Azimut Announces Initial Mineral Resource Estimate for the Patwon Gold Zone, Elmer Property, James Bay Region, Quebec

21 Novembro 2023 - 8:30AM

Azimut Exploration Inc. (“Azimut” or the

“Company”) (

TSXV: AZM)

(

OTCQX: AZMTF) is pleased to announce the

results of the initial mineral resource estimate (“MRE”) for the

Patwon Gold Zone on its 100% owned Elmer Property

in the Eeyou Istchee James Bay region of Quebec:

- Indicated

resources: 311,200

ounces in 4.99 million tonnes grading 1.93 g/t

Au

- Inferred

resources:

513,900

ounces in 8.22 million tonnes grading 1.94 g/t

Au

The MRE, prepared according to National

Instrument 43-101 (“NI 43-101”), confirms the quality of the gold

mineralization in the Patwon Zone and supports additional

exploration to further expand the mineral inventory. Two objectives

have been defined for the upcoming drilling program, which is

scheduled to commence in early 2024:

- Expand the

Patwon Gold Zone, which remains open near surface along

strike, using shallow drill holes from surface down to a vertical

depth of 300 metres; and

- Follow up on significant

gold-bearing zones along shear zones directly on strike or

subparallel to Patwon. The main drill-ready target zones have a

cumulative strike length of 20.5 kilometres.

HIGHLIGHTS (see Figures 1 to

6)

- The initial MRE

comprises:Open-pit mineral resources using a 0.55

g/t Au cut-off:Indicated: 309,200 ounces

(“oz”) in 4.97 million tonnes (“Mt”) grading 1.93 g/t AuInferred:

310,700 oz in 4.21

Mt grading 2.29 g/t AuBulk underground mineral

resources using a 1.05 g/t Au

cut-off:Inferred: 163,700

oz in 3.49 Mt grading 1.46 g/t AuSelective underground

mineral resources using a 1.90 g/t Au

cut-off:Indicated: 2,000 oz in 0.022 Mt

grading 2.83 g/t

AuInferred: 39,500

oz in 0.52 Mt grading 2.36 g/t Au

- As noted above, the MRE considers

three potential mining methods for Patwon. The MRE is based on

approximately 60,609 metres of diamond drill core in 167 holes

drilled by Azimut between November 2019 and March 2023. A complete

list of results is available on the following webpage: Elmer

Drilling Data.

- 3D modelling of the gold zone

indicates that Patwon remains open along strike and at depth.

Incremental drilling at shallow depth along strike could add

resources to the initial MRE. Patwon is currently defined along a

strike length of 600 metres, from surface to a

vertical depth of 860 metres (900 m

down-dip), with an average estimated true width of

35 metres and a dip of 75° to the north. The

open-pit resources are defined from surface to a maximum depth of

376 m. The key geologic features of the zone are described in Table

1 in the press release issued on June 29, 2023.

- A sensitivity analysis indicates

low variability of the MRE under various gold price and cut-off

grade scenarios, underscoring the robustness of the Patwon Gold

Zone.

- Preliminary metallurgical tests

indicate non-refractory free-milling gold that is easily

recoverable through a combination of gravity circuit and

conventional cyanide leaching. Recovery rates reach up to 94%, with

gravity recoveries up to 37%. (see press releases of May 4 and

November 21, 2021).

- Several target areas outside the

Patwon Zone have been tested by 15,554 metres of diamond drill

core in 75 holes drilled by Azimut. The results from these

programs have been very encouraging (see press release of June 29,

2023). Follow-up drilling is part of the work planned for

2024.

Table 1: Patwon Gold Zone – 2023 Mineral

Resource Estimate

|

Patwon Gold Project |

|

Bulk Underground Mineral Resource (at 1.05 g/t Au

cut-off) |

|

Category |

Tonnes |

Grade |

Ounces |

|

(t) |

(g/t Au) |

(oz Troy Au) |

|

Indicated |

|

|

|

|

Inferred |

3,496,000 |

1.46 |

163,700 |

|

Selective Underground Mineral Resource (at 1.9 g/t Au

cut-off) |

|

Category |

Tonnes |

Grade |

Ounces |

|

(t) |

(g/t Au) |

(oz Troy Au) |

|

Indicated |

22,000 |

2.83 |

2,000 |

|

Inferred |

520,000 |

2.36 |

39,500 |

|

Open-Pit Mineral Resource (at 0.55 g/t Au

cut-off) |

|

Category |

Tonnes |

Grade |

Ounces |

|

(t) |

(g/t Au) |

(oz Troy Au) |

|

Indicated |

4,972,000 |

1.93 |

309,200 |

|

Inferred |

4,212,000 |

2.29 |

310,700 |

|

Patwon Gold Project Total Resources |

|

Classification |

Tonnes |

Grade |

Ounces |

|

(t) |

(g/t Au) |

(oz Troy Au) |

|

Total Indicated |

4 994 000 |

1.93 |

311,200 |

|

Total Inferred |

8,228,000 |

1.94 |

513,900 |

Notes:

- These mineral resources are not

mineral reserves as they do not have demonstrated economic

viability. The MRE follows current CIM Definition Standards (2014)

and CIM MRMR Best Practice Guidelines (2019). A technical report

supporting the MRE will be filed within 45 days in accordance with

NI 43-101. The results are presented undiluted and are considered

to have reasonable prospects for eventual economic extraction

(“RPEEE”).

- The independent and qualified

persons (“QPs”) for the mineral resource estimate, as defined in NI

43-101, are Martin Perron, P.Eng., Chafana Hamed Sako, P.Geo., and

Simon Boudreau, P.Eng., all from InnovExplo Inc. The effective date

is November 14, 2023.

- The estimate encompasses six (6)

mineralized domains and one (1) dilution zone developed using

LeapFrog Geo and interpolated using LeapFrog Edge.

- 1.0-m composites were calculated

within the mineralized zones using the grade of the adjacent

material when assayed or a value of zero when not assayed.

High-grade capping on composites (supported by statistical

analysis) was set between 15.0 and 40.0 g/t Au for high-grade

envelopes, 0.2 and 12.5 g/t Au for lower-grade envelopes, and 1.0

g/t Au for the dilution envelope.

- The estimate was completed using a

sub-block model in Leapfrog Edge, with a parent block size of 4m x

4m x 4m (X,Y,Z) and a sub-block size of 1m x 1m x 1m (X,Y,Z).

- Grade interpolation was obtained by

the Inverse Distance Squared (ID2) method using hard

boundaries.

- Density values of 2.76 to 2.8 g/cm3

were assigned to all mineralized zones.

- Mineral resources were classified

as Indicated and Inferred. Indicated resources are defined with a

minimum of three (3) drill holes in areas where the drill spacing

is less than 20 m, and Inferred resources with two (2) drill holes

in areas where the drill spacing is less than 40 m and there is

reasonable geological and grade continuity.

- The MRE is locally pit constrained.

The out-pit resources meet the RPEEE requirement by applying

constraining volumes to all blocks (combined bulk and selective

underground long-hole extraction scenario) using Deswik Mineable

Shape Optimizer (DSO).

- The RPEEE requirement is satisfied

by having cut-off grades based on reasonable parameters for surface

and underground extraction scenarios, minimum widths, and

constraining volumes. The estimate is presented for potential

underground scenarios (realized in Deswik) over a minimum width of

2 m for blocks 20 to 24 m high by 16 to 20 m long at

a cut-off grade of 1.05 g/t Au for the bulk long-hole method (BLH)

and 1.90 g/t Au for the selective long-hole method (SLH). Cut-off

grades reflect the currently defined geometry and dip of the

mineralized envelopes. The potential open-pit component (OP) of the

2023 MRE is locally constrained by an optimized surface in GEOVIA

Whittle™ using a rounded cut-off grade of 0.55 g/t Au. The surface

cut-off grade was calculated using the following parameters: mining

cost = CA$3.55/t; mining overburden cost = CA$2.49/t; processing

cost = CA$22.00/t; G&A cost = CA$15.60/t; selling costs =

CA$5.00/t; gold price = US$1,800/oz; USD/CAD exchange rate = 1.30;

overburden slope angle = 30°; bedrock slope angle = 50°; and mill

recovery = 94%. The underground MRE was based on two mining

methods, the choice of which depends on the width of the

mineralization. The underground cut-off grade was calculated using

the following parameters: mining cost = CA$35.00/t (bulk long-hole)

to CA$95.00/t (selective long-hole); processing cost = CA$22.00/t;

G&A cost = CA$15.60/t; selling costs = CA$5.00/t; price =

US$1,800/oz; USD/CAD exchange rate = 1.30; and mill recovery =

94%.

- Cut-off grades should be

re-evaluated in light of future prevailing market conditions (metal

prices, exchange rates, mining costs etc.).

- The number of metric tons (tonnes)

was rounded to the nearest thousand, following the recommendations

in NI 43-101. The metal contents are presented in troy ounces

(tonnes x grade / 31.10348) rounded to the nearest hundred. Any

discrepancies in the totals are due to rounding effects.

- The QPs are not aware of any known

environmental, permitting, legal, title-related, taxation,

socio-political, or marketing issues or any other relevant issue

not reported in the Technical Report that could materially affect

the Mineral Resources Estimate.

Table 2: Patwon Gold Zone – Mineral

Resource Sensitivity to Cut-Off Grade

|

Gold Price(US$) |

Mining Method |

Cut-Off Grade(g/t Au) |

Indicated Resources |

Inferred Resources |

|

Tonnes(t) |

Grade (g/t Au) |

Ounces Au |

Tonnes(t) |

Grade (g/t Au) |

Ounces Au |

|

1,440 |

OP |

0.65 |

4,297,000 |

2.11 |

291,400 |

3,033,000 |

2.66 |

260,000 |

|

BLH |

1.30 |

0 |

0 |

0 |

2,543,000 |

1.68 |

137,000 |

|

SLH |

2.35 |

26,000 |

2.97 |

2,400 |

407,000 |

2.78 |

36,000 |

|

1,620 |

OP |

0.60 |

4,604,000 |

2.02 |

299,600 |

3,418,000 |

2.52 |

276,600 |

|

BLH |

1.15 |

0 |

0 |

0 |

3,218,000 |

1.54 |

159,400 |

|

SLH |

2.10 |

25,000 |

2.81 |

2,300 |

464,000 |

2.55 |

38,000 |

|

1,710 |

OP |

0.55 |

4,958,000 |

1.94 |

308,500 |

4,024,000 |

2.33 |

301,000 |

|

BLH |

1.10 |

0 |

0 |

0 |

3,266,000 |

1.51 |

158,200 |

|

SLH |

2.00 |

19,000 |

2.93 |

1,800 |

479,000 |

2.45 |

37,800 |

|

1,800 Base Case |

OP |

0.55 |

4,972,000 |

1.93 |

309,200 |

4,212,000 |

2.29 |

310,700 |

|

BLH |

1.05 |

0 |

0 |

0 |

3,496,000 |

1.46 |

163,700 |

|

SLH |

1.90 |

22,000 |

2.80 |

2,000 |

520,000 |

2.36 |

39,500 |

|

1,890 |

OP |

0.50 |

5,308,000 |

1.85 |

315,700 |

4,691,000 |

2.18 |

328,700 |

|

BLH |

1.00 |

0 |

0 |

0 |

3,678,000 |

1.41 |

166,800 |

|

SLH |

1.80 |

21,000 |

2.80 |

1,900 |

549,000 |

2.26 |

40,000 |

|

1,980 |

OP |

0.50 |

5,333,000 |

1.85 |

316,800 |

4,890,000 |

2.16 |

339,100 |

|

BLH |

0.95 |

0 |

0 |

0 |

3,851,000 |

1.36 |

168,000 |

|

SLH |

1.70 |

22,000 |

2.74 |

2,000 |

576,000 |

2.18 |

40,400 |

|

2,160 |

OP |

0.45 |

5,692,000 |

1.76 |

322,900 |

5,543,000 |

2.04 |

363,600 |

|

BLH |

0.85 |

0 |

0 |

0 |

4,760,000 |

1.22 |

186,500 |

|

SLH |

1.55 |

22,000 |

2.74 |

1,900 |

551,000 |

1.99 |

35,300 |

Notes: Numbers may not add up

due to rounding. The reader is cautioned that the figures provided

in Table 2 should not be interpreted as a statement of mineral

resources. Quantities and estimated grades for different gold

prices (and cut-off grades) are presented for the sole purpose of

demonstrating the sensitivity of the mineral resources model to the

selection of a specific gold price. OP: Open Pit /

BLH: Bulk Long-Hole / SLH:

Selective Long-Hole.

EXPLORATION UPSIDE

Azimut considers the 35-kilometre-long Elmer

Property to remain at an early exploration stage with strong gold

potential supported by the following salient features:

| |

1) |

A favourable

geological and structural context: |

|

|

|

- |

Archean greenstone belt dominated by felsic intrusions, felsic

volcanics and gabbroic sills |

| |

|

- |

Extensive shear zones along the

belt |

| |

|

- |

Low-grade greenschist metamorphic

window over a large part of the property |

| |

|

- |

Close to a major geological

subprovince boundary |

| |

2) |

The presence of numerous gold prospects outlining a highly

prospective area 12 kilometres long by 3 kilometres wide,

containing frequent high-grade gold values often accompanied by a

broad and consistent alteration footprint (Ag-Bi-Mo-Pb-S-Te-W);

and |

| |

3) |

A low level of

exploration maturity with limited follow-up drilling on many of the

property’s prospects. |

Main target zones

Four extensive target areas (Patwon East, Patwon

West, Wolf – A21, Gabbro) have been reassessed and prioritized for

follow-up drilling (see press release of June 29, 2023):

Patwon East

- A gold-bearing shear zone at least

2.3 kilometres long

- Good correlation with induced

polarization anomalies

- Ten (10) mineralized holes,

including:ELM22-225: 1.35

g/t Au over 8.87 m, including 15.30 g/t Au over

0.57 mELM21-088:

122.0 g/t Au, 160.0 g/t Ag, 307.0 g/t Te over

0.50 mELM22-202: 4.29

g/t Au over 0.95 m

Patwon West

- A gold-bearing shear zone at least

3.5 kilometres long

- Surface mineralization grading up

to 12.65 g/t Au (grab samples). Note that grab

samples are selective by nature and unlikely to represent average

grades.

- Two (2) holes with significant

mineralized

intercepts:ELM20-043: 1.90

g/t Au over 1.70

mELM20-045: 0.52

g/t Au over 1.50 m

Wolf – A21

- A 12-kilometre-long trend of

altered felsic volcanics, with gold-rich polymetallic potential

(Au, Cu, Zn, Ag volcanogenic target)

- Surface mineralization

grading:19.25 g/t Au over 1.00 m (channel

sample)12.03 g/t Au over 1.75 m (channel sample)Up

to 58.2 g/t Au (grab

samples)

- Seven (7) drill holes with

significant mineralized intercepts,

including:ELM21-107: 3.70

g/t Au over 0.70

mELM22-212: 0.30

g/t Au over 17.0 m, including 2.55 g/t Au over

1.00 m

Gabbro

- A gold-bearing shear zone at least

2.7 kilometres long

- Surface mineralization grading up

to 77.8 g/t Au, 167.0 g/t Ag (grab samples)

- Nine (9) holes with significant

mineralized intercepts,

including:ELM22-183: 1.06

g/t Au over 2.16

mELM22-185: 1.38

g/t Au over 1.50

mELM22-187: 0.40

g/t Au over 7.75 m, including 2.85 g/t Au over

0.75

mELM22-182: 2.51

g/t Au over 0.50 m

About the Elmer Property

The Elmer Property comprises 515 claims (271.3

km2) over a 35-kilometre strike length. It lies 285 kilometres

north of the town of Matagami, 60 kilometres east of the village of

Eastmain, and 5 kilometres west of the paved Billy-Diamond

Highway, a major all-season paved highway. The region benefits from

excellent infrastructure, including significant road access, a

hydroelectric power grid and airports.

Qualified Persons

InnovExplo Inc., a mining consulting firm based

in Val-d’Or (Quebec), prepared the MRE as defined by NI 43-101. The

independent QPs, within the meaning of NI 43-101, are Martin Perron

(P.Eng.), Chafana Hamed Sako (P.Geo.), and Simon Boudreau (P.Eng.),

all from InnovExplo Inc.

Dr. Jean-Marc Lulin (P.Geo.) prepared this press

release as Azimut’s QPs within the meaning of NI 43-101. Rock

Lefrançois (P.Geo.), Vice President Exploration, François

Bissonnette (P.Geo.), Operations Manager, Brigitte Dejou (P.Eng.),

Senior Consultant, and Lise Chénard (P.Eng.), Senior Consultant,

have also reviewed the content of this press release.

About Azimut

Azimut is a leading mineral exploration company

with a solid reputation for target generation and partnership

development. The Company holds the largest mineral exploration

portfolio in Quebec (Canada). Its wholly owned flagship project,

the Elmer Gold Project, has advanced to the

resource stage with a strong exploration upside. The Company also

controls a strategic land position for copper-gold, nickel and

lithium (see the document: Azimut in Numbers).

The Company uses a pioneering approach to big

data analytics (the proprietary AZtechMine™ expert

system) enhanced by extensive exploration know-how. Azimut’s

competitive edge is based on systematic regional-scale data

analysis and concurrently active projects. The Company maintains

rigorous financial discipline and a strong balance sheet, with 85.2

million shares issued and outstanding.

Contact and Information

Jean-Marc Lulin, President and

CEOTel.: (450) 646-3015

Jonathan Rosset, Vice President Corporate

DevelopmentTel: (604)

202-7531info@azimut-exploration.com

www.azimut-exploration.com

Cautionary note regarding forward-looking

statements

This press release contains forward-looking

statements, which reflect the Company’s current expectations

regarding future events related to the drilling results at the

Elmer Property. To the extent that any statements in this press

release contain information that is not historical, the statements

are essentially forward-looking and are often identified by words

such as “consider”, “anticipate”, “expect”, “estimate”, “intend”,

“project”, “plan”, “potential”, “suggest” and “believe”. The

forward-looking statements involve risks, uncertainties, and other

factors that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements.

There are many factors that could cause such differences,

particularly volatility and sensitivity to market metal prices, the

impact of changes in foreign currency exchange rates and interest

rates, imprecision in reserve estimates, recoveries of gold and

other metals, environmental risks, including increased regulatory

burdens, unexpected geological conditions, adverse mining

conditions, community and non-governmental organization actions,

changes in government regulations and policies, including laws and

policies, global outbreaks of infectious diseases, including

COVID-19, and failure to obtain necessary permits and approvals

from government authorities, as well as other development and

operating risks. Although the Company believes that the assumptions

inherent in the forward-looking statements are reasonable, undue

reliance should not be placed on these statements, which only apply

as of the date of this document. The Company disclaims any

intention or obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, other than as required to do so by applicable securities

laws. The reader is directed to carefully review the detailed risk

discussion in our most recent Annual Report filed on SEDAR+ for a

fuller understanding of the risks and uncertainties that affect the

Company’s business.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

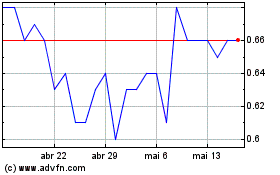

Azimut Exploration (TSXV:AZM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Azimut Exploration (TSXV:AZM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024