Clearside Biomedical Announces Fourth Quarter and Full Year 2023 Financial Results and Provides Corporate Update

12 Março 2024 - 5:05PM

Clearside Biomedical, Inc. (Nasdaq: CLSD), a biopharmaceutical

company revolutionizing the delivery of therapies to the back of

the eye through the suprachoroidal space (SCS®), today reported

financial results for the fourth quarter and year ended December

31, 2023, and provided a corporate update.

“This is an exciting time for Clearside with

substantial progress in our tyrosine kinase inhibitor (TKI) program

and expanded use of our injection device technology for drug

delivery into the suprachoroidal space,” said George Lasezkay,

Pharm.D., J.D., Clearside’s President and Chief Executive Officer.

“We are laser focused on completing our ODYSSEY Phase 2b clinical

trial of CLS-AX (axitinib injectable suspension) in wet AMD and

expect to report topline data in the third quarter of this

year.”

Dr. Lasezkay continued, “Our proprietary SCS

Microinjector® enables reliable, simple, in-office, non-surgical

drug delivery into the suprachoroidal space targeted directly to

the site of disease in the back of the eye. This trusted delivery

method, combined with axitinib’s differentiated mechanism of action

and high potency, offers the potential for CLS-AX to be a

best-in-class product for long-term maintenance therapy for wet AMD

patients. In ODYSSEY, we are looking to replicate the excellent

safety profile, stable vision, and reduced frequency of injections

over 6 months that we observed in our OASIS Phase 1/2a and

Extension Study.”

“In addition, our development and

commercialization partners continue to report positive safety and

efficacy results utilizing our SCS Microinjector. We are very

excited to begin working closely with our newest licensing partner,

BioCryst Pharmaceuticals, on their program targeting diabetic

macular edema (DME) exclusively using suprachoroidal delivery of

their proprietary plasma kallikrein inhibitor, avoralstat. With the

upfront licensing fee from BioCryst combined with our recently

completed equity financing, we expect our existing cash and cash

equivalents will enable us to fund our operating expenses into the

third quarter of 2025,” concluded Dr. Lasezkay.

Key Highlights

- Completion of a

registered direct offering in February 2024, which generated $15.0

million in gross proceeds to Clearside.

- On January 1, 2024,

a new permanent Category 1 Current Procedural Terminology (CPT)

code for XIPERE® (triamcinolone acetonide injectable

suspension) for suprachoroidal use became available for physician

use.

- Completion of

participant randomization in December 2023 in ODYSSEY, Clearside’s

Phase 2b clinical trial of CLS-AX using suprachoroidal delivery in

neovascular age-related macular degeneration (wet AMD), with

topline data expected in the third quarter of 2024.

- Entered into an

exclusive, worldwide license with BioCryst Pharmaceuticals in

November 2023 to use Clearside’s SCS Microinjector for the delivery

of BioCryst’s proprietary plasma kallikrein inhibitor, avoralstat,

for the treatment of DME. The terms of the agreement include an

upfront license fee from BioCryst of $5.0 million and an additional

$77.5 million in potential clinical, regulatory and post-approval

sales-based milestone payments plus tiered mid-single digit

royalties on annual global net product sales.

- Multiple data

presentations on the use of Clearside’s suprachoroidal delivery

platform were featured at prominent medical meetings, including

American Academy of Ophthalmology (AAO), American Society of Retina

Specialists, The Retina Society, Macula Society and Hawaiian Eye

and Retina.

- Presentations of

data on CLS-AX in wet AMD highlighted the excellent safety profile,

stable vision and reduced frequency of injections observed for up

to 6-months in the OASIS® Phase 1/2a clinical trial and Extension

Study.

- Positive data was

presented on the extended treatment duration of XIPERE utilizing

suprachoroidal delivery. Real-world data showed excellent

durability in which more than 75% of eyes did not require

retreatment for 6 months after a single dose of XIPERE, supporting

Clearside’s approach to extended drug release and reduced treatment

burden for patients by delivering drug directly to the back of the

eye via suprachoroidal administration with the SCS

Microinjector.

- REGENXBIO’s

ABBV-RGX-314 gene therapy using suprachoroidal delivery continues

to be well tolerated in the Phase 2 ALTITUDE® trial for treatment

of diabetic retinopathy and the Phase 2 AAVIATE® trial for

treatment of wet AMD.

- Aura Biosciences

presented positive clinical safety and efficacy updates of bel-sar

for early-stage choroidal melanoma from its ongoing Phase 2

clinical trial with suprachoroidal administration. Additionally, in

November 2023, Aura received FDA Agreement under a Special Protocol

Assessment (SPA) for its CoMpass Phase 3 clinical trial of

belzupacap sarotalocan (bel-sar) in early-stage choroidal melanoma.

Aura dosed the first patient in the CoMpass trial in December

2023.

Fourth Quarter 2023 Financial

Results

- License Revenue: License and other

revenue for the fourth quarter of 2023 was $6.3 million, compared

to $0.3 million for the fourth quarter of 2022. The $6.0 million

increase was primarily attributable to the receipt of $5.0 million

in an upfront license fee from BioCryst and $1.0 million in a

milestone payment from Aura Biosciences.

- Research and Development (R&D)

Expenses: R&D expenses for the fourth quarter

of 2023 were $6.3 million, compared to $5.0 million for the fourth

quarter of 2022. The increase was primarily due to ODYSSEY clinical

trial costs.

- General and Administrative

(G&A) Expenses: G&A expenses for the

fourth quarter of 2023 were $2.9 million, compared to $3.2 million

for the fourth quarter of 2022. The decrease was primarily due to

lower insurance premiums and timing of patent-related costs.

- Other Expense:

Non-cash interest expense for the fourth quarter of 2023 was $2.3

million, compared to $2.0 million for the fourth quarter of 2022.

Non-cash interest expense was comprised of imputed interest on the

liability related to the sales of future royalties and the

amortization of the associated issuance costs.

- Net Loss: Net loss for the fourth

quarter of 2023 was $4.8 million, or $0.08 per share of common

stock, compared to net loss of $9.7 million, or $0.16 per share of

common stock, for the fourth quarter of 2022. The decrease in net

loss was primarily attributable to the receipt of $5.0 million in

an upfront license fee from BioCryst in the fourth quarter of

2023.

- Cash Position: As of December 31,

2023, Clearside’s cash and cash equivalents totaled $28.9 million.

Subsequent to the quarter end, in February 2024, Clearside

completed a registered direct offering of stock and warrants which

generated $15.0 million in gross proceeds. The Company believes

that with the inclusion of the net proceeds from this offering, it

will have sufficient resources to fund its planned operations into

the third quarter of 2025.

Full Year 2023 Financial

Results

- License Revenue: License and other

revenue for the year ended December 31, 2023 was $8.2 million,

compared to $1.3 million for the year ended December 31, 2022. The

$6.9 million increase was primarily attributable to the receipt of

$5.0 million in an upfront license fee from BioCryst and $1.4

million in milestone payments from Aura Biosciences.

- R&D Expenses:

R&D expenses for the year ended December 31, 2023 were $20.8

million, compared to $19.6 million for the year ended December 31,

2022. The increase was primarily due to ODYSSEY clinical trial

costs, offset by decreases in other miscellaneous expenses.

- G&A Expenses:

G&A expenses for the year ended December 31, 2023 were $11.9

million, compared to $11.8 million for the year ended December 31,

2022.

- Other Income: Other income for the

year ended December 31, 2023 was $1.7 million, compared to $0.7

million for the year ended December 31, 2022. The increase was due

to higher interest rates earned on cash and cash equivalents.

- Other Expense:

Non-cash interest expense for the year ended December 31, 2023 was

$9.4 million, compared to $3.3 million for the year ended December

31, 2022. Non-cash interest expense was comprised of imputed

interest on the liability related to the sales of future royalties

and the amortization of the associated issuance costs.

- Net Loss: Net loss for the year

ended December 31, 2023 was $32.5 million, or $0.53 per share of

common stock, compared to net loss of $32.9 million, or $0.55 per

share of common stock, for the year ended December 31, 2022.

Conference Call & Webcast

Details

Clearside’s management will host a webcast and

conference call today at 4:30 p.m. Eastern Time to discuss the

financial results and provide a corporate update. The live and

archived webcast may be accessed on the Clearside website under the

Investors section: Events and Presentations. The live call can be

accessed by dialing 888-506-0062 (U.S.) or 973-528-0011

(international) and entering conference code: 694916. The Company

suggests participants join 15 minutes in advance of the event.

About Clearside Biomedical,

Inc.

Clearside Biomedical, Inc. is a

biopharmaceutical company revolutionizing the delivery of therapies

to the back of the eye through the suprachoroidal space (SCS®).

Clearside’s SCS injection platform, utilizing the Company’s

patented SCS Microinjector®, enables an in-office, repeatable,

non-surgical procedure for the targeted and compartmentalized

delivery of a wide variety of therapies to the macula, retina, or

choroid to potentially preserve and improve vision in patients with

sight-threatening eye diseases. Clearside is developing its own

pipeline of small molecule product candidates for administration

via its SCS Microinjector. The Company’s lead program, CLS-AX

(axitinib injectable suspension), for the treatment of neovascular

age-related macular degeneration (wet AMD), is in Phase 2b clinical

testing. Clearside developed and gained approval for its first

product, XIPERE® (triamcinolone acetonide injectable suspension)

for suprachoroidal use, which is available in the U.S. through a

commercial partner. Clearside also strategically partners its SCS

injection platform with companies utilizing other ophthalmic

therapeutic innovations. For more information, please visit

clearsidebio.com and follow us on LinkedIn and X.

Cautionary Note Regarding

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “believe”, “expect”, “may”, “plan”,

“potential”, “will”, and similar expressions, and are based on

Clearside’s current beliefs and expectations. These forward-looking

statements include statements regarding the clinical development of

CLS-AX, the expected timing of topline results from the ODYSSEY

clinical trial, the potential benefits of CLS-AX, Clearside’s

suprachoroidal delivery technology and Clearside’s SCS

Microinjector® and Clearside’s ability to fund its operations into

the third quarter of 2025. These statements involve risks and

uncertainties that could cause actual results to differ materially

from those reflected in such statements. Risks and uncertainties

that may cause actual results to differ materially include

uncertainties inherent in the conduct of clinical trials,

Clearside’s reliance on third parties over which it may not always

have full control and other risks and uncertainties that are

described in Clearside’s Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the U.S. Securities and

Exchange Commission (SEC) on March 12, 2024 and Clearside’s other

Periodic Reports filed with the SEC. Any forward-looking statements

speak only as of the date of this press release and are based on

information available to Clearside as of the date of this release,

and Clearside assumes no obligation to, and does not intend to,

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Investor and Media Contacts:Jenny Kobin Remy

Bernarda ir@clearsidebio.com(678) 430-8206

|

CLEARSIDE BIOMEDICAL, INC. |

|

Selected Financial Data |

|

(in thousands, except share and per share data) |

|

(unaudited) |

|

|

| Statements of

Operations Data |

|

Three Months EndedDecember

31, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

License and other revenue |

|

$ |

6,345 |

|

|

$ |

330 |

|

|

$ |

8,226 |

|

|

$ |

1,327 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

— |

|

|

|

204 |

|

|

|

355 |

|

|

|

204 |

|

|

Research and development |

|

|

6,313 |

|

|

|

5,027 |

|

|

|

20,846 |

|

|

|

19,630 |

|

|

General and administrative |

|

|

2,947 |

|

|

|

3,169 |

|

|

|

11,869 |

|

|

|

11,770 |

|

|

Total operating expenses |

|

|

9,260 |

|

|

|

8,400 |

|

|

|

33,070 |

|

|

|

31,604 |

|

| Loss from operations |

|

|

(2,915 |

) |

|

|

(8,070 |

) |

|

|

(24,844 |

) |

|

|

(30,277 |

) |

| Other income |

|

|

360 |

|

|

|

449 |

|

|

|

1,719 |

|

|

|

669 |

|

| Non-cash interest expense on

liability related to the sales of future royalties |

|

|

(2,277 |

) |

|

|

(2,042 |

) |

|

|

(9,360 |

) |

|

|

(3,339 |

) |

|

Net loss |

|

$ |

(4,832 |

) |

|

$ |

(9,663 |

) |

|

$ |

(32,485 |

) |

|

$ |

(32,947 |

) |

| Net loss per share of common

stock — basic and diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.55 |

) |

| Weighted average shares

outstanding — basic and diluted |

|

|

62,404,329 |

|

|

|

60,412,700 |

|

|

|

61,806,959 |

|

|

|

60,204,862 |

|

| Balance Sheet

Data |

December 31, |

|

|

December 31, |

|

| |

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

28,920 |

|

|

$ |

48,258 |

|

| Total assets |

|

34,018 |

|

|

|

51,303 |

|

| Liabilities related to the

sales of future royalties, net |

|

41,988 |

|

|

|

33,977 |

|

| Total liabilities |

|

49,930 |

|

|

|

40,696 |

|

| Total stockholders’ (deficit)

equity |

|

(15,912 |

) |

|

|

10,607 |

|

Source: Clearside Biomedical, Inc.

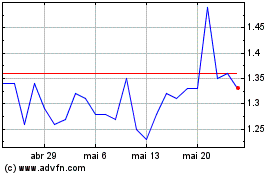

Clearside Biomedical (NASDAQ:CLSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Clearside Biomedical (NASDAQ:CLSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024