Compagnie de l'Odet : 2023 results

|

2023 results |

March 14, 2024 |

Results in line with

expectations after significant changes in

scope

- Changes in the

scope of consolidation and reclassifications into discontinued

operations or held for sale pursuant to IFRS 5 include:

-

Bolloré

Africa Logistics for the 2022 fiscal year, sold on December 21,

2022;

- Bolloré

Logistics for fiscal years 2022 and 2023 reclassified as a business

held for sale (sale completed on February 29,

2024);

- Lagardère,

fully consolidated by Vivendi from December 1, 2023;

- Editis,

deconsolidated since June 21, 2023 and sold on November 14,

2023.

- Revenue:

13,678 million euros, -5% at constant scope and exchange

rates.

- Adjusted

operating income (EBITA

(1)

(2)):

981 million euros, down 6%

(1), impacted by the slowdown in

oil logistics after an exceptional 2022 and a lower contribution

from UMG.

- Net

income: 520 million euros, compared with 2,706 million

euros in 2022, which included the capital gain on the sale of

Bolloré Africa Logistics (3,150 million euros) and, at Vivendi, the

result of the deconsolidation of Telecom Italia (-1,494 million

euros) and the capital gain on the contribution of the stake in

Banijay Holdings Group to FL Entertainment (515 million euros).

- Net

income, Group share: 122 million euros.

- Net

debt: 1,907 million at December 31, 2023, compared with a

net cash position of €709 million at December 31, 2022, due to the

increase in Vivendi debt and Bolloré's simplified cash tender offer

on its own shares.

- Group liquidity: 13 billion

euros in cash and confirmed credit lines as of February

29, 2024, at Compagnie de l’Odet level (including Bolloré and

excluding Vivendi).

- Proposed

dividend: 4 euros per share compared to 3.6 euros per

share in 2022.

2023 results

(*)

During the meeting of Compagnie de l’Odet's

Board of Directors on March 14, 2024, the financial statements for

2023 were approved.

Revenue was 13,678 million euros, down

5% at constant scope and exchange rates:

- Bolloré Energy: 2,788 million, -24%

mainly impacted by lower prices and volumes of petroleum products,

after the sharp rise in 2022 (+45%) in an international context

severely disrupted by the war in Ukraine;

- Communications (Vivendi): 10,506

million euros, +3%, mainly due to the growth of Havas (+4%) and

Groupe Canal+ (+3%);

- Industry: 314 million euros, down

14%, due to the continuing slowdown at Blue in the bus and battery

business, and lower volumes in the film business despite an

increase in Systems sales.

On a reported basis, revenue was

stable, taking into account +793 million euros in changes

in scope (including mainly +645 million euros corresponding to the

full consolidation of Lagardère by Vivendi since December 1, 2023)

and-52 million euros of foreign exchange impacts (appreciation of

the Euro against the US Dollar, the Argentinian peso and the

British pound).

Adjusted operating income

(EBITA

(3))

came out at 981 million euros, down 6% at constant scope and

exchange rates:

- Bolloré Energy (4): 44 million,

down 69%, impacted by lower prices and volumes of petroleum

products and negative inventory effects;

- Communications: 1,105 million euros

(5), up 4%, with good performance from Havas and Groupe Canal+, but

lower contribution from UMG (negative impact of the introduction of

the share-based compensation plan);

- Industry (4): -114 million euros,

an improvement of 11 million euros on a reported basis compared

with 2022, taking into account the improvement in battery and film

results.

Financial income amounted to -114

million euros, compared with -1,066 million euros in

2022.This includes an increase in dividends received and investment

income. In 2022, a loss of 1,494 million euros from the

discontinuation of accounting of Telecom Italia as an

equity-accounted company and the fair value adjustment of the

shareholding in Vivendi's financial statements. It also included a

515 million euros capital gain on Banijay Holdings Group following

Vivendi's exchange of its 32.9% stake in Banijay for 19.9% in FL

Entertainment (FLE), listed since July 1, 2022.

The net income from equity-accounted

non-operating companies totaled -76 million euros,

compared with-346 million euros in 2022. This includes -89 million

euros share of MultiChoice net income, and 27 million euros

contribution from the Socfin Group. In 2022, it included -393

million euros of Telecom Italia's share of net income (6) and

a 48 million euros contribution from the Socfin Group.

After tax of -198 million euros (compared with

-83 million euros in 2022), consolidated net income is 520

million euros, compared with 2,706 million euros in 2022,

which included the capital gain on the sale of Bolloré Africa

Logistics (3,150 million euros) and, at Vivendi, the result of the

deconsolidation of Telecom Italia (-1,494 million euros) and the

capital gain on the contribution of the stake in Banijay Holdings

Group to FL Entertainment (515 million euros).

Net income Group share came out

at 122 million euros, compared with 1,904 million

euros in 2022.

Shareholders' equity was 32,707 million

euros, compared with 32,941 million euros at December 31,

2022, taking into account the full consolidation of Lagardère

(equity-accounted in 2022 and until November 30, 2023) and the

acquisition of Bolloré shares as part of the simplified cash tender

offer.

As of December 31, 2023, the Group (excluding

Vivendi) had a net positive cash position of 932 million

euros, down from 1,569 million euros at the end of 2022.

Including Vivendi, The Group’s net debt

amounted to 1,907 million euros, compared with a positive

cash position of 709 million euros at December 31, 2022, taking

into account:

- Bolloré's net cash position

excluding Vivendi fell by 0.6 billion euros, mainly as a result of

the simplified cash tender offer.

- Increase in Vivendi's debt of 1.98

billion euros, mainly due to the integration of Lagardère (7) whose

net debt amounted to 2,027 million euros (8) at 31 December

2023.

Taking these factors into account,

gearing stood at 6% at December 31, 2023.

At the end of February 2024, the Group

(including Bolloré and excluding Vivendi) had 13 billion euros in

cash and confirmed credit lines.

Group

structure

- Sale of

Bolloré Logistics to CMA CGM

- On February 29,

2024, the Bolloré Group and the CMA CGM Group announced the

completion of the sale of 100% of Bolloré Logistics to CMA CGM, it

being specified that the transfer of Bolloré Logistics Sweden AB to

the CMA CGM Group remains subject to the latter obtaining

investment clearance in Sweden.

- The purchase

price is 4.850 billion euros, on the basis of the

estimated debt and cash on the completion

date.

- The estimated

consolidated net capital gain in the 2024 results is expected to be

around 3.7 billion euros.

- In application

of IFRS 5 and to ensure the comparability of results, all Bolloré

Logistics activities for the years 2022 and 2023 have been

reclassified to discontinued operations.

- Transactions on Bolloré and

Vivendi share

-

Bolloré’s simplified cash tender offer on its own

shares

- The simplified

cash tender offer initiated by Bolloré on its own shares at a price

of 5.75 euros per share closed on May 30, 2023, with settlement and

delivery on June 7, 2023.

- 99.1 million

shares were tendered to the offer, representing 34.33% of the

shares targeted by the offer and 3.36% of the share capital of

Bolloré SE, i.e. an amount of 570 million euros.

- Compagnie de

l'Etoile des Mers, 49% owned by Compagnie de l'Odet and 51% by

Bolloré Participations SE, contributed 9.9 million shares to the

simplified cash tender offer, representing 100% of the Bolloré SE

shares it held, i.e. 0.34% of Bolloré SE's share capital.

- On January 11,

2024, Bolloré SE cancelled 101,493,058 treasury shares (including

99.1 million shares acquired under the simplified cash tender

offer). As a result, the number of shares making up the capital of

Bolloré SE was reduced to 2,849,681,316.

- In view of the

sale of Bolloré Logistics to CMA CGM on February 29, 2024, the

earn-out payment of 0.25 euros per Bolloré SE share tendered to the

offer, representing an amount of 25 million euros, was paid in

accordance with the agreed terms (9) with effect from March 11,

2024.

-

Sale

of Vivendi shares

- In May 2023,

with a view to the cancellation of shares by Vivendi, and in order

not to cross the 30% threshold that would trigger a public offer

for Vivendi, the Bolloré Group, through Compagnie de Cornouaille,

sold on the stock market 18.6 million Vivendi shares for 177

million euros.

- Following these

sales and the cancellation of shares by Vivendi, the Group holds

308 million Vivendi shares, representing 29.9% of its share

capital.

- Study of

the Vivendi split project

- Meetings on

December 13, 2023 and January 30, 2024, Vivendi’s Supervisory Board

authorized the Management Board to study the possibility of

splitting Vivendi into several entities, each of which would be

listed on the stock market and structured around Groupe Canal+;

Havas. a company combining the assets in publishing and

distribution assets through the majority stake in the Lagardère

group and the 100% stake in Prisma Media; and an investment company

holding listed and unlisted financial interests in the culture,

media and entertainment sectors.

- The Group is

continuing its feasibility study. If the Supervisory Board

authorizes the Management Board to go ahead with the project, a

number of important steps will have to be taken. These include,

among others, consultation with the employee representation bodies

of the entities concerned, before which no decision in principle

will be taken, obtaining the necessary regulatory authorizations,

the required approvals from the Group's creditors and the consent

of Vivendi's shareholders at a General Meeting.

- As indicated on

December 13, such a transaction would take between 12 and 18 months

to complete.

- Vivendi

transactions

- Combination with Lagardère

- On June 9, 2023,

the European Commission authorized Vivendi to go ahead with its

planned combination with Lagardère (10) subject to the fulfilment

of the two commitments proposed by Vivendi, namely the sale of

Editis and of Gala magazine.

- On November 21,

2023, Vivendi finalized the combination with the Lagardère group

following the sale of 100% of Editis’ capital to International

Media Invest, which took place on November 14, and the sale of Gala

magazine to the Groupe Figaro, which took place on November 21,

2023. Vivendi has fully consolidated Lagardère since December 1,

2023.

- As of December

31, 2023, taking into account the exercise of transfer rights since

the completion of the combination, Vivendi held 84.4 million

Lagardère shares, representing 59.8% of the share capital and 50.6%

of the voting rights. At that date, 27.7 million transfer rights

were exercisable (11) representing a financial commitment of 667

million euros on 19.6% of Lagardère's share capital, recognized on

the balance sheet as a financial liability.

- Groupe Canal+

acquires several key holdings

- On June 21, 2023, Groupe Canal+ and

PCCW Limited announced the signature of a strategic partnership to

accelerate the development of Viu (12), Asia’s leading streaming

platform. On February 26, 2024, Groupe Canal+ increased its stake

in Viu to 30% in accordance with the terms of the transaction

announced on June 21, 2023.

- On July 20,

2023, Groupe Canal+ announced that it had acquired a 12% stake in

Viaplay Group, the leading pay-TV operator in the Nordic countries.

At the end of 2023, Groupe Canal+ announced its intention to

participate in the recapitalization of Viaplay, approved at the EGM

of January 10, 2024. Following the recapitalization, completed on

February 9, 2024, Groupe Canal+ holds 29.33% of Viaplay's

capital.

- On February 1,

2024, Groupe Canal+ crossed the 35% threshold and announced that it

had submitted a non-binding indicative offer at 105 rands per share

to the board of MultiChoice Group (12) to acquire all its

shares, subject to obtaining the necessary regulatory approvals. On

February 5, 2024, this offer was rejected by MultiChoice Group

Board of Directors. On March 5, Groupe Canal+ announced jointly

with MultiChoice Group that it was raising its offer to 125 rands

per share, paid in cash, and entering into an exclusivity agreement

with MultiChoice Group. Groupe Canal+ must submit its mandatory

offer by April 8, 2024.

Proposed dividend: 4 euros per

share

The General Shareholders Meeting will be asked

to distribute a dividend of 4 euros per share compared to 3.6 euros

per share in 2022.

The dividend will be detached on June 25, 2024

and the payment, exclusively in cash, will be made on June 27,

2024.

Consolidated key figures for Compagnie

de l’Odet

|

(in millions of euros) |

2023 * |

2022 * |

Change |

|

Revenue |

13,678 |

13,634 |

0% |

|

EBITDA (1) |

1,369 |

1,607 |

(15%) |

|

Depreciation and provisions |

(388) |

(529) |

|

|

Adjusted operating income (EBITA

(1)) |

981 |

1,078 |

(9%) |

|

Amortization resulting from PPAs and IFRS 16 restatement of

concessions (1) |

(227) |

(272) |

|

|

EBIT |

753 |

806 |

(7%) |

|

of which equity-accounted operating

companies (2) |

313 |

373 |

|

|

Financial income |

(114) |

(1,066) |

|

|

Share of net income of equity-accounted non-operating

companies |

(76) |

(346) |

|

|

Taxes |

(198) |

(83) |

|

|

Income from discontinued and held for sale activities |

155 |

3,396 |

|

|

Net income |

520 |

2,706 |

|

|

Net income, Group share |

122 |

1,904 |

|

|

Minorities |

397 |

802 |

|

|

|

|

|

|

|

|

31 December2023 |

31 December2022 |

Change |

|

Shareholders’ equity |

32,707 |

32,941 |

(234) |

|

o/w Group share |

11,550 |

11,193 |

357 |

|

Net debt / (cash) |

1,907 |

(709) |

2,616 |

|

Gearing (3) |

6 % |

na |

|

* In accordance with IFRS 5, and in order to

ensure comparability of results, the reclassifications as

discontinued operations or operations in the process of being sold

concern the Group's Transport and Logistics operations outside

Africa for the 2022 and 2023 financial years (these activities have

been earmarked for disposal since 8 May 2023). As a reminder, the

published figures already included the reclassification as

discontinued operations of the Group's Transport and Logistics

activities in Africa for financial year 2022 (these activities were

sold on 12/21/2022) and Editis for the 2022 and 2023 financial

years (since 06/21/2023, Editis has been deconsolidated following

the loss of control and sold on 11/14/2023).

(1) See

glossary.(2) Including, for 2023, contributions

from UMG (67 million euros) and Lagardère (125 million euros)

accounted for using the operational equity method at Vivendi and

the contribution of UMG accounted for under the operational equity

method at Compagnie de l’Odet (122 million euros), as opposed to

368 million euros in 2022.(3) Gearing: net

debt/equity ratio.

Revenue by business activity in 2023

(*)

|

(in millions of euros) |

2023 |

2022 |

Reported |

Organic |

|

|

|

|

|

growth |

growth |

|

|

Bolloré Energy |

2,788 |

3,599 |

(23%) |

(24%) |

|

|

Communications (Vivendi) |

10,506 |

9,590 |

10% |

3% |

|

|

Industry |

314 |

369 |

(15%) |

(14%) |

|

|

Other (Agricultural Assets, Holdings) |

70 |

77 |

(8%) |

(38%) |

|

|

Total |

13,678 |

13,634 |

0% |

(5%) |

|

Change in revenue per quarter

(*)

|

(in millions of euros) |

1er quarter |

2ème quarter |

3ème quarter |

4ème quarter |

|

|

2023 |

2022 (1) |

2022 |

2023 |

2022 (1) |

2022 |

2023 |

2022 (1) |

2022 |

2023 |

2022 (1) |

2022 |

|

Bolloré Energy |

712 |

848 |

848 |

641 |

775 |

772 |

668 |

978 |

951 |

766 |

1,059 |

1,030 |

|

Communications (Vivendi) |

2,290 |

2,244 |

2,216 |

2,407 |

2,307 |

2,310 |

2,425 |

2,352 |

2,366 |

3,385 |

3,333 |

2,698 |

|

Industry |

74 |

111 |

112 |

74 |

93 |

94 |

85 |

72 |

73 |

81 |

90 |

91 |

|

Other (Agricultural Assets, Holdings) |

15 |

26 |

14 |

18 |

32 |

21 |

18 |

31 |

23 |

19 |

25 |

18 |

|

Total |

3,090 |

3,229 |

3,189 |

3,140 |

3,207 |

3,196 |

3,196 |

3,433 |

3,413 |

4,251 |

4,507 |

3,836 |

Adjusted operating income by business activity

(EBITA) (*)

|

(in millions of euros) |

2023 |

2022 |

Reportedgrowth |

Organicgrowth |

|

Bolloré Energy

(2) |

44 |

141 |

(69%) |

(69%) |

|

Communications |

1,105 |

1,090 |

1% |

4% |

|

Vivendi (3) |

934 |

868 |

8% |

12% |

|

UMG (Bolloré 18% equity

method) |

172 |

222 |

(22%) |

(24%) |

|

Industry (2) |

(114) |

(125) |

8% |

10% |

|

Other (Agricultural Assets, Holdings) |

(54) |

(28) |

n.a. |

n.a. |

|

Group EBITA |

981 |

1,078 |

(9%) |

(6%) |

All amounts are expressed in millions of euros

and rounded to the nearest decimal.

* In accordance with IFRS 5, and in order to

ensure comparability of results, the reclassifications as

discontinued operations or operations in the process of being sold

concern the Group's Transport and Logistics operations outside

Africa for the 2022 and 2023 financial years (these activities have

been earmarked for disposal since 8 May 2023).

(1) Like-for-like scope and exchange rates.

(2) Before group fees and Bolloré

trademark royalties.(3) Of which the contributions from

UMG (94 million euros) and Lagardère (125 million euros) using the

equity method at Vivendi in 2023.A detailed presentation of the

results of its subsidiary Bolloré SE is available on

www.bollore.com.The audit procedures of the consolidated financial

statements have been carried out. The certification report will be

issued after finalisation of the procedures required to submit the

Universal Registration Document (URD).

Comparability of financial

statements

- In

accordance with IFRS 5 and to ensure comparability of

results, the reclassification as discontinued operations or

operations in the process of being sold concerns Bolloré Logistics

for the years 2022 and 2023 (these operations have been in the

process of being sold since 8 May 2023);

- As a reminder,

the published figures already included the reclassification of

Bolloré Africa Logistics for the 2022 financial year (sold on

12/21/2022) and Editis for the 2022 and 2023 financial years (since

06/21/2023, Editis has been deconsolidated following the loss of

control and sold on 11/14/2023);

-

Performance indicators

- On 31 December

2023, the Bolloré Group had not changed the definition of

performance indicators, particularly EBITA, which are comparable to

those of 31 December 2022. However, EBITA and operating income data

are now presented before Group expenses.

- Change

in scope of consolidation

- Lagardère has

been fully consolidated since 1 December 2023, after being

accounted for by the equity method for the first 11 months of

2023;

- Viu has been

accounted for using the equity method since 21 June 2023.

- Editis was sold

on 14 November 2023;

- Prisma Media

sold Gala magazine on 21 November 2023;

- Bolloré Africa

Logistics was sold on 21 December 2022;

- On 31 December

2022, Vivendi ceased to account for Telecom Italia as an

equity-method stake, considering that it no longer exercises

significant influence over Telecom Italia in view of the

resignation of its two representatives of the Telecom Italia Board

of Directors.

- Trend in

the main currencies

|

Average rate |

2023 |

2022 |

Change |

|

USD |

1.08 |

1.05 |

3% |

|

GBP |

0.87 |

0.85 |

2% |

|

PLN |

4.54 |

4.68 |

(3%) |

|

JPY |

151.83 |

137.97 |

10% |

|

CNY |

7.66 |

7.08 |

8% |

|

CHF |

0.97 |

1.01 |

(3%) |

|

ZAR |

19.95 |

17.20 |

16% |

Glossary

- Organic

growth: growth at like-for-like scope and exchange

rates.

- Adjusted

operating income (EBITA): operating income before

amortisation of intangible assets related to business combinations

– PPA (purchase price allocation), impairment of goodwill and other

intangible assets related to business combinations and the impact

of IFRS 16 on concession contracts.

-

EBITDA: operating income before depreciation and

amortisation and the impact of IFRS 16 on concession

contracts.

- Net

financial debt / Net cash position: sum of borrowings at

amortised cost, less cash and cash equivalents, cash management

financial assets and net derivative financial instruments (assets

or liabilities) with an underlying net financial indebtedness, as

well as cash deposits backed by borrowings.

The non-GAAP measures defined above should be

considered in addition to, and not as a substitute for, other GAAP

measures of operational and financial performance, and Compagnie de

l’Odet considers these to be relevant indicators of the Group’s

operational and financial performance. Furthermore, it should be

noted that other companies may define and calculate these

indicators differently. It is therefore possible that the

indicators used by Compagnie de l’O cannot be directly compared

with those of other companies.

The percentages changes indicated in this

document are calculated in relation to the same period of the

preceding fiscal year, unless otherwise stated. Due to rounding in

this presentation, the sum of some data may not correspond exactly

to the calculated total and the percentage may not correspond to

the calculated variation.

(1) See glossary.

(2) Including for 2023, contributions from

equity-accounted operating companies at Vivendi (UMG (€94 million)

and Lagardère (€125 million)) and contribution of UMG’s

equity-accounted operating company (€122 million) at Compagnie de

l’Odet.

* In accordance with IFRS 5 and to ensure

comparability of results, the reclassifications to discontinued or

held for sale concern the Group's Transport and Logistics

activities outside Africa for the 2022 and 2023 fiscal years (these

activities are intended to be sold as of May 8, 2023).

(3) See glossary for EBITA definition.(4) Before group expenses

and Bolloré trademark fees.

(5) Including contributions from UMG (€94m) and

Lagardère (€125m) accounted for by the equity method at Vivendi in

2023.(6) Vivendi ceased to account for Telecom Italia as an

equity-accounted shareholding on 12/31/2022.

(7) Vivendi has fully consolidated Lagardère

since December 1, 2023.(8) As reported by Vivendi after restatement

of commitments to repurchase minority interests (667 million

euros).(9) See terms agreed in Bolloré SE securities note (Autorité

des marchés financiers visa n°23-161 dated May 15, 2023). (10)

Pursuant to Article 7(2) of Regulation (EC) 139/2004 on the control

of concentrations between undertakings, Vivendi could not exercise

the voting rights attached to the Lagardère shares acquired from

Amber Capital in 2021 and the Lagardère shares acquired under the

tender offer in 2022 until the approval of the acquisition of

control of Lagardère by the European Commission.

(11) As part of the tender offer, Vivendi has

allocated 31,139,281 Lagardère transfer rights, exercisable at a

unit price of €24.10 up and including December 15, 2023. However,

the General Meeting of beneficiaries of Lagardère share transfer

rights, held on December 11, 2023, approved the extension of the

transfer rights exercise period to June 15, 2025. The other terms

and conditions of the transfer rights remain unchanged, in

particular the exercise price of €24.10.(12) Viu and Multichoice

Group Ltd are accounted for by Vivendi as non-operating companies

accounted for under the equity method.

- 2024 03 14 Odet CP résultats 2023 UK

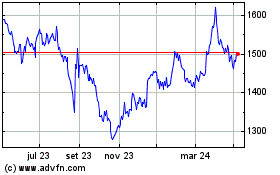

Compagnie de lOdet (EU:ODET)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

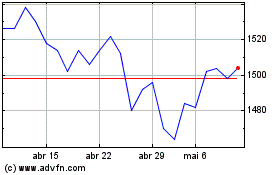

Compagnie de lOdet (EU:ODET)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025