MAG Silver Corp. (TSX / NYSE American: MAG)

(“MAG”, or the

“Company”) is pleased to

announce it has filed on SEDAR, the Juanicipio Mineral Resource and

Mineral Reserves NI 43-101 Technical Report (the “

2024

Technical Report” or the “

Report”) for

the Juanicipio Mine (44% MAG, 56% Fresnillo plc, the mine operator)

located in the state of Zacatecas, Mexico. The Report was prepared

in accordance with the requirements of National Instrument 43-101 –

Standards of Disclosure for Mineral Projects (“

NI

43-101”). The Report was prepared by AMC Mining

Consultants (Canada) Ltd. (“

AMC”) of Vancouver,

with assistance from Knight Piésold and Co.

(“

KP”), both independent consultants, on behalf of

MAG. This Report provides an update to the “MAG Silver Juanicipio

NI 43-101 Technical Report, Amended and Restated, Zacatecas State,

Mexico” 2017 Technical Report by AMC. Mineral Resource and Mineral

Reserve estimates are current as of May 31, 2023. The Report has an

effective date of March 4, 2024.The monetary values shown in the

Report are in US dollars ($) and on a 100% basis unless stated

otherwise.

MAG Silver Comments on Technical Report

Highlights:

- Robust

economics; after tax NPV5% of

$1.2 billion – The Report reflects the strength of

Juanicipio’s economics over an initial 13-year life of mine

(“LOM”) generating an annual average free cashflow

of over $130 million (“M”) at pricing of $22/oz

silver and $1,750/oz gold. Payable production is 93 million ounces

(“Moz”) of silver, 557 thousand ounces

(“koz”) of gold, 719 million pounds

(“Mlbs”) of lead and 991 Mlbs of Zinc.

- 33%

growth in Mineral Resources (from 2017 PEA) with high potential to

increase – Substantial growth in Measured and Indicated

(“M&I”) Mineral Resources to 17.0 million

tonnes (“Mt”) at grades of 310 grams per tonne

(“g/t”) silver, 1.86 g/t gold, 2.89% lead and

5.32% zinc. Extensive near-term upside potential is highlighted

with 16% growth in Inferred Mineral Resources of 14.1 Mt at grades

of 236 g/t silver, 1.06 g/t gold, 2.41% lead and 6.12% zinc, most

of which are in Valdecañas and its splays, which largely remain

open.

-

Inaugural Mineral Reserve estimate significantly increases

economic confidence – 15.4Mt of Proven and Probable

Mineral Reserves at grades of 248 g/t silver, 1.58 g/t gold, 2.64%

lead and 4.80% zinc (628 g/t silver equivalent

(“AgEq”) providing a strong foundation for the

highly derisked initial 13-year LOM specifically in the first years

where silver grades are high.

-

Simplified and robust underground production plan

– Based on actual production achieved (to May 31, 2023) part way

through ramp-up maintaining a conservative approach to production

at an annual average of approximately 1.3 million tonnes per annum

(“Mtpa”). Stoping is largely (>90%) from

longhole with some cut and fill (<10%). Importantly, development

has now reached levels where the Valdecañas Vein is thicker and

continuous along strike allowing for more efficient mining and

lower costs. Optimization of the mine plan will continue in

2024.

-

Efficient mine plan and milling complex in action

– Juanicipio has demonstrated consistent improvement in mining and

milling performance over the ramp up period coupled with improving

metal recovery. Grounded in real-world production data this

establishes a springboard for further optimization efforts.

-

Exploration upside – In addition to near mine

exploration potential, the overall 7,679 Ha Juanicipio property

remains largely unexplored with high potential for discovery of new

mineralization. Of the remaining 95% of the property outside of the

mine area, only the Los Tajos and Mesa Grande areas have had

initial drill testing. Drilling in both these areas has proven the

geological foundation for discovery including lithologies,

alteration and geochemical signatures and the interception of

narrow high-level mineralized epithermal veins. Triunfo, 10 km

south of the mine, a vast area displaying strong evidence for

silica cap, not unlike that of Valdecañas, is also a high priority

target. With strategic drilling plans in place, the Company aims to

unlock additional value from the extensive land holdings.

“The 2024 Technical Report reaffirms Juanicipio

as a generational and premier silver mining asset. Bringing

Juanicipio online in 2023 was the culmination of a series of

successes since the discovery of Valdecañas in 2005. With the

Report reflecting the mine's startup phase, our focus now shifts to

optimizing operations as Juanicipio enters steady-state. We are

strategically positioned for sustained success with a robust

production profile, compelling economics and significant

exploration potential. In the short term, we anticipate resource

conversion to prolong high-grade silver production and mine life.

Looking ahead, this district scale project remains 95% unexplored

with multiple potentially high impact targets identified,” said

George Paspalas, President and CEO of MAG. “Juanicipio remains well

positioned for enduring success and a cornerstone of MAG’s strategy

as we continue to maximise its value and foster Company

growth.”

Table 1: 2024 Technical Report key

economic assumptions and results

|

Juanicipio deposit |

Unit |

2023 LOM evaluation |

|

Total ore |

kt |

15,356 |

|

Gold grade1 |

g/t |

1.58 |

|

Silver grade1 |

g/t |

248 |

|

Lead grade1 |

% |

2.64 |

|

Zinc grade1 |

% |

4.80 |

|

Gold recovery1 |

% |

84.4 |

|

Silver recovery1 |

% |

86.6 |

|

Lead recovery1 |

% |

86.8 |

|

Zinc recovery1 |

% |

72.3 |

|

Gold price |

$/oz |

1,750 |

|

Silver price |

$/oz |

22.00 |

|

Lead price |

$/lb |

1.00 |

|

Zinc price |

$/lb |

1.15 |

|

Gross revenue |

$M |

4,879 |

|

Selling costs2 |

$M |

773 |

|

Management fee |

$M |

158 |

|

Capital costs |

$M |

453 |

|

Operating costs (total)3 |

$M |

1,318 |

|

Operating costs (total)3 |

$/t |

85.85 |

|

Cumulative pre-tax net cash flow4 |

$M |

2,116 |

|

Cumulative post-tax net cash flow4 |

$M |

1,570 |

|

Pre-tax NPV @ 5% discount rate5 |

$M |

1,656 |

|

Post-tax NPV @ 5% discount rate5 |

$M |

1,224 |

Notes:- Numbers may not compute exactly due to

rounding.- Exchange rate MXP19:US$1. Metal prices: gold - $1750/oz;

silver 22/oz; lead - $1.00/lb; zinc - $1.15/lb.1 Life-of-mine (LOM)

average recoveries to concentrates.2 Selling costs include

penalties, treatment, transportation, and refining costs.3 Includes

mine operating costs, milling, and mine G&A.4 Undiscounted from

1 June 2023. Cash flow after employee profit sharing benefit

(PTU).5 Discounted from 1 June 2023. Depreciation expenses of $453M

(for the remaining project and sustaining capital), and sunk costs

of $840M (prior to 31 May 2023) are recognized in the tax

calculations.

Mineral Resource Estimates

M&I Mineral Resource estimates (Table 2) are

reported for the Valdecañas Vein, which constitutes the majority of

the identified mineralized material. Inferred Mineral Resource

estimates (Table 2) are reported for the balance of the Valdecañas

Vein, as well as its hangingwall and footwall splays (Ramal 1,

Anticipada and Pre-Anticipada), the orthogonal Venadas Vein, and

for the Juanicipio Vein where the first discovery was made. This

estimate is dated May 31, 2023 and supersedes the previous estimate

outlined in the 2017 AMC Technical Report.

The new estimates show a significant increase of

tonnage, contained metal and most importantly confidence in both

M&I of 33%, including what has been mined to May 31, 2023, and

for the first time includes Measured Resources. Likewise, expansion

and infill drilling since the last Technical Report has also

increased Inferred Mineral Resources by 16% with the majority of

that coming from the East and West Dilatant Zones (see press

release dated August 5, 2021) and the growing hangingwall

Anticipada Vein.

Table 2: Juanicipio Mineral Resources at

31 May 2023 (100% basis)

|

Resource category |

Cut-off grade |

Quantity |

Grade |

Contained metal |

|

Tonnes (kt) |

Au (g/t) |

Ag (g/t) |

Pb (%) |

Zn (%) |

Au (koz) |

Ag (koz) |

Pb (kt) |

Zn (kt) |

|

Measured |

209 g/t Ag Eq |

1,441 |

2.19 |

780 |

1.42 |

2.70 |

102 |

36,130 |

20 |

39 |

|

Indicated |

15,555 |

1.83 |

266 |

3.03 |

5.56 |

916 |

133,039 |

472 |

865 |

|

Measured & Indicated |

16,996 |

1.86 |

310 |

2.89 |

5.32 |

1,017 |

169,169 |

492 |

904 |

|

Inferred |

14,051 |

1.06 |

236 |

2.41 |

6.12 |

480 |

106,676 |

339 |

860 |

Notes:

- CIM Definition Standards (2014) were used for reporting.

- Mineral Resources are reported inclusive of Mineral

Reserves.

- Mineral Resources are reported at or above a cut-off grade of

209 grams per tonne (g/t) silver equivalent (AgEq), equivalent to

$96.9 NSR. While a 3 m minimum width is applied and blocks

above the cut-off grade are largely contiguous mineable shapes have

not been defined, which may result in the tonnes of underground

Mineral Resources being slightly exaggerated.

- Mineral Resources are reported at values based on metal price

assumptions, metallurgical recovery assumptions, mining costs,

processing costs, general and administrative (G&A) costs, and

variable smelting and transportation costs.

- Metal price assumptions considered for the calculation of metal

equivalent values are gold (US$1,450.00/oz), silver (US$20.00/oz),

lead (US$0.90/lb), and zinc (US$1.15/lb).

- Assumed metal recoveries of 75.84%, 87.06%, 86.33% and 74.48%

for Au, Ag, Pb, and Zn, respectively and on NSR factors of

US$30.71/g Au, US$0.46/g Ag, US$15.01/% Pb and US$11.36/% Zn.

- Mineral Resources are reported on a 100% basis. The MAG share

is 44%.

- Totals may not compute exactly due to rounding.

- The Mineral Resources were estimated by Fresnillo. Mr John

Morton Shannon, P.Geo. (EGBC #32865), has reviewed the Mineral

Resources and takes QP responsibility.

Source: AMC based on Fresnillo data, 2023.

Mineral Reserve Estimates

Table 3 shows the reported inaugural Mineral

Reserve estimate for the Juanicipio Mine and forms the basis for

the initial 13-year mine life plan outlined in the Technical Report

and highlighted in this release. The Reserves of Proven and

Probable incorporate Measured and Indicated Resources respectively

and apply a cut-off value that considers mining, processing, and

general and administration costs, with a variable trucking cost for

each mining block. Mineral Reserves are largely reported above a

value of $122/t ore for longhole stopes which represents >90% of

the mine plan and $150/t ore for cut and fill stopes.

Table 3: Summary of Mineral Reserves as

of 31 May 2023 (100% basis)

|

Reserve category |

Cut-off grade |

Quantity |

Grade |

Contained metal |

|

Tonnes(kt) |

Au (g/t) |

Ag (g/t) |

Pb (%) |

Zn (%) |

Au (koz) |

Ag (koz) |

Pb (kt) |

Zn (kt) |

|

Proven |

277 g/t AgEq |

735 |

1.48 |

545 |

1.05 |

1.99 |

35 |

12,865 |

8 |

15 |

|

Probable |

14,622 |

1.59 |

233 |

2.72 |

4.94 |

746 |

109,357 |

398 |

722 |

|

Proven and Probable |

15,356 |

1.58 |

248 |

2.64 |

4.80 |

781 |

122,221 |

406 |

736 |

Notes:

- CIM Definition Standards (2014)

were used for reporting.

- All figures rounded to reflect the

relative accuracy of the estimates. Mineral Reserves are reported

at a cut-off value based on metal price assumptions, metallurgical

recovery assumptions, mining costs, processing costs, G&A

costs, sustaining capital costs, and variable trucking costs.

- NSR values are calculated as:

- NSR =

30.71*Au+0.46*Ag+15.01*Pb+11.36*Zn. Units Au (g/t), Ag (g/t), Pb

(%), Zn (%).

- NSR factors are based on metal

prices of $1,450/oz Au, $20.00/oz Ag, $0.90/lb Pb, and $1.15/lb Zn

and estimated recoveries of 75.84% Au, 87.06% Ag, 86.33% Pb, and

74.48% Zn.

- Payable metal assumptions for Au

are 95% for lead concentrates, and 65% for zinc concentrate; for

Ag: 95% for lead concentrates, and 70% for zinc concentrate. Lead

95% payable and zinc 85% payable.

- The all-inclusive operating costs

for longhole stopes and cut-and-fill stopes are $122/tonne and

$150/tonne respectively (277 g/t AgEq based on weighted average for

mining method). The marginal stope cut-off value is generally above

$121/t for cut-and-fill and $93/t for longhole stopes.

- Projected stope hangingwall and

footwall dilution (ELOS) was included in the stope optimization

process. The dilution thickness for stope hangingwall and footwall

varies by mining method.

- Additional operational mucking

dilution of 0.5 m for longhole and cut-and-fill stopes is applied

to the Mineral Reserve calculation. An extra endwall dilution for

longhole stopes is assumed as 0.50 m.

- Mining recovery factors are 95% for

longhole stopes and 98% for cut-and-fill stopes. Mining recovery

factor for ore drive development is 99%. Mining recovery factor for

both sill pillars and rib pillars is 0%.

- Exchange rate of 19 MXP to

US$1.

- The Mineral Reserves were estimated

by Fresnillo. Mr Paul Salmenmaki P.Eng. (EGBC #40227), has reviewed

the estimates and accepts QP responsibility for them.

- Totals may not compute exactly due

to rounding.

- Note reported on a 100% basis and

MAG Silver owns 44% of Minera Juanicipio.

Source: AMC / Fresnillo, 2023.

Current Mine Plan

The mine is accessed via twin declines in the

Sierra Valdecañas and a (conveyor) decline near the process plant

in the Linares valley to the top of the mineralization. The

declines split into three internal footwall ramp systems that

access the ore on a 20 m sub-level spacing, with central accesses

and footwall drives to the mineralization. Level to level stopes

floor to floor are mined from the extents inwards to the central

access (retreat) with rock fill placed within 20 m of the

retreating face. Truck haulage is currently used for transporting

ore and waste, however the installation of a conveyor in the

conveyor ramp in 2024 to 2025 has been approved and will become the

primary method for transporting ore from underground to the process

plant.

All scheduling is carried out using Enhanced

Production Scheduling (“EPS”) software. During EPS

scheduling, additional dilution ranging from 1% to 5% for mucking

and other sources, as well as mining recovery factors of 95% for

longhole stoping and 98% for cut and fill. The schedule (Table 4)

uses development advance rates in main ramps and lateral drifting

in ore of 90 m/month and 50 m/month respectively. Nameplate ore

processing capacity of 4,000 tpd was achieved in Q3 2023, averaging

about 3,700 tpd in the latter part of the 2023 (approximately 1.3

Mtpa). Optimization and efficiency improvements in underground

productivity, equipment utilisation and mining methods are in

progress. Mine operations are currently in a ramp-up stage.

Table 4: Mine production schedule by year

|

Description |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|

Ore tonnes (t) |

360 |

1,285 |

1,303 |

1,294 |

1,300 |

1,318 |

1,297 |

|

Au (g/t) |

1.26 |

1.45 |

1.50 |

1.59 |

1.53 |

1.93 |

1.65 |

|

Ag (g/t) |

620 |

403 |

373 |

300 |

287 |

198 |

155 |

|

Pb (%) |

1.62 |

1.44 |

1.57 |

2.18 |

3.09 |

3.46 |

3.03 |

|

Zn (%) |

3.27 |

2.76 |

2.70 |

3.71 |

5.10 |

6.15 |

5.39 |

|

Fe (%) |

6.67 |

6.46 |

6.77 |

7.33 |

6.88 |

6.54 |

6.76 |

|

Description |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

Total |

|

Ore tonnes (t) |

1,308 |

1,309 |

1,308 |

1,302 |

1,272 |

702 |

15,356 |

|

Au (g/t) |

1.61 |

1.66 |

1.61 |

1.51 |

1.37 |

1.72 |

1.58 |

|

Ag (g/t) |

198 |

169 |

200 |

245 |

135 |

172 |

248 |

|

Pb (%) |

2.97 |

2.65 |

2.82 |

3.13 |

2.72 |

3.11 |

2.64 |

|

Zn (%) |

4.89 |

5.20 |

4.92 |

5.75 |

5.87 |

6.15 |

4.80 |

|

Fe (%) |

6.65 |

6.56 |

6.58 |

6.10 |

5.39 |

6.38 |

6.54 |

Source: Fresnillo, 2023.

Process Plant

The Juanicipio plant was designed with a nominal

capacity of 4,000 tpd and consists of a comminution circuit with

primary crushing and a semi-autogenous grinding mill and ball mill,

followed by sequential flotation to produce a silver-rich lead,

zinc and gold-silver-bearing pyrite concentrates. Operations

commenced in March 2023, with commercial production declared in

June 2023 and nameplate processing achieved in September 2023.

Commissioning and ramp-up have gone well, with

the plant achieving designed throughput in line with expectations.

Silver, lead and zinc recovery and concentrate grades are and

continue to improve with time and optimisation efforts. January

2024 recoveries were 90.0%, 74.0%, 89.5% and 78.5% for silver,

gold, lead and zinc respectively. Gold recovery has improved as

ramp-up and circuit optimizations, including the February startup

of the Knelson concentrator, have progressed. Continual testing and

process optimisation is ongoing to maximize recovery and

concentrate grades.

Table 5: Average mill recoveries used to

estimate production in the financial model

|

|

Gold |

Silver |

Lead |

Zinc |

|

Mill recovery |

84.4% |

86.6% |

86.8% |

72.3% |

Project infrastructure

A 6.5 km access road, mostly over hilly terrain,

accesses the main declines portal site from the mill, with the

plant site being connected to the main highway by a 1.4 km road.

Both the 1.4 km two lane sealed road, which is suitable for use by

heavy vehicles, and the access road to the main portals area are

fully constructed and in operation.

Power is currently supplied to a main substation

at the processing site via a 115 kilovolt (“kV”)

overhead power line connected to the state-owned power grid. From

the mill, a 13.2 kV power line has been extended to the conveyor

drive, with a similar line to the main mine portals location.

With completion of a Reverse Osmosis plant in

2023 and optimizing the consumption of treated municipal

wastewater, all process water requirements are satisfied through

the exclusive use of treated wastewater. Potable water is purchased

from local providers as required.

Detailed design of the tailings storage facility

(“TSF”) for the project was undertaken by Knight

Piésold. It is estimated that the Juanicipio processing plant will

produce approximately 12.2 Mt of tailings for surface storage over

the anticipated initial mine life of approximately 13 years.

Mill tailings will be discharged to a TSF which has a total volume

capacity of approximately 8.5 Mt as currently designed. It is

envisaged that the remaining required tailings storage will come

from potential deepening of the Cell 2 basin (currently being

pursued), a future expansion to the TSF through construction of an

adjacent cell, and / or from a vertical raise of the dam. The

Qualified Person (“QP”) understands that all

permitting documentation for construction of Cell 2 has been

submitted and is expected to be approved in Q1 2024.

Truck haulage is currently used for transporting

ore and waste from the mine workings to surface. Development waste

is either hauled to surface by trucks via the twin access declines

or placed directly into stopes as backfill. Once the conveyor

system to surface is in operation, ore transport from various

mining levels will be by truck haulage to the crusher on 1950

relative level (“RL”). The crushed material will

then be placed on a load-out belt that feeds the first of two

sequential underground conveyors that bring the material to

surface. At surface, a third conveyor delivers the material to an

8,000 t capacity stockpile that is adjacent to the mill.

Although the main maintenance workshop is

located on surface, all major scheduled planned maintenance and

rebuilds will take place in the underground workshop. The

underground workshop is located on 1850 Level and has multiple

service bays with overhead cranes.

There are two temporary pump stations already in

operation that together can handle 2,500 gallons per minute

(“gpm”). The main pump station on 1850 Level has

three pumps installed with a fourth available on stand-by. The

current capacity is 5,000 gpm. A second permanent pump station is

planned for 1650 Level that will pump to the 1850 Level station. A

further main pump station is planned for the bottom of the mine

(1250 Level) with a capacity of 2,500 gpm. It is estimated that the

current and planned pump stations should provide sufficient

capacity for the life of the mine.

The overall plan for handling groundwater is an

advanced dewatering strategy that will largely depend on accessing

the lower levels of the mine well ahead of stope production. This

early development approach provides a means for installing a series

of dewatering holes and sumps that will dewater sections of the

mine prior to production mining. In 2023, the majority of

Juanicipio process and operational water requirements was sourced

from dewatering underground workings, with the water used primarily

for mine development and dust control. Juanicipio also purchased

potable well water from third parties for mine development and

domestic use.

Environmental and

permitting

Environmental investigations included baseline

assessments and initial studies required under Mexican

Environmental Laws, inclusive of a Regional Environmental Impact

Statement (MIA-R) are up to date. Fresnillo, on behalf of Minera

Juanicipio, has confirmed that the project does not have any

environmental obligations or liabilities identified to date.

Key permits and licenses for the project are in

place and Fresnillo has indicated that all the land included in the

design and operation of the Juanicipio Mine has been purchased.

Operating costs and capital

costs

The operating costs used for the evaluation of

project economics are based on actual operating costs and benchmark

costs for similar operations in the area. Average LOM operating

costs from the latest cost model for the 2023 Mineral Reserves are

summarized as follows:

- Mining - $63.32/t ore

- Processing - $12.15/t ore

- General and Administration- $10.38/t ore

- Total operating cost - $85.85/t ore

For cut-off purposes, the average cut-off values

used were $122/t for longhole stopes and $150/t for cut-and-fill

stopes to also cover the LOM sustaining capital costs for mining,

processing, and G&A; and the operating management fee

(totalling $36/t).

Fresnillo has advanced the project through

detailed engineering, project construction, and initial mine

development and stoping leading to achievement of commercial

production in mid-2023. Internal estimates for the remaining

Juanicipio capital, inclusive of sustaining capital and as of 31

May 2023, total $453M.

The key aspects of the remaining project and LOM

sustaining capital cost estimate ($413M) includes lateral and

vertical development as well as project capital requirements ($40M)

for remaining surface and underground infrastructure items (e.g.

underground to surface conveyor system, tailings facility,

etc.).

Economics

Using the referenced production projections and

cost estimates, Juanicipio has a post-tax NPV5% of $1,224M (pre-tax

$1,656M). Project economics are shown to be most sensitive to

silver price and silver grade, followed by operating costs.

Qualified Persons: All

scientific or technical information in this press release including

assay results referred to, and mineral resource and mineral reserve

estimates, if applicable, is based upon information prepared by or

under the supervision of the following:

- P. Salmenmaki, P.Eng.

- R. Chesher, FAusIMM (CPMET)

- M. Molavi, P.Eng.

- J. M. Shannon, P.Geo.

- C. Stewart, P.Geo.all of AMC, and:

- G. Dominguez, P.E., independent consultant of KP.

All are “Qualified Persons” for purposes of NI

43-101.

About MAG Silver Corp.

MAG Silver Corp. is a growth-oriented Canadian

exploration company focused on advancing high-grade, district scale

precious metals projects in the Americas. MAG is emerging as a

top-tier primary silver mining company through its (44%) joint

venture interest in the 4,000 tpd Juanicipio Mine, operated by

Fresnillo plc (56%). The mine is located in the Fresnillo Silver

Trend in Mexico, the world's premier silver mining camp, where in

addition to underground mine production and processing of

high-grade mineralised material, an expanded exploration program is

in place targeting multiple highly prospective targets. MAG is also

executing multi-phase exploration programs at the 100% earn-in Deer

Trail Project in Utah and the 100% owned Larder Project, located in

the historically prolific Abitibi region of Canada.

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

Cautionary Note to United States

Investors

Unless otherwise indicated, technical disclosure

included herein, including the use of the terms “Mineral Resources”

and “Mineral Reserves” and all Mineral Resource and Mineral Reserve

estimates contained in such technical disclosure has been prepared

in accordance with the requirements of NI 43-101 and the Canadian

Institute of Mining, Metallurgy and Petroleum (the

“CIM”) – CIM Definition Standards on Mineral

Resources and Mineral Reserves, adopted by the CIM Council, as

amended (the “CIM Definition Standards”). NI

43-101 is an instrument developed by the Canadian Securities

Administrators that establishes standards for all public disclosure

an issuer makes of scientific and technical information concerning

mineral projects.

Canadian standards, including NI 43-101, differ

significantly from the disclosure requirements of the U.S.

Securities and Exchange Commission (“SEC”) under

subpart 1300 of Regulation S-K (the “SEC Modernization

Rules”). The Company is not required to provide disclosure

on its mineral properties under the SEC Modernization Rules and

provides disclosure under NI 43-101 and the CIM Definition

Standards. Accordingly, information contained in this press release

may differ significantly from the information that would be

disclosed had the Company prepared the Mineral Resource or Mineral

Reserve estimates under the standards adopted under the SEC

Modernization Rules.

Cautionary Note to Investors Concerning

Estimates of Mineral Resources

“Inferred Mineral Resources” are Mineral

Resources for which quantity and grade or quality are estimated

based on limited geological evidence and sampling. Geological

evidence is sufficient to imply but not verify geological and grade

or quality continuity. “Inferred Mineral Resources” are based on

limited information and have a great amount of uncertainty as to

their existence and great uncertainty as to their economic and

legal feasibility, although it is reasonably expected that the

majority of “Inferred Mineral Resources” could be upgraded to

“Indicated Mineral Resources” with continued exploration. Under

Canadian rules, estimates of Inferred Mineral Resources are

considered too speculative geologically to have the economic

considerations applied to them to enable them to be categorized as

Mineral Resources and, accordingly, may not form the basis of

feasibility or pre-feasibility studies, or economic studies except

for a Preliminary Economic Assessment as defined under NI 43-101.

Indicated and Inferred Mineral Resources that are not Mineral

Resources do not have demonstrated economic viability.

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this release,

including any information relating to MAG’s future oriented

financial information, are “forward-looking information” and

“forward-looking statements” within the meaning of applicable

Canadian and United States securities legislation (collectively

herein referred as “forward-looking statements”), including the

“safe harbour” provisions of provincial securities legislation, the

U.S. Private Securities Litigation Reform Act of 1995, Section 21E

of the U.S. Securities Exchange Act of 1934, as amended and Section

27A of the U.S. Securities Act. Such forward-looking statements

include, but are not limited to:

- statements that address achieving

the nameplate 4,000 tpd milling rate at Juanicipio;

- statements that address our

expectations regarding exploration and drilling;

- statements regarding production

expectations and nameplate;

- statements regarding the additional

information from future drill programs;

- estimated future exploration and

development operations and corresponding expenditures and other

expenses for specific operations;

- the Company’s expectations

regarding the tailings storage facility at Juanicipio;

- the Company’s estimation of

tailings production and waste;

- the expected capital, sustaining

capital and working capital requirements at Juanicipio;

- the anticipated operations of the

processing plant at Juanicipio and the related impacts on

production for the current financial year;

- expected upside from additional

exploration;

- expectations relating to permits

and license; and

- other future events or

developments.

When used in this release, any statements that

express or involve discussions with respect to predictions,

beliefs, plans, projections, objectives, assumptions or future

events of performance (often but not always using words or phrases

such as “anticipate”, “believe”, “estimate”, “expect”, “intend”,

“plan”, “strategy”, “goals”, “objectives”, “project”, “potential”

or variations thereof or stating that certain actions, events, or

results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions), as they relate to the Company or management, are

intended to identify forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

and are subject to certain known and unknown risks, uncertainties

and assumptions.

Forward-looking statements are necessarily based

upon estimates and assumptions, which are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are beyond the Company’s control and

many of which, regarding future business decisions, are subject to

change. Assumptions underlying the Company’s expectations regarding

forward-looking statements contained in this release include, among

others: MAG’s ability to carry on its various exploration and

development activities including project development timelines, the

timely receipt of required approvals and permits, the price of the

minerals produced, the costs of operating, exploration and

development expenditures, the impact on operations of changes to

the Mexican tax and legal regimes, MAG’s ability to obtain adequate

financing, outbreaks or threat of an outbreak of a virus or other

contagions or epidemic disease will be adequately responded to

locally, nationally, regionally and internationally.

Although MAG believes the expectations expressed

in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in the forward-looking statements. These

forward-looking statements involve known and unknown risks,

uncertainties and many factors could cause actual results,

performance or achievements to be materially different from any

future results, performance or achievements that may be expressed

or implied by such forward-looking statements including amongst

others: estimates of Mineral Resources and Mineral Reserves being

based on interpretation and assumptions which are inherently

imprecise; no guarantee that licenses and permits required to

conduct business will be obtained, which may result in an

impairment or loss in the Company’s mineral properties; rights to

use the surface of the Company’s mineral properties are not

guaranteed; the properties in which the Company has an interest are

located primarily in Mexico; economic and political instability may

affect the Company’s business; community relations may affect the

Company’s business, including its interest in Juanicipio; adequate

funding may not be available, resulting in the possible loss or

dilution of the Company’s interests in its properties; substantial

expenditures are required for commercial operations and if

financing for such expenditures is not available on acceptable

terms, the Company may not be able to justify commercial

operations; uncertainties and risks relating to the operation of

the Juanicipio Mine; the Company’s capital and operating costs,

production schedules and economic returns are based on certain

assumptions which may prove to be inaccurate; Juanicipio capital

requirements contemplated in the 2024 Technical Report are subject

to volatility and uncertainty; Mineral projects, such as

Juanicipio, are uncertain and it is possible that actual capital

and operating costs and economic returns will differ significantly

from those estimated for project production; the Juanicipio Mine

plan and design and the financial results may not be consistent

with the 2024 Technical Report; the continued operation of

Juanicipio may be adversely impacted by a lack of access to a

skilled workforce; labour risks; the continued operation of

Juanicipio may be adversely impacted by lack of access and

availability of infrastructure, power and water, and other matters;

risks related to the Company’s decision to participate in the

development, exploration, processing and production of the

Juanicipio Mine; the Company may encounter certain transportation

and refining risks that could have a negative impact on its

operations; the Company’s mineral properties are subject to title

risk and any challenge to the title to any of such properties may

have a negative impact on the Company; risks related to potential

Indigenous rights claims made against the Company’s mineral

properties and the complex nature of such claims; title opinions

provide no guarantee of title and any challenge to the title to any

properties may have may have a negative impact on the Company;

title to the properties in which the Company has an interest that

are not registered in the name of the Company may result in

potential title disputes having a negative impact on the Company;

the Company being a minority shareholder and non-operator of

Juanicipio and therefore is dependent on, and subject to, the

decisions of the majority shareholder and operator of Juanicipio;

the Company holds its Juanicipio interest through a minority

shareholding in the Juanicipio Entities and therefore may be

adversely impacted by disputes amongst the shareholders; risks

related to the highly competitive nature of the mineral exploration

industry; tailings storage facility / permit risks; risks related

to natural disasters; the Company may face equipment shortages,

access restrictions and a lack of infrastructure; the Company is

dependent on its key personnel, none of whom are insured by the

Company; foreign currency fluctuations and inflationary pressures

may have a negative impact on the Company’s financial position and

results; risks related to amendments to the Federal Mining Law; the

Company’s activities within Mexico are subject to extensive laws

and regulations governed by Mexican regulators; as well as those

risks more particularly described under the heading “Risk Factors”

in the Company’s Annual Information Form dated March 27, 2023

available under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. This list is not exhaustive of the factors that may affect

any of the Company’s forward-looking statements. The Company’s

forward-looking statements are based on the beliefs, expectations

and opinions of management on the date the statements are made and,

other than as required by applicable securities laws, the Company

does not assume any obligation to update forward-looking statements

if circumstances or management’s beliefs, expectations or opinions

should change. For the reasons set forth above, investors should

not attribute undue certainty to or place undue reliance on

forward-looking statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and quarterly reports and

other public filings, accessible through the Internet at

www.sedarplus.ca and www.sec.gov.

LEI: 254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, Vice President, Investor Relations and Communications

Phone: (604) 630-1399

Toll Free: (866) 630-1399

Email: info@magsilver.com

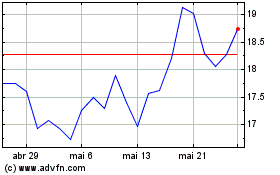

MAG Silver (TSX:MAG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

MAG Silver (TSX:MAG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024