p.m. ET) to discuss the announced Alberta Montney

consolidation. A slide deck will accompany the conference call and

can be found on Crescent Point’s website.

Participants can listen to this event online via webcast.

The conference call can be accessed without operator assistance by

registering online to receive an instant automated call back.

Alternatively, the conference call can be accessed with operator

assistance by dialing 1‑888‑390‑0605. The webcast will be archived

for replay and can be accessed on Crescent Point’s conference calls

and webcasts webpage. The replay will be available approximately

one hour following completion of the call.

Shareholders and investors can also find a presentation on

Crescent Point's website, further highlighting details of the

Transaction.

ALBERTA MONTNEY LAND POSITION

The following graphic shows the acquired assets in relation to

Crescent Point’s existing land position in the Alberta Montney.

2024 PRELIMINARY GUIDANCE

|

|

Prior |

Revised |

|

Total Annual Average Production (boe/d) (1) |

145,000 - 151,000 |

200,000 - 208,000 |

|

|

|

|

|

Capital Expenditures |

|

|

|

Development capital expenditures ($ millions) |

$1,050 - $1,150 |

$1,450 - $1,550 |

|

Capitalized administration ($ millions) |

$40 |

$40 |

|

Total ($ millions) (2) |

$1,090 - $1,190 |

$1,490 - $1,590 |

1) The revised total annual average production

(boe/d) is comprised of approximately 65% Oil, Condensate &

NGLs and 35% Natural Gas. Assumes production of 56,000 boe/d (50%

oil and liquids) for the assets acquired as part of the

Transaction

2) Land expenditures and net property

acquisitions and dispositions are not included. Revised development

capital expenditures is allocated as follows: approximately 90%

drilling & development and 10% facilities & seismic

RETURN OF CAPITAL OUTLOOK

|

|

Prior |

Revised |

|

Base Dividend |

|

|

|

Current quarterly base dividend per share (1) |

$0.10 |

$0.115 |

|

Additional Return of Capital |

|

|

|

% of excess cash flow (2) |

60% |

60% |

1) The planned quarterly base dividend increase

to $0.115 per share is subject to approval from the Board of

Directors, the successful closing of the Transaction and market

conditions. This dividend increase is expected to be effective in

connection with the first quarter 2024 dividend

2) Total return of capital is based on a

framework that targets to return to shareholders approximately 60%

of excess cash flow

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor will there be

any sale of these securities, in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

The common shares offered in the equity offering described

herein will be offered to the public through certain underwriters

and their affiliates by way of a prospectus supplement (the

"Prospectus Supplement") to Crescent Point’s short form base shelf

prospectus dated November 3, 2023 (the "Prospectus")

filed with the securities regulatory authorities in each of the

provinces of Canada and included in its registration statement on

Form F-10 filed with the U.S. Securities and Exchange Commission

(“SEC”). The Offering is made only by the Prospectus. The

Prospectus contains important detailed information about the

securities being offered. Before investing, prospective purchasers

should read the Prospectus Supplement, the Prospectus and the

documents incorporated by reference therein for more complete

information about Crescent Point and the Offering.

A copy of the Prospectus is, and a copy of the Prospectus

Supplement will be, available free of charge on SEDAR+ at

www.sedarplus.com and on the SEC website at www.sec.gov/edgar.

Alternatively, copies may be obtained upon request in Canada by

contacting the Company at the contacts below.

Definitions / Specified Financial Measures

Throughout this press release, the Company uses the terms

"adjusted funds flow" (equivalent to "adjusted funds flow from

operations"), "excess cash flow", "excess cash flow per share",

"net debt", "leverage ratio" (equivalent to "net debt to adjusted

funds flow") "base dividends" and "recycle ratio". These specified

financial measures do not have any standardized meaning as

prescribed by International Financial Reporting Standards and,

therefore, may not be comparable with the calculation of similar

measures presented by other issuers.

The most directly comparable financial measure for adjusted

funds flow from operations and excess cash flow disclosed in the

Company's financial statements is cash flow from operating

activities, which, for the three and nine month periods ended

September 30, 2023, was $648.9 million and $1.58 billion

respectively. The most directly comparable financial measure for

net debt disclosed in the Company's financial statements is

long-term debt, which, for the nine month period ended September

30, 2023 was $2.95 billion. The most directly comparable financial

measure for base dividends disclosed in the Company’s financial

statements is dividends declared, which for the three and nine

month periods ended September 30, 2023 was $71.7 million and $143.6

million, respectively. For the quarter ended September 30, 2023,

adjusted funds flow, excess cash flow, discretionary excess cash

flow, net debt and base dividends were $687.1 million, $321.6

million, $268.6 million, $2.88 billion and $53.0 million,

respectively. For the nine month period ended September 30, 2023,

adjusted funds flow, excess cash flow, discretionary excess cash

flow, net debt and base dividends were $1.76 billion, $752.8

million, $590.3 million, $2.88 billion and $162.5 million,

respectively.

Excess cash flow forecasted for 2023 to 2024 is a

forward-looking non-IFRS measure and is calculated consistently

with the measures disclosed in the Company's MD&A. Refer to the

Specified Financial Measures section of the Company's MD&A for

the three and nine month periods ended September 30, 2023.

Excess cash flow per share is a non-IFRS ratio and calculated as

excess cash flow divided by the number of shares outstanding.

Excess cash flow per share presents a measure of financial

performance to assess the ability of the Company to finance

dividends, potential share repurchases, debt repayments and

returns-based growth. This measure is based on current shares

outstanding.

Recycle ratio is a non-IFRS ratio and is calculated as operating

netback before hedging divided by FD&A costs. Recycle ratios

may not be comparable year-over-year given significant changes

executed over the last three years. Recycle ratio is a common

metric used in the oil and gas industry and is used to measure

profitability on a per boe basis.

For an explanation of the composition of adjusted funds flow,

excess cash flow, excess cash flow per share, net debt, leverage

ratio and how they provide useful information to an investor and

qualitative reconciliations to the applicable IFRS measures, see

the Company's MD&A for the quarter ended September 30, 2023

available online at www.sedarplus.ca or EDGAR at www.sec.gov and on

our website at www.cresecent pointenergy.com. The section of the

MD&A entitled "Specific Financial Measures" is incorporated

herein by reference. There are no significant differences in

calculations between historical and forward-looking specific

financial measures. For an explanation of the calculation of

"recycle ratio" please see the “Reserves and Drilling Data"

advisory below.

Management believes the presentation of the specified financial

measures above provides useful information to investors and

shareholders as the measures provide increased transparency and the

ability to better analyze performance against prior periods on a

comparable basis. This information should not be considered in

isolation or as a substitute for measures prepared in accordance

with IFRS.

Notice to US Readers Regarding Oil and Gas

Disclosure

The oil and natural gas reserves contained in this press release

have generally been prepared in accordance with Canadian disclosure

standards, which are not comparable in all respects of United

States or other foreign disclosure standards. For example, the

United States Securities and Exchange Commission (the "SEC")

generally permits oil and gas issuers, in their filings with the

SEC, to disclose only proved reserves (as defined in SEC rules),

but permits the optional disclosure of "probable reserves" (as

defined in SEC rules). Canadian securities laws require oil and gas

issuers, in their filings with Canadian securities regulators, to

disclose not only proved reserves (which are defined differently

from the SEC rules) but also probable reserves, each as defined in

National Instrument 51-101 – Standards of Disclosure for Oil and

Gas Activities ("NI 51-101"). Accordingly, "proved reserves" and

"probable reserves" disclosed in this news release may not be

comparable to US standards, and in this news release, Crescent

Point has disclosed reserves designated as "proved plus probable

reserves". Probable reserves are higher-risk and are generally

believed to be less likely to be accurately estimated or recovered

than proved reserves. In addition, under Canadian disclosure

requirements and industry practice, reserves and production are

reported using gross volumes, which are volumes prior to deduction

of royalties and similar payments. The SEC rules require reserves

and production to be presented using net volumes, after deduction

of applicable royalties and similar payments. Moreover, Crescent

Point has determined and disclosed estimated future net revenue

from its reserves using forecast prices and costs, whereas the SEC

rules require that reserves be estimated using a 12-month average

price, calculated as the arithmetic average of the

first-day-of-the-month price for each month within the 12-month

period prior to the end of the reporting period. Consequently,

Crescent Point's reserve estimates and production volumes in this

news release may not be comparable to those made by companies using

United States reporting and disclosure standards. Further, the SEC

rules are based on unescalated costs and forecasts. All amounts in

the news release are stated in Canadian dollars unless otherwise

specified.

Forward-Looking Statements

This press release contains "forward-looking statements" and

"future oriented financial information" within the meaning of

applicable securities legislation, such as section 27A of the

Securities Act of 1933 and section 21E of the Securities Exchange

Act of 1934, and contains “forward-looking information” within the

meaning of applicable Canadian securities laws (collectively,

“forward-looking statements”). The Company has tried to identify

such forward-looking statements by use of such words as "could",

"should", "can", "anticipate", "expect", "believe", "will", "may",

"continues", "strategy", "potential", "grow", "estimate" and other

similar expressions, but these words are not the exclusive means of

identifying such statements.

In particular, this press release contains forward-looking

statements pertaining, among other things, to the following: the

expected benefits of the Transaction, including, but not limited to

the accretion to adjusted funds flow and excess cash flow per share

metrics, enhanced return of capital profile and a dominant position

in both the Alberta Montney and Kaybob Duvernay plays; the

Company's low-decline, long-cycle assets in Saskatchewan; the focus

of strategic priorities on continued operational execution, balance

sheet strength and increasing return of capital to the Company's

shareholders; the increase of total corporate premium drilling

inventory of over 20 years and the ability to achieve long-term

sustainable and attractive growth; the acquisition of 800 premium

Montney drilling locations in Alberta; the Company's return of

capital framework on a go-forward basis; the ability of the Company

to further increase shareholder returns; the expected increase to

the Company’s quarterly dividend and timing thereof; pro-forma

leverage ratio of 1.4 times adjusted funds flow following closing

and 1.1 times at year-end 2024 at US$80/bbl WTI; characteristics of

the acquired assets; the creation of the seventh-largest Canadian

energy producer and largest land owner in the Alberta Montney's

volatile oil fairway; limited expiry concerns; royalty

expectations, including favourable royalty rates; driving

operational synergies across the combined asset base with respect

to drilling and completion design, shared infrastructure, well-pad

development continuity and supply chain management efficiencies and

the ability of the Company to achieve such synergies following

closing; acquisition of decades of inventory with highly attractive

returns, capital efficiencies and finding and development costs,

which all rank in the top quartile within the Company's asset

portfolio; the Company's long-term sustainability and an attractive

organic growth profile; the expected 2024 production and growth of

the acquired assets within the Company's five-year plan; benefits

of long-term contracts in place, including, but not limited to

ensuring adequate market access for future scalability of liquids

and natural gas production; benefits of acquired infrastructure;

excess cash flow and return of capital per share expected to

increase by over 15 percent on average throughout five-year plan,

in addition to the per-share growth and significant return of

capital expected within Crescent Point's current outlook; expected

tax pools; asset cost structure; pro-forma corporate production;

significant drilling inventory in place to deliver additional

long-term organic growth; increased scale is expected to allow the

Company to continue to improve its cost of capital; 2024

preliminary guidance and the release thereof, which incorporates

the Transaction, including annual average production, oil and

liquids weighting and development capital expenditures; 2024 budget

allocation by area; development capital expenditures associated

with the newly acquired assets, which are forecast to grow from

approximately 56,000 boe/d in 2024 to 80,000 boe/d within the

five-year business plan; capital expenditures expected to moderate

throughout the five-year plan, resulting in significant excess cash

flow generation; expected allocation of the Company's 2024 budget;

timing to release formal 2024 guidance; expected accretion of the

Transaction; net debt and leverage ratio at closing and year end

2024; near term net debt target; plans to increase the allocation

of excess cash flow to dividend and share repurchases; return of

capital framework; long-term target leverage ratio; the ability of

the Company to extend and the effectiveness of its hedging;

anticipated funding of the cash portion of the Transaction; ability

of the Company to enter into the new three-year term loan; 1P and

2P reserves associated with the acquired assets; undiscounted

future development capital; NPV of the 1P and 2P reserves of the

acquired assets; 2024 preliminary guidance including, but not

limited to total annual average production (including expected oil,

condensate, NGLs and natural gas production), capital expenditures

(including development capital expenditures and capitalized

administration); and return of capital outlook, including base

dividend, and the additional return of capital targeted as a

percentage of excess cash flow.

Statements relating to "reserves" are also deemed to be

forward-looking statements, as they involve the implied assessment,

based on certain estimates and assumptions, that the reserves

described exist in the quantities predicted or estimated and that

the reserves can be profitably produced in the future. Actual

reserve values may be greater than or less than the estimates

provided herein. Unless otherwise noted, reserves referenced herein

are given as at December 31, 2022. Also, estimates of reserves and

future net revenue for individual properties may not reflect the

same confidence level as estimates and future net revenue for all

properties due to the effect of aggregation. All required reserve

information for the Company is contained in its Annual Information

Form for the year ended December 31, 2022 and in the

Company’s material change reports dated April 6, 2023 and September

1, 2023, each of which is accessible at www.sedarplus.ca and EDGAR

(accessible at www.sec.gov/edgar).

With respect to disclosure contained herein regarding resources

other than reserves, there is uncertainty that it will be

commercially viable to produce any portion of the resources and

there is significant uncertainty regarding the ultimate

recoverability of such resources.

All forward-looking statements are based on Crescent Point's

beliefs and assumptions based on information available at the time

the assumption was made. Crescent Point believes that the

expectations reflected in these forward-looking statements are

reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements

included in this report should not be unduly relied upon. By their

nature, such forward-looking statements are subject to a number of

risks, uncertainties and assumptions, which could cause actual

results or other expectations to differ materially from those

anticipated, expressed or implied by such statements, including

those material risks discussed in the Company's Annual Information

Form for the year ended December 31, 2022 under "Risk Factors" and

our Management's Discussion and Analysis for the year ended

December 31, 2022 under the headings "Risk Factors" and

"Forward-Looking Information" and the Management's Discussion and

Analysis for the three and six months ended September 30, 2023,

under the heading "Forward-Looking Information". The material

assumptions are disclosed in the Management's Discussion and

Analysis for the year ended December 31, 2022, under the headings

“Overview”, “Commodity Derivatives”, "Liquidity and Capital

Resources", "Critical Accounting Estimates" and "Guidance" and in

the Management's Discussion and Analysis for the three and nine

months ended September 30, 2023, under the headings

"Overview", "Commodity Derivatives", "Liquidity and Capital

Resources" and "Guidance". In addition, risk factors include: the

Transaction may not be completed, or may not be completed in a

timely manner; the Company may not receive all required approvals

to close the Transaction; the combined entity may fail to realize,

or may fail to realize in the expected timeframes, the anticipated

benefits resulting from the Transaction; risks related to the

integration of Hammerhead's business into the Company's existing

business, including that the Company's shareholders may be exposed

to additional business risks not previously applicable to their

investment; if the Transaction is not completed, the Company's

shareholders will not realize the anticipated benefits of the

Transaction and the Company's future business and operations could

be adversely affected; discrepancies between actual and estimated

production of the combined entity; changes in future commodity

prices relative to the Company's anticipated forecasts could have a

negative impact on the reserves attributable to the assets acquired

in the Transaction and, in particular, on the development of

undeveloped reserves and financial risk of marketing reserves at an

acceptable price given market conditions; volatility in market

prices for oil and natural gas, decisions or actions of OPEC and

non-OPEC countries in respect of supplies of oil and gas; delays in

business operations or delivery of services due to pipeline

restrictions, rail blockades, outbreaks, blowouts and business

closures; the risk of carrying out operations with minimal

environmental impact; industry conditions including changes in laws

and regulations including the adoption of new environmental laws

and regulations and changes in how they are interpreted and

enforced; uncertainties associated with estimating oil and natural

gas reserves; risks and uncertainties related to oil and gas

interests and operations on Indigenous lands; economic risk of

finding and producing reserves at a reasonable cost; uncertainties

associated with partner plans and approvals; operational matters

related to non-operated properties; increased competition for,

among other things, capital, acquisitions of reserves and

undeveloped lands; competition for and availability of qualified

personnel or management; incorrect assessments of the value and

likelihood of acquisitions and dispositions, and exploration and

development programs; unexpected geological, technical, drilling,

construction, processing and transportation problems; the impact of

severe weather events and climate change; availability of

insurance; fluctuations in foreign exchange and interest rates;

stock market volatility; general economic, market and business

conditions, including uncertainty in the demand for oil and gas and

economic activity in general and as a result of the COVID-19

pandemic; changes in interest rates and inflation; uncertainties

associated with regulatory approvals; geopolitical conflicts,

including the impacts of the war in Ukraine and the Middle East;

uncertainty of government policy changes; the impact of the

implementation of the Canada-United States-Mexico Agreement;

uncertainty regarding the benefits and costs of dispositions;

failure to complete acquisitions and dispositions; uncertainties

associated with credit facilities and counterparty credit risk;

changes in income tax laws, tax laws, crown royalty rates and

incentive programs relating to the oil and gas industry; the

wide-ranging impacts of the COVID-19 pandemic, including on demand,

health and supply chain; and other factors, many of which are

outside the control of the Company. The impact of any one risk,

uncertainty or factor on a particular forward-looking statement is

not determinable with certainty as these are interdependent and

Crescent Point's future course of action depends on management's

assessment of all information available at the relevant time.

Included in this press release are Crescent Point's 2024

guidance in respect of capital expenditures and average annual

production and five-year plan information and expectations which

are based on various assumptions as to production levels, commodity

prices and other assumptions and are provided for illustration only

and are based on budgets and forecasts that have not been finalized

and are subject to a variety of contingencies including prior

years' results. The Company's return of capital framework,

including the expected increase to the Company’s quarterly

dividend, is based on certain facts, expectations and assumptions

that may change and, therefore, this framework may be amended as

circumstances necessitate or require. To the extent such estimates

constitute a "financial outlook" or "future oriented financial

information" in this presentation, as defined by applicable

securities legislation, such information has been approved by

management of Crescent Point. Such financial outlook or future

oriented financial information is provided for the purpose of

providing information about management's current expectations and

plans relating to the future. Readers are cautioned that reliance

on such information may not be appropriate for other purposes.

Additional information on these and other factors that could

affect Crescent Point's operations or financial results are

included in Crescent Point's reports on file with Canadian and U.S.

securities regulatory authorities. Readers are cautioned not to

place undue reliance on this forward-looking information, which is

given as of the date it is expressed herein or otherwise. Crescent

Point undertakes no obligation to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless required to do so pursuant to

applicable law. All subsequent forward-looking statements, whether

written or oral, attributable to Crescent Point or persons acting

on the Company's behalf are expressly qualified in their entirety

by these cautionary statements.

Reserves and Drilling Data

Certain terms used herein but not defined are defined in NI

51-10, CSA Staff Notice 51-324 – Revised Glossary to NI 51-101

Standards of Disclosure for Oil and Gas Activities (“CSA Staff

Notice 51-324”) and/or the Canadian Oil and Gas Evaluation (“COGE”)

Handbook and, unless the context otherwise requires, shall have the

same meanings herein as in NI 51-101, CSA Staff Notice 51-324 and

the COGE Handbook, as the case may be.

This press release contains metrics commonly used in the oil and

natural gas industry, including "recycle ratio", and “future

development capital”. These terms do not have a standardized

meaning and may not be comparable to similar measures presented by

other companies and, therefore, should not be used to make such

comparisons. Readers are cautioned as to the reliability of oil and

gas metrics used in this press release. Management uses these oil

and gas metrics for its own performance measurements and to provide

investors with measures to compare the Company’s performance over

time; however, such measures are not reliable indicators of the

Company’s future performance, which may not compare to the

Company’s performance in previous periods, and therefore should not

be unduly relied upon.

Recycle ratio is calculated as operating netback divided by

finding and development (F&D) costs. Management uses recycle

ratio for its own performance measurements and to provide

shareholders with measures to compare the Company’s performance

over time.

Future development capital ("FDC") reflects the best estimate of

the cost required to bring undeveloped proved and probable reserves

on production. Changes in FDC can result from acquisition and

disposition activities, development plans or changes in capital

efficiencies due to inflation or reductions in service costs and/or

improvements to drilling and completion methods.

There are numerous uncertainties inherent in estimating

quantities of crude oil, natural gas and NGL reserves and the

future cash flows attributed to such reserves. The reserve and

associated cash flow information set forth above are estimates

only. In general, estimates of economically recoverable crude oil,

natural gas and NGL reserves and the future net cash flows

therefrom are based upon a number of variable factors and

assumptions, such as historical production from the properties,

production rates, ultimate reserve recovery, timing and amount of

capital expenditures, marketability of oil and natural gas, royalty

rates, the assumed effects of regulation by governmental agencies

and future operating costs, all of which may vary materially. For

these reasons, estimates of the economically recoverable crude oil,

NGL and natural gas reserves attributable to any particular group

of properties, classification of such reserves based on risk of

recovery and estimates of future net revenues associated with

reserves prepared by different engineers, or by the same engineers

at different times, may vary. The Company’s actual production,

revenues, taxes and development and operating expenditures with

respect to its reserves will vary from estimates thereof and such

variations could be material.

The estimates for reserves for individual properties may not

reflect the same confidence level as estimates of reserves for all

properties due to the effects of aggregation. This press

release contains estimates of the net present value of the

Company’s future net revenue from our reserves. Such amounts do not

represent the fair market value of our reserves. The recovery and

reserve estimates of the Company’s reserves provided herein are

estimates only and there is no guarantee that the estimated

reserves will be recovered.

This press release references more than 20 years of premium

drilling locations in the Corporation’s corporate inventory,

including booked and unbooked locations. Drilling locations exclude

wells that are currently being drilled or have been drilled and are

awaiting completion. Drilling locations are disclosed in two

categories: (i) net booked 2P locations; and (ii) unbooked

locations. Of the 800 drilling locations of Hammerhead identified

herein, 252 are net booked 2P locations and 548 are unbooked

locations, as assigned by independent evaluator McDaniel &

Associates Consultants Ltd. in its reserves report in respect of

Hammerhead assets dated effective November 1, 2023. Unbooked future

drilling locations are not associated with any reserves or

contingent resources and have been identified by the Company and

have not been audited by independent qualified reserves evaluators.

Unbooked locations have been identified by Crescent Point’s

management as an estimation of the Company’s multi‐year drilling

activities based on evaluation of applicable geologic, seismic,

engineering, production and reserves information. There is no

certainty that Crescent Point will drill all unbooked drilling

locations and if drilled there is no certainty that such locations

will result in additional oil and gas reserves or production. The

drilling locations on which Crescent Point actually drill wells

will ultimately depend upon a number of uncertainties and factors,

including, but not limited to, the availability of capital,

equipment and personnel, oil and natural gas prices, costs,

inclement weather, seasonal restrictions, drilling results,

additional geological, geophysical and reservoir information that

is obtained, production rate recovery, gathering system and

transportation constraints, the net price received for commodities

produced, regulatory approvals and regulatory changes. Expected

well performance comes from analyzing historical well productivity

within the geographic area outlined on the respective slides. The

expected well is an average of our future planned inventory.

NI 51-101 includes condensate within the product type of natural

gas liquids (NGLs). The Company has disclosed condensate separately

from other natural gas liquids in this press release since the

price of condensate as compared to other natural gas liquids is

currently significantly higher and the Company believes that

presenting the two commodities separately provides a more accurate

description of its operations and results therefrom. This press

release discloses potential net drilling locations, which are not

yet booked. The Company’s ability to drill and develop these

locations and the drilling locations on which the Company actually

drills wells depends on a number of uncertainties and factors,

including, but not limited to, the availability of capital,

equipment and personnel, oil and natural gas prices, costs,

inclement weather, seasonal restrictions, drilling results,

additional geological, geophysical and reservoir information that

is obtained, production rate recovery, gathering system and

transportation constraints, the net price received for commodities

produced, regulatory approvals and regulatory changes. As a result

of these uncertainties, there can be no assurance that the

potential future drilling locations that the Company has identified

will ever be drilled and, if drilled, that such locations will

result in additional crude oil, natural gas or NGLs produced. As

such, the Company’s actual drilling activities may differ

materially from those presently identified, which could adversely

affect the company’s business.

Where applicable, a barrels of oil equivalent ("boe") conversion

rate of six thousand cubic feet of natural gas to one barrel of oil

equivalent (6Mcf:1bbl) has been used based on an energy equivalent

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Given that the

value ratio based on the current price of crude oil as compared to

natural gas is significantly different than the energy equivalency

of the 6:1 conversion ratio, utilizing the 6:1 conversion ratio may

be misleading as an indication of value.

FOR MORE INFORMATION ON CRESCENT POINT ENERGY, PLEASE

CONTACT:

Shant Madian, Vice President, Capital Markets,

orSarfraz Somani, Manager, Investor

RelationsTelephone: (403) 693-0020 Toll-free (US and Canada):

888-693-0020 Fax: (403) 693-0070Address: Crescent Point Energy

Corp. Suite 2000, 585 - 8th Avenue S.W. Calgary AB T2P 1G1

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3f06e61-4e7f-4242-97b8-ea80f1d41ab1

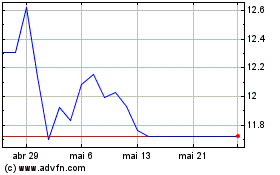

Crescent Point Energy (TSX:CPG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Crescent Point Energy (TSX:CPG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025