NOT FOR DISTRIBUTION IN THE UNITED STATES OR OVER UNITED STATES

WIRE SERVICES

Montreal (Québec), February

26, 2024 – Rogers Sugar Inc. (the

“Company” or “Rogers Sugar”)

(TSX: RSI) today announced the issue and sale of common shares (the

“Common Shares”) for aggregate gross proceeds to

the Company of approximately $110 million at an offering price of

$5.18 per Common Share, the net proceeds of which will be used to

fund a portion of the Eastern Canada capacity expansion project

(the “Expansion Project”) undertaken by the

Company’s wholly owned operating subsidiary Lantic Inc.

(“Lantic”), as further described below.

The sale of Common Shares is pursuant to a

bought deal public offering (the “Public

Offering”) and two concurrent non-brokered private

placements (the “Concurrent Private Placements”

and, collectively with the Public Offering, the “Equity

Offerings”).

Fonds de solidarité des travailleurs du Québec

(F.T.Q.) (“FSTQ”), the largest development capital

investment network in Québec, will be a cornerstone investor in the

Equity Offerings, agreeing to purchase approximately

$50 million of Common Shares in a concurrent private

placement. In addition, longtime Rogers Sugar shareholder Belkorp

Industries Inc. (“Belkorp”) has agreed to purchase

approximately $10 million of Common Shares, also by way of a

concurrent private placement.

The Expansion Project

“Our capacity expansion project will further

position Rogers Sugar to deliver consistent, profitable growth as

we benefit from the positive trends in the North American sugar

market, and we thank the investors whose support is making the

project a reality,” said Mike Walton, President and Chief Executive

Officer of Rogers Sugar and Lantic.

The Expansion Project will increase the

production capacity of Lantic’s Montreal plant by approximately

20%, or 100,000 metric tonnes. The project includes investments in

sugar refining technology and equipment, as well as in logistical

infrastructure at Lantic’s Montreal sugar refinery and in the

Greater Toronto Area to serve the Eastern Canada market.

The Expansion Project is made up of three key

components: (i) the expansion of refining capacity with the

addition of new sugar refining equipment at the Montreal plant;

(ii) the construction of a new bulk rail loading station in

Montreal to serve increased shipments to the Eastern Canada market;

and (iii) the expansion of logistics and storage capacity in the

Greater Toronto Area.

The total investment for the Expansion Project

is estimated at approximately $200 million. In addition to the

Equity Offerings announced today, as previously disclosed, the

Expansion Project is receiving significant support from the Québec

Government in the form of loans from Investissement Québec to

Lantic for up to $65 million.

As disclosed in the Company’s recent

first-quarter 2024 report, the Expansion Project is progressing as

planned. Work is underway and major equipment has been ordered.

Demand for high-quality, reliable, industrial

bulk sugar has steadily increased over the last few years,

especially in Eastern Canada where the food-processing industry is

expanding and is expected to continue to grow in the future. The

growth in demand is directly associated with an increase in the

production of sugar containing products by our business partners in

the food manufacturing sector. The capacity expansion will support

this growth and further position the Company to serve those

food-processing customers and to benefit from additional long-term

demand for bulk sugar.

Rogers Sugar is funding this growth investment

in a manner that ensures the Company’s capital structure remains

aligned with its current profile. Throughout the construction

process and in the future, the Company intends to continue to

provide reliable returns to its shareholders.

Details of the Public Offering of Common

Shares

The Public Offering is being made through a

syndicate of underwriters (collectively the

“Underwriters”) co-led by BMO Capital Markets and

National Bank Financial Inc., under which the Underwriters have

agreed to purchase, on a bought deal basis, 9,660,000 Common Shares

for aggregate gross proceeds of approximately

$50 million, at an offering price of $5.18

per Common Share (the “Offering

Price”). The Company has granted the Underwriters

an option to purchase up to an additional 15% of the Common Shares,

on the same terms and conditions, exercisable in whole or in part

at any time until 30 days after closing of the Public Offering, to

cover any over-allotments, if any, and for market stabilization

purposes (the “Over-Allotment Option”).

The Public Offering is expected to close on or

about March 4, 2024 and is subject to customary conditions,

including the entering into of a definitive underwriting agreement,

the closing of the Concurrent Private Placements and receipt of all

regulatory approvals, including the approval of the Toronto Stock

Exchange (the “TSX”). The Common Shares will be

offered by way of a prospectus supplement (the “Prospectus

Supplement”) to the Company’s short form base shelf

prospectus dated August 14, 2023 (the “Shelf

Prospectus”) to be filed with the securities commissions

and other similar regulatory authorities in each of the provinces

of Canada.

A copy of the Shelf Prospectus is available

under the Company’s profile on SEDAR+ at www.sedarplus.ca or may be

obtained by contacting the Underwriters. The Prospectus Supplement

is expected to be filed on or about February 28, 2024, and will

likewise be accessible through the Company’s profile on SEDAR+ or

via the Underwriters.

Concurrent Private

Placements

Concurrently with and conditionally on the

closing of the Public Offering, (i) FSTQ has agreed to purchase

9,652,510 Common Shares for an aggregate price of approximately $50

million (the “FSTQ Private Placement Shares”), and

(ii) Belkorp has agreed to purchase 2,007,722 Common Shares for an

aggregate price of approximately $10 million (together with the

FSTQ Private Placement Shares, the “Private Placement

Shares”). Should the Over-Allotment Option be exercised,

in whole or in part, by the Underwriters, FSTQ and Belkorp will

have the option (the “Additional Subscription

Option”) to purchase additional Common Shares under the

Concurrent Private Placements in the same proportion of the Common

Shares that are purchased by the Underwriters pursuant to the

Over-Allotment Option.

The Private Placement Shares and the Common

Shares purchased pursuant to the Additional Subscription Option

will be issued at the Offering Price and will be subject to a

statutory hold period of four months from the date of their

issuance, in accordance with Canadian securities regulations and,

as well as a contractual hold period of six months from the date of

their issuance. The closing of the Concurrent Private Placements is

subject to a number of conditions, including the concurrent closing

of the Public Offering and the receipt of all regulatory approvals,

including the approval of the TSX.

Use of Proceeds

The Company intends to use the net proceeds of

the Equity Offerings to finance a portion of the Expansion Project

which was announced on August 14, 2023 and is further described

above.

In the event that all or part of the

Over-Allotment Option and the Additional Subscription Option are

exercised, the additional net proceeds received from the exercise

of such options will be used for working capital purposes.

Additional Disclosures

In addition to the subscription by Belkorp of

Private Placement Shares, certain other insiders of the Company,

namely Mike Walton, Don Jewell, Jean-Sébastien Couillard, Mike

Heskin, Rod Kirwan and Louis Turenne will subscribe for a total of

77,220 Common Shares in the Public Offering. The subscriptions for

Common Shares by Belkorp and the other aforementioned insiders are

related party transactions within the meaning of applicable

Canadian securities laws. Such transactions are exempt from the

formal valuation and minority approval requirements applicable to

related party transactions on the basis that the value of the

transactions insofar as they involve related parties is less than

25 percent of the Company’s market capitalization. The board of

directors of the Company has approved the Equity Offerings. A

material change report in respect of these related party

transactions could not be filed earlier than 21 days prior to the

closing of the Equity Offerings due to the fact that the Equity

Offerings were launched on the date hereof and the terms of the

participation of these related parties was confirmed concurrently,

and the Equity Offerings are expected to be closing on or about

March 4, 2024.

Cautionary Notice Regarding

Forward-Looking Statements

All statements, other than statements of

historical fact, contained in this press release including, but not

limited to those relating to the Equity Offerings, the expected use

of proceeds, the Expansion Project, its estimated budget and the

anticipated benefits resulting therefrom, the trends in the North

American sugar market, the anticipated closing date of the Equity

Offerings and the receiving of all necessary regulatory approvals,

constitute “forward-looking information” or “forward-looking

statements” within the meaning of certain securities laws, and are

based on expectations, estimates and projections as of the time of

this press release.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by the Company as of the time of such statements, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. These estimates and

assumptions may prove to be incorrect. Many of these uncertainties

and contingencies can directly or indirectly affect, and could

cause, actual results to differ materially from those expressed or

implied in any forward-looking statements. Certain important

estimates or assumptions by the Company in making forward-looking

statements include, but are not limited to, the successful closing

of the Equity Offerings, and all requisite regulatory and stock

exchange approvals being obtained. There can be no assurance that

these assumptions will prove to be correct. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. The Company does not undertake

any obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

About Rogers Sugar Inc.

Rogers Sugar is a corporation established under

the laws of Canada. The Company holds all of the common shares of

Lantic, and its administrative office is in Montréal, Québec.

Lantic has been refining sugar for 135 years and operates cane

sugar refineries in Montreal, Québec and Vancouver, British

Columbia, as well as the only Canadian sugar beet processing

facility in Taber, Alberta. Lantic also operates a distribution

center in Toronto, Ontario. Lantic’s sugar products are mainly

marketed under the “Lantic” trademark in Eastern Canada, and the

“Rogers” trademark in Western Canada and include granulated, icing,

cube, yellow and brown sugars, liquid sugars and specialty syrups.

Lantic owns all of the shares of The Maple Treat Company

(“TMTC”) and its head office is located in

Montréal, Québec. TMTC operates bottling plants in Granby,

Dégelis and St-Honoré-de-Shenley, Québec and in Websterville,

Vermont. TMTC’s products include maple syrup and derived maple

syrup products supplied under retail private label brands in

approximately 50 countries and are sold under various brand

names. The Company’s goal is to offer the best quality sugars and

sweeteners to satisfy its customers.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Mr. Jean-Sébastien CouillardVice President of Finance, Chief

Financial Officer & Corporate SecretaryTel: (514) 940-4350

investors@lantic.caWebsite: www.lanticrogers.com

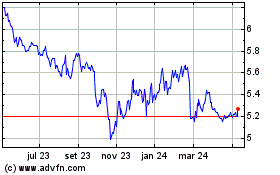

Rogers Sugar (TSX:RSI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

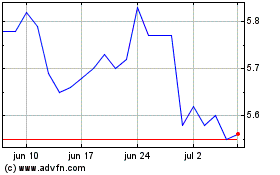

Rogers Sugar (TSX:RSI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025