High Arctic Acquires Private Rental Business in Canada

28 Dezembro 2023 - 3:05PM

High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) announces that today it has closed the acquisition

of Delta Rental Services Ltd. ("Delta") for aggregate purchase

consideration of $7 million subject to earn-out provisions,

pursuant to a Share Purchase Agreement between High Arctic and the

shareholders of Delta (the "Delta Acquisition").

Delta is a privately owned rentals company

headquartered in Red Deer, Alberta, Canada, founded in 2016.

Delta’s business is focussed on pressure control equipment and

equipment supporting the high-pressure stimulation of oil and gas

wells, along with other well site rental equipment. Delta supports

a range of customers including top-tier multi-national and domestic

energy producers and their contractors.

The Delta Acquisition includes all of the

assets, personnel and contracts of Delta including the retention of

their current yard and office lease in Red Deer. The consideration

includes $3.43 million in cash paid at closing with the remaining

$3.57 million payable as 75% in cash and 25% in High Arctic common

shares to the selling shareholders as an earn-out over three years,

subject to achieving certain financial performance targets. Each

annual earn-out payment is adjusted up or down depending upon the

amount of over or under performance of the Delta business to the

targets. Issuance of the common shares pursuant to the earn-out

would be subject to regulatory approvals including the approval of

the Toronto Stock Exchange (“TSX”).

In its most recently completed financial year,

Delta recorded over $8 million in revenue at margins consistent

with High Arctic’s Canadian business. The total consideration

represents a 3 – 3.5x multiple of the Corporation’s estimated

annual after-tax cash flow contribution from Delta.

Mike Maguire, CEO of High Arctic, said “Delta is

an important strategic development for High Arctic. We are excited

to be bringing co-founder Mr. JD Morrical and the Delta team into

High Arctic. The Delta brand is a strong one synonymous with

quality and service. The combination of Delta and High Arctic

expands geographical coverage in Alberta and offers both

operational synergies and potential for cross deployment of

underutilized assets. I am confident the combined HAES Rentals and

Delta team will deliver performance greater than the sum of its

parts.”

“The Delta Acquisition addresses strategic

objectives of scaling our Canadian business and pursuing

opportunities for growth that enhance shareholder value. The Delta

Acquisition is expected to increase Canadian revenues three to

four-fold and contribute strongly to positive cash flow. The Delta

Acquisition contemplates, and the structure of the consideration is

reflective of, High Arctic’s intention to reorganize and separate

the Canadian and PNG businesses and maximize a return of capital to

shareholders. I am confident that this transaction is symbolic of

the prospects for a purely Canadian entity and how additional

accretive transactions can be unearthed.”

JD Morrical, President of Delta, said “I am keen

to start the next part of the Delta story as a substantive part of

High Arctic’s Canadian business. We have enjoyed a good

relationship with the HAES Rentals team built on mutual respect and

shared values. I am very happy that the small business that Scott

Odegard and I created has grown to the point that High Arctic wants

us to be part of their group. It also represents a cash realization

as we honor Scott, his family, and transition the business with his

passing in 2021. I am thankful for the support of our loyal

customers and staff who are more like family to us, and I am glad

that they will all become part of the High Arctic team. I look

forward to playing a key leadership role in forging these two

rentals businesses together and continuing their growth.”

Non-GAAP Measures

High Arctic uses certain performance measures

that are not recognizable under International Financial Reporting

Standards (“IFRS”). These performance measures include cash flow

and after-tax cash flow. Management believes that this measure

provides supplemental financial information that is useful in the

evaluation of High Arctic’s operations. Readers should be

cautioned, however, that these measures should not be construed as

alternatives to measures determined in accordance with IFRS as an

indicator of High Arctic’s performance. The Corporation’s method of

calculating these measures may differ from that of other

organizations and, accordingly, these may not be comparable.

Forward-Looking

Statements

This press release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the Corporation’s actual

results, performance or achievements to vary from those described

in this press release. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, but are

not limited to, statements pertaining to the following: the

expected benefits of the Delta Acquisition; the expected

operational synergies; the expected deployment of underutilized

assets; the expected performance of the combined rental business;

the estimated annual after-tax cashflow contribution from Delta;

the anticipated scaling and growth of High Arctic’s Canadian

business; the expected increase in Canadian revenues; the

Corporation’s ability to unearth future accretive transactions; the

issuance of the common shares pursuant to the earn-out; and the

Corporation’s ability to obtain TSX and other regulatory approvals

for the issuance of the common shares. The Corporation’s actual

results could differ materially from those anticipated in these

forward-looking statements as a result of the risk factors set

forth above and elsewhere in this press release. The

forward-looking statements contained in this press release are

expressly qualified in their entirety by this cautionary statement.

These statements are given only as of the date of this press

release. The Corporation does not assume any obligation to update

these forward-looking statements to reflect new information,

subsequent events or otherwise, except as required by law.

About High Arctic

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

pressure control and other oilfield equipment on a rental basis to

exploration and production companies, from its bases in Whitecourt

and Red Deer, Alberta.

For further information, please contact:

Mike MaguireChief Executive

Officer1.587.318.38261.800.668.7143

High Arctic Energy Services Inc.Suite 2350, 330–5th Avenue

SWCalgary, Alberta, Canada T2P 0L4website: www.haes.caEmail:

info@haes.ca

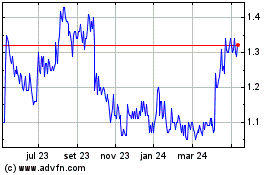

High Arctic Energy Servi... (TSX:HWO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

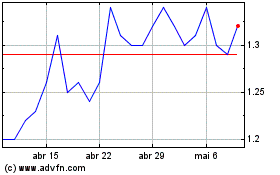

High Arctic Energy Servi... (TSX:HWO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025