K92 Mining Inc. (“

K92” or

the “

Company”) (TSX:

KNT;

OTCQB:

KNTNF) is pleased to announce results

from the updated resource estimate completed on the Kora and Judd

deposits, at its producing Kainantu Gold Mine in Papua New Guinea.

The resource estimate is based on surface and underground

exploration diamond drilling and underground face sampling. The

focus of exploration at Kora and Judd since the previous resource

estimates (previous effective date of October 31, 2021 for Kora and

December 31, 2021 for Judd) has been predominantly on resource

growth.

Kora and Judd Deposit Mineral Resource

Estimate Highlights

- Kora Measured and Indicated

Resource of 2.3 million ounces at 10.24 g/t gold equivalent

(“AuEq”)(1), representing an +8%

increase from the previous resource estimate of 2.1 million ounces

in October 2021.

- Kora Inferred Resource has

increased substantially to 3.9 million ounces at 8.60 g/t AuEq,

representing a +58% increase from the previous resource estimate of

2.5 million ounces in October 2021. This has resulted primarily

from successful drilling of the southern extensions of the K1 and

K2 lodes.

- Judd Measured and Indicated

Resource of 0.35 million ounces at 8.68 g/t

AuEq(1), representing an increase

of +167% from the previous resource estimate of 0.13 million ounces

in December 2021.

- Judd Inferred Resource of

0.56 million ounces at 7.72 g/t AuEq, representing a +211% increase

from the previous resource estimate of 0.18 million ounces in

December 2021. The increase in the Judd resource has been the

result of a significant amount of drilling since the last resource,

with drill defined strike length extended +130% since the end of

2021.

- Significant component of

the updated Kora and Judd Mineral Resource are high grade (see Fig

3, 4, 7 and 8).

- Excellent reconciliation

between mill feed and the updated resource model with a 1%

difference in gold ounces. Depletion from the previous resource

based on production was approximately 900 kt at 10.4 g/t AuEq (7.9

g/t Au, 0.68% Cu, 12 g/t Ag) or 300 koz AuEq contained

metal(2).

Resource Growth Opportunities and

Exploration Targets

- Significant expansion

potential at both the Kora and Judd vein systems. The Kora vein

system is open along strike and at depth, with exploration focused

on Kora, Kora South and Kora Deeps target areas. The Judd vein

system is open in all directions, with drilling focused on Judd,

Judd South and Judd Deeps target areas. Drilling plans to commence

at Kora South Deeps and Judd South Deeps in 2024 (see Fig 10 and

11).

- In addition to the Kora and

Judd vein systems, there are multiple near-mine high-priority

exploration areas including: Arakompa, Maniape and Karempe.

Drilling at Arakompa is planned to commence in late-2023 / Q1 2024

(see Fig 12).

- Multiple highly prospective

porphyry targets also being explored, with drilling at the A1

Porphyry target underway. The Blue Lake Porphyry deposit which

hosts a 10.8 million ounces AuEq / 4.7 billion pounds inferred

resource (see August 9, 2022 press release) is open at depth and

the Company plans to follow-up with a third, deeper

program.

- Currently up to 11 drill

rigs operating and in October 2023, K92 increased its exploration

budget to a record of US$20 million.

Note (1): Cut-Off of

3 g/t gold equivalent.Note (2): Based on production recorded from

the beginning of Q4 2021 to the end of Q3 2023.

Table 1 – Global Kora and Judd Mineral

Resource (Effective Date September 12, 2023, 3 g/t gold equivalent

cut-off)

|

|

Tonnes |

Gold |

Silver |

Copper |

AuEq |

|

|

Mt |

g/t |

moz |

g/t |

moz |

% |

kt |

g/t |

moz |

|

Kora |

|

|

|

|

|

|

|

|

|

|

Measured |

3.7 |

8.74 |

1.0 |

20.5 |

2.5 |

1.21 |

45.0 |

10.96 |

1.3 |

|

Indicated |

3.1 |

6.99 |

0.7 |

21.9 |

2.2 |

1.31 |

41.3 |

9.40 |

1.0 |

|

Total M&I |

6.9 |

7.94 |

1.8 |

21.1 |

4.7 |

1.25 |

86.2 |

10.24 |

2.3 |

|

Inferred |

14.3 |

5.60 |

2.6 |

28.7 |

13.2 |

1.62 |

231.2 |

8.60 |

3.9 |

|

|

|

|

|

|

|

|

|

|

|

|

Judd |

|

|

|

|

|

|

|

|

|

|

Measured |

0.4 |

9.05 |

0.12 |

19.0 |

0.25 |

0.80 |

3.2 |

10.58 |

0.14 |

|

Indicated |

0.8 |

6.37 |

0.17 |

15.6 |

0.42 |

0.73 |

6.2 |

7.76 |

0.21 |

|

Total M&I |

1.2 |

7.24 |

0.29 |

16.7 |

0.67 |

0.75 |

9.4 |

8.68 |

0.35 |

|

Inferred |

2.3 |

6.27 |

0.45 |

15.8 |

1.15 |

0.76 |

17.2 |

7.72 |

0.56 |

|

|

|

|

|

|

|

|

|

|

|

|

Kora and Judd |

|

|

|

|

|

|

|

|

|

|

Measured |

4.1 |

8.77 |

1.2 |

20.4 |

2.7 |

1.17 |

48.2 |

10.92 |

1.5 |

|

Indicated |

4.0 |

6.86 |

0.9 |

20.6 |

2.6 |

1.19 |

47.4 |

9.05 |

1.2 |

|

Total M&I |

8.1 |

7.83 |

2.0 |

20.5 |

5.3 |

1.18 |

95.6 |

10.00 |

2.6 |

|

Inferred |

16.5 |

5.69 |

3.0 |

27.0 |

14.3 |

1.50 |

248.3 |

8.48 |

4.5 |

- The Independent and Qualified

Person responsible for the Mineral Resource estimate is Simon Tear,

P.Geo. of H & S Consultants Pty. Ltd., Sydney, Australia, and

the effective date of the estimate is September 12, 2023.

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability.

- Geological interpretation has

generated a series of narrow, sub-vertical vein structures based on

delineated wireframes on 10m, 20m and 25m spaced cross sections.

The design of the lode wireframes is based on a combination of

logged geology, Au, Cu & Ag assay grades and locally on a

nominal minimum mining width of 5.2m, all coupled with geological

sense.

- Resources were compiled at 3 g/t

gold equivalent cut-off grades for Kora and Judd.

- Density (t/m3) was modelled using

Ordinary Kriging on 2,778 sample measurements. Areas within the

mineral wireframes where no density grades were interpolated had

average default values inserted at appropriate levels.

- Reported tonnage and grade figures

are rounded from raw estimates to reflect the order of accuracy of

the estimate.

- Minor variations may occur during

the addition of rounded numbers.

- Estimations used metric units

(metres, tonnes and g/t).

- Gold equivalents are calculated as AuEq = Au g/t + Cu%*1.6481+

Ag g/t*0.0114. Gold price US$1,700/oz; Silver US$22.5/oz; Copper

US$4.00/lb. Metal payabilities and recoveries are incorporated into

the AuEq formula. Recoveries of 95% for copper and 80% for silver

were used.

John Lewins, K92 Chief Executive Officer and

Director, stated, “The updated Kora and Judd Resource estimate has

significantly exceeded our expectations for both the Measured and

Indicated resource and the Inferred resource. The combined Kora and

Judd Measured and Indicated resource increased +13%, net of

depletion, to 8.1 million tonnes at 10.00 g/t AuEq for 2.6 million

ounces AuEq, and the Inferred resource increased +70%, net of

depletion, to 16.5 million tonnes at 8.48 g/t AuEq for 4.5 million

ounces AuEq. When comparing the updated resource model’s depletion

to mill actuals, Kainantu has delivered a gold reconciliation

in-line with the updated resource model within 1%.

Importantly, the resource growth was also

achieved expeditiously, over a period of less than two years and at

discovery cost of less than US$7.5 per ounce gold equivalent. This

was driven by the strong continuity of the Kora and Judd vein

systems, with almost all holes intersecting the mineralized

structure.

Looking ahead, exploration at the Kora and Judd

vein systems will remain a major focus, with drilling targeting

multiple highly prospective target areas concurrently, including

Kora, Kora South, Kora Deeps, Judd, Judd South and Judd Deeps. Kora

Deeps and Judd Deeps have only recently commenced drilling from the

twin incline, and the initial reported results from this area via

Judd underground development in late-Q3 have been very promising,

including 4.6 m at 14.89 g/t AuEq and 6.8 m at 11.77 g/t AuEq from

channel sampling in an area previously sparsely drilled and

interpreted to be waste. Later in 2024, exploration plans to

commence at Kora South Deeps and Judd South Deeps, also from the

twin incline.

Beyond the Kora and Judd vein systems, there are

multiple highly prospective areas for resource growth near mine

infrastructure, including Arakompa, Maniape and Karempe.

Exploration pad construction at Arakompa, which hosts a historic

resource of 800 koz at 9.0 g/t Au, is underway with plans to

commence drilling near-term. Porphyry exploration continues to

progress, with drilling underway at A1 and plans for follow-up

drilling at the Blue Lake Porphyry in the medium term. Blue Lake

hosts an Inferred Resource of 10.8 moz AuEq or 4.7 blbs CuEq.

Recently, in October 2023, K92 increased its

exploration expenditure guidance to US$20 million. This was driven

by our conviction in the geological potential of the Kainantu

Project and we look forward to announcing results from multiple

target areas near-term in addition to operational announcements as

we transform Kainantu into a Tier 1 Mid-Tier producer over the next

18 months with construction of the Stage 3 and 4 Expansions

underway.”

Key Assumptions and

Parameters

Underground drilling consists of diamond core

for a range of core sizes depending on the length of hole and

expected ground conditions. Sampling is sawn half core under

geological control and generally ranges between 0.5m to 1.0m.

Underground face sampling is completed for every fired round and is

to industry standard. QAQC data indicated no significant issues

with the sampling or the accuracy of the on-site analysis. Current

core recovery of the mineral zone is +95%, with initial drilling

recoveries around the 90% mark.

Geological logging is consistent and is based on

a full set of logging codes covering lithology, alteration, and

mineralization. All sampling and analytical work for the mine

exploration program is performed by Intertek Testing Services (PNG)

LTD, an independent accredited laboratory that is located on site.

External check assays for QA/QC purposes are performed at SGS

Australia Pty Ltd in Townsville, Queensland, Australia.

The geological interpretation of the vein

systems is represented as 3D wireframe solids snapped to a

combination of diamond drillhole data and underground face sampling

(see Fig 1 and 5). Definition of the wireframes is based on

identified gold (and copper and silver) mineralization in drill

core nominally at a 0.1-0.2 g/t Au gold cut-off in conjunction with

geological control/sense and current mining widths. The Kora Link

is a broader zone of more variably continuous mineralization and

butts onto both the K1 and K2 lodes in various places. A total of 4

lodes were delineated for the Judd deposit, with a dominant J1 lode

and subordinate parallel lodes for J2, J3 and J1W.

The wireframes were used to extract 1-metre

‘best-fit’ composites (minimum of 0.5m) from the drillhole &

sampling database for gold, copper and silver. A total of 30,791

composites were used in the grade interpolation, 24,925 for Kora

and 5,866 for Judd. A gold top cut of 1000 g/t was applied to K2, a

400 g/t top cut was applied to the Kora Link and a 400 g/t top cut

was applied for the Judd composites. A top cut of 300 g/t was

applied to the silver composites but no top cuts was applied to the

copper composites. Variography was good for the mined areas of K1

and J1 (due to the face sampling) but only moderate to poor for

other areas, as would likely be expected for the style of

mineralization.

Grade interpolation of the composite data was

completed using Ordinary Kriging with a block size of 1m (X

direction) by 5m (Y direction) by 5m (Z direction). A larger block

size check model for Kora indicated no evidence of over-smoothing

of the gold grade with the smaller block size. A check model

excluding the face sampling data indicated no significant

difference in gold grade for the measured and indicated estimates

at Kora.

Density data was modelled using Ordinary Kriging

on a total of 2,778 sample measurements for the different lodes.

Density values were determined using the weight in air/weight in

water method (Archimedes Principle) on single pieces of

representative core. Default average density values were applied to

the different lodes where there was a lack of modelled data.

Average density for the global estimates are 2.77t/m3 for Kora and

2.61t/m3 for Judd.

A three-pass search strategy was used for the

grade interpolation. Search ellipse parameters are listed below. 4

search domains with varying ellipsoid orientations were used for

both of K1 and K2 with the search ellipse orientations generally

reflecting the subtle changes in dip and strike of the vein

systems. The much smaller Kora Link Lode required only 2 search

domains as did the J1 and J2 lodes at Judd.

Table 2 – Mineral Resource Search

Ellipse Pass Specifications

|

Pass No |

X radius(m) |

Y radius(m) |

Z radius(m) |

Min Data |

Min Octants |

Max Data |

|

1 |

2 |

25 |

25 |

12 |

4 |

32 |

|

2 |

4 |

50 |

50 |

12 |

4 |

32 |

|

3 |

12 |

125 |

125 |

6 |

2 |

32 |

Allocation of the classification of the Mineral

Resources is derived from the search pass numbers produced from the

grade interpolation which essentially is a function of the

drillhole and face sample data point distribution. Additional

considerations were included in the assessment of the

classification; in particular, the geological understanding and

complexity of the deposit, sample recovery, quality of the QAQC

sampling and outcomes, density data, check models and

reconciliation with production. Defined shapes were used to better

define the Measured Resource distribution (i.e. the removal of the

‘spotted dog’ effect).

Table 3 – Resource Classification by

Pass Category

|

Pass Category |

Resource Classification |

|

1 |

Measured |

|

2 |

Indicated |

|

3 |

Inferred |

All material mined within the mineral wireframes

up to the effective date has been removed from the resource model.

Gold reconciliation of the new resource model with the global mill

feed material up to the end of the third quarter for 2023 has been

reasonably good with the difference in gold ounces from the mill

being within ~1% of that estimated by the model.

The Inferred Mineral Resources in this estimate

have a lower level of confidence than that applied to an Indicated

Mineral Resource and must not be converted to a Mineral Reserve. It

is reasonably expected that the majority of the Inferred Mineral

Resource could be updated to an Indicated Mineral Resource with

continued exploration.

Gold equivalents are calculated as AuEq = Au g/t

+ Cu%*1.6481+ Ag g/t*0.0114. Gold price US$1,700/oz; Silver

US$22.5/oz; Copper US$4.00/lb. Metal payabilities and recoveries

are incorporated into the AuEq formula. Recoveries of 95% for

copper and 80% for silver.

The estimate of Mineral Resources may be

materially affected by environmental, permitting, legal, title,

taxation, socio-political, marketing, or other relevant issues.

Mineral Resources, which are not Mineral

Reserves, do not have demonstrated economic viability.

It is anticipated that the updated Mineral

Resource estimate will not result in a material change to the

mineral reserve estimate set forth in the Technical Report entitled

“Independent Technical Report, Kainantu Gold Mine Integrated

Development Plan, Kainantu Project, Papua New Guinea” with an

effective date of January 1, 2022 (the “IDP Technical Report”). In

addition, the increase to the Measured and Indicated mineral

resources and inferred mineral resources will not materially impact

the design parameters and conclusions outlined in the Kainantu

Stage 3 Expansion Definitive Feasibility Study Case or Kainantu

Stage 4 Expansion Preliminary Economic Assessment Case of the IDP

Technical Report. However, as a result of the updated Mineral

Resource estimate, the Company expects the potential mine life to

be extended for both the Stage 3 Expansion Definitive Feasibility

Study Case and Stage 4 Expansion Preliminary Economic Assessment

Case.

Qualified Persons

K92 mine geology manager and mine exploration

manager, Andrew Kohler, MAIG, a qualified person under the meaning

of Canadian National Instrument 43-101 – Standards of Disclosure

for Mineral Projects, has reviewed and is responsible for the

technical content of this news release. Data verification by Mr.

Kohler includes significant time onsite reviewing drill core, face

sampling, underground workings, and discussing work programs and

results with geology and mining personnel.

Simon Tear, P.Geo of H & S Consultants Pty.

Ltd. of Sydney, Australia is a Qualified Person as defined under NI

43-101 for the Mineral Resource estimate discussed above. Mr. Tear

has reviewed and approved the contents of this press release in

relation to the Mineral Resources.

About K92

K92 Mining Inc. is engaged in the production of

gold, copper and silver at the Kainantu Gold Mine in the Eastern

Highlands province of Papua New Guinea, as well as exploration and

development of mineral deposits in the immediate vicinity of the

mine. The Company declared commercial production from Kainantu in

February 2018 and is in a strong financial position. A maiden

resource estimate on the Blue Lake copper-gold porphyry project was

completed in August 2022. K92 is operated by a team of mining

company professionals with extensive international mine-building

and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

For further information, please contact David

Medilek, P.Eng., CFA, President at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain “forward-looking

statements” under applicable Canadian securities legislation. Such

forward-looking statements include, without limitation: (i) the

results of the Kainantu Mine Definitive Feasibility Study, and the

Kainantu 2022 Preliminary Economic Assessment, including the Stage

3 Expansion, a new standalone 1.2 mtpa process plant and supporting

infrastructure; (ii) statements regarding the expansion of the mine

and development of any of the deposits; (iii) the Kainantu Stage 4

Expansion, operating two standalone process plants, larger surface

infrastructure and mining throughputs; and (iv) the potential

extended life of the Kainantu Mine.

All statements in this news release that address

events or developments that we expect to occur in the future are

forward-looking statements. Forward-looking statements are

statements that are not historical facts and are generally,

although not always, identified by words such as “expect”, “plan”,

“anticipate”, “project”, “target”, “potential”, “schedule”,

“forecast”, “budget”, “estimate”, “intend” or “believe” and similar

expressions or their negative connotations, or that events or

conditions “will”, “would”, “may”, “could”, “should” or “might”

occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made. Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and

unknown risks, uncertainties and other factors, many of which are

beyond our ability to control, that may cause our actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

information. Such factors include, without limitation, Public

Health Crises, including the COVID-19 virus; changes in the price

of gold, silver, copper and other metals in the world markets;

fluctuations in the price and availability of infrastructure and

energy and other commodities; fluctuations in foreign currency

exchange rates; volatility in price of our common shares; inherent

risks associated with the mining industry, including problems

related to weather and climate in remote areas in which certain of

the Company’s operations are located; failure to achieve

production, cost and other estimates; risks and uncertainties

associated with exploration and development; uncertainties relating

to estimates of mineral resources including uncertainty that

mineral resources may never be converted into mineral reserves; the

Company’s ability to carry on current and future operations,

including development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; the Company’s ability to meet or achieve

estimates, projections and forecasts; the availability and cost of

inputs; the availability and costs of achieving the Stage 3

Expansion or the Stage 4 Expansion; the ability of the Company to

achieve the inputs the price and market for outputs, including

gold, silver and copper; failures of information systems or

information security threats; political, economic and other risks

associated with the Company’s foreign operations; geopolitical

events and other uncertainties, such as the conflicts in Ukraine,

Israel and Palestine; compliance with various laws and regulatory

requirements to which the Company is subject to, including

taxation; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions, including relationship with the communities

in Papua New Guinea and other jurisdictions it operates; other

assumptions and factors generally associated with the mining

industry; and the risks, uncertainties and other factors referred

to in the Company’s Annual Information Form under the heading “Risk

Factors”.

Estimates of mineral resources are also

forward-looking statements because they constitute projections,

based on certain estimates and assumptions, regarding the amount of

minerals that may be encountered in the future and/or the

anticipated economics of production. The estimation of mineral

resources and mineral reserves is inherently uncertain and involves

subjective judgments about many relevant factors. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. The accuracy of any such estimates is a function of the

quantity and quality of available data, and of the assumptions made

and judgments used in engineering and geological interpretation,

Forward-looking statements are not a guarantee of future

performance, and actual results and future events could materially

differ from those anticipated in such statements. Although we have

attempted to identify important factors that could cause actual

results to differ materially from those contained in the

forward-looking statements, there may be other factors that cause

actual results to differ materially from those that are

anticipated, estimated, or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

CAUTIONARY NOTE TO U.S. READERS

CONCERNING ESTIMATES OF MINERAL RESERVES AND MINERAL

RESOURCES

Information concerning the properties and

operations of K92 has been prepared in accordance with Canadian

standards under applicable Canadian securities laws and may not be

comparable to similar information for United States companies. The

terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated

Mineral Resource” and “Inferred Mineral Resource” used in this

presentation are Canadian mining terms as defined in the Definition

Standards for Mineral Resources and Mineral Reserves adopted by the

Canadian Institute of Mining, Metallurgy and Petroleum

(“CIM”) on May 10, 2014 and incorporated by

reference in National Instrument 43-101 – Standards of Disclosure

for Mineral Projects (“NI 43-101”). While the

terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated

Mineral Resource” and “Inferred Mineral Resource” are recognized

and required by Canadian securities regulations, they are not

defined terms under standards of the United States Securities and

Exchange Commission (“SEC”). As such, certain

information contained in this presentation concerning descriptions

of mineralization and resources under Canadian standards is not

comparable to similar information made public by United States

companies subject to the reporting and disclosure requirements of

the SEC. An “Inferred Mineral Resource” has a great amount of

uncertainty as to its existence and as to its economic and legal

feasibility. Under Canadian rules, estimates of Inferred Mineral

Resources may not form the basis of feasibility or pre-feasibility

studies. It cannot be assumed that all or any part of an “Inferred

Mineral Resource” will ever be upgraded to a higher confidence

category through additional exploration drilling and technical

evaluation. Readers are cautioned not to assume that all or any

part of an “Inferred Mineral Resource” exists or is economically or

legally mineable. Under United States standards, mineralization may

not be classified as a “Reserve” unless the determination has been

made that the mineralization could be economically and legally

produced or extracted at the time the Reserve estimation is made.

Readers are cautioned not to assume that all or any part of the

Measured or Indicated Mineral Resources will ever be converted into

Mineral Reserves. In addition, the definitions of “Proven Mineral

Reserves” and “Probable Mineral Reserves” under CIM standards

differ from the standards of the SEC. Historical results or

feasibility models presented herein are not guarantees or

expectations of future performance.

Figure 1 – Kora Resource Lode Wireframes

Long Section, Cross Section and Plan View

Figure 2 – K1 and K2 Resource Category

Long Sections

Figure 3 – K1 Resource Long

Section

(Resource Statement is for 3 g/t AuEq Cut-off

only)

Figure 4 – K2 Resource Long

Section

(Resource Statement is for 3 g/t AuEq Cut-off

only)

Figure 5 – Judd Resource Lode Wireframes

Long Section, Cross Section and Plan View

Figure 6 – J1 and J2 Resource Category

Long Sections

Figure 7 – J1 Resource Long

Section

(Resource Statement is for 3 g/t AuEq Cut-off

only)

Figure 8 – J2 Resource Long

Section

(Resource Statement is for 3 g/t AuEq Cut-off

only)

Figure 9 – Kora-Judd Vein System Long

Section

Figure 10 – Kora-Irumafimpa Vein System

Long Section

Figure 11 – Judd Vein System Long

Section

Figure 12 – Near Mine

Exploration Targets

Suite 488 - 1090 West Georgia StreetVancouver,

British ColumbiaCanada V6E 3V7

Telephone: +1 (604) 416-4445Facsimile: +1 (604)

608-9110www.k92mining.com

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1cab52c2-e973-4240-9122-cd94f7c68417

https://www.globenewswire.com/NewsRoom/AttachmentNg/e2b27c69-54bd-46ca-94ba-9434e5dd7027

https://www.globenewswire.com/NewsRoom/AttachmentNg/43b6b440-a7e8-4898-9ff8-a820ae2205e4

https://www.globenewswire.com/NewsRoom/AttachmentNg/111e024d-2d37-4ed4-b471-8d9bc4dacdf6

https://www.globenewswire.com/NewsRoom/AttachmentNg/8df4f5a0-87f7-49f8-a3e4-d584097825e5

https://www.globenewswire.com/NewsRoom/AttachmentNg/3b37c494-955c-44f9-aa03-13c07543f910

https://www.globenewswire.com/NewsRoom/AttachmentNg/77201feb-c03c-4d65-99b0-85b69edb7c14

https://www.globenewswire.com/NewsRoom/AttachmentNg/b62c23c1-3fdc-40a2-ae16-5e36cc70868a

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e2aefb1-96a3-44d5-915c-37dd1547574e

https://www.globenewswire.com/NewsRoom/AttachmentNg/6bb8b6a5-877e-4a7f-acaa-c93e8f115dc6

https://www.globenewswire.com/NewsRoom/AttachmentNg/642fb879-a484-4ec8-a542-a1201b09949b

https://www.globenewswire.com/NewsRoom/AttachmentNg/df8bd013-0921-4e87-9a29-f91e92c93db7

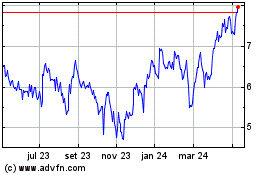

K92 Mining (TSX:KNT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

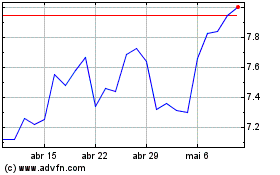

K92 Mining (TSX:KNT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025