Helius Medical Technologies, Inc. (Nasdaq:HSDT) (“Helius” or the

“Company”), a neurotech company focused on delivering a novel

therapeutic neuromodulation approach for balance and gait deficits,

today announced results for the quarter ended September 30, 2023.

Third Quarter and Recent Business Updates

- Q3 2023 revenue

of $143 thousand, compared to $196 thousand in Q3 2022, the

decrease due to the expiration of the Patient Therapy Access

Program (“PTAP”) on June 30, 2023.

- Operating cash

burn of $2.5 million in Q3 2023, a decrease of $1.4 million

compared to Q3 2022, reflecting continued focus on cash

management.

- Ended the

quarter with $7.0 million of cash, cash equivalents, and proceeds

receivable from warrant exercises, extending the Company’s cash

runway into Q2 2024.

- Received

universal product code (“UPC”) numbers from Wolters Kluwer Health –

Medi-Span® (“Medi-Span”) for the Portable Neuromodulation

Stimulator (“PoNS®”) system and mouthpiece. Together with the

previously announced Durable Medical Equipment, Prosthetics,

Orthotics and Supplies (“DMEPOS”) accreditation, the UPC numbers

allow for dual paths of reimbursement.

- Received a

letter of intent (“LOI”) from the Québec Ministry of Health and

Social Services (“MSSS”) for the purchase of up to 30 PoNS systems

across multiple sites to be used to evaluate the benefit of PoNS

TherapyTM and determine reimbursement opportunities for stroke

patients.

- Received an

order for 10 PoNS Systems from the School of Rehabilitation at the

Université de Montréal (“UdeM”) to be used to evaluate the benefit

and health economic value of PoNS Therapy in the treatment of

stroke patients.

- Added sixth

Center of Excellence to the PoNS Therapeutic Experience Program

(“PoNSTEP”), a multi-center, company-sponsored, open label

observational interventional trial designed to evaluate the impact

of adherence to PoNS Therapy in patients with multiple sclerosis

(“MS”).

- Announced the

release of a white paper published by Pacific Blue Cross (“PBC”)

and HealthTech Connex (“HTC”) demonstrating that PoNS TherapyTM can

drastically decrease disability and improve the likelihood of

returning to work for patients suffering from traumatic brain

injury (“TBI”).

“We are pleased with the tremendous progress we

made in the third quarter and recent weeks,” said Dane Andreeff,

President and Chief Executive Officer of Helius. “We began the

third quarter with the successful conclusion of our Patient Therapy

Access Program, which expired on June 30. Through PTAP, we sold

PoNS to qualifying patients at a significant discount, thereby

reducing a major barrier to access while allowing us to add to our

ongoing MS patient registry. The registry collects important health

economic evidence to establish the value of PoNS on key clinical

and therapeutic outcomes, which is critical for third party

reimbursement. In September, we opened a second path toward

reimbursement in the U.S. by receiving UPC numbers for both the

PoNS system and mouthpiece and having the codes listed in the

Medi-Span database, as we also continue to pursue HCPCS codes for

reimbursement under our DMEPOS accreditation. As a result, we are

now in the position to begin negotiating with payers using the UPC

codes specific to the PoNS systems and mouthpieces with the listed

prices of $25,700 and $7,900, respectively.

We also developed relationships with two

important Canadian Healthcare providers, receiving an order for ten

PoNS systems from the School of Rehabilitation at the Université de

Montréal as well as a letter of intent from the Québec Ministry of

Health and Social Services to purchase thirty PoNS systems to treat

gait and/or balance deficit in stroke patients. We believe that

evidence from the treatment outcome will support the health

economic benefit and cost effectiveness of incorporating PoNS

Therapy as a first line treatment for stroke patients. Furthermore,

this evidence should provide a valuable benchmark for other

Canadian healthcare providers and private payers as they evaluate

reimbursement of PoNS Therapy. The data from these clinical

application trials will also provide supporting evidence of PoNS

Therapy’s therapeutic benefit that can strengthen the

registrational program for stroke currently ongoing in the

U.S.”

Andreeff continued, “Finally, we were thrilled

by the study results from the white paper recently published by

Pacific Blue Cross and HealthTech Connex demonstrating that PoNS

Therapy can drastically decrease disability in 89% of patients

suffering from long-term disability due to chronic TBI and promote

a sustainable return to work outcome for approximately 50% of these

patients. We believe that these findings will significantly

strengthen our reimbursement efforts with Canadian insurance

companies and healthcare providers while highlighting the health

economic benefit and cost effectiveness of PoNS Therapy as we

negotiate coverage with U.S. payers.”

“With what we’ve set in motion during 2023, and

a cash runway that will take us into the second quarter of next

year, we are excited about the road ahead, and the chance to help

more people with MS, TBI, and stroke who suffer from balance and

gait impairment,” concluded Andreeff.

Third Quarter 2023 Financial

Results

Total revenue for the third quarter of 2023 was

$143 thousand, a decrease of $53 thousand compared to $196 thousand

in the third quarter of 2022, primarily attributable to decreased

unit sales of PoNS systems in the U.S. following the termination of

the PTAP on June 30, 2023, partially offset by increased net

product sales in Canada.

Cost of revenue increased to $187 thousand for

the three months ended September 30, 2023, compared to $101

thousand for the comparable period in 2022, due to fixed overhead

costs, which are primarily comprised of salaries and benefits of

employees involved in management of the supply chain and certain

production costs.

Selling, general and administrative expenses for

the third quarter of 2023 were $2.2 million, a decrease of $1.2

million compared to $3.4 million in the third quarter of 2022,

primarily the result of a decrease in performance-based stock-based

compensation.

Research and development expenses for the third

quarter of 2023 decreased slightly to $722 thousand, compared to

$751 thousand in the third quarter of 2022.

Total operating expenses for the third quarter

of 2023 decreased to $3.1 million, compared to $4.9 million in the

third quarter of 2022.

Operating loss for the third quarter of 2023

decreased $1.7 million to a loss of $3.2 million, compared to an

operating loss of $4.9 million in the third quarter of 2022.

Net loss was $3.7 million for the third quarter

of 2023, compared to a net loss of $1.0 million in the

corresponding prior year period. The basic and diluted net loss per

share for the third quarter was $5.49 per share, compared to a net

loss of $2.90 per share for the third quarter of 2022.

Cash and Liquidity

Cash used in operating activities for the three

months ended September 30, 2023 was $2.5 million, a decrease of

$1.4 million compared to the third quarter of 2022, reflecting the

results of our continued focus on managing cash burn.

As of September 30, 2023, the Company had cash

of $6.6 million, compared to $14.5 million as of December 31, 2022.

The Company also had $0.4 million in proceeds receivable from

warrant exercises as of September 30, 2023, and now estimates its

cash runway extends into the second quarter of 2024.

The Company had no debt outstanding as of

September 30, 2023.

Conference Call

As previously announced, management will host a

conference call as follows:

|

Date: |

Thursday, November 9, 2023 |

|

|

|

|

Time: |

4:30 p.m. Eastern Time |

|

|

|

|

Toll free: |

800-225-9448 |

|

|

|

|

International: |

203-518-9708 |

|

|

|

|

Conference ID: |

HSDTQ323 |

|

|

|

|

Webcast: |

Click Here |

The webcast will be archived under the Newsroom

section of the Company’s investor relations website.

About Helius Medical Technologies,

Inc.

Helius Medical Technologies is a leading

neurotech company in the medical device field focused on neurologic

deficits using orally applied technology platform that amplifies

the brain’s ability to engage physiologic compensatory mechanisms

and promote neuroplasticity, improving the lives of people dealing

with neurologic diseases. The Company’s first commercial product is

the Portable Neuromodulation Stimulator. For more information about

the PoNS® or Helius Medical Technologies, visit

www.heliusmedical.com.

About the PoNS Device and PoNS

Therapy

The Portable Neuromodulation Stimulator (“PoNS”)

is an innovative, non-implantable, orally applied therapy that

delivers neurostimulation through a mouthpiece connected to a

controller and it’s used, primarily at home, with physical

rehabilitation exercise, to improve balance and gait. The PoNS

device, which delivers mild electrical impulses to the tongue, is

indicated for use in the United States as a short-term treatment of

gait deficit due to mild-to-moderate symptoms from multiple

sclerosis (“MS”) and is to be used as an adjunct to a supervised

therapeutic exercise program in patients 22 years of age and over

by prescription only.

PoNS has shown effectiveness in treating gait or

balance and a significant reduction in the risk of falling in

stroke patients in Canada, where it received authorization for sale

in three indications: (i) for use as a short-term treatment (14

weeks) of gait deficit due to mild and moderate symptoms from

stroke and is to be used in conjunction with physical therapy; (ii)

for use as a short-term treatment (14 weeks) of chronic balance

deficit due to mild-to-moderate traumatic brain injury (“mmTBI”)

and is to be used in conjunction with physical therapy; and (iii)

for use as a short-term treatment (14 weeks) of gait deficit due to

mild and moderate symptoms from MS and is to be used in conjunction

with physical therapy. PoNS is also authorized for sale in

Australia for short term use by healthcare professionals as an

adjunct to a therapeutic exercise program to improve balance and

gait. For more information visit www.ponstherapy.com.

Cautionary Disclaimer

Statement

Certain statements in this news release are not

based on historical facts and constitute forward-looking statements

or forward-looking information within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995 and Canadian

securities laws. All statements other than statements of historical

fact included in this news release are forward-looking statements

that involve risks and uncertainties. Forward-looking statements

are often identified by terms such as “believe,” “expect,”

“continue,” “will,” “goal,” “aim” and similar expressions. Such

forward-looking statements include, among others, statements

regarding the Company’s expected results from business and

financial performance in 2023, the sufficiency of the Company’s

future cash position, the development, commercialization and

success of the Company’s PoNS device and related treatment, future

decisions and approvals from applicable regulatory entities in the

U.S. and Canada, and the Company’s strategic operating plans.

There can be no assurance that such statements

will prove to be accurate and actual results and future events

could differ materially from those expressed or implied by such

statements. Important factors that could cause actual results to

differ materially from the Company’s expectations include

uncertainties associated with the Company’s capital requirements to

achieve its business objectives, disruptions in the banking system

and financial markets, lingering impacts of the COVID-19 pandemic,

the effect of macroeconomic conditions and the Company’s ability to

access capital markets, the Company’s ability to train physical

therapists in the supervision of the use of the PoNS Treatment, the

Company’s ability to secure contracts with rehabilitation clinics,

the Company’s ability to obtain national Medicare coverage and to

obtain a reimbursement code so that the PoNS device is covered by

Medicare and Medicaid, the Company’s ability to build internal

commercial infrastructure, secure state distribution licenses,

build a commercial team and build relationships with Key Opinion

Leaders, neurology experts and neurorehabilitation centers, market

awareness of the PoNS device, availability of funds, manufacturing,

labor shortage and supply chain risks, disruptions in the

manufacturing process of the PoNS device due to the transition to a

new manufacturer, the Company’s ability to maintain and enforce our

intellectual property rights, clinical trials and the clinical

development process, the product development process, the

regulatory submission review and approval process, the Company’s

operating costs and use of cash, and our ability to achieve

significant revenues, ongoing government regulation, and other

risks detailed from time to time in the “Risk Factors” section of

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2022, and its other filings with the United States

Securities and Exchange Commission and the Canadian securities

regulators, which can be obtained from either at www.sec.gov or

www.sedar.com.

The reader is cautioned not to place undue

reliance on any forward-looking statement. The forward-looking

statements contained in this news release are made as of the date

of this news release and the Company assumes no obligation to

update any forward-looking statement or to update the reasons why

actual results could differ from such statements except to the

extent required by law.

Investor Relations Contact

Lisa M. Wilson, In-Site Communications, Inc.T:

212-452-2793E: lwilson@insitecony.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Helius Medical Technologies, Inc. |

|

|

|

Unaudited Condensed Consolidated Statements of

Operations |

|

|

|

(in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Product sales, net |

$ |

132 |

|

|

$ |

195 |

|

|

$ |

482 |

|

|

$ |

497 |

|

|

Other revenue |

|

11 |

|

|

|

1 |

|

|

|

28 |

|

|

|

8 |

|

|

Total revenue |

|

143 |

|

|

|

196 |

|

|

|

510 |

|

|

|

505 |

|

|

Cost of revenue |

|

187 |

|

|

|

101 |

|

|

|

493 |

|

|

|

313 |

|

|

Gross profit (loss) |

|

(44 |

) |

|

|

95 |

|

|

|

17 |

|

|

|

192 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

2,196 |

|

|

|

3,393 |

|

|

|

7,639 |

|

|

|

8,673 |

|

|

Research and development expenses |

|

722 |

|

|

|

751 |

|

|

|

2,292 |

|

|

|

3,468 |

|

|

Amortization expense |

|

32 |

|

|

|

47 |

|

|

|

109 |

|

|

|

141 |

|

|

Goodwill and fixed asset impairment |

|

159 |

|

|

|

757 |

|

|

|

159 |

|

|

|

757 |

|

|

Total operating expenses |

|

3,109 |

|

|

|

4,948 |

|

|

|

10,199 |

|

|

|

13,039 |

|

|

Loss from operations |

|

(3,153 |

) |

|

|

(4,853 |

) |

|

|

(10,182 |

) |

|

|

(12,847 |

) |

|

Nonoperating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

68 |

|

|

|

(919 |

) |

|

|

257 |

|

|

|

(919 |

) |

|

Change in fair value of derivative liability |

|

(393 |

) |

|

|

5,489 |

|

|

|

2,051 |

|

|

|

5,489 |

|

|

Foreign exchange (loss) gain |

|

(192 |

) |

|

|

(747 |

) |

|

|

62 |

|

|

|

(910 |

) |

|

Other income (expense), net |

|

7 |

|

|

|

— |

|

|

|

7 |

|

|

|

1 |

|

|

Nonoperating income (expense), net |

|

(510 |

) |

|

|

3,823 |

|

|

|

2,377 |

|

|

|

3,661 |

|

|

Loss before provision for income taxes |

|

(3,663 |

) |

|

|

(1,030 |

) |

|

|

(7,805 |

) |

|

|

(9,186 |

) |

|

Provision for income taxes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net loss |

$ |

(3,663 |

) |

|

$ |

(1,030 |

) |

|

$ |

(7,805 |

) |

|

$ |

(9,186 |

) |

|

Loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(5.49 |

) |

|

$ |

(2.90 |

) |

|

$ |

(13.60 |

) |

|

$ |

(53.77 |

) |

|

Diluted |

$ |

(5.49 |

) |

|

$ |

(2.90 |

) |

|

$ |

(13.60 |

) |

|

$ |

(53.77 |

) |

|

Weighted average number of common shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

667,809 |

|

|

|

355,754 |

|

|

|

573,950 |

|

|

|

170,823 |

|

|

Diluted |

|

667,809 |

|

|

|

355,754 |

|

|

|

573,950 |

|

|

|

170,823 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Helius Medical Technologies, Inc. |

|

|

|

Unaudited Condensed Consolidated Balance

Sheets |

|

|

|

(in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

6,596 |

|

|

$ |

14,549 |

|

|

Accounts receivable, net |

|

94 |

|

|

|

71 |

|

|

Other receivables |

|

472 |

|

|

|

272 |

|

|

Inventory, net |

|

521 |

|

|

|

589 |

|

|

Prepaid expenses and other current assets |

|

893 |

|

|

|

1,216 |

|

|

Total current assets |

|

8,576 |

|

|

|

16,697 |

|

|

Property and equipment, net |

|

182 |

|

|

|

347 |

|

|

Intangible assets, net |

|

31 |

|

|

|

140 |

|

|

Operating lease right-of-use asset, net |

|

65 |

|

|

|

103 |

|

|

Total assets |

$ |

8,854 |

|

|

$ |

17,287 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

497 |

|

|

$ |

627 |

|

|

Accrued and other current liabilities |

|

849 |

|

|

|

1,280 |

|

|

Current portion of operating lease liabilities |

|

47 |

|

|

|

54 |

|

|

Current portion of deferred revenue |

|

42 |

|

|

|

27 |

|

|

Total current liabilities |

|

1,435 |

|

|

|

1,988 |

|

|

Operating lease liabilities, net of current portion |

|

23 |

|

|

|

56 |

|

|

Deferred revenue, net of current portion |

|

136 |

|

|

|

175 |

|

|

Derivative liability |

|

4,239 |

|

|

|

6,917 |

|

|

Total liabilities |

|

5,833 |

|

|

|

9,136 |

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Class A common stock, $0.001 par value; 150,000,000 shares

authorized; 687,799 and 563,974 shares issued and outstanding as of

September 30, 2023 and December 31, 2022,

respectively |

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

162,391 |

|

|

|

159,645 |

|

|

Accumulated deficit |

|

(158,912 |

) |

|

|

(151,107 |

) |

|

Accumulated other comprehensive loss |

|

(459 |

) |

|

|

(388 |

) |

|

Total stockholders' equity |

|

3,021 |

|

|

|

8,151 |

|

|

Total liabilities and stockholders' equity |

$ |

8,854 |

|

|

$ |

17,287 |

|

| |

|

|

|

|

|

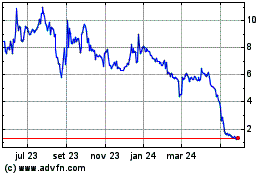

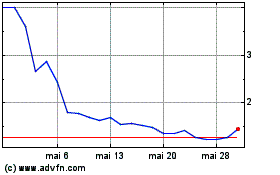

Helius Medical Technolog... (NASDAQ:HSDT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Helius Medical Technolog... (NASDAQ:HSDT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025