Element Fleet Management Corp. (TSX: EFN) (“Element” or the

“Company”) announced today that the Toronto Stock Exchange (the

“TSX”) has approved the Company’s notice of intention to renew its

normal course issuer bid (the “NCIB”) for its issued and

outstanding common shares (the “Common Shares”) in furtherance of

its capital return strategy.

Under the NCIB approved by the TSX, the Company

may purchase on the open market (or otherwise as permitted) up to

38,852,159 Common Shares, representing approximately 10% of the

“public float” of the Common Shares, at its discretion during the

period commencing on November 15, 2023 and ending on the earlier of

November 14, 2024 and the completion of purchases under the NCIB.

The actual number of Common Shares which may be purchased pursuant

to the NCIB and the timing of such purchases will be determined by

management of the Company, subject to applicable law and the rules

of the TSX.

Under the rules of the TSX, during the six

months ended October 31, 2023, the average daily trading volume of

the Common Shares on the TSX was 674,520, and, accordingly, daily

purchases on the TSX pursuant to the NCIB will be limited to

168,630 Common Shares, other than purchases made pursuant to the

block purchase exception. As of November 1, 2023, the Company had

389,064,826 Common Shares issued and outstanding and a “public

float” of 388,521,595 Common Shares.

Purchases made pursuant to the NCIB are expected

to be made through the facilities of the TSX or through alternative

trading systems in Canada, at prevailing market prices or as

otherwise permitted. The NCIB will be funded using existing cash

resources and any Common Shares repurchased by the Company under

the NCIB will be cancelled. The Company believes that the NCIB is

in the best interests of the Company and constitutes a desirable

use of its funds.

Under the current NCIB that commenced on

November 15, 2022 and will end on November 14, 2023, the Company

sought and obtained approval from the TSX to purchase up to

39,228,719 Common Shares for cancellation. For the period from

commencement of the current NCIB up to and including October 31,

2023, the Company repurchased for cancellation an aggregate of

3,984,022 Common Shares for approximately $73.9 million, including

commission, at a volume weighted average price of $18.56 per Common

Share.

The Company applies trade date accounting in

determining the date on which the share repurchase is reflected in

its consolidated financial statements. Trade date accounting is the

date on which management commits the Company to purchase the Common

Shares. Under the current NCIB, the Company has repurchased Common

Shares over the TSX and over alternative trading systems in

Canada.

The Company will also enter into an automatic

securities purchase plan (the “ASPP”) with an independent

designated broker in order to facilitate repurchases of Common

Shares. The ASPP has been approved by the TSX and will be entered

into effective as of or about November 13, 2023. Under the ASPP,

the Company’s independent designated broker may purchase Common

Shares under the NCIB at times when the Company would ordinarily

not be permitted to, due to its regular self-imposed blackout

periods. Before the commencement of any particular internal trading

black-out period, the Company may, but is not required to, instruct

its independent designated broker to make purchases of Common

Shares under the NCIB during the ensuing blackout period in

accordance with the terms of the NCIB. Such purchases will be

determined by the independent designated broker in its sole

discretion based on parameters established by the Company prior to

commencement of the applicable blackout period in accordance with

the terms of the ASPP and applicable TSX rules. Outside of these

blackout periods, Common Shares will continue to be purchasable by

the Company at its discretion under the NCIB.

The ASPP will terminate on the earliest of the

date on which: (a) the purchase limit specified in the ASPP has

been reached, (b) the purchase limit under the applicable NCIB has

been reached, (c) the Company terminates the ASPP in accordance

with its terms, in which case the Company will issue a press

release confirming such termination, and (d) the applicable NCIB

terminates.

About Element Fleet

Management

Element Fleet Management (TSX: EFN) is the

largest publicly traded pure-play automotive fleet manager in the

world, providing the full range of fleet services and solutions to

a growing base of loyal, world-class clients – corporates,

governments and not-for-profits – across North America, Australia

and New Zealand. Element enjoys proven resilient cash flow, a

significant proportion of which is returned to shareholders in the

form of dividends and share buybacks; a scalable operating platform

that magnifies revenue growth into earnings growth; and an evolving

capital-lighter business model that enhances return on equity.

Element’s services address every aspect of clients’ fleet

requirements, from vehicle acquisition, maintenance, accidents and

remarketing, to integrating EVs and managing the complexity of

gradual fleet electrification. Clients benefit from Element’s

expertise as the largest fleet solutions provider in its markets,

offering unmatched economies of scale and insight used to reduce

fleet operating costs and improve productivity and performance. For

more information, visit www.elementfleet.com/investors.

Forward-Looking Statements

This press release includes forward-looking

statements regarding Element and its business. Such statements are

based on the current expectations and views of future events of

Element’s management. In some cases the forward-looking statements

can be identified by words or phrases such as “may”, “will”,

“expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”,

“believe” or the negative of these terms, or other similar

expressions intended to identify forward-looking statements,

including, among others, statements regarding Element’s

enhancements to clients’ service experience and service levels;

enhancement of financial performance; improvements to client

retention trends; reduction of operating expenses; increases in

efficiency; EV strategy and capabilities; global EV adoption rates;

dividend policy and the payment of future dividends; creation of

value for all stakeholders; expectations regarding syndication;

growth prospects and expected revenue growth; level of workforce

engagement; improvements to magnitude and quality of earnings;

executive hiring and retention; focus and discipline in investing;

balance sheet management and plans to reduce leverage ratios;

anticipated benefits of the balanced scorecard initiative;

Element’s proposed share purchases, including the number of common

shares to be repurchased, the timing thereof; TSX acceptance of the

NCIB, any renewal thereof, and Element entering into the ASPP; and

expectations regarding financial performance. No forward-looking

statement can be guaranteed. Forward-looking statements and

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors which may

cause Element’s actual results, performance or achievements, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statement or information. Accordingly, readers

should not place undue reliance on any forward-looking statements

or information. Such risks and uncertainties include those

regarding the fleet management and finance industries, economic

factors and many other factors beyond the control of Element. A

discussion of the material risks and assumptions associated with

this outlook can be found in Element’s annual MD&A, and Annual

Information Form for the year ended December 31, 2022, each of

which has been filed on SEDAR+ and can be accessed at

www.sedarplus.com. Except as required by applicable securities

laws, forward-looking statements speak only as of the date on which

they are made and Element undertakes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events, or otherwise.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

Contact:

Rocco Colella

Director, Investor Relations

(437) 349-3796

rcolella@@elementcorp.com

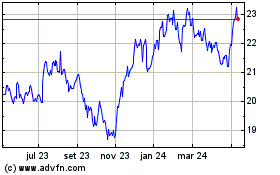

Element Fleet Management (TSX:EFN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

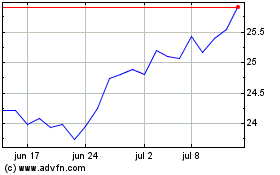

Element Fleet Management (TSX:EFN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025