Kering: Press release - 2023 Annual Results

Kering - Press release - 2023 Full-year results

|

PRESS RELEASE |

|

February 8, 2024 |

2023 ANNUAL RESULTS

Revenue: €19,566

milliondown 4% as reported, down 2% on a

comparable basis

Recurring operating income down to €4,746

million

Net income attributable to the Group: €2,983

millionRecommended ordinary dividend: €14 per share

“In a trying year for the group, we strengthened

our organization and took significant steps to further enhance the

visibility and exclusivity of our Houses. We are focused on

revitalizing Gucci, leveraging the unique blend of craftsmanship,

Italian heritage, and modernity that characterizes this iconic

House. The launch of Kering Beauté and the acquisition of Creed, a

storied maker of high-end fragrances, will enable us to capture our

share of the steadily growing beauty market. In a market

environment that remains uncertain in early 2024, our continuing

investments in our Houses will put pressure on our results in the

short term. Thanks to the experience gained across the group

through a decade of outstanding expansion, we are confident in

achieving our long-term ambitions.”

François-Henri Pinault, Chairman and

Chief Executive Officer

-

Revenue amounted to €19.6 billion in

2023, a decrease of 4% as reported, including

significant impacts from changes in exchange rates and the scope of

consolidation (-4% and +2% respectively) and down 2% on a

comparable basis.

- Sales from the

directly operated retail network, including e-commerce, were stable

on a comparable basis.

- Wholesale and

Other revenue fell 11% on a comparable basis, as the Group further

strengthened the exclusivity of its Houses’ distribution.

- In the fourth quarter of

2023, revenue was down 6% as reported and down 4% on a

comparable basis. Sales from the directly operated retail network

dropped 2% on a comparable basis. Revenue grew in Asia-Pacific and

Japan. Trends in Western Europe and North America improved

sequentially.

- 2023 recurring operating

income totaled €4.7 billion in 2023, down 15% from the

2022 level. Recurring operating margin was 24.3% in 2023 versus

27.5% in 2022.

- 2023 net income

attributable to the Group amounted to €3.0 billion.

- Free

cash flow from operations was €2.0 billion in 2023.

Excluding real estate acquisitions and disposals, free cash flow

from operations was €3.3 billion.

Financial indicators

|

(in € millions) |

|

2023 |

2022 |

Change |

|

|

|

|

|

|

|

Revenue |

|

19,566 |

20,351 |

-4% |

|

Comparable change (1) |

|

|

|

-2% |

|

|

|

|

|

|

|

Recurring operating income |

|

4,746 |

5,589 |

-15% |

|

% of revenue |

|

24.3% |

27.5% |

|

|

EBITDA |

|

6,569 |

7,255 |

-9% |

|

% of revenue |

|

33.6% |

35.6% |

|

|

|

|

|

|

|

|

Net income attributable to the Group |

|

2,983 |

3,614 |

-17% |

|

|

|

|

|

|

|

Recurring net income attributable to the Group

(2) |

|

3,061 |

3,747 |

-18% |

(1) Change on a comparable scope

and exchange rate basis.(2) Recurring net income

attributable to the Group: net income from continuing operations

attributable to the Group, excluding non-recurring items.

Operating performance

|

Revenue (in € millions) |

|

2023 |

2022 |

Reported change |

Comparable change(1) |

|

|

|

|

|

|

|

|

Gucci |

|

9,873 |

10,487 |

-6% |

-2% |

|

Yves Saint Laurent |

|

3,179 |

3,300 |

-4% |

-1% |

|

Bottega Veneta |

|

1,645 |

1,740 |

-5% |

-2% |

|

Other Houses |

|

3,514 |

3,874 |

-9% |

-8% |

|

Kering Eyewear and Corporate |

|

1,568 |

1,139 |

+38% |

+11% |

|

|

|

|

|

|

|

|

Eliminations |

|

(213) |

(189) |

- |

- |

|

|

|

|

|

|

|

|

KERING |

|

19,566 |

20,351 |

-4% |

-2% |

|

|

|

|

|

|

|

(1) Change on a comparable scope

and exchange rate basis.

|

Recurring operating income (in € millions) |

|

2023 |

2022 |

Change |

|

|

|

|

|

|

|

Gucci |

|

3,264 |

3,732 |

-13% |

|

Yves Saint Laurent |

|

969 |

1,019 |

-5% |

|

Bottega Veneta |

|

312 |

366 |

-15% |

|

Other Houses |

|

212 |

558 |

-62% |

|

Kering Eyewear and Corporate |

|

(7) |

(88) |

+92% |

|

|

|

|

|

|

|

Eliminations |

|

(4) |

2 |

- |

|

|

|

|

|

|

|

KERING |

|

4,746 |

5,589 |

-15% |

Gucci

Gucci’s 2023 revenue was €9.9

billion, down 6% as reported and down 2% on a comparable basis.

Sales from the directly operated retail network, which account for

91% of revenue, dropped 2% on a comparable basis. Wholesale revenue

was down 5% on a comparable basis.

In the fourth quarter of 2023,

Gucci’s revenue decreased 4% on a comparable basis. Sales from the

directly operated retail network were down 4% on a comparable

basis, with sequential improvements in North America and

Asia-Pacific, as well as in Leather Goods and Women’s

Ready-to-Wear. Towards the end of the quarter, Gucci reopened its

historic store on via Monte Napoleone in Milan. Wholesale revenue

was up 3% on a comparable basis in the quarter.

Gucci's recurring operating

income totaled €3.3 billion in 2023. The recurring

operating margin was 33.1%, as investments in implementing

the House’s strategy weighed on profitability.

Yves Saint Laurent

In 2023, Yves Saint Laurent’s

revenue amounted to €3.2 billion, down 4% as

reported and down 1% on a comparable basis. Sales from the directly

operated retail network rose by 4% on a comparable basis, while

revenue from Wholesale, still undergoing rationalization, was down

26% on a comparable basis.

In the fourth quarter of 2023,

sales were down 5% on a comparable basis, while revenue from the

directly operated retail network was stable. Yves Saint Laurent

performed well in Asia-Pacific and Japan, while sales in North

America and Western Europe declined year-on-year, with trends

improving sequentially. The House opened its largest store

worldwide in the fourth quarter, on the Champs-Elysées in Paris.

Wholesale revenue was down 39% in the fourth quarter.

Yves Saint Laurent achieved recurring

operating income of nearly €1 billion in 2023, and its

recurring operating margin remained above 30%.

Bottega Veneta

Bottega Veneta's revenue totaled

€1.6 billion in 2023, down 5% as reported and down

2% on a comparable basis. Sales from the directly operated retail

network rose by 4% on a comparable basis, while Wholesale revenue

fell by 24% on a comparable basis, in line with the House’s

strategy.

Sales in the fourth quarter of

2023 were down 4% on a comparable basis, and up 5% in the

directly operated retail network, driven by Bottega Veneta’s solid

performance in North America and encouraging signs in Asia-Pacific,

particularly Mainland China. Wholesale revenue was down 37% on a

comparable basis.

In 2023, Bottega Veneta achieved

recurring operating income of €312 million,

yielding a recurring operating margin of 19%,

reflecting the House’s continuing investments.

Other Houses

2023 revenue from Other Houses

amounted to €3.5 billion, down 9% as reported and down 8% on a

comparable basis. On a comparable basis, sales from the directly

operated retail network rose by 3%, while Wholesale revenue was

down 29%.

In the fourth quarter of 2023,

sales from the Other Houses dropped 5% on a comparable basis, while

sales from the directly operated retail network were up 4%.

Wholesale revenue was down 30%.

Trends improved significantly for Balenciaga in

North America and Western Europe, and the House also delivered a

solid performance in Asia-Pacific. At Alexander McQueen, sales in

the directly operated retail network were up fueled by its

Ready-to-Wear collections. Brioni had another very good

quarter.

Kering’s Jewelry Houses maintained their

excellent momentum, with double-digit growth in the fourth quarter,

driven by the success of all collections.

The Other Houses generated recurring

operating income of €212 million in 2023, while

recurring operating margin fell to 6%.

Kering Eyewear and Corporate

In 2023, Kering Eyewear’s

revenue hit a new record of €1.5 billion (up 35%

as reported and up 10% on a comparable basis), benefiting from the

consolidation of Maui Jim and excellent development of the brand

portfolio. In the fourth quarter, sales were up 6%

on a comparable basis.

Kering Eyewear’s recurring operating

income rose sharply to €276 million, reflecting Maui Jim’s

contribution and the Eyewear division’s newly acquired scale.

Taking into account Kering Beauté and Corporate

costs, the Kering Eyewear & Corporate segment posted a

recurring operating loss of €7 million, an improvement from 2022.

Creed’s high level of profitability offset start-up costs at Kering

Beauté.

Financial performance

In 2023, Kering’s net financial

expense totaled €410 million.

The effective tax rate on

recurring income was 27.4%.

Net profit attributable to the

Group was €3.0 billion.

Earnings per share amounted to

€24.40.

Cash flow and financial

position

Free cash flow from operations was over €2.0

billion in 2023. Excluding real estate acquisitions and disposals,

free cash flow from operations was €3.3 billion.

At December 31, 2023, Kering’s net debt amounted

to €8.5 billion. The increase reflects the acquisitions

carried out during the year.

Dividend

In its February 7, 2024 meeting, Kering’s Board

of Directors decided to ask shareholders to approve a cash dividend

of €14.00 per share at the Annual General Meeting to be held on

April 25, 2024 to approve the financial statements for the year

ended December 31, 2023.An interim dividend of €4.50 per share was

paid on January 17, 2024. If approved, a final dividend of €9.50

will be paid on May 6, 2024 on positions determined on the evening

of May 3, 2024. The ex-date for the final dividend payment will be

the morning of May 2, 2024.

Outlook

To achieve its long-term vision, Kering invests

in the development of its Houses, so that they continuously

strengthen their desirability and the exclusivity of their

distribution, strike a perfect balance between creative innovation

and timelessness, and achieve the highest standards in terms of

quality, sustainability, and experience for their customers. In an

environment of ongoing economic and geopolitical uncertainty,

Kering will continue to execute on its strategy and vision, in

pursuit of two key ambitions: to maintain a trajectory of long-term

profitable growth, and to confirm its status as one of the most

influential groups in the Luxury industry.

In 2024, in a context of ongoing normalization of

the sector’s growth, the impact of Kering’s investment strategy

will weigh on the group’s full-year recurring operating income

(based on the scope of consolidation and exchange rates at December

31, 2023), which should post a decline compared to the level

reported in 2023, particularly in the first half of the year. The

group will prioritize expenses and investments supporting the

long-term development and growth of its houses, while remaining

vigilant and disciplined with regards to its cost structure.

***

At its February 7, 2024 meeting, Kering’s Board

of Directors, chaired by François-Henri Pinault, approved the

consolidated financial statements for 2023. The consolidated

financial statements have been audited and are in the process of

being certified.

WEBCAST

Kering will present its

2023 results in a webcast, which can be accessed

here at 8:30 a.m. (CET) on Thursday,

February 8, 2024.

The presentation will

be followed by a Q&A session for analysts and investors.

The slides (PDF) will

be available ahead of the webcast at www.kering.com/en/finance.

A replay of the webcast

will also be available at www.kering.com/en/finance.

The notes to the consolidated financial

statements are included in the 2023 financial document available at

www.kering.com.

About Kering

A global Luxury group, Kering manages the

development of a series of renowned Houses in Fashion, Leather

Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta,

Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo,

Qeelin and Ginori 1735, as well as Kering Eyewear and Kering

Beauté. By placing creativity at the heart of its strategy, Kering

enables its Houses to set new limits in terms of their creative

expression while crafting tomorrow’s Luxury in a sustainable and

responsible way. We capture these beliefs in our signature:

“Empowering Imagination”. In 2023, Kering had 49,000 employees and

revenue of €19.6 billion.

Contacts

|

Press |

|

|

| Emilie

Gargatte |

+33 (0)1 45 64 61

20 |

emilie.gargatte@kering.com |

| Marie de

Montreynaud |

+33 (0)1 45 64 62

53 |

marie.demontreynaud@kering.com |

| |

|

|

|

Analysts/investors |

|

|

| Claire

Roblet |

+33 (0)1 45 64 61

49 |

claire.roblet@kering.com |

| Julien

Brosillon |

+33 (0)1 45 64 62

30 |

julien.brosillon@kering.com |

|

APPENDICES EXCERPT FROM THE

CONSOLIDATED FINANCIAL STATEMENTS AND ADDITIONAL

INFORMATION RELATING TO THE 2023 ANNUAL RESULTS

POSITION AS OF DECEMBER 31, 2023

AUDITED FINANCIAL STATEMENTS, CERTIFICATION IN

PROGRESS |

| |

|

|

|

|

| |

|

|

|

|

| |

Contents |

|

Page |

|

| |

|

|

|

|

| |

Highlights and announcements since January 1,

2023 |

8 |

|

| |

Consolidated income statement |

11 |

|

| |

Consolidated statement of comprehensive

income |

12 |

|

| |

Consolidated balance sheet |

13 |

|

| |

Consolidated statement of changes in equity |

14 |

|

| |

Consolidated statement of cash flows |

15 |

|

| |

Revenue by quarter |

16 |

|

| |

Main definitions |

17 |

|

| |

|

|

|

| |

|

|

|

HIGHLIGHTS AND ANNOUNCEMENTS SINCE

JANUARY 1, 2023

Launch of the Circular Hub, the first

dedicated circular economy platform in the Italian Luxury

industryFebruary 21, 2023 – With support of Kering, Gucci

launched its Circular Hub, the first dedicated circular economy

platform for the Luxury sector, in Italy on February 21, 2023. Its

aim is to accelerate the circular transformation of the Italian

fashion industry's production model across the entire value chain,

encompassing raw materials, design, and the optimization of

production and logistics. It is a platform for innovation,

supporting the design and manufacturing of circular products and

the development of new solutions.

Kering Eyewear acquires French

manufacturing company UNTMarch 13, 2023 – Kering Eyewear

strengthened its position in the Luxury eyewear industry by

acquiring 100% of Usinage & Nouvelles Technologies (UNT) on

June 30, 2023. UNT is based in the Jura region of France and is a

key player in the manufacturing of high precision metal and

mechanical components for the Luxury eyewear sector.

Kering plots a new course in terms of

sustainability with group-wide target for reducing absolute

emissions by 40%March 17, 2023 – Kering announced a

commitment to reducing its greenhouse gas emissions by 40% in

absolute terms by 2035 compared with 2021. This new target, which

covers scopes 1, 2 and 3 of the Greenhouse Gas Protocol (GHG

Protocol), forms part of the evolution of the Group’s

sustainability strategy and represents a necessary step to

accelerate the implementation of the Group’s vision of modern and

responsible luxury.

Preliminary investigation by the European

CommissionApril 19, 2023 – On April 18, 2023, as part of a

preliminary investigation into the fashion sector in several

countries under EU antitrust rules, the European Commission started

an inspection at the Italian premises of Kering subsidiary Gucci.

The Group is fully cooperating with the Commission as regards this

investigation.

Kering unveils its Italian headquarters

in the center of MilanMay 25, 2023 – Kering announced the

opening of its new 9,500 square-meter offices in Milan. Kering is

the sole occupant of the six-floor Palazzo Pertusati, located in

the central Via Senato.

Acquisition of luxury fragrance House

Creed by Kering BeautéJune 26, 2023 – Kering Beauté’s

acquisition of a 100% stake in Creed, announced on June 26, 2023,

was completed on October 17, 2023. Creed has been consolidated in

Kering’s financial statements since November 1, 2023. The

acquisition of Creed represents a major milestone for Kering

Beauté. A perfect fit with the Group’s portfolio of renowned Luxury

Houses, it gives Kering Beauté substantial scale and a platform for

supporting the future development of other Kering Beauté fragrance

franchises, particularly by leveraging Creed’s global distribution

network.

Acquisition of a significant stake in

ValentinoJuly 27, 2023 – Kering acquired a 30% stake in

Valentino for €1.7 billion from Mayhoola, as part of a strategic

partnership that leaves open the possibility for Mayhoola to become

a shareholder in Kering. The agreement comprises an option for

Kering to acquire 100% of the share capital of Valentino no later

than 2028. This stake has been accounted for in Kering’s financial

statements using the equity method since November 30, 2023.

Maison Boucheron acquires a High Jewelry

workshopNovember 6, 2023 – Boucheron pursued its

development strategy and strengthened its production capabilities

by acquiring a High Jewelry workshop employing around 60

craftspeople near Place Vendôme in Paris on October 31, 2023.

Bond issuesAs part of the

Group’s active liquidity management, Kering carried out three bond

issues in 2023, helping it to enhance its funding flexibility and

allowing it both to refinance existing debt and fund recent

acquisitions. The great success of these issues with investors

underscored the market’s confidence in the Group’s credit quality.

Kering’s long-term debt is rated A with a stable outlook by

Standard & Poor's.

- On February 20, 2023, Kering

carried out a €1.5 billion bond issue consisting of two tranches:

- a €750 million tranche with a

6-year maturity and a 3.25% coupon,

- and a €750 million tranche with a

10-year maturity and a 3.375% coupon.

The issue allowed the Group to refinance existing

debt and, in part, fund the Maui Jim acquisition.

- On August 29, 2023, Kering carried

out a €3.8 billion bond issue consisting of four tranches:

- a €750 million tranche with a

2-year maturity and a 3.75% coupon,

- a €750 million tranche with a

4-year maturity and a 3.625% coupon,

- a €1 billion tranche with an 8-year

maturity and a 3.625% coupon,

- a €1.3 billion tranche with a

12-year maturity and a 3.875% coupon.

This issue was partly intended to fund the

acquisition of Creed.

- On November 16, 2023, Kering

carried out an £800 million bond issue consisting of two tranches:

- a £400 million tranche with a

3-year maturity and a 5.125% coupon,

- a £400 million tranche with a

9-year maturity and a 5% coupon.

This issue allowed the Group to diversify its

funding sources by raising money in the sterling bond market for

the first time.

Acquisition of a prestigious property on

Fifth Avenue in New York CityJanuary 22, 2024 – Kering

announced the acquisition of a prestigious New York City property

comprising luxury retail spaces across multiple floors and totaling

approximately 115,000 sq. ft, or 10,700 sq. m., located at 715-717

Fifth Avenue, on the southeast corner of 56th Street, for $963

million (€885 million). This investment represents a new milestone

in Kering’s selective real-estate strategy aimed at securing key

locations that are highly desirable for its Houses.

APPOINTMENTS AND MOVEMENTS SINCE JANUARY

1, 2023

Appointment of Sabato de Sarno as Gucci’s

Creative Director January 28, 2023 – Sabato De Sarno’s

appointment as Creative Director of Gucci was announced on January

28, 2023. He is responsible for defining and expressing the House’s

creative vision through womenswear, menswear, leather goods,

accessories, and lifestyle collections. Sabato De Sarno presented

his first collection during Milan Women's Fashion Week in September

2023.

Appointment of Raffaella Cornaggia as

Chief Executive Officer of Kering BeautéFebruary 3, 2023 –

Raffaella Cornaggia was appointed as CEO of Kering Beauté on

February 3, 2023. She is based in Paris, and has joined the Group’s

Executive Committee. Supported by a team of seasoned professionals,

her role is to develop Bottega Veneta, Balenciaga, Alexander

McQueen, Pomellato and Qeelin’s expertise in the Beauty category

while carrying out strategic acquisitions in that sector.

Departure of Daniela Riccardi from

Kering's Board of DirectorsApril 27, 2023 – In the meeting

of the Board of Directors held after the end of the AGM on

Thursday, April 27, 2023, Daniela Riccardi resigned from her role

as a director of Kering.

Appointment of Maureen Chiquet to

Kering’s Board of DirectorsJuly 18, 2023 – The Board of

Directors, after consultation with the Nominations & Governance

Committee, decided to coopt Maureen Chiquet as independent director

for the remainder of Daniela Riccardi’s term of office (expiring on

December 31, 2025). She joined Kering’s Board of Directors in

September 2023. Maureen Chiquet, a US citizen, has more than 35

years' experience in the fashion and luxury goods sector, including

nine years as Global CEO of Chanel.

Moves to strengthen Kering’s governance

and organizationJuly 18, 2023 - Kering announced a series

of top appointments aimed at reinforcing stewardship of its Houses,

further elevating its operational expertise and strengthening its

organization:

- In addition to her existing role as

President and CEO of Yves Saint Laurent since 2013, Francesca

Bellettini was appointed Kering Deputy CEO in charge of Brand

Development.

- Jean-Marc Duplaix, Chief Financial

Officer since 2012, was appointed Kering Deputy CEO in charge of

Operations and Finance.

- Jean-François Palus, Kering Group

Managing Director, was appointed President and CEO of Gucci,

replacing Marco Bizzarri, who had been President and CEO of Gucci

since 2015 and who left the company on September 23, 2023.

- Armelle Poulou, Director of

Corporate Finance, Treasury and Insurance since 2019, was appointed

Chief Financial Officer of Kering on September 1, 2023. She reports

to Jean-Marc Duplaix.

Alexander McQueen and Sarah Burton

announce the end of their collaborationSeptember 11, 2023

– Alexander McQueen and its Creative Director Sarah Burton

announced the end of their collaboration after two decades

together.

Seán McGirr appointed Creative Director

of Alexander McQueenOctober 3, 2023 – Seán McGirr was

appointed as Alexander McQueen’s Creative Director. He was

previously Head of Ready-to-Wear at JW Anderson.

Departure of Tidjane Thiam from Kering's

Board of DirectorsJanuary 9, 2024 – In order to have the

necessary time to devote to his political commitments, Tidjane

Thiam – who was elected President of the Democratic Party of Ivory

Coast on December 22, 2023 – submitted his resignation from his

position as Director to the Chairman of Kering’s Board of

Directors. Tidjane Thiam became an independent Director of Kering

on June 16, 2020. He was Chair of the Audit Committee and a member

of the Remuneration Committee.

CONSOLIDATED INCOME

STATEMENT

|

(in € millions) |

2023 |

2022 |

|

CONTINUING OPERATIONS |

|

|

|

Revenue |

19,566 |

20,351 |

|

Cost of sales |

(4,639) |

(5,153) |

|

Gross margin |

14,927 |

15,198 |

|

Other personnel expenses |

(2,982) |

(2,830) |

|

Other recurring operating income and expenses |

(7,199) |

(6,779) |

|

Recurring operating income |

4,746 |

5,589 |

|

Other non-recurring operating income and expenses |

(103) |

(194) |

|

Operating income |

4,643 |

5,395 |

|

Financial result |

(410) |

(260) |

|

Income before tax |

4,233 |

5,135 |

|

Income tax expense |

(1,163) |

(1,420) |

|

Share in earnings (losses) of equity-accounted companies |

4 |

2 |

|

Net income from continuing operations |

3,074 |

3,717 |

|

o/w attributable to the Group |

2,983 |

3,613 |

|

o/w attributable to minority interests |

91 |

104 |

|

DISCONTINUED OPERATIONS |

|

|

|

Net income from discontinued operations |

– |

1 |

|

o/w attributable to the Group |

– |

1 |

|

o/w attributable to minority interests |

– |

– |

|

TOTAL GROUP |

|

|

|

Net income of consolidated companies |

3,074 |

3,718 |

|

o/w attributable to the Group |

2,983 |

3,614 |

|

o/w attributable to minority interests |

91 |

104 |

|

|

|

|

|

(in € millions) |

2023 |

2022 |

|

Net income attributable to the Group |

2,983 |

3,614 |

|

Basic earnings per share (in €) |

24.38 |

29.34 |

|

Diluted earnings per share (in €) |

24.37 |

29.31 |

|

Net income from continuing operations attributable to the

Group |

2,983 |

3,613 |

|

Basic earnings per share (in €) |

24.38 |

29.33 |

|

Diluted earnings per share (in €) |

24.37 |

29.30 |

|

Net income from continuing operations (excluding non-recurring

items) attributable to the Group |

3,061 |

3,747 |

|

Basic earnings per share (in €) |

25.02 |

30.42 |

|

Diluted earnings per share (in €) |

25.01 |

30.39 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

|

(in € millions) |

2023 |

2022 |

|

Net income |

3,074 |

3,718 |

|

o/w attributable to the Group |

2,983 |

3,614 |

|

o/w attributable to minority interests |

91 |

104 |

|

Change in currency translation adjustments relating to

consolidated subsidiaries : |

(75) |

(69) |

|

change in currency translation adjustments |

(75) |

(69) |

|

amounts transferred to the income statement |

– |

– |

|

Change in foreign currency cash flow hedges : |

(4) |

246 |

|

change in fair value |

268 |

(68) |

|

amounts transferred to the income statement |

(271) |

327 |

|

tax effects |

(1) |

(13) |

|

Change in other comprehensive income (loss) of

equity-accounted companies : |

– |

– |

|

change in fair value |

– |

– |

|

tax effects |

– |

– |

|

Gains and losses recognized in equity, to be transferred to

the income statement |

(79) |

177 |

|

Change in provisions for pensions and other post-employment

benefits : |

1 |

24 |

|

change in actuarial gains and losses |

1 |

30 |

|

tax effects |

– |

(6) |

|

Change in financial assets measured at fair value

: |

(23) |

(225) |

|

change in fair value |

(33) |

(272) |

|

tax effects |

10 |

47 |

|

Gains and losses recognized in equity, not to be

transferred to the income statement |

(22) |

(201) |

|

Total gains and losses recognized in equity |

(101) |

(24) |

|

COMPREHENSIVE INCOME |

2,973 |

3,694 |

|

o/w attributable to the Group |

2,879 |

3,576 |

|

Net income of consolidated companies attributable to minority

interests |

94 |

118 |

CONSOLIDATED BALANCE SHEET

Assets

|

(in € millions) |

2023 |

2022 |

|

Goodwill |

7,112 |

4,053 |

|

Brands and other intangible assets |

8,178 |

7,357 |

|

Lease right-of-use assets |

4,984 |

4,929 |

|

Property, plant and equipment |

5,341 |

3,388 |

|

Investments in equity-accounted companies |

1,750 |

49 |

|

Non-current financial assets |

536 |

855 |

|

Deferred tax assets |

1,520 |

1,640 |

|

Other non-current assets |

16 |

8 |

|

Non current assets |

29,437 |

22,279 |

|

Inventories |

4,550 |

4,465 |

|

Trade receivables and accrued income |

1,151 |

1,180 |

|

Current tax receivables |

765 |

378 |

|

Current financial assets |

136 |

167 |

|

Other current assets |

1,406 |

1,136 |

|

Cash and cash equivalents |

3,922 |

4,336 |

|

Current assets |

11,930 |

11,662 |

|

Assets held for sale |

– |

– |

|

TOTAL ASSETS |

41,367 |

33,941 |

Equity and liabilities

|

(in € millions) |

2023 |

2022 |

|

Equity attributable to the Group |

15,212 |

13,998 |

|

Equity attributable to the minority interests |

798 |

785 |

|

Equity |

16,010 |

14,783 |

|

Non-current borrowings |

10,026 |

4,347 |

|

Non-current lease liabilities |

4,511 |

4,420 |

|

Other non-current financial liabilities |

13 |

- |

|

Non-current provisions for pensions and other post-employment

benefits |

68 |

66 |

|

Non-current provisions |

21 |

19 |

|

Deferred tax liabilities |

1,776 |

1,572 |

|

Other non-current liabilities |

311 |

228 |

|

Non current liabilities |

16,726 |

10,652 |

|

Current borrowings |

2,400 |

2,295 |

|

Current lease liabilities |

884 |

812 |

|

Current financial liabilities |

588 |

663 |

|

Trade payables and accrued expenses |

2,200 |

2,263 |

|

Current provisions for pensions and other post-employment

benefits |

12 |

12 |

|

Current provisions |

163 |

168 |

|

Current tax liabilities |

536 |

567 |

|

Other current liabilities |

1,848 |

1,726 |

|

Current liabilities |

8,631 |

8,506 |

|

Liabilities associated with assets held for sale |

– |

– |

|

TOTAL EQUITY AND LIABILITIES |

41,367 |

33,941 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

Before appropriation of net income(in €

millions) |

Number of shares outstanding |

Share capital |

Capitalreserves |

Keringtreasuryshares |

Cumulative translation

adjustments |

Remeasurement of financial

instruments |

Otherreserves and net income |

Group |

Minorityinterests |

TOTAL |

|

As of January 1, 2022 |

124,068,705 |

499 |

1,655 |

(380) |

(82) |

165 |

11,469 |

13,326 |

389 |

13,715 |

|

Net income |

|

|

|

|

|

|

3,614 |

3,614 |

104 |

3,718 |

|

Total gains and losses recognized in equity |

|

|

|

|

(83) |

21 |

24 |

(38) |

14 |

(24) |

|

Comprehensive income |

|

|

|

|

(83) |

21 |

3,638 |

3,576 |

118 |

3,694 |

|

Change in equity of Kering SA |

102,862 |

|

38 |

|

|

|

|

38 |

– |

38 |

|

Change in equity of subsidiaries |

|

|

|

|

|

|

|

– |

346 |

346 |

|

Expense related to share-based payments |

|

|

|

|

|

|

45 |

45 |

– |

45 |

|

Cancellation of Kering treasury shares |

|

(3) |

(379) |

382 |

|

|

|

– |

– |

– |

|

(Acquisitions) disposals of Kering treasury shares |

(1,951,197) |

|

|

(1,030) |

|

|

|

(1,030) |

– |

(1,030) |

|

Distribution of dividends |

|

|

|

|

|

|

(1,605) |

(1,605) |

(45) |

(1,650) |

|

Other changes |

|

|

|

|

|

|

(352) |

(352) |

(23) |

(375) |

|

As of December 31, 2022 |

122,220,370 |

496 |

1,314 |

(1,028) |

(165) |

186 |

13,195 |

13,998 |

785 |

14,783 |

|

Net income |

|

|

|

|

|

|

2,983 |

2,983 |

91 |

3,074 |

|

Total gains and losses recognized in equity |

|

|

|

|

(78) |

(26) |

|

(104) |

3 |

(101) |

|

Comprehensive income |

|

|

|

|

(78) |

(26) |

2,983 |

2,879 |

94 |

2,973 |

|

Change in equity of Kering SA |

|

|

|

|

|

|

|

– |

– |

– |

|

Change in equity of subsidiaries |

|

|

|

|

|

|

|

– |

9 |

9 |

|

Expense related to share-based payments |

16,928 |

|

|

10 |

|

|

15 |

25 |

– |

25 |

|

Cancellation of Kering treasury shares |

|

(3) |

(330) |

333 |

|

|

|

– |

– |

– |

|

(Acquisitions) disposals of Kering treasury shares |

342,883 |

|

|

230 |

|

|

(217) |

13 |

– |

13 |

|

Distribution of dividends |

|

|

|

|

|

|

(1,705) |

(1,705) |

(42) |

(1,747) |

|

Other changes |

|

|

|

5 |

|

|

(3) |

2 |

(48) |

(46) |

|

As of December 31, 2023 |

122,580,181 |

493 |

984 |

(450) |

(243) |

160 |

14,268 |

15,212 |

798 |

16,010 |

CONSOLIDATED STATEMENT OF CASH

FLOW

|

(in € millions) |

2023 |

2022 |

|

Net income from continuing operations |

3,074 |

3,717 |

|

Net recurring charges to depreciation, amortization and provision

on non-current operating assets |

1,823 |

1,666 |

|

Other non-cash (income) expenses |

94 |

(334) |

|

Cash flow received from operating activities |

4,991 |

5,049 |

|

Interest paid (received) |

300 |

287 |

|

Dividends received |

(9) |

(7) |

|

Current tax expense |

1,007 |

1,597 |

|

Cash flow received from operating activities before

tax, dividends and interests |

6,289 |

6,926 |

|

Change in working capital requirement |

(396) |

(902) |

|

Income tax paid |

(1,434) |

(1,746) |

|

Net cash received from operating activities |

4,459 |

4,278 |

|

Acquisitions of property, plant and equipment and intangible

assets |

(2,611) |

(1,071) |

|

Disposals of property, plant and equipment and intangible

assets |

135 |

1 |

|

Acquisitions of subsidiaries and associates, net of cash

acquired |

(5,093) |

(1,565) |

|

Disposals of subsidiaries and associates, net of cash

transferred |

– |

(32) |

|

Acquisitions of other financial assets |

(56) |

(235) |

|

Disposals of other financial assets |

251 |

115 |

|

Interest and dividends received |

76 |

17 |

|

Net cash received from (used in) investing

activities |

(7,298) |

(2,770) |

|

Increase (decrease) in share capital and other transactions |

– |

38 |

|

Dividends paid to shareholders of Kering SA |

(1,712) |

(1,483) |

|

Dividends paid to minority interests in consolidated

subsidiaries |

(42) |

(45) |

|

Transactions with minority interests |

(24) |

317 |

|

(Acquisitions) disposals of Kering treasury shares |

(10) |

(1,030) |

|

Issuance of bonds and bank debt |

6,205 |

1,742 |

|

Redemption of bonds and bank debt |

(957) |

(904) |

|

Issuance (redemption) of other borrowings |

174 |

343 |

|

Repayment of lease liabilities |

(880) |

(824) |

|

Interest paid and equivalent |

(377) |

(298) |

|

Net cash received from (used in) from financing

activities |

2,377 |

(2,144) |

|

Net cash received from (used in) discontinued operations |

– |

(8) |

|

Impact of exchange rate variations on cash and cash

equivalents |

18 |

222 |

|

Net increase (decrease) in cash and cash

equivalents |

(444) |

(422) |

|

|

|

|

|

Cash and cash equivalents at opening |

4,094 |

4,516 |

|

Cash and cash equivalents at closing |

3,650 |

4,094 |

REVENUE FOR THE FIRST, SECOND, THIRD AND

FOURTH QUARTERS OF 2023

|

(in € millions ) |

|

Q4 2023 |

Q4 2022(1) |

Reported change |

Comparable change(1) |

Q3 2023 |

Q3 2022(1) |

Reported change |

Comparable change(1) |

Q2 2023 |

Q2 2022(1) |

Reported change |

Comparable change(1) |

Q1 2023 |

Q1 2022 (1) |

Reported change |

Comparable change(1) |

|

Gucci |

|

2,528 |

2,733 |

-8% |

-4% |

2,217 |

2,581 |

-14% |

-7% |

2,512 |

2,582 |

-3% |

+1% |

2,616 |

2,591 |

+1% |

+1% |

|

Yves Saint Laurent |

|

835 |

903 |

-8% |

-5% |

768 |

916 |

-16% |

-12% |

770 |

742 |

+4% |

+7% |

806 |

739 |

+9% |

+8% |

|

Bottega Veneta |

|

431 |

469 |

-8% |

-4% |

381 |

437 |

-13% |

-7% |

438 |

438 |

+0% |

+3% |

395 |

396 |

-0% |

+0% |

|

Other Houses |

|

853 |

924 |

-8% |

-5% |

805 |

995 |

-19% |

-15% |

966 |

982 |

-2% |

-1% |

890 |

973 |

-9% |

-9% |

|

Kering Eyewear and Corporate |

|

366 |

295 |

+24% |

+7% |

333 |

253 |

+31% |

+3% |

436 |

283 |

+54% |

+21% |

433 |

308 |

+41% |

+11% |

|

Eliminations |

|

(46) |

(40) |

- |

- |

(40) |

(45) |

- |

- |

(64) |

(53) |

- |

- |

(63) |

(51) |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KERING |

|

4,967 |

5,284 |

-6% |

-4% |

4,464 |

5,137 |

-13% |

-9% |

5,058 |

4,974 |

+2% |

+3% |

5,077 |

4,956 |

+2% |

+1% |

(1) Change on a comparable scope and

exchange rate basis.

MAIN DEFINITIONS

“Reported” and “comparable”

revenueThe Group’s “reported” revenue corresponds to

published revenue. The Group also uses “comparable” data to measure

organic growth. “Comparable” revenue refers to 2022 revenue

adjusted as follows

by:- neutralizing

the portion of revenue corresponding to entities divested in

2022;- including the

portion of revenue corresponding to entities acquired in

2023;- remeasuring

2022 revenue at 2023 exchange rates.These adjustments give rise to

comparative data at constant scope and exchange rates, which serve

to measure organic growth.

Recurring operating incomeThe

Group’s operating income includes all revenues and expenses

directly related to its activities, whether these revenues and

expenses are recurring or arise from non-recurring decisions or

transactions.Other non-recurring operating income and expenses

consist of items that, by their nature, amount or frequency, could

distort the assessment of the Group’s operating performance as

reflected in its recurring operating income. They include changes

in Group structure, the impairment of goodwill and brands and,

where material, of property, plant and equipment and intangible

assets, capital gains and losses on disposals of non-current

assets, restructuring costs and disputes.“Recurring operating

income” is therefore a major indicator for the Group, defined as

the difference between operating income and other non-recurring

operating income and expenses. This intermediate line item is

intended to facilitate the understanding of the operating

performance of the Group and its Houses and can therefore be used

as a way to estimate recurring performance. This indicator is

presented in a manner that is consistent and stable over the long

term in order to ensure the continuity and relevance of financial

information.

EBITDAThe Group uses EBITDA to

monitor its operating performance. This financial indicator

corresponds to recurring operating income plus net charges to

depreciation, amortization and provisions on non-current operating

assets recognized in recurring operating income.

Free cash from operations, available cash

flow from operations and available cash flowThe Group uses

an intermediate line item, “Free cash flow from operations”, to

monitor its financial performance. This financial indicator

measures net operating cash flow less net operating investments

(defined as acquisitions and disposals of property, plant and

equipment and intangible assets).The Group has also defined an

indicator, “Available cash flow from operations”, in order to take

into account capitalized fixed lease payments (repayments of

principal and interest) pursuant to IFRS 16, and thereby reflect

all of its operating cash flows.“Available cash flow” therefore

corresponds to available cash flow from operations plus interest

and dividends received, less interest paid and equivalent

(excluding leases).

Net debtNet debt is one of the

Group’s main financial indicators, and is defined as borrowings

less cash and cash equivalents. Consequently, the cost of net debt

corresponds to all financial income and expenses associated with

these items, including the impact of derivative instruments used to

hedge the fair value of borrowings.

Effective tax rate on recurring

incomeThe effective tax rate on recurring income

corresponds to the effective tax rate excluding tax effects

relating to other non-recurring operating income and expenses.

- Kering - Press release - 2023 Full-year results

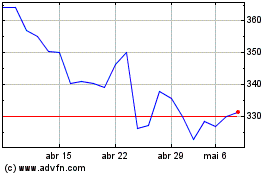

Kering (EU:KER)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Kering (EU:KER)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024