Delivers on 2023 guidance, strong 2024 outlook of

2.1 million Au eq. oz.

Tasiast and La Coipa projects completed driving significant free

cash flow

Great Bear exceeds expectations and adds more than one million

high-grade inferred ounces

TORONTO, Feb. 14, 2024 (GLOBE NEWSWIRE) --

Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the

“Company”) today announced its results for the fourth-quarter and

year ended December 31, 2023.

This news release contains forward-looking

information about expected future events and financial and

operating performance of the Company. We refer to the risks and

assumptions set out in our Cautionary Statement on Forward-Looking

Information located on page 48 of this release. All dollar amounts

are expressed in U.S. dollars, unless otherwise noted.

2023 full-year results and 2024

guidance:

|

|

2023 guidance

(+/- 5%) |

Q4 2023 results |

2023 full-year results |

2024 guidance

(attributable)1

(+/- 5%) |

Gold equivalent

production1

(ounces) |

2.1 million |

546,513 |

2.15 million |

2.1 million |

Production cost of

sales1,2

($ per Au eq. oz.) |

$970 |

$976 |

$942 |

$1,020 |

All-in sustaining

cost1,2,3

($ per Au eq. oz.) |

$1,320 |

$1,353 |

$1,316 |

$1,360 |

|

Attributable1 capital

expenditures4 (million) |

$1,000 million |

$298 million

(Capital expenditures of $311 million4) |

$1,055 million

(Capital expenditures of $1,098 million4) |

$1,050 million

|

- Attributable1 production

in 2024 is expected to be 2.1 million Au eq. oz. Kinross has

forecasted stable production guidance of approximately 2.0

million attributable Au eq. oz. in each of 2025 and 2026.

Operational, development project and

exploration highlights:

- Tasiast had record

throughput in Q4 2023 and achieved record full-year production. It

remains well-positioned to deliver another strong year in

2024.

- La Coipa achieved

record quarterly production driven by strong throughput and

grades.

- Paracatu delivered

another year of steady production including record recovery in

2023.

- Tasiast,

Paracatu and La

Coipa represented nearly 70% of production and were

the lowest cost mines in the portfolio, contributing significant

free cash flow.

- Great Bear

increased its year-over-year inferred resource estimate by 45%,

adding more than one million ounces primarily driven by high-grade

underground additions. Kinross has increased Great Bear’s mineral

resource estimate to approximately 2.8 million Au oz. of measured

and indicated mineral resources, and to approximately 3.3 million

ounces of inferred mineral resources.

- At Manh Choh,

mining activities are well underway including the commencement of

ore mining and stockpiling. The project remains on budget and on

schedule for initial production in the second half of 2024.

- At Round Mountain,

mining of Phase S has commenced. Development of

the Phase X exploration decline is approaching the

target mineralization, with drilling activities having commenced in

early 2024 and set to ramp up through the year.

2023 Q4 and full-year

highlights:

- Production of

546,513 Au eq. oz. in Q4 2023, and 2,153,020 Au eq. oz. in

2023.

- Production cost of

sales2 of $976 per Au eq. oz. in Q4 2023, and

$942 per Au eq. oz. in 2023.

- All-in sustaining

cost3 of $1,353 per Au eq. oz. sold in Q4 2023,

and $1,316 per Au eq. oz. sold in 2023.

-

Margins5 of $998 per Au eq. oz. sold in

Q4 2023, and $1,003 for 2023.

- Operating cash

flow6 of $410.9 million in Q4 2023, and

$1,605.3 million in 2023.

- Adjusted operating cash

flow3 was $407.4 million in Q4 2023, and

$1,669.9 million in 2023.

- Attributable free cash

flow3 was $116.7 million in Q4 2023, and $559.7

million in 2023.

- Reported net

earnings7 of $65.4 million in Q4 2023, or $0.06

per share, and $416.3 million, or $0.34 per share, in 2023.

- Adjusted net

earnings3, 8 of $140.0

million, or $0.11 per share in Q4 2023, and $539.8 million, or

$0.44 per share, in 2023.

- Cash and cash

equivalents of $352.4 million, and total

liquidity9 of $1.9 billion at December

31, 2023. The Company also continued to prioritize debt reduction,

repaying the remaining balance on both its Tasiast loan and

revolving credit facility in Q4 2023.

- Kinross’ Board of Directors

declared a quarterly dividend of $0.03 per common

share payable on March 21, 2024, to shareholders of record

at the close of business on March 6, 2024.

CEO Commentary:

J. Paul Rollinson, President and CEO, made the following

comments in relation to 2023 fourth-quarter and year-end

results:

“2023 was a great year at Kinross and I am proud

of our global team who achieved the results that underpin our

reputation as strong operators. We met our production, cost and

capital guidance, and completed our projects at Tasiast and La

Coipa. Our portfolio of mines produced solid results, we more than

doubled free cash flow year-over-year while maintaining our

investment grade balance sheet, and we are carrying this momentum

into 2024.

“We expect to deliver another strong year in

2024, producing approximately 2.1 million gold equivalent ounces.

Our development projects are progressing well and we look forward

to first production from Manh Choh in the second half of the year.

Great Bear continues to exceed expectations and we were excited to

add more than one million ounces of higher-grade underground

resource. We continue to successfully target extensions of the

resource at depth, reinforcing our view that Great Bear has the

potential to be a large, long-life, high-grade mining complex.

“Operating responsibly, delivering on our

commitments and advancing our ESG strategy continue to be key

principles of our day-to-day operations. Kinross was recently named

to the Dow Jones Sustainability World Index, reflecting our

commitment to corporate citizenship as a core value and key

strategic driver of our business. We expect to publish our 2023

Sustainability and ESG Report in May and some highlights from the

year include:

- Completed construction of the solar

power plant at Tasiast and are on track to achieve our goal of

reducing emissions intensity by 30% by 2030 from our 2021

baseline;

- In Brazil, we published a book on

the Cerrado biodiversity corridor, highlighting the importance of

protecting this critical region and the strategic approach taken by

our Paracatu site;

- Made approximately $10 million of

monetary and in-kind contributions through site social investments;

and

- Established the “Kinross Alaska

Future Leaders” scholarship at the University of Alaska Fairbanks

focused on advancing the inclusion of underrepresented people in

the resource industry.”

Financial results

Summary of financial and operating

results

|

|

|

Three months ended |

Years ended |

|

|

|

December 31, |

December 31, |

|

(unaudited, in millions of U.S. dollars, except ounces, per share

amounts, and per ounce amounts) |

2023

|

2022 |

2023

|

2022

|

|

Operating Highlights |

|

|

|

|

|

| Total

gold equivalent ounces from continuing

operations(a),(b) |

|

|

|

|

|

Produced |

|

546,513 |

|

|

595,683 |

|

|

2,153,020 |

|

|

1,957,237 |

|

|

Sold |

|

565,389 |

|

|

620,599 |

|

|

2,179,936 |

|

|

1,927,818 |

|

|

|

|

|

|

|

|

|

Financial Highlights from Continuing

Operations(a) |

|

|

|

|

|

|

Metal sales |

|

$ |

1,115.7 |

|

$ |

1,076.2 |

|

$ |

4,239.7 |

|

$ |

3,455.1 |

|

|

Production cost of sales |

|

$ |

552.0 |

|

$ |

526.5 |

|

$ |

2,054.4 |

|

$ |

1,805.7 |

|

|

Depreciation, depletion and amortization |

|

$ |

271.7 |

|

$ |

251.9 |

|

$ |

986.8 |

|

$ |

784.0 |

|

|

Impairment charges and asset derecognition |

|

$ |

38.9 |

|

$ |

350.0 |

|

$ |

38.9 |

|

$ |

350.0 |

|

| Operating

earnings |

|

$ |

193.5 |

|

$ |

(160.1 |

) |

$ |

801.4 |

|

$ |

117.7 |

|

| Net

earnings (loss) from continuing operations attributable to common

shareholders |

|

$ |

65.4 |

|

$ |

(106.0 |

) |

$ |

416.3 |

|

$ |

31.9 |

|

| Basic

earnings (loss) per share from continuing operations attributable

to common shareholders |

|

$ |

0.06 |

|

$ |

(0.08 |

) |

$ |

0.34 |

|

$ |

0.02 |

|

| Diluted

earnings (loss) per share from continuing operations attributable

to common shareholders |

|

$ |

0.06 |

|

$ |

(0.08 |

) |

$ |

0.34 |

|

$ |

0.02 |

|

| Adjusted

net earnings from continuing operations attributable to common

shareholders(c) |

|

$ |

140.0 |

|

$ |

108.2 |

|

$ |

539.8 |

|

$ |

283.1 |

|

| Adjusted

net earnings from continuing operations per

share(c) |

|

$ |

0.11 |

|

$ |

0.09 |

|

$ |

0.44 |

|

$ |

0.22 |

|

| Net cash

flow of continuing operations provided from operating

activities |

|

$ |

410.9 |

|

$ |

474.3 |

|

$ |

1,605.3 |

|

$ |

1,002.5 |

|

| Adjusted

operating cash flow from continuing operations(c) |

|

$ |

407.4 |

|

$ |

496.1 |

|

$ |

1,669.9 |

|

$ |

1,256.5 |

|

| Capital

expenditures from continuing operations(d) |

|

$ |

311.3 |

|

$ |

316.8 |

|

$ |

1,098.3 |

|

$ |

764.2 |

|

|

Attributable(g) capital expenditures from continuing

operations(c) |

$ |

297.7 |

|

$ |

312.7 |

|

$ |

1,055.0 |

|

$ |

755.0 |

|

|

Attributable(g) free cash flow from continuing

operations(c) |

$ |

116.7 |

|

$ |

162.6 |

|

$ |

559.7 |

|

$ |

247.3 |

|

| Average

realized gold price per ounce from continuing

operations(e) |

|

$ |

1,974 |

|

$ |

1,731 |

|

$ |

1,945 |

|

$ |

1,793 |

|

|

Production cost of sales from continuing operations per equivalent

ounce(b) sold(f) |

|

$ |

976 |

|

$ |

848 |

|

$ |

942 |

|

$ |

937 |

|

|

Production cost of sales from continuing operations per ounce sold

on a by-product basis(c) |

|

$ |

936 |

|

$ |

793 |

|

$ |

892 |

|

$ |

912 |

|

| All-in

sustaining cost from continuing operations per ounce sold on a

by-product basis(c) |

|

$ |

1,328 |

|

$ |

1,203 |

|

$ |

1,284 |

|

$ |

1,255 |

|

| All-in

sustaining cost from continuing operations per equivalent

ounce(b) sold(c) |

|

$ |

1,353 |

|

$ |

1,236 |

|

$ |

1,316 |

|

$ |

1,271 |

|

|

Attributable(g) all-in cost from continuing operations

per ounce sold on a by-product basis(c) |

|

$ |

1,699 |

|

$ |

1,525 |

|

$ |

1,619 |

|

$ |

1,538 |

|

|

Attributable(g) all-in cost from continuing operations

per equivalent ounce(b) sold(c) |

|

$ |

1,709 |

|

$ |

1,540 |

|

$ |

1,634 |

|

$ |

1,545 |

|

|

(a) |

Results for the three months and year-ended December 31, 2023

and 2022 are from continuing operations and exclude results from

the Company’s Chirano and Russian operations due to the

classification of these operations as discontinued and their sale

in 2022. |

|

(b) |

“Gold equivalent ounces” include silver ounces produced and

sold converted to a gold equivalent based on a ratio of the average

spot market prices for the commodities for each period. The ratio

for 2023 was 83.13:1 (2022 – 82.90:1). |

|

(c) |

The definition and reconciliation of these non-GAAP financial

measures and ratios is included on pages 26 to 30 of this news

release. Non-GAAP financial measures and ratios have no

standardized meaning under IFRS and therefore, may not be

comparable to similar measures presented by other

issuers. |

|

(d) |

“Capital expenditures from continuing operations” is as

reported as “Additions to property, plant and equipment” on the

consolidated statements of cash flows. |

|

(e) |

“Average realized gold price per ounce from continuing

operations” is defined as gold metal sales from continuing

operations divided by total gold ounces sold from continuing

operations. |

|

(f) |

“Production cost of sales from continuing operations per

equivalent ounce sold” is defined as production cost of sales

divided by total gold equivalent ounces sold from continuing

operations. |

|

(g) |

“Attributable” includes Kinross’ share of Manh Choh (70%)

costs, capital expenditures and cash flow, as

appropriate. |

|

|

|

The following operating and financial results are based on

fourth-quarter and year-end 2023 gold equivalent

production:

Production: Kinross produced

546,513 Au eq. oz. from continuing operations in Q4 2023, compared

with 595,683 Au eq. oz. from continuing operations in Q4 2022.

Over the full year, Kinross produced 2,153,020

Au eq. oz. from continuing operations, compared with full-year 2022

production of 1,957,237 Au eq. oz. from continuing operations. The

10% year-over-year increase was largely a result of higher

production at La Coipa due to the ramp-up of operations in the

second half of 2022, and higher mill grades, recoveries and

throughput at Tasiast, partially offset by lower production at Bald

Mountain, consistent with the mine plan.

Average realized gold price:

The average realized gold price from continuing operations in Q4

2023 was $1,974 per ounce, compared with $1,731 per ounce in Q4

2022. For full-year 2023, the average realized gold price per ounce

from continuing operations was $1,945, compared with $1,793 per

ounce for full-year 2022.

Revenue: During the fourth

quarter, revenue from continuing operations increased to $1,115.7

million, compared with $1,076.2 million during Q4 2022. Revenue

from continuing operations increased to $4,239.7 million for

full-year 2023, compared with $3,455.1 million for full-year 2022.

The 23% year-over-year increase is due to the increase in

production at Tasiast and La Coipa and higher average realized gold

price.

Production cost of sales:

Production cost of sales from continuing operations per Au eq.

oz.2 sold was $976 for Q4 2023, compared with $848 in Q4

2022. Production cost of sales from continuing operations per Au

eq. oz.2 sold was $942 for full-year 2023, largely in

line with $937 per Au eq. oz. for full-year 2022.

Production cost of sales from continuing

operations per Au oz. sold on a by-product basis3 was

$936 in Q4 2023 compared with $793 in Q4 2022, based on gold sales

of 543,173 ounces and silver sales of 1,890,563 ounces. Production

cost of sales from continuing operations per Au eq. oz. sold on a

by-product basis3 was $892 for full-year 2023, in line

with $912 for full-year 2022, based on 2023 gold sales of 2,074,989

ounces and silver sales of 8,718,491 ounces.

Margins5: Kinross’

margin from continuing operations per Au eq. oz. sold was $998 for

Q4 2023, compared with the Q4 2022 margin of $883. Full-year 2023

margin from continuing operations per Au eq. oz. sold was $1,003,

compared with $856 for full-year 2022.

All-in sustaining

cost3: All-in sustaining cost from continuing

operations per Au eq. oz. sold was $1,353 in Q4 2023, compared with

$1,236 in Q4 2022. Full-year all-in sustaining cost from continuing

operations per Au eq. oz. sold was $1,316, compared with $1,271 for

full-year 2022.

In Q4 2023, all-in sustaining cost from

continuing operations per Au oz. sold on a by-product

basis3 was $1,328, compared with $1,203 in Q4 2022.

All-in sustaining cost from continuing operations per Au oz. sold

on a by-product basis3 was $1,284 for full-year 2023,

compared with $1,255 in 2022.

Operating cash

flow6: Operating cash flow from continuing

operations was $410.9 million for Q4 2023, compared with $474.3

million for Q4 2022. Operating cash flow from continuing operations

for full-year 2023 was $1,605.3 million, compared with $1,002.5

million for full-year 2022, primarily due to the increase in

margins.

Adjusted operating cash flow3 from

continuing operations for Q4 2023 was $407.4 million, compared with

$496.1 million for Q4 2022. Adjusted operating cash

flow3 from continuing operations for full-year 2023 was

$1,669.9 million, compared with $1,256.5 million in 2022.

Attributable1

free cash flow3:

Attributable free cash flow from continuing operations was $116.7

million in Q4 2023, compared with $162.6 million in Q4 2022.

Attributable free cash flow for full-year 2023 from continuing

operations was $559.7 million compared with attributable free cash

flow of $247.3 million in 2022.

Earnings7: Reported

net earnings from continuing operations were $65.4 million for Q4

2023, or $0.06 per share, compared with reported net loss of $106.0

million, or $0.08 per share, for Q4 2022. Full-year reported net

earnings in 2023 were $416.3 million, or $0.34 per share, compared

with reported net earnings of $31.9 million, or $0.02 per share, in

2022.

Adjusted net

earnings3,8 from continuing

operations were $140.0 million, or $0.11 per share, for Q4 2023,

compared with $108.2 million, or $0.09 per share, for Q4 2022.

Full-year adjusted net earnings3,8

from continuing operations were $539.8 million, or $0.44 per share,

compared with $283.1 million, or $0.22 per share, for full-year

2022.

Attributable1

capital expenditures4: Full-year

attributable capital expenditures from continuing operations were

$1,055.0 million compared with $755.0 million for 2022. The

full-year increase was primarily due to an increase in capital

stripping at Tasiast and Fort Knox, and increased development

activities at the Manh Choh project. Capital expenditures from

continuing operations4 were $311.3 million for Q4 2023,

compared with $316.8 million for Q4 2022. Capital expenditures from

continuing operations4 for full-year 2023 were $1,098.3

million, compared with $764.2 million in 2022.

Balance sheet

During the quarter, the Company repaid the

$140.0 million balance on its Tasiast loan, ahead of its 2027

maturity date, and the remaining $50 million balance on the

revolving credit facility.

After the repayments, Kinross had cash and cash

equivalents of $352.4 million as of December 31, 2023, compared

with $418.1 million at December 31, 2022.

The Company had additional available

credit10 of $1,557.5 million as of December 31, 2023,

and total liquidity9 of approximately $1.9 billion.

Return of capital

As part of its continuing quarterly dividend

program, the Company declared a dividend of $0.03 per common share

payable on March 21, 2024, to shareholders of record as of March 6,

2024. In 2023, the Company did not repurchase any shares.

Operating results

Mine-by-mine summaries for 2023 fourth-quarter

and full-year operating results may be found on pages 21 and 25 of

this news release. Highlights include the following:

Tasiast performed strongly in

2023, with production increasing 15% compared with full-year 2022.

The record annual production was mainly a result of strong grades,

record throughput following the completion of the Tasiast 24k

project, and higher recoveries. Quarter-over-quarter, production

was lower as a result of lower grades and timing of ounces

processed at the mill, partially offset by higher throughput and

recovery.

Tasiast’s full-year cost of sales per ounce was

lower year-over-year mainly due to the increase in production as

well as the higher proportion of capital development related to

capital stripping of West Branch 5. Cost of sales per ounce sold

was largely in line quarter-over-quarter. Following the completion

of the solar power plant, the Company expects to realize immediate

and long-term operating cost savings.

Paracatu full-year production

increased compared with 2022 primarily due to an increase in mill

throughput, as well as record-high recoveries, partially offset by

lower grades. Production decreased quarter-over-quarter mainly due

to lower grades, as expected, partially offset by higher mill

throughput. Cost of sales per ounce sold was higher in both

comparable periods mainly due to lower ounces sold and increased

mining volumes, as expected, and unfavourable foreign exchange

changes.

La Coipa continued to perform

well and achieved record quarterly production since its restart in

February 2022 driven by strong grades and throughput. Cost of sales

per ounce was higher year-over-year and quarter-over-quarter mainly

due to a reduction in capitalized stripping.

Fort Knox full-year production

and cost of sales were largely in line with 2022.

Quarter-over-quarter production increased mainly due to higher mill

throughput as well as timing of ounces processed in the mill.

Compared with Q3 2023, cost of sales per ounce sold was higher

mainly due to less capital development, partially offset by higher

production.

Round Mountain full-year

production increased year-over-year primarily due to an increase in

ounces recovered from the heap leach pads. Quarter-over-quarter

production decreased primarily due to fewer ounces recovered from

the heap leach pads, partially offset by higher grades. Full-year

cost of sales per ounce increased year-over-year mainly as a result

of higher-cost ounces recovered from the heap leach pads and less

capital development. Cost of sales per ounce sold in Q4 2023

decreased compared with the previous quarter largely due to lower

costs related to labour and consumables, partly offset by timing of

inventory movements.

Bald Mountain full-year

production decreased largely due to lower grades and timing of

ounces recovered from the heap leach pads. Compared with the

previous quarter, production increased mainly due to higher grades.

Full-year cost of sales per ounce sold increased as a result of

higher-cost heap leach ounces, as well as higher contractor,

reagent and maintenance costs. Compared with Q3 2023, fourth

quarter cost of sales per ounce sold was lower mainly due to higher

production, a higher proportion of capital development, and lower

contractor and reagent costs, partially offset by timing of ounces

recovered.

Development projects

Great Bear

At the Great Bear project, the

Company’s robust exploration program continues to make excellent

progress, execution planning for the advanced exploration program

is well underway, and permitting continues to advance on plan.

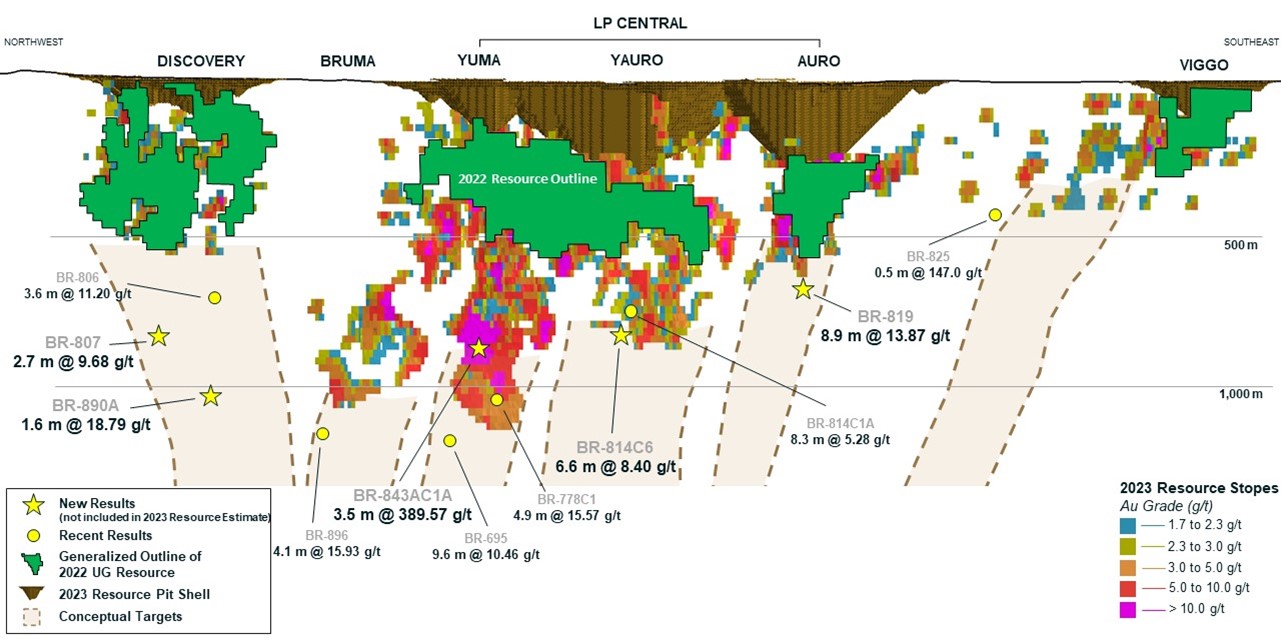

Following the completion of its 2023 drilling

program, Kinross has increased Great Bear’s mineral resource

estimate to approximately 2.8 Moz. of measured and indicated

resources and approximately 3.3 Moz. of inferred resources. This

includes the addition of more than one million higher-grade,

underground inferred ounces, representing a 45% year-over-year

increase.

Kinross continues to add higher-grade material to the

underground resource base, as demonstrated by the year-over-year

increase in the inferred grade, which went from 3.6 g/t to 4.5 g/t.

While the primary additions were in the LP zone, resources at Hinge

and Limb, traditional Red Lake style deposits proximal to the LP

zone, also increased. Further, high-grade intercepts below the

resource at Hinge in 2023 demonstrated the potential for this

mineralization to also continue at depth potentially supplementing

LP zone production in the future.

The updated mineral resource estimate is set out in the table

below:

|

Great Bear Mineral Resource estimates |

|

|

|

2022

(Au koz) |

Year-over-year additions

(Au koz) |

2023

(Au koz) |

Grade

(Au g/t) |

|

Measured and Indicated Resources |

2,737 |

75 |

2,813 |

2.7 |

|

Inferred Resources |

2,290 |

1,025 |

3,315 |

4.5 |

Since the last update on November 8, 2023, the Company has received

additional assay results, with a selection of the new results

highlighted below. Recent results highlighted in this release

were received after the 2023 resource database cut-off and have not

been used to inform year end resource figures.

Notable exploration results at Great Bear in the fourth

quarter include:

- BR-807 (Discovery)

2.7m @ 9.7 g/t Au at a vertical depth of 880m

- BR-814C6 (Yauro)

6.6m @ 8.4 g/t Au at a vertical depth of 750m

- Including 2.3m @ 23.3 g/t Au

- BR-819 (Auro) 8.9m @

13.9 g/t Au at a vertical depth of 700m

- Including 2.3m @ 51.5 g/t Au

- BR-843AC1A (Yuma)

15.4m @ 89.1 g/t Au at a vertical depth of 900m

- Including 3.5m @

389.6 g/t Au

- BR-890 (Discovery)

1.6m @ 18.8 g/t Au at a vertical depth of 1070m

These results continue to support the view of a

high-grade, large, long-life mining complex at Great Bear. Hole

BR-843AC1A has intersected 3.5m @ 389.6 g/t at 900m vertical depth

at Yuma and is expected to further increase the grade of already

high-grade resource stopes in that area. Holes BR-814C6 and BR-819

demonstrate the continuity of wide, high-grade mineralization below

the current resource at Yauro and Auro respectively. To the

northwest, holes BR-807 and BR-890A have intersected high-grade

mineralization at depths of 880m and 1070m respectively, vertically

below surface which highlights the highly prospective undertested

area beneath Discovery.

Kinross is progressing provincial permitting,

engineering, and execution planning activities for an advanced

exploration (AEX) program that would establish an underground

decline to obtain a bulk sample and allow for definition and infill

drilling in the LP zone. The mining lease for the main AEX surface

footprint has now been received, providing Kinross with the

necessary surface and mining rights to develop the AEX project,

subject to obtaining the required provincial permits.

Detailed engineering for AEX infrastructure is

well underway, and orders have been placed for the onsite camp and

high-quality water treatment facility. Procurement activities for

additional infrastructure and site construction activities are

progressing well.

Kinross is targeting a start of the surface

construction for the AEX program in the second half of 2024,

subject to receipt of permits, with start of the underground

decline planned in mid-2025.

For the main project, Kinross continues to

advance technical studies, including engineering and field test

work campaigns, with plans to release the results of this work in

the form of a preliminary economic assessment in the second half of

2024.

The required Federal Impact Assessment for the

main project is underway. The Initial Project Description has been

submitted to the Impact Assessment Agency of Canada, formally

kicking off the federal assessment process. The Detailed Project

Description is expected to be formally submitted in Q1 2024.

Studies are ongoing and the Company expects to file its Impact

Statement in the first half of 2025.

Selected Great Bear Drill

Results

See Appendix A for full results.

|

Hole ID |

|

From

(m) |

To

(m) |

Width

(m) |

True

Width (m) |

Au

(g/t) |

Target |

|

BR-807 |

|

964.5 |

980.6 |

16.1 |

14.1 |

0.59 |

Discovery |

|

BR-807 |

and |

994.5 |

1,009.5 |

15.0 |

13.2 |

1.65 |

|

|

BR-807 |

including |

1,002.3 |

1,008.0 |

5.8 |

5.1 |

3.33 |

|

|

BR-807 |

and |

1,027.2 |

1,037.7 |

10.5 |

9.2 |

0.44 |

|

|

BR-807 |

and |

1,059.0 |

1,069.5 |

10.5 |

9.2 |

0.89 |

|

|

BR-807 |

and |

1,084.8 |

1,089.0 |

4.2 |

3.7 |

1.74 |

|

|

BR-807 |

and |

1,095.7 |

1,209.0 |

113.3 |

99.7 |

0.67 |

|

|

BR-807 |

including |

1,106.7 |

1,109.7 |

3.0 |

2.7 |

9.68 |

|

|

BR-807 |

and including |

1,207.9 |

1,209.0 |

1.2 |

1.0 |

21.70 |

|

|

BR-814C6 |

|

717.7 |

729.4 |

11.7 |

9.4 |

0.71 |

Yauro |

|

BR-814C6 |

and |

893.3 |

897.2 |

3.9 |

3.1 |

0.61 |

|

|

BR-814C6 |

and |

910.8 |

919.0 |

8.3 |

6.6 |

8.40 |

|

|

BR-814C6 |

including |

913.2 |

916.0 |

2.9 |

2.3 |

23.32 |

|

|

BR-814C6 |

and |

928.0 |

931.3 |

3.3 |

2.6 |

0.72 |

|

|

BR-814C6 |

and |

1,036.5 |

1,040.5 |

4.0 |

3.2 |

6.91 |

|

|

BR-814C6 |

including |

1,037.5 |

1,040.5 |

3.0 |

2.4 |

8.78 |

|

|

BR-814C6 |

and |

1,068.0 |

1,074.6 |

6.6 |

5.2 |

0.72 |

|

|

BR-819 |

|

849.2 |

855.7 |

6.5 |

5.7 |

0.38 |

Auro |

|

BR-819 |

and |

876.0 |

886.2 |

10.2 |

8.9 |

13.87 |

|

|

BR-819 |

including |

879.0 |

881.7 |

2.7 |

2.3 |

51.45 |

|

|

BR-843AC1A |

|

1,317.1 |

1,336.4 |

19.3 |

15.4 |

89.14 |

Yuma |

|

BR-843AC1A |

including |

1,317.1 |

1,321.5 |

4.4 |

3.5 |

389.57 |

|

|

BR-843AC1A |

and |

1,481.8 |

1,484.8 |

3.0 |

2.4 |

2.07 |

|

|

BR-890A |

|

1,331.5 |

1,363.2 |

31.7 |

26.3 |

2.01 |

Discovery |

|

BR-890A |

including |

1,361.2 |

1,363.2 |

2.0 |

1.6 |

18.79 |

|

|

BR-890A |

and |

1,369.5 |

1,375.7 |

6.2 |

5.1 |

0.77 |

|

Results are preliminary in nature and are subject to

on-going QA/QC. Lengths are subject to rounding.

See Appendix B for a LP zone long section.

Manh Choh

At the 70% owned Manh Choh

project, of which Kinross is the operator, construction is

essentially complete, on budget and on schedule for production in

the second half of 2024. Mining activities are well underway

including the commencement of ore mining and stockpiling.

Transportation of ore to Fort Knox, where it will be processed, has

commenced and will gradually increase throughout the first half of

the year.

Modifications to the Fort Knox mill continue to

progress on schedule and on budget. Construction of the

conveyors and associated buildings are planned for the first

quarter along with interior piping and mechanical installations.

The commissioning and operational readiness team is in place and

preparing for pre-commissioning activities following the mechanical

completion of each area.

Tasiast solar power plant

At the Tasiast solar power

plant, construction of the solar field and battery system

is now complete, with first solar power delivered to the Tasiast

grid in December 2023. Commissioning of the battery system and

energy management system will continue in early 2024, supporting

the solar field and battery system integration and power ramp-up.

During the first quarter of 2024, grid scenario testing involving

incumbent generators, the solar field, and battery systems will

continue toward ensuring stable power from this new renewable

energy source. The Tasiast solar power plant has a continuous

power generation capacity of 34MW and an 18MW battery storage

system.

Round Mountain

The extension strategy at Round

Mountain is advancing on plan. At Phase

S, the operations team is in place and stripping remains

on schedule. For the heap leach pad expansion, detailed engineering

is complete, procurement is in progress, and construction

activities remain on track.

At Phase X, development of the

exploration decline is progressing well and more than 50% complete,

with approximately 1,475 metres developed so far, and is

approaching the target mineralization. Underground definition

drilling commenced in early 2024 and is set to ramp up throughout

the year. The Company expects to begin drilling the primary Phase X

target in Q2. At Gold Hill, drilling

continues to progress as planned with an infill program from the

bottom of the pit and exploration drilling from surface.

Chile

Kinross’ activities in Chile are currently

focused on La Coipa and potential opportunities to extend its mine

life. The Lobo-Marte project continues to provide

optionality as a potential large, low-cost mine upon the conclusion

of mining at La Coipa. While the Company focuses its technical

resources on La Coipa, it will continue to engage and build

relationships with communities related to Lobo-Marte and government

stakeholders.

Company Guidance

The following section of the news release represents

forward-looking information and users are cautioned that actual

results may vary. We refer to the risks and assumptions contained

in the Cautionary Statement on Forward-Looking Information on page

48 of this news release.

This Company Guidance section below

references all-in sustaining cost per equivalent ounce sold and

sustaining, non-sustaining and attributable capital expenditures,

which are non-GAAP ratios and financial measures, as applicable,

with no standardized meaning under IFRS and therefore, may not be

comparable to similar measures presented by other issuers. The

definitions of these non-GAAP ratios and financial measures and

comparable reconciliations are included on pages 26 to

30 of this news release.

Attributable1

production guidance

In 2024, Kinross expects to produce 2.1 million

attributable Au eq. oz.11 (+/- 5%) from its operations,

in line with total 2023 production of 2,153,020 Au eq. oz. Kinross’

annual production is expected to remain stable in 2025 and 2026 at

2.0 million attributable Au eq. oz.11 (+/-

5%) per year.

Annual attributable1

gold equivalent production guidance

(+/- 5%) |

|

2024 |

2.1 million oz. |

|

2025 |

2.0 million oz. |

|

2026 |

2.0 million oz. |

In 2024, attributable production is expected to be higher in the

second half of the year, which is largely driven by expected

initial production at Manh Choh, as well as higher production at

Paracatu.

Attributable1

cost guidance

Production cost of sales is expected to be

$1,020 per Au eq. oz.11 (+/- 5%) for 2024. In

2023, production cost of sales was $942 per Au eq. oz. The moderate

year-over-year increase in 2024 is mainly due to production mix,

including higher expected production from the Company’s U.S. assets

and lower production at Paracatu, and inflationary impacts.

The Company expects its all-in sustaining

cost3 to be $1,360 per Au eq. oz. (+/- 5%) for 2024. In

2023, all-in sustaining cost3 was $1,316 per Au eq. oz.

sold.

2024 attributable1

production and cost guidance

|

Attributable basis1 |

Q4 2023

results |

2023 full-year

results |

2024 guidance

(+/- 5%) |

| Gold equivalent

basis |

|

|

|

|

Production (Au eq. oz.) |

546,513 |

2.15 million |

2.1 million11 |

|

Production cost of sales per Au eq. oz.2 sold |

$976 |

$942 |

$1,020 |

|

All-in sustaining cost per Au eq. oz. sold3 |

$1,353 |

$1,316 |

$1,360 |

2024 attributable1

production and cost guidance by country

|

Country |

2024 production

guidance

(Au eq. oz.)11

(+/-5%) |

Percentage

of total

forecast

production12 |

2024 guidance

production cost of sales

(per Au eq. oz. sold)2,11

(+/-5%) |

2023 production

cost of sales

(per Au eq. oz. sold)2 |

|

United States |

730,000 |

35% |

$1,330 |

$1,318 |

|

Brazil |

510,000 |

24% |

$1,080 |

$909 |

|

Chile |

250,000 |

12% |

$800 |

$681 |

|

Mauritania |

610,000 |

29% |

$670 |

$661 |

|

TOTAL |

2.1 million |

100% |

$1,020 |

$942 |

Material assumptions used to forecast 2024 production cost of sales

are as follows:

- a gold price of $2,000 per

ounce;

- a silver price of $25 per

ounce;

- an oil price of $75 per

barrel;

- foreign exchange rates of:

- 4.75 Brazilian reais to the U.S.

dollar;

- 800 Chilean pesos to the U.S.

dollar;

- 35 Mauritanian ouguiyas to the U.S.

dollar; and

- 1.30 Canadian dollars to the U.S.

dollar;

Taking into account existing currency and oil hedges:

- a 10% change in foreign currency

exchange rates13 would be expected to result in an

approximate $20 impact on production cost of sales per

ounce;

- specific to the Brazilian real, a

10% change in this exchange rate would be expected to result in an

approximate $40 impact on Brazilian production cost of sales per

ounce;

- specific to the Chilean peso, a 10%

change in this exchange rate would be expected to result in an

approximate $30 impact on Chilean production cost of sales per

ounce;

- a $10 per barrel change in the

price of oil would be expected to result in an approximate $3

impact on fuel consumption costs on production cost of sales per

ounce; and

- a $100 change in the price of gold

would be expected to result in an approximate $4 impact on

production cost of sales per ounce as a result of a change in

royalties.

Attributable1 capital

expenditures4 guidance

Attributable capital expenditures for 2024 are

forecast to be approximately $1,050 million (+/- 5%) and are

summarized in the table below. The 2024 capital expenditures

guidance is in line with 2023 results.

Kinross’ attributable capital expenditures

outlook for 2025 and 2026 is $850 million and $650 million,

respectively, based on currently approved projects. As Kinross

continues to develop and optimize its portfolio for production

beyond 2026, other projects may be incorporated into its capital

expenditures, as well as potential inflationary impacts, over the

2024-2025 timeframe.

Country |

Forecast 2024

sustaining

capital14

(+/-5%)

(attributable)1

(million) |

Forecast 2024

non-sustaining

capital14

(+/-5%)

(attributable)1

(million) |

Total 2024

forecast

capital14

(+/-5%)

(attributable)1

(million)

|

2023

sustaining

capital3

million)

|

2023

non-sustaining

capital3

(million)

|

2023

total capital

(consolidated)

(million)

|

2023

total capital

(attributable)1

(million)

|

|

U.S. |

$250 |

$180 |

$430 |

$303 |

$216 |

$519 |

$476 |

|

Brazil |

$145 |

$0 |

$145 |

$167 |

$0 |

$167 |

$167 |

|

Chile |

$55 |

$15 |

$70 |

$36 |

$39 |

$75 |

$75 |

|

Mauritania |

$50 |

$270 |

$320 |

$46 |

$263 |

$309 |

$309 |

|

Canada15 and

other |

$0 |

$85 |

$85 |

$2 |

$26 |

$28 |

$28 |

|

|

|

|

|

|

|

|

|

|

TOTAL |

$500 |

$550 |

$1,050 |

$554 |

$544 |

$1,098 |

$1,055 |

2024 sustaining capital14 includes the

following forecast spending estimates:

|

• Mine development: |

$115 million (United States); $20 million (Chile); |

|

• Mobile equipment: |

$65 million (United States); $60 million (Brazil); $5 million

(Chile); $20 million (Mauritania) |

|

• Mill facilities: |

$5 million (United States); $25 million (Brazil); $10 million

(Chile); $5 million (Mauritania) |

|

• Leach facilities: |

$25 million (United States) |

|

• Tailings facilities: |

$5 million (United States); $50 million (Brazil), $5 million

(Chile); $15 million (Mauritania) |

2024 non-sustaining capital14 includes the

following forecast spending estimates:

|

• Tasiast West Branch stripping: |

$235 million |

|

• Round Mountain Phase S stripping and others: |

$120 million |

|

• Great Bear AEX and studies15: |

$85 million |

|

• Manh Choh (70%)16: |

$60 million |

|

• Development and growth projects and studies: |

$50 million |

Other 2024 guidance

|

Category |

2024 Guidance |

Summary |

Exploration and Business

Development ($M)

|

$185 (+/- 5%) |

2024 guidance includes

approximately $160 million of exploration spend on greenfields,

brownfields and minex exploration targets (2023 - $158.9

million).

For details about the 2024 exploration program, see page 14.

|

General and Administrative

($M)

|

$115 (+/- 5%) |

Largely in line with 2023

results.

|

Other Operating Costs ($M)

|

~$100 |

Primarily relates to studies and

permitting activities, as well as care and maintenance and

reclamation activities at non-operating sites.

|

Effective Tax Rate

(ETR)17

|

33% - 38% |

ETR based on adjusted net

earnings3 from continuing operations.

|

Taxes paid (cash) ($M)

|

$155 |

Taxes paid is expected to increase by approximately $5 million for

every $100/oz movement in the realized gold price.

|

DD&A ($/oz.)18

|

$540/oz. (+/- 5%) |

The forecasted increase in

DD&A per ounce largely relates to an increase in depreciable

asset base, relating to assets recently or to be put into service

for 2024.

|

Interest paid ($M)

(incl. capitalized interest)

|

$150 |

Includes approximately $105

million of capitalized interest and $45 million of interest

expense.

Interest expense excludes accretion of the Company’s reclamation

and remediation obligations, as well as lease liabilities, which

for 2023 totaled $39.1 million. |

Environment, Social and Governance

In 2023, Kinross continued its strong ESG

performance through implementation of its ESG strategy, with

priority focus areas in Workforce and Communities, Natural Capital

and Climate and Energy. ESG is a key factor in the Company’s

culture, business strategy and future growth plans. Our focus on

strong governance was maintained, including a bespoke ESG training

session conducted for the Board of Directors. In addition, updated

Social Performance standards were developed, while work began on

updating the standards for health and safety, and environment.

Kinross maintained consistently high ESG ratings

as measured by S&P CSA, MSCI, Refinitiv, Moody’s ESG, and

Sustainalytics. With a 97th percentile ranking as of

December 31, 2023, in its S&P Global Corporate Sustainability

Assessment (CSA), Kinross was named a constituent of the Dow Jones

Sustainability Indices (DJSI) World Index for 2023 and the S&P

ESG 1200. In The Globe and Mail’s annual Board Games

governance rating, Kinross maintained its ranking

in the top group of Canadian mining companies. Kinross obtained

external assurance of conformance with the Responsible Gold Mining

Principles, which were established by the World Gold Council, and

was provided a limited assurance statement as of March 31, 2023.

The Company has established an ongoing process to ensure that every

Kinross site meets the conformance requirements every three

years.

Across sites, operational ESG performance

focused on the Company’s First Priorities including health and

safety, environment, and communities. In health and

safety, the Company maintained low injury frequency rates

that were in line with three-year averages and continued its focus

on a people-centric and progressive safety philosophy. In

environment, Kinross completed a detailed

assessment of the Company’s status against the requirements of the

Task Force on Nature-related Disclosures and plans to use the

results to inform development of a Natural Capital strategy during

2024. At Paracatu, Kinross published a book on the flora and fauna

of the Cerrado biodiversity corridor, also highlighting the

Company’s long-term strategy to protect the biodiversity of this

critical region in Brazil.

Kinross has also progressed on its

Climate Strategy. Kinross is focused on renewable

power purchase agreements, electric autonomous haulage

partnerships, and energy-efficient opportunities across sites. The

outcome of these initiatives is that Kinross is on track to achieve

its greenhouse gas reduction goal of reducing emissions intensity

by 30% in 2030 from its baseline. The Tasiast solar power

plant, which has power generation capacity of 34MW and a

battery system of 18MW, was completed and is expected to provide

annualized fuel savings of 17 million litres of heavy oil, with a

payback of less than five years. This translates into an 18%

reduction of GHG emissions from the power plant over life of mine.

Annualized GHG emissions reductions are estimated at 50 kilotonnes

CO2e and, as a result, 22.5% of Tasiast’s energy

generation will be from renewable sources.

In host communities, a high level of

interactions was maintained and approximately $10 million of

monetary and in-kind contributions were made through site

community investment strategies throughout the

year. In the fourth quarter, Kinross Chile donated three fully

equipped research facilities to the University of Atacama’s high

altitude research station in the Nevado Tres Cruces National Park

near the La Coipa mine.

Kinross’ support of education

and training continued across all our sites. In Alaska, the Company

donated $350,000 to the University of Alaska Fairbanks to establish

the ‘Kinross Alaska Future Leaders Scholarship,’ which will focus

on advancing the inclusion of underrepresented people in the

resource development industry. In Canada, the endowed Kinross Chair

in Environmental Governance at the University of Guelph continued

to advance knowledge, with the most recent Chair exploring links

between the environment and reconciliation. In Chile, research

agreements are now in place with the University of Atacama in areas

covering health and safety as well as paleontology.

Kinross continued its close engagement with

Indigenous peoples related to its mines and

operations. At the Great Bear project in northwestern Ontario, an

updated exploration agreement was signed together with the

Wabauskang and Lac Seul First Nations. At the Manh Choh project in

Alaska, a groundbreaking ceremony was held with the presence of the

Chief, elders, and delegates from the Native Village of Tetlin, as

well as Alaska’s Governor and other government officials.

Through an in-depth consultation process across

all Kinross sites and coordinated through the Kinross Global

Inclusion and Diversity Council, an updated Diversity,

Equity and Inclusion Strategy was developed. Roll-out of

this strategy will commence in 2024. In 2023, Kinross achieved the

highest percentage of female employees to date and also increased

the percentage of women across all levels of management. Kinross

launched an updated set of leadership principles designed to

provide leaders at all levels with clear expectations about what

makes a leader at Kinross and how strong leadership enhances

business outcomes. Through our support for Skills for Change in

Toronto, the Company helped 40 black youth get training in Science,

Technology, Engineering and Math (STEM) subjects.

In anticipation of Bill S-211, Canada’s Modern

Slavery Act, which aims to prevent and reduce the risk of forced

labour in supply chains, a human rights task force was established

to provide cross-functional coordination on the important work

being done in this area and to help prepare the Company’s first

modern slavery statement to be published in May 2024.

For more information on Kinross’ sustainability

performance, see the Company’s 2022 Sustainability and ESG

Report and its ESG Analyst Centre located on

the Company website. The Sustainability and ESG Report follows the

Global Reporting Initiative (GRI) and Sustainability Accounting

Standards Board (SASB) reporting standards. The Company’s 2023

Sustainability and ESG Report is expected to be published in May

2024.

Exploration update

In 2023, approximately 300,000 metres of

drilling was completed for all exploration projects (brownfields,

greenfields, minex).

Brownfields exploration

The Company’s brownfields exploration efforts –

which accounts for approximately 90% of the Company’s exploration

budget – continued to primarily focus within the footprint of

existing mines and projects during 2023.

Highlights of the 2023 brownfields exploration

programs include results from: Round Mountain, Curlew Basin,

Alaska, Bald Mountain, Tasiast and Chile, as well as Great Bear as

detailed on page 6.

Round Mountain

The Phase X exploration decline that commenced

in 2023 is designed to provide a platform for definition drilling

of the main Phase X underground target. The exploration

program plans for definition drill holes in critical areas to

test growth potential outward from the main zone of mineralization,

in particular testing for continuity of mineralization along strike

in areas where surface drilling was limited. Exploration holes are

also planned to be drilled at the end of the decline to test for

mineralization beyond the planned development. In parallel with

developing the decline, Kinross has commenced opportunity drilling

between the open pit and the main underground target in Q4

2023.

2023 exploration work at Gold Hill demonstrated

significant upside potential at this organic growth target. This

year’s work confirmed an 800 metre strike extension of multiple

veins yielding high grade intercepts within the Jersey vein zone

(D-1195, -94 and -96), suggesting that this robust system continues

and remains open (reported in Q2 2023). These results build on

successful strike extensions from previous years.

Exploration drilling (7,950m) at Gold Hill was

accelerated to be completed in the first half of 2023 to fuel

studies and initial permitting efforts. Exploration drilling from

surface and definition drilling from the bottom of the pit resumed

in Q4 2023 and is planned to continue into the first half of

2024.

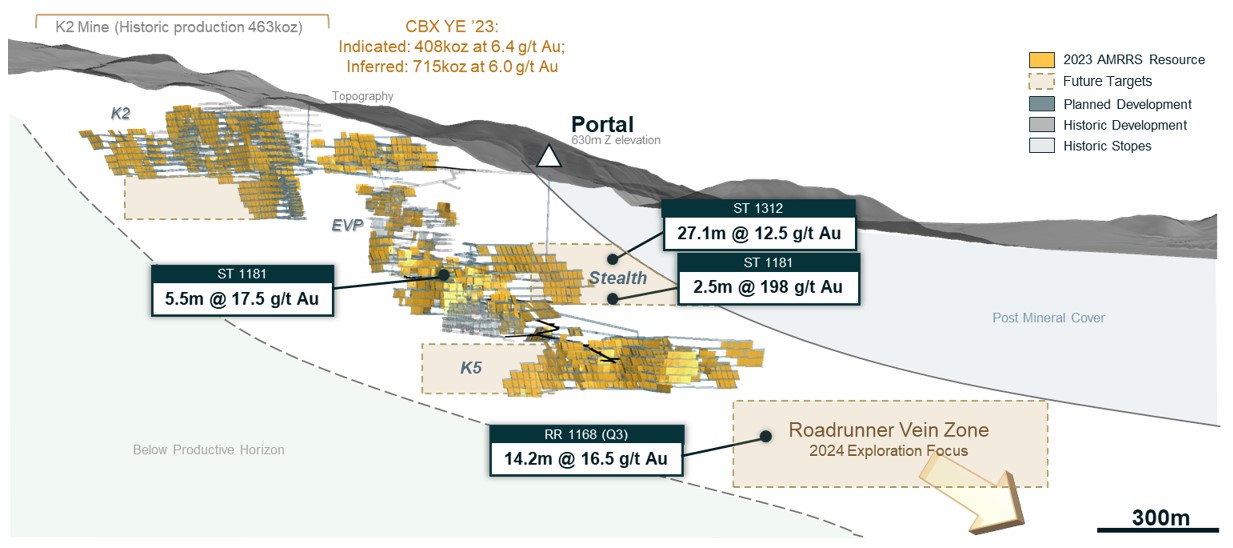

Curlew Basin

Results at Curlew Basin continue to trend well.

At this organic growth project, the 2023 exploration program

(16,900m diamond drilling) delivered the following successes:

- Confirmed extensions and continuity

in several critical vein zones with multiple wide, high-grade

intercepts.

- ST-1312 – 27.1m @ 12.5 g/t Au, includes

10.7m @ 19.9 g/t Au

- ST-1181 – 2.5m @ 198.4 g/t Au, includes 0.3m @

1,610.0 g/t Au

- Demonstrated upside potential

continues with the spatially distinct mineralization at the new

“Roadrunner” zone (reported in Q3 14.2m @16.5 g/t

Au, includes 7.3m @ 25.3 g/t Au).

Underground drilling resumed in Q4 2023 and will be the primary

focus for the first half of 2024.

- Meaningful resource increase,

including a 34% increase in the inferred resource (note: the

cut-off date for the 2023 year-end mineral resource estimate

precedes the new intercepts listed above).

In 2024, Kinross plans to follow up on resource

growth and new discoveries.

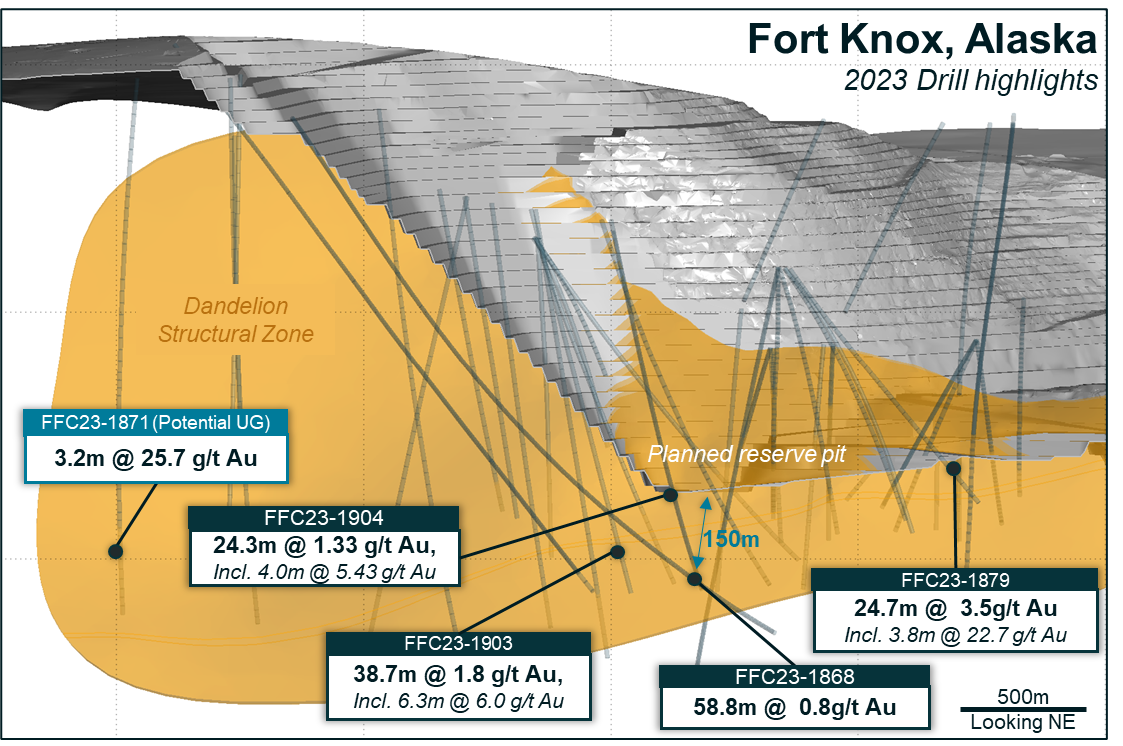

Alaska

Drilling this year in Alaska primarily focused on two main

areas: targets for proximal growth around the Fort Knox pit, and

targets for potential deeper underground mineralization.

Proximal growth highlights include:

- FFC23-1879 – 24.7m @ 3.5 g/t Au, includes 3.8m @ 22.7 g/t

Au

- FFC23-1868 – 58.8m @ 0.8 g/t Au

- FFC23-1903 – 38.7m @ 1.8 g/t Au, includes 6.3m @ 6.0 g/t

Au

- FFC23-1904 – 24.3m @ 1.3 g/t Au, includes 4.0m @ 5.4 g/t

Au

Underground Dandelion shear highlight:

- FFC23-1871 – 3.2m @ 25.7 g/t Au

These proximal growth highlights have not been

included in the current resource update and may offer potential to

augment medium-term production plans at Fort Knox.

At Manh Choh, 2,090 metres of drilling was

completed across six target areas. The near-mine exploration area

was expanded to include several new targets identified along the

mine road corridor. Regional reconnaissance work also continued

this year and will continue across the greater Tetlin lease area in

2024.

Bald Mountain

Exploration drilling focused on near-term growth

enabling the addition of 78koz. to reserves this year. In 2024, the

strategy will continue to focus on low-strip, near-pit extensions

across six target areas in the North and South area of operations,

as well as test new target areas within the Bida trend.

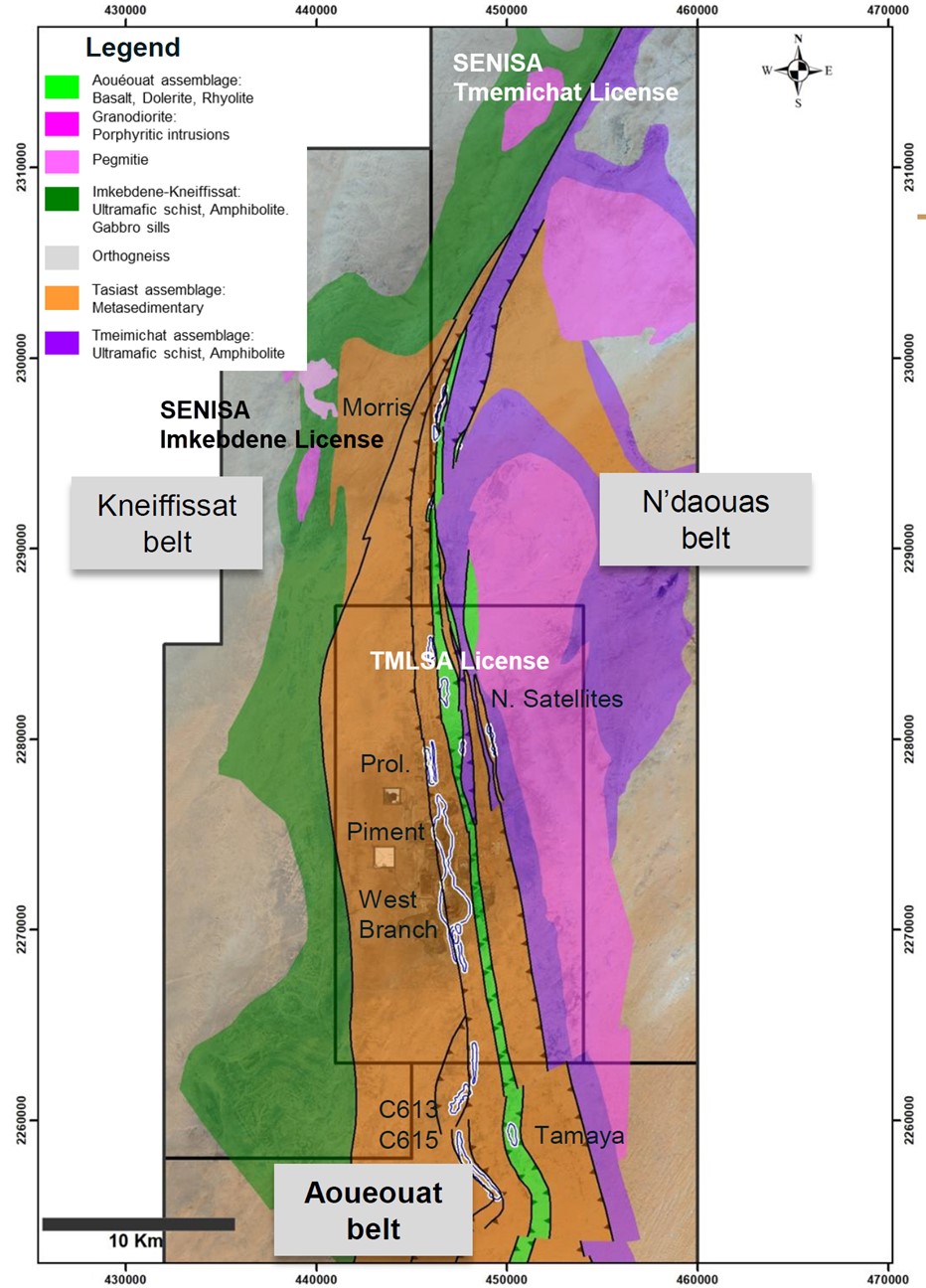

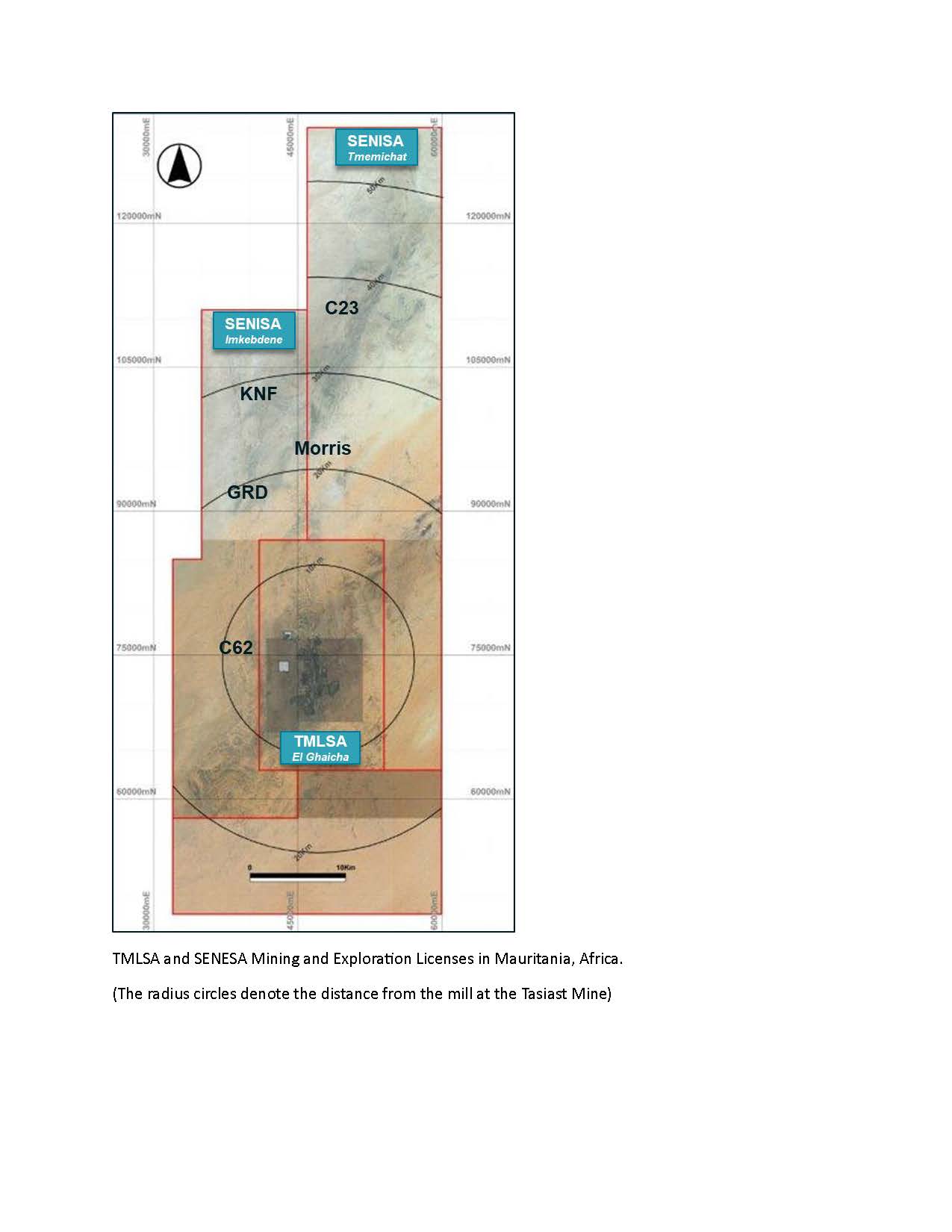

Tasiast

At Tasiast, exploration drilling resumed in Q4

2023 targeting soil anomalies in the north satellite area on the

TMLSA license. The work tested for the potential northern extension

of a known structure that forms part of the 75km long Aoueouat

Greenstone Belt, hosting Kinross’ known gold deposits. The reverse

circulation drill program successfully outlined mineralization and

proved the continuity of a known structure. A follow-up drilling

program is planned later this year.

Reverse circulation drilling of priority targets

on the SENISA licenses also began in Q4 2023 and is expected to

continue throughout the year. The initial program was designed to

test the western extremity of the greenstone belt, roughly 9km due

west of Kinross’ Piment deposit, where favorable geochemistry and

prospecting had outlined anomalous gold.

Drilling around the existing operations for deep

extensions at West Branch, Piment and Prolongation that could

support underground mining will be a focus in 2024, with deep

drilling expected to begin later this year.

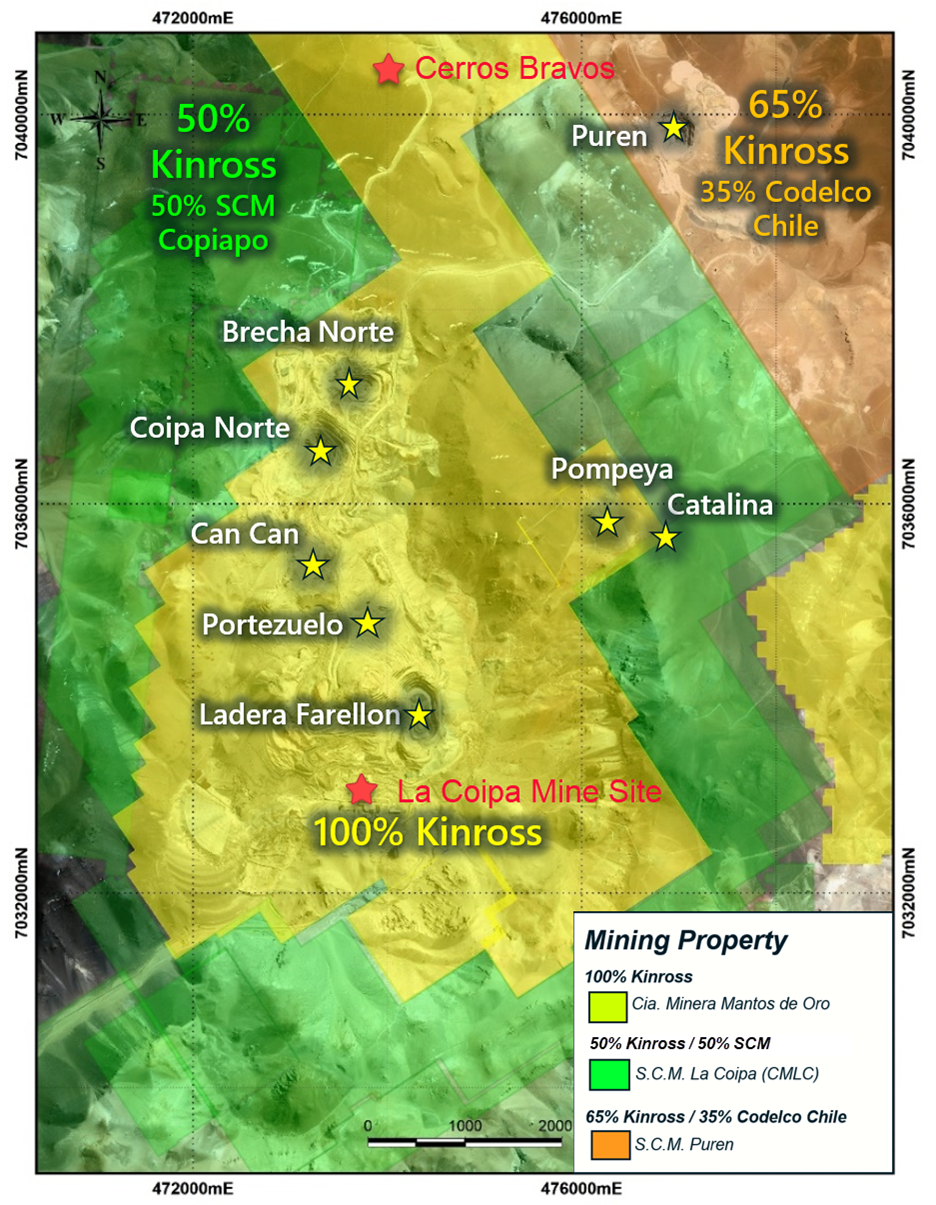

Chile

In Chile, the brownfields drilling program was

successful in uncovering potential porphyry mineralization when

testing a target at Cerros Bravos on Kinross’ 100% owned property.

The porphyry is located approximately 8km due north of Kinross’

mine facilities. Follow-up work in 2024 is expected to include

geophysics and additional drilling.

At the La Coipa extensions, approximately

~15,000 metres were drilled in 2023 in and around current and

historically active pits to extend oxide mineralization and

generate geotechnical and geometallurgical data to support

progressing these projects.

Brazil

In Brazil, brownfields and greenfields

exploration efforts are focused on the Company’s extensive land

packages, which are primarily along the northwest corridor from the

Paracatu mine. Kinross’ land holdings extend for over 35km and are

hosted by the sedimentary package that hosts Paracatu. Extensive

soil surveying has uncovered numerous anomalies that have been

followed up by prospecting, sampling and mapping. Recent drilling

of some of these anomalies have revealed similar style

mineralization and grades to Paracatu.

In 2024, Kinross expects to actively drill a

number of untested targets and follow up on the best results.

Greenfields exploration

update

The primary greenfields exploration strategy is

to identify and explore in areas that have the potential to host

high-grade gold deposits. The Company looks for opportunities where

it can stake its own claims or collaborate with high-quality junior

exploration companies through either joint venture agreements or

via equity investment. The primary focus is exploring for orogenic,

epithermal, Carlin and intrusion related gold and gold-copper style

deposits.

The greenfields exploration programs in 2023

were focused on targets located in Canada, the USA and Finland with

approximately 52,000 metres of drilling completed on all

projects.

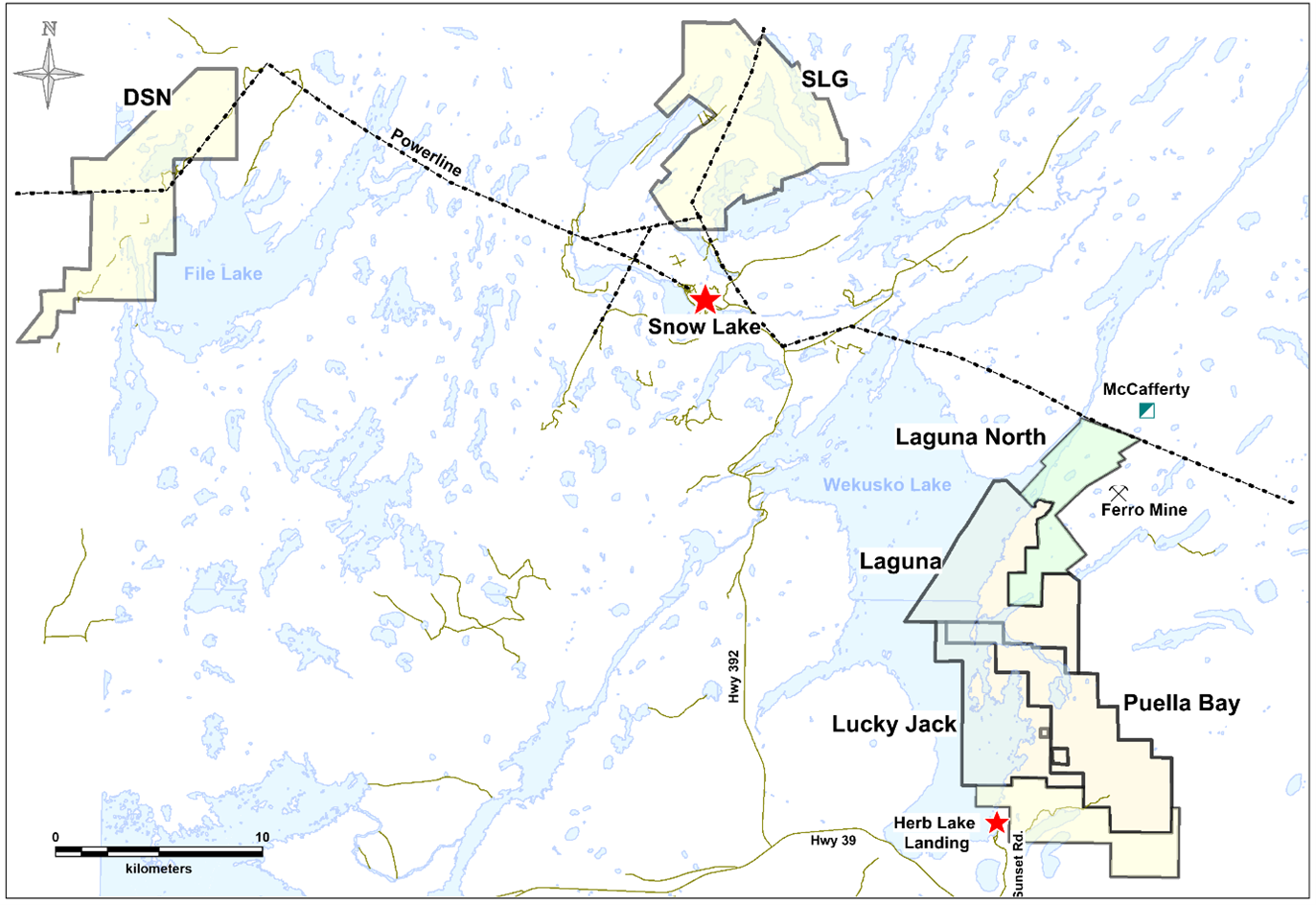

Canada

Outside of Great Bear, the focus in Canada was

on the large land holdings in Snow Lake, Manitoba, where Kinross

has 100% ownership in six exploration properties: Laguna, Puella

Bay, Lucky Jack, Laguna North, DSN and SLG. Work on the Laguna and

the Laguna North properties over the past few years has uncovered

gold rich, shear hosted vein systems.

Prospecting and mapping on the Laguna North

property was successful, with the discovery of a new quartz vein

assaying 104.5 g/t Au and 1.8 g/t Ag. Kinross plans to follow

up in the coming field season with more detailed prospecting and

mapping.

Highlights from prospecting and mapping on the

SLG property returned 6.0, 7.4, 9.4 and 11.5 g/t Au from

mineralized quartz vein material within a shear zone that our

geologists have uncovered for over a 200m along strike. Roughly

1.5km due south of the gold showing described above, geologists

uncovered veining that contained copper and zinc mineralization

with one of the samples returning 0.2 g/t Au, 15.5 g/t Ag, 2.03% Zn

and 0.89% Cu. Further work on all of these areas is planned in

2024.

In February 2023, a joint venture was

established with BTU Metals Corp., who holds a large land package

abutting the southern boundary of Kinross’ Great Bear project in

Red Lake, Ontario. Upon signing the agreement, compilation and

modelling work began, and the relogging and sampling of existing

core got underway in the second half of the year and will continue

in 2024. A drilling program is anticipated at the end of the year,

testing the best targets resulting from the relogging and modelling

work.

USA

Kinross holds a number of projects in Nevada

that are either 100% owned or are in joint venture with private

individuals.

Work on Kinross’ various projects consisted of

geophysics, prospecting and mapping as well as reverse circulation

drilling of targets that were more advanced. A total of 38 reverse

circulation drill holes for 12,785 metres, were conducted over the

combined land packages during the year. These properties have the

potential to host low sulphidation epithermal, Carlin and porphyry

style deposits.

Work continues on evaluating and adding new

pipeline projects through third party agreements and claim staking

opportunities in the principal metallogenic belts throughout the US

Great Basin, including the Walker Lane and the primary trends of

Carlin-type deposits.

Finland

In the Central Lapland Greenstone Belt of

northern Finland, exploration was conducted on Kinross’ joint

venture and 100% owned projects. Kinross’ land positions are

proximal to Agnico Eagle’s Kittilä Gold mine and Rupert Resource’s

Ikkari gold deposit, that has reported more than 4 million ounces

at 2.2 g/t Au in indicated resources.

Work in 2023 consisted of prospecting and

mapping during the summer months and Base of Till drilling that was

conducted throughout the year. The resulting gold anomalies were

followed up with diamond drilling. A total of 21 holes for 3,116

metres of core and 10,981 metres of Base of Till drilling was

carried out on Kinross’ various properties.

The latest joint venture agreement was signed

with Aurion Resources on August 23, 2023, for its Launi East

property. The property hosts the potential for orogenic gold

mineralization and contains at least seven gold zones discovered

prior to the joint venture. Limited diamond drilling has been

carried out over the numerous gold showings and work will build on

the existing data and vector in priority areas. Compilation work as

well as mapping and Base of Till drilling was undertaken on the

property before year end. The results will be followed up in

2024.

2024 Focus

For 2024, the exploration expenditure guidance

(brownfields, greenfields and minex) is $160 million (+/-5%)

compared with the $158.9 million spent in 2023. The 2024 programs

are designed to follow-up on existing zones of mineralization and

to make new discoveries in all of Kinross’ jurisdictions.

Looking at the priority exploration projects:

- At Great Bear, expand the mineralized zones, LP, Hinge and

Limb, and explore for new mineralization on Kinross’ land

package

- At Curlew, expand on the existing resource and follow-up on the

newly discovered high-grade mineralization at Roadrunner

- At Round Mountain, begin to delineate the Phase X

mineralization from the underground exploration decline. Additional

drilling from surface and the bottom of the pit at Gold Hill will

test the numerous, high-grade gold veins

- At Tasiast, underground-focused drilling from surface at Piment

and West Branch and exploration of the SENISA and TMLSA land

packages

- In Chile, a number of greenfields and brownfields targets will

be drill tested over the course of the year and the porphyry

mineralization at Cerros Bravos will be followed up

- At Paracatu, expand regional exploration activities

- In Canada, continue to explore the Snow Lake, Manitoba, land

package

Appendix C: Refer to page 42 of

this news release for supplementary illustrations.

Full drill results are available here: www.kinross.com/Exploration-Drill-Results-Appendix-C-Q4-YE-2023

2023 Mineral Reserves and Mineral

Resources update

(See the Company’s detailed Annual

Mineral Reserve and Mineral Resource Statement estimated as at

December 31, 2023 and explanatory notes starting at page

32.)

Kinross maintained its gold price assumptions of

$1,400 per ounce and $1,700 per ounce for its mineral reserve and

mineral resource estimates, respectively, as of December 31,

202310.

The Company also maintained its silver price

assumption of $17.50 per ounce and of $21.30 per ounce for its

mineral reserve and mineral resource estimates5.

Kinross continues to prioritize quality,

high-margin, low-cost ounces in its portfolio, and maintained its

fully loaded costing methodology.

Kinross is focused on upgrading the quality of

its resources and delineating high-grade gold ounces with the

objective of converting to reserves. While there was an overall

reduction in reserves at year-end 2023, additions to resources are

primarily high-grade ounces driven by the substantial increase at

Great Bear.

Kinross Gold Mineral Reserve and Mineral Resource

estimates19

|

|

|

2022

(Au koz) |

Depletion

(Au koz) |

Geology & Engineering

(Au koz) |

2023

(Au koz) |

|

Proven and Probable Reserves |

25,535 |

(2,435) |

(344) |

22,757 |

|

Measured and Indicated Resources |

26,211 |

(69) |

(174) |

25,968 |

|

Inferred Resources |

10,522 |

(85) |

1,049 |

11,484 |

Proven and Probable Mineral Reserves

Kinross’ total proven and probable mineral

reserve estimates decreased by 11%, or 2.8 million Au oz., to 22.8

million Au oz. at year-end 2023 compared with 25.5 million Au oz.

at year-end 2022. The net decrease was mostly due to depletion,

with an additional decrease of 0.4 million Au oz. at Paracatu due

to geological and engineering updates, with decreases offset by an

increase of 0.1 million Au oz. at Bald Mountain due to the addition

of several smaller pits (converting from resource).

The Company’s total proven and probable silver

mineral reserve estimate decreased by 34% or 12.4 million Ag oz. to

23.7 million Ag oz. at year-end 2023 compared with 36.1 million Ag

oz. at year-end 2022. The net decrease was mostly due to depletion

at La Coipa.

Measured and Indicated Mineral

Resources

Kinross’ total measured and indicated mineral

resource estimate at year-end 2023 was 26.0 million Au oz. compared

with 26.2 million Au oz. at year-end 2022. The slight reduction was

largely a result of increased costs at Paracatu, Fort Knox and

small conversions of mineral resources to mineral reserves at Bald

Mountain. Decreases were offset by a geologic increase at

Tasiast.

The Company’s total measured and indicated

silver resources decreased by 10% to 34.0 million Ag oz. at

year-end 2023 compared with 37.6 million Ag oz. at year-end

2022.

Inferred Mineral Resources

Kinross’ total inferred mineral resource

estimate increased by 9% or 1.0 million Au oz. to 11.5 million Au

oz. at year-end 2023, compared with 10.5 million Au oz. at year-end

2022. The increase can be attributed to Great Bear which added 1.0

million ounces of inferred material, and Curlew Basin (Kettle

River).

The Company’s total inferred silver resources decreased by 13%

to 4.0 million Ag oz. at year-end 2023 compared with 4.6 million Ag

oz. at year-end 2022.

Board update

Mr. Ian Atkinson, who has been a Board member

since February 2016, will, pursuant to Kinross’ retirement policy,

be retiring and not stand for re-election at the Company’s Annual

General Meeting of Shareholders in May 2024. Kinross’ management

and Board would like to thank Mr. Atkinson for his many

contributions during his tenure, including those related to his

role as Chair of the Corporate Governance and Nominating Committee

and his membership on the Corporate Responsibility and Technical

Committee and the Human Resources and Compensation Committee.

The Board of Directors of Kinross has appointed

Mr. George Paspalas as a Director with an effective date of January

1, 2024. Mr. Paspalas is a veteran of the mining industry with

nearly 40 years of mining experience and brings a wealth of

knowledge to his new position. He is currently the President &

Chief Executive Officer and a board director of MAG Silver Corp., a

Canadian silver producer and exploration company, a position he has

held from May 2013. Prior to that, Mr. Paspalas held senior

leadership positions at Aurizon Mines Ltd., Silver Standard

Resources Inc., Sargold Resources Corp., and Placer Dome. He has a

B. Eng. (Hons) from the University of New South Wales and has

completed the Advanced Management Program from INSEAD. Mr. Paspalas

has been appointed to sit on the Company’s Corporate Responsibility

and Technical Committee.

The appointment of Mr. Paspalas will support the

transition of Mr. Atkinson’s retirement as both individuals have

commensurate skillsets, including capital markets and senior-level

resource industry experience, deep technical knowledge, and

operational leadership.

Conference call details

In connection with this news release, Kinross

will hold a conference call and audio webcast on Thursday, February

15, 2024, at 8 a.m. ET to discuss the results, followed by a

question-and-answer session. To access the call, please dial:

Canada & US

toll-free – +1 (888) 330-2446; Passcode: 4915537

Outside of Canada & US – +1 (240) 789-2732;

Passcode: 4915537

Replay (available up to 14 days after the

call):

Canada & US toll-free – +1 (800) 770-2030;

Passcode: 4915537

Outside of Canada & US – +1 (647) 362-9199;

Passcode: 4915537

You may also access the conference call on a

listen-only basis via webcast at our website www.kinross.com. The audio

webcast will be archived on www.kinross.com.

This release should be read in conjunction with

Kinross’ 2023 year-end Financial Statements and Management’s

Discussion and Analysis report at www.kinross.com. Kinross’ 2023

year-end Financial Statements and Management’s Discussion and

Analysis have been filed with Canadian securities regulators

(available at www.sedar.com) and furnished

with the U.S. Securities and Exchange Commission (available at

www.sec.gov). Kinross

shareholders may obtain a copy of the financial statements free of

charge upon request to the Company.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold

mining company with operations and projects in the United States,

Brazil, Mauritania, Chile and Canada. Our focus is on delivering

value based on the core principles of responsible mining,

operational excellence, disciplined growth, and balance sheet

strength. Kinross maintains listings on the Toronto Stock Exchange

(symbol:K) and the New York Stock Exchange (symbol:KGC).

Media Contact

Victoria Barrington

Senior Director, Corporate Communications

phone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

Chris Lichtenheldt

Vice-President, Investor Relations

phone: 416-365-2761

chris.lichtenheldt@kinross.com

Review of operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

Gold equivalent ounces |

|

|

|

|

|

|

|

|

Produced |

|

Sold |

|

Production cost of sales ($millions) |

|

Production cost of sales/equivalent ounce

sold |

|

|

2023 |

2022 |

|

2023 |

2022 |

|

2023 |

2022 |

|

2023 |

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tasiast |

160,764 |

143,002 |

|

171,199 |

147,019 |

|

$ |

110.4 |

$ |

96.2 |

|

$ |

645 |

$ |

654 |

|

Paracatu |

127,940 |

180,809 |

|

132,886 |

183,190 |

|

|

144.2 |

|

130.3 |

|

|

1,085 |

|

711 |

| La

Coipa |

73,823 |

67,683 |

|

73,477 |

68,135 |

|

|

52.9 |

|

39.4 |

|

|

720 |

|

578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fort

Knox |

84,215 |

83,739 |

|

81,306 |

87,061 |

|

|

104.3 |

|

102.1 |

|

|

1,283 |

|

1,173 |

| Round

Mountain |

55,764 |

61,929 |

|

56,495 |

67,484 |

|

|

82.6 |

|

95.1 |

|

|

1,462 |

|

1,409 |

| Bald

Mountain |

44,007 |

58,521 |

|

49,375 |

66,847 |

|

|

57.1 |

|

62.8 |

|

|

1,156 |

|

939 |

|

United States Total |

183,986 |

204,189 |

|

187,176 |

221,392 |

|

|

244.0 |

|

260.0 |

|

|

1,304 |

|

1,174 |

|

|

|

|

|

|

|

|

|

|

|