IntelGenx Technologies Corp. (TSX:IGX) (OTCQB:IGXT) (the

“

Company”) announces that its wholly-owned

subsidiary, IntelGenx Corp. (“

IntelGenx Corp.”),

has entered into a third amended and restated loan agreement dated

as of March 8, 2024 (amending the second amended and restated loan

agreement dated as of September 30, 2023) (the “

Loan

Agreement”) with atai Life Sciences AG

(“

atai”), pursuant to which, among other things,

atai has agreed to make (i) one (1) additional term loan in the

amount of US$1,000,000 to IntelGenx Corp., which loan is to be

disbursed within three (3) business days of the execution of the

Loan Agreement (the “

First Tranche Loan”), and

(ii) one (1) additional term loan in the amount of US$1,000,000 to

IntelGenx Corp., which loan is to be disbursed upon the achievement

of a pre-defined milestone (the “

Second Tranche

Loan” and collectively with the Second Tranche Loan, the

“

Additional Term Loans”). The Additional Term

Loans will mature on February 1, 2026.

Subject to obtaining approval from the Toronto

Stock Exchange (the “TSX”), the Loan Agreement

provides for the ability for atai to convert (the

“Conversion Feature”), from time to time, (i) the

principal outstanding under the First Tranche Loan into shares of

common stock of the Company (the “Shares”) at a

conversion price of US$0.185 per Share (the “Conversion

Price”), and (ii) the principal outstanding under the

Second Tranche Loan into Shares at a conversion price equal to the

greater of (a) the Conversion Price and (b) the 5-day

volume-weighted average price (the “5-day VWAP”)

of the Shares on the TSX ending on the day preceding the

disbursement by atai of the Second Tranche Loan to the Company or

IntelGenx, less the maximum permissible discount under the

applicable TSX rules.

Additionally, and subject to approval of the

TSX, the Company may elect, with the consent of atai, to pay any

accrued but unpaid interest on the Additional Term Loans in Shares

at a price per Share equal to the 5-day VWAP of the Shares ending

on the day that is the second business day before the day the

interest becomes due and payable, less the maximum permissible

discount under the applicable TSX rules.

Concurrently to entering into the Loan

Agreement, the Company has issued 4,000,000 warrants (the

“Warrants”) to atai. The Warrants entitle atai to

purchase Shares at a price of US$0.17 per Share, for a period of 36

months following their issuance.

Furthermore, on December 5, 2023, atai made a

loan in the amount of US$500,000 to the Company, which will mature

on December 31, 2024.

Related Party Transactions

atai is an insider of the Company as a result of

its beneficial ownership of, or control or direction over, directly

or indirectly, greater than 10% of the outstanding Shares. The

participation of atai in the Loan Agreement (including the issuance

of the Warrants) constitutes a “related party transaction” within

the meaning of Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions (“MI

61-101”) which, absent any available exemption, would

require a formal valuation and minority approval under

MI 61-101. The board of directors of the Company unanimously

determined that the Company may rely on the “financial hardship”

exemption from the formal valuation and minority approval

requirements set out in Section 5.5(g) and Section 5.7(e) of

MI 61-101 with respect to such transaction, given that the

Company is in serious financial difficulty, the participation of

atai in the Loan Agreement is designed to improve the financial

position of the Company, the exemption provided for in Section

5.5(f) of MI 61-101 is not available, as the transaction

contemplated is not subject to court approval under bankruptcy or

insolvency law, and there is no other requirement, corporate or

otherwise, to hold a meeting to obtain any approval of the

Company’s shareholders. In addition, the Company has one or more

independent directors who have determined that the terms and

conditions of the participation of atai in the Loan Agreement is

reasonable for the Company in the circumstances and is in its best

interests. The Company did not file a material change report in

respect of the related party transaction 21 days in advance of

closing of the offering because insider participation had not been

determined at that time. The shorter period was necessary in order

to permit the Company to close the Loan Agreement in a timeframe

consistent with usual market practice for transactions of this

nature.

Early Warning Disclosure

This press release is also being issued pursuant

to National Instrument 62-103 – The Early Warning System and

Related Take-Over Bid and Insider Reporting Issues (“NI

62-103”) in connection with the acquisition by atai

(Wallstraße 16, 10179 Berlin, Germany) of certain conversion rights

and Warrants under the Loan Agreement (the

“Acquisition”). The Acquisition occurred on a

private placement basis. In connection with the Acquisition, atai

will advance up to US$2 million, the principal of which will be

convertible into 10,810,810 Shares (assuming that the Second

Tranche Loan is advanced and that the conversion price of the

Second Tranche Loan will be equal to US$0.185), and atai also

acquired 4,000,000 Warrants.

Immediately prior to the Acquisition, atai had

ownership and control over 37,300,000 Shares and securities

convertible into approximately 226,708,724 Shares representing

approximately 65.78% of the issued and outstanding Shares, on a

partially diluted basis. Assuming the conversion and/or exercise of

the principal amount of Additional Term Loans and Warrants, atai

would beneficially own or control in aggregate 278,819,534 Shares

representing approximately 67% of the issued and outstanding Shares

of the Company, on a partially diluted basis.

atai’s acquisitions and dispositions were made

for investment purposes. In accordance with applicable securities

laws, atai may, from time to time and at any time, acquire

additional shares and/or other equity, debt or other securities or

instruments (collectively, “Securities”) of the

Company in the open market or otherwise, and reserves the right to

dispose of any or all of its Securities in the open market or

otherwise at any time and from time to time, and to engage in

similar transactions with respect to the Securities, the whole

depending on market conditions, the business and prospects of the

Company and other relevant factors.

An early warning report will be filed under the

Company’s profile on the SEDAR+ website at www.sedarplus.ca. To

obtain more information or to obtain a copy of the early warning

report filed in respect of this press release, please contact atai

by email at ir@atai.life.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities described herein in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

qualification or registration under the securities laws of any such

jurisdiction. This press release does not constitute an offer of

securities for sale in the United States. The securities described

herein have not been, nor will they be, registered under the United

States Securities Act of 1933, as amended, and such securities may

not be offered or sold within the United States absent registration

under U.S. federal and state securities laws or an applicable

exemption from such U.S. registration requirements.

About IntelGenx

IntelGenx is a leading drug delivery company

focused on the development and manufacturing of pharmaceutical

films. IntelGenx’s superior film technologies, including

VersaFilm®, DisinteQ™, VetaFilm® and transdermal VevaDerm™, allow

for next generation pharmaceutical products that address unmet

medical needs. IntelGenx’s innovative product pipeline offers

significant benefits to patients and physicians for many

therapeutic conditions. IntelGenx's highly skilled team provides

comprehensive pharmaceuticals services to pharmaceutical partners,

including R&D, analytical method development, clinical

monitoring, IP and regulatory services. IntelGenx's

state-of-the-art manufacturing facility offers full service by

providing lab-scale to pilot- and commercial-scale production. For

more information, visit www.intelgenx.com.

Forward-Looking Information

This document may contain forward-looking

information which involve substantial risks and uncertainties.

Statements that are not purely historical are forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. All statements, other than statements of

historical fact, contained in this press release including, but not

limited to, statements regarding (i) the disbursement of the

First Tranche Loan and the Second Tranche Loan, (ii) the

achievement of the pre-determined milestone to disburse the Second

Tranche Loan, (iii) the receipt of the TSX approvals, (iv) the

Conversion Feature (including the conversion price for the Second

Tranche Loan), (v) the payment of interest into Shares, and

(vi) generally, the “About IntelGenx” paragraph which

essentially describe the Corporation’s outlook and objectives,

constitute “forward-looking information” or “forward-looking

statements” and are based on necessarily based upon a number of

estimates and assumptions that, while considered reasonable by the

Corporation as the time of such statements, are inherently subject

to significant business, economic and competitive uncertainties and

contingencies. All forward-looking statements are expressly

qualified in their entirety by this cautionary statement. Because

these forward-looking statements are subject to a number of risks

and uncertainties, IntelGenx’ actual results, objectives and plans

could differ materially from those expressed or implied by these

forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to, those

discussed under the heading “Risk Factors” in IntelGenx’ annual

report on Form 10-K, filed with the United States Securities and

Exchange Commission and available at www.sec.gov, and also filed

with Canadian securities regulatory authorities at

www.sedarplus.ca. IntelGenx assumes no obligation to update any

such forward-looking statements. Moreover, all forward-looking

information contained herein is subject to certain assumptions.

There can be no assurance that such approvals will be obtained.

For more information, please contact:

Stephen KilmerInvestor Relations(647)

872-4849stephen@kilmerlucas.com

Or

Andre Godin, CPA, CAPresident and CFOIntelGenx Technologies

Corp.(514) 331-7440 ext 203andre@intelgenx.com

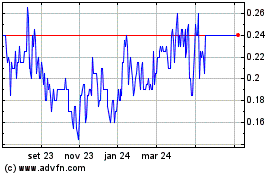

Intelgenx Technologies (TSX:IGX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

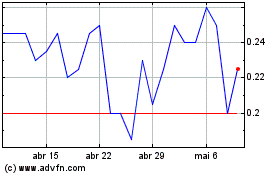

Intelgenx Technologies (TSX:IGX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024