Results for fiscal year 2022/2023

Results for fiscal year

2022/2023

After a transformative 2022/2023,

Derichebourg is confident for the 2023/2024 fiscal

year

The Board meeting of December 6, 2023, chaired

by Mr. Daniel Derichebourg, approved the parent company and

consolidated financial statements for the year ended September 30,

2023. During this meeting, the Chairman of the Board of Directors

highlighted the resilience of the Derichebourg Group’s results

within a more challenging economic environment than the previous

two years, and welcomed the CAPEX plan underway to create new

value-added niches for the Group. He also highlighted the value

creation potential for the Group of the 48.31% stake in Elior

Group, whose results are improving. The Board of Directors will

propose to the General Meeting of January 30, 2024 the payment of a

dividend payment of €0.16 per share.

The figures in this press release are in

accordance with the IFRS 5 classification of the Multiservices

business as of September 30, 2023 (comparative balance sheet and

income statement) and the new division of operating segments into

Recycling and Services to Municipalities. Finally, it should be

noted that the Ecore Group acquired on December 17, 2021 was

consolidated for 12 months this fiscal year and 9.5 months last

fiscal year.

Consolidated revenue

Full-year consolidated revenue was €3.6 billion,

down 16.7% year on year, mainly due to the revenue decline in the

Recycling division (down 17.8%), partly offset by a 10.9% increase

in Services to Municipalities revenue.

|

(in thousands of metric tons) |

FY 2022/2023 |

FY 2021/2022 |

Change |

|

Ferrous metals |

4,686.6 |

4,972.7 |

(5.8%) |

|

Non-ferrous metals |

770.4 |

812.5 |

(5.2%) |

|

Total volumes |

5,457.0 |

5,785.2 |

(5.7%) |

|

(in millions of euros) |

FY 2022/2023 |

FY 2021/2022 (1) |

Change |

|

Ferrous metals |

1,646.2 |

2,114.9 |

(22.2%) |

|

Non-ferrous metals |

1,605.1 |

1,877.3 |

(14.5%) |

|

Services |

177.0 |

179.6 |

(1.4%) |

|

Recycling revenue |

3,428.3 |

4,171.7 |

(17.8%) |

|

Services to Municipalities revenue |

183.0 |

165.1 |

10.9% |

|

Holding company revenue |

10.0 |

11.1 |

(10.4%) |

|

Total Group |

3,621.3 |

4,348.0 |

(16.7%) |

(1) : Restated for the

reclassification of companies from Business Services to “Income

from discontinued activities” following their transfer to Elior

Group.

Recycling

From May/June 2022 onwards, economic

expectations deteriorated in Europe, driven by rising energy costs

as a result of reduced supplies of fossil fuels from Russia

following the invasion of Ukraine. The rise in gas prices led to a

sharp increase in spot and forward electricity prices, due to the

European mechanism for setting electricity prices.

The Group’s ferrous scrap metal customers, who

are electro-intensive, adjusted their production rates downwards

from summer 2022, so as not to be overly penalized by these

historically high electricity costs. Spot prices only returned to

sustainable levels in spring 2023.

Rising energy and food prices triggered an

inflationary cycle. The policy pursued by central banks to combat

inflation, which was spreading throughout the economy, resulted in

a historic rise in interest rates (up 400 bps in 18 months in

Europe), provoking the desired effect, namely a slowdown in

economic activity. This slowdown came early for the end sectors to

which the Group is exposed:

- the automotive

sector for ferrous scrap metal supplies and aluminum ingot

sales;

- the long steel

sector for construction and infrastructure;

- the general

economy for non-ferrous metals.

Ferrous scrap metal volumes were down 5.8%. The

decline in the underlying business was around 11.5%, in line with

that of steel production in the major markets served by the Group.

Against this backdrop, the price of ferrous scrap metal fell versus

the previous year, a period in which it reached record highs. The

average price of ferrous scrap metal sold was down €75/t (around

17%) compared to last year.

Volumes of non-ferrous metals sold were down

5.2%. The downward trend in the economic environment mentioned in

the previous paragraph explains this decrease, which is also around

9% after restatement for changes in consolidation scope.

The price of all metals processed by the Group

fell sharply compared to last year, by around €225/t or 10%.

Services to Municipalities

Revenue rose 10.9% driven by the commencement of

several contracts and the full-year impact of contracts commenced

last year, including:

- Waste collection

contracts for Paris districts, renewed under new economic terms in

September 2022;

- the management

contract for the recently commissioned sorting center in

Angers;

- various other

waste collection contracts (Nantes, Guérande, etc.).

Recurring EBITDA1

Recurring EBITDA for the fiscal year amounted to

€334.8 million, down by 27.1% compared to last year, mainly due to

falling volumes and unit margins and increasing costs in the

Recycling business (electricity from January 2023 in

particular).

Recurring operating profit

(loss)2

After taking into account €151.3 million in

depreciation over the fiscal year, recurring operating profit

amounted to €184.9 million, down 43.6% year on year.

Operating profit (loss)

Non-recurring items for the fiscal year

include:

- the net capital

gain realized on the sale of eight recycling centers to the Riva

Group in fulfillment of the commitments made by Derichebourg

Environnement to the European Commission to obtain authorization to

acquire the Ecore Group (€12.6 million).

- a capital gain

generated in April 2023 on the transfer of Derichebourg

Multiservices to Elior Group, net of disposal costs of €50.7

million.

- the financial

consequences of a ruling by the French Supreme Court against the

Group in a dispute between Veolia and various subsidiaries of the

Services to Municipalities business following the takeover of staff

assigned to waste collection contracts in 2014 (€3.7 million).

Allowing for these items, which had an overall

positive net impact of €59.8 million, operating profit amounted to

€244.7 million, down 23.5% compared to last year.

Profit (loss) before tax

After €29.6 million in financial expenses (up €9

million due to the increase in interest rates) and net other

financial expenses of €1.6 million, Group profit before tax came to

€213.5 million, down 30.0% year on year.

Income from associates

Income from associates (€37.7 million loss)

includes a €39.4 million loss generated by Elior Group for the

year. In the first half, the share of income was 24.36%. For the

second half, it was 48.3%, taking into account the securities-based

remuneration for the transfer of the Multiservices division. This

€39.4 million expense corresponds to €35.1 million in costs

classified as non-recurring by Elior Group.

Net profit (loss) from continuing

operations

After taking into account a corporate income tax

expense of €44.0 million, entailing an effective tax rate of 27.5%

on profit before tax restated for the capital gain on the transfer

of Derichebourg Multiservices to Elior Group, and income from

associates, net profit from continuing operations totaled €131.8

million, down 40% year on year.

Income net of tax from discontinued

activities

First-half 2022/2023 income net of tax from the

Multiservices business was €5.6 million, it came to €19.2 million

for the full 2021/2022 fiscal year.

Consolidated net profit

(loss)

Consolidated net profit for the 2022/2023 fiscal

year totaled €137.4 million, down 42.5% year on year. The portion

attributable to Derichebourg SA shareholders was €136.9

million.

Update on the cyberattack of November

10, 2023

Following the cyberattack on November 10, 2023,

the Group’s IT activities are gradually being restored. Its

operational activities have not been interrupted, although they

have been slowed down.

Outlook

In the medium term, the Group is convinced of

the role and future of recycled raw materials due to the benefits

they provide in terms of greenhouse gas emissions and energy

consumption compared to primary metal production. This confidence

is corroborated by the numerous projects expected to materialize in

Europe over the coming years for the construction of electric steel

mills that can consume ferrous scrap metal. Due to be commissioned

between 2027 and 2030, these projects will generate additional

demand for several million metric tons.

The Group is optimistic for the 2023/2024 fiscal

year for the following reasons:

- The first

few months of the year were in line with the last few months of the

previous year: the Group seems to have reached a plateau in terms

of volumes processed, which are now comparable with the same months

of the previous year, with limited fluctuation.

- Despite

sluggish economic growth, recent increases in ferrous scrap metal

prices, albeit limited, reflect a shortage of collected materials

in relation to steel mill requirements, particularly for export

markets.

- During

the 2023/2024 fiscal year, several production facilities invested

in during the 2022/2023 fiscal year will come on stream, helping to

boost the Group’s added value.

- From

January 2024, the Group will benefit from new electricity prices in

France, which will translate into full-year savings of around €15

million, at equivalent volumes.

- In

Services to Municipalities, revenue is expected to rise slightly,

as is profitability measured in terms of EBITDA.

-

Derichebourg will also benefit from Elior Group’s improved

results.

Against this backdrop, the Group has set itself

the target of generating recurring EBITDA in excess of €350 million

for the 2023/2024 fiscal year, with tangible investments

representing less than 50% of recurring EBITDA.

Annex 1: INCOME STATEMENT

|

(in millions of euros) |

FY 2022/2023 |

FY 2021/2022 1 |

Change |

|

Revenue |

3,621.3 |

4,348.0 |

(16.7%) |

|

Recurring EBITDAi |

334.8 |

459.3 |

(27.1%) |

|

|

315.8 |

445.8 |

(29.2%) |

- Services to Municipalities

|

30.5 |

25.2 |

20.7% |

|

Recurring operating profit (loss) |

184.9 |

328.0 |

(43.6%) |

|

|

184.9 |

332.1 |

(44.3%) |

- Services to Municipalities

|

13.9 |

10.4 |

33.9% |

|

Net non-recurring items |

59.8 |

(8.1) |

|

|

Operating profit (loss) |

244.7 |

319.9 |

(23.5%) |

|

Net financial expenses |

(29.6) |

(20.2) |

|

|

Other financial items |

(1.6) |

5.5 |

|

|

Profit (loss) before tax |

213.5 |

305.1 |

(30.0%) |

|

Income tax |

(44.0) |

(83.3) |

|

|

Income from associates |

(37.7) |

(2.1) |

|

|

Income from discontinued or held-for-sale activities |

5.6 |

19.2 |

|

|

Net profit (loss) attributable to non-controlling interests |

(0.5) |

(1.4) |

|

|

Net profit attributable to shareholders |

136.9 |

237.6 |

(42.3%) |

1 Restated for the reclassification of companies from Business

Services to “Income from discontinued activities” following their

transfer to Elior Group.

Annex 2: BALANCE SHEET

|

Assets |

|

|

|

|

(in millions of euros) |

9/30/2023 |

9/30/2022 |

Change |

|

Goodwill |

276.1 |

473.8 |

|

|

Intangible assets |

2.0 |

5.3 |

|

|

Property, plant and equipment |

838.5 |

766.3 |

|

|

Right-of-use assets |

274.5 |

259.0 |

|

|

Financial assets |

5.0 |

10.7 |

|

|

Interests in associates and joint ventures |

414.8 |

208.0 |

|

|

Deferred taxes |

23.2 |

32.0 |

|

|

Other assets |

0.0 |

0.5 |

|

|

Total non-current assets |

1,834.2 |

1,755.6 |

4.5% |

|

Inventories |

158.3 |

185.1 |

|

|

Trade receivables |

305.8 |

462.2 |

|

|

Tax receivables |

7.4 |

6.7 |

|

|

Other assets |

105.7 |

86.9 |

|

|

Financial assets |

11.4 |

15.5 |

|

|

Cash and cash equivalents |

161.1 |

323.2 |

|

|

Financial instruments |

1.5 |

3.0 |

|

|

Total current assets |

751.1 |

1,082.7 |

(30.6%) |

| Total

non-current assets and asset groups held for sale |

- |

40.6 |

|

|

Total assets |

2,585.3 |

2,878.9 |

(10.3%) |

|

Liabilities |

|

|

|

|

(in millions of euros) |

9/30/2023 |

9/30/2022 |

Change |

|

Group shareholders’ equity |

990.4 |

918.8 |

|

|

Non-controlling interests |

2.4 |

5.0 |

|

|

Total shareholders’ equity |

992.8 |

923.8 |

7.5% |

|

Loans and financial debts |

773.6 |

807.9 |

|

|

Provision for pensions and similar benefits |

28.2 |

43.2 |

|

|

Other provisions |

31.8 |

34.8 |

|

|

Deferred taxes |

33.4 |

32.7 |

|

|

Other liabilities |

4.2 |

5.0 |

|

|

Total non-current liabilities |

871.2 |

923.6 |

(5.7%) |

|

Loans and financial debts |

160.2 |

168.7 |

|

|

Provisions |

14.3 |

16.3 |

|

|

Trade payables |

390.0 |

503.0 |

|

|

Tax payables |

9.7 |

6.2 |

|

|

Other liabilities |

144.9 |

318.6 |

|

|

Financial instruments |

2.2 |

2.3 |

|

|

Total current liabilities |

721.3 |

1,015.1 |

(22.5%) |

| Total

liabilities related to a group of assets held for

sale |

|

16.4 |

|

|

Total equity & liabilities |

2,585.3 |

2,878.9 |

(0.7%) |

Annex 3: CHANGE IN NET FINANCIAL DEBT

FROM September 30, 2022 TO September 30, 2023

| Net

financial debt at September 30, 2022 |

653.4 |

| Recurring

EBITDA |

(334.8) |

| Non-recurring

costs |

9.2 |

| Change in

working capital requirements |

61.5 |

| Net financial

expenses |

29.6 |

| Corporate

income taxes |

44.6 |

| Capital

expenditure |

260.5 |

| New rights of

use from operating leases |

25.7 |

| Asset

disposals |

(37.9) |

| Dividends |

51.0 |

|

Acquisitions |

7.1 |

| Other (incl.

IFRS 5 impact) |

2.9 |

|

Net financial debt at September 30, 2023 |

772.7 |

1 Recurring EBITDA = Recurring operating profit + net

depreciation and amortization on tangible and intangible assets and

right-of-use assets2 Recurring operating profit (loss): operating

profit (loss) +/- non-recurring items

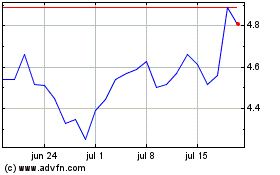

- Results for fiscal year 2022-2023

Derichebourg (EU:DBG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Derichebourg (EU:DBG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024