Public announcement in accordance with article 7:97, §4/1 of the

Belgian Companies and Associations Code (“BCAC”) concerning a

capital increase by contribution in kind

Press releaseBrussels, 29 March

2024Regulated information – Inside information

Public announcement in

accordance with article 7:97, §4/1 of the Belgian Companies and

Associations Code (“BCAC”) concerning a capital increase by

contribution in kind

On 20 November 2023, Orange Belgium SA (the

“Company”) received notification from Nethys SA

(“Nethys”) of its wish to contribute its 25% + 1

shareholding in VOO Holding SA (“VOO”) to the

capital of the Company, provided that such contribution results in

Nethys holding at least 11% of the Company's share capital (after

contribution), pursuant to the provisions of the shareholders'

agreement entered into by and between the Company, Atlas Services

Belgium SA (“ASB”) and Nethys on 2 June 2023.

Nethys can be considered a “related” party to

the Company within the meaning of the IAS standards, as it has

significant influence over VOO within the meaning of IAS and VOO is

part of the group to which the Company belongs.

Date and value of the planned transaction

Subject to the approval of the extraordinary

general meeting scheduled for 2 May 2024, the contribution will be

made on that date. It consists of 559,901,637 outstanding class B

shares issued by VOO (the “Contributed Shares”)

(i.e. 557,941,104 class B shares issued on 30 May 2023 and

1,960.533 class B shares to be issued on 30 April 2024), free of

all encumbrances and with all rights attaching thereto (including

the right to the full amount of any dividends which may be

attributed to such shares in respect of the financial year ending

31 December 2023 and the current financial year which commenced on

1 January 2024).

On the basis of the valuations of the Company

and the Contributed Shares, an equity value of the Company of EUR

1,229,783,798 and a value of the Contributed Shares of EUR

153,196,833 have been retained by the Company and Nethys.

Consequently, in exchange for the Contributed Shares, new shares of

the Company will be issued (hereinafter referred to as the

“New Shares”) at a total issue price of EUR

153,196,833 (including the share premium), i.e. an amount of EUR

20.52 (rounded) per New Share (including the share premium of EUR

18.32 (rounded) per share). Fractions of shares will be rounded

down. Following the capital increase, Nethys will hold a total of

7,467,448 shares in the Company, representing 11.08% of the share

capital.

Benefits of the transaction for the Company

The acquisition of the Contributed Shares by way

of the contribution enables the Company to complete the acquisition

of 100% of VOO without having to pay any cash consideration. As a

result, the current right of Nethys to sell to the Company all of

its class B shares issued by VOO for cash (the “Nethys Put

Option”) will expire and the corresponding financial

liability on the Company's balance sheet will disappear.

The acquisition of the Contributed Shares by way

of a contribution also enables the Company to preserve its existing

financial resources which can be used for other purposes, such as

new investments or future growth opportunities.

The contribution will increase the Company's

asset base and potentially unlock value-creating synergies for the

Company and all shareholders. The contribution will help foster the

development and integration of VOO and its subsidiaries' activities

within the Company, creating a network and communications operator

capable of offering a quadruple-play service. This strategic move

is designed to ensure the sustainability and stimulate the

sustained growth of the integrated business.

Finally, although the increase will result in

dilution of existing shareholders due to the issue of New Shares,

the long-term benefits of the proposed transaction - such as the

expected synergies - are expected to have a positive impact and

contribute to increasing the overall value of the Company. Dilution

is an inevitable effect of any capital increase in kind, which in

this case is offset by the benefits of acquiring valuable assets

without immediate cash outlay.

In the context of the proposed contribution, it

is intended that Nethys and ASB will enter into a shareholders'

agreement granting Nethys the right to nominate candidates for two

directorships in the Company, as well as veto rights over certain

reserved matters.

Opinion of the Committee of Independent

Directors

As the proposed contribution transaction falls

within the scope of Article 7:97 of the Belgian Companies and

Associations Code, the Company's board of directors has appointed a

committee of three independent directors for the purpose of

evaluating the contribution transaction described above. This

committee, assisted by an investment bank, acting as an independent

expert, and a law firm, issued a written and reasoned opinion on

this subject to the Company's board of directors on 4 March 2024.

In this opinion, the Committee of Independent Directors considers

in particular that:

“the proposed transaction (i.e. the contribution

by Nethys of its 25% stake plus one share in VOO Holding to the

Company, in exchange for 11% of the Company's share capital (after

dilution)) is not detrimental to Orange Belgium within the meaning

of Article 7:97 §3 of the Belgian Companies and Associations

Code”.

In addition, the assessment made by the

Company's statutory auditor of the proposed transaction in

accordance with Article 7:97, §4 of the Belgian Companies and

Associations Code states that “Based on our assessment, nothing has

come to our attention that causes us to believe that the financial

and accounting data contained in the opinion of the Committee of

Independent Directors dated 4 March 2024 and the minutes of the

Board of Directors dated 7 March 2024, supporting the proposed

transaction, are not fair and sufficient in all material respects

in light of the information available to us in our capacity as

statutory auditor of Orange Belgium SA. “.

Consequently, at its meeting of 7 March 2024,

the Company's Board of Directors decided, on the basis of the

opinion delivered by the committee of independent directors and

taking into account the opinion of the statutory auditor, to submit

the capital increase by contribution in kind for approval by the

Company's extraordinary general meeting scheduled for 2 May

2024.

About Orange BelgiumOrange Belgium is one of the

major telecommunication operators on the Belgian market, with

revenues of 1,749 million euros in 2023 and over 3 million

customers on 31 December 2023, and in Luxembourg, via its

subsidiary Orange Communications Luxembourg. Thanks to its own

fixed and mobile networks, Orange Belgium offers both residential

and business customers fixed and mobile connectivity services and

convergent offerings (internet, telephony, television, including

original TV content: Be tv, VOOsport, etc.). As a responsible

operator, Orange Belgium invests to reduce its ecological footprint

and promote sustainable and inclusive digital practices. Orange

Belgium is also a wholesale operator, offering its partners access

to its infrastructure as well as a broad portfolio of connectivity

and mobility services, including offerings based on Big Data and

the Internet of Things (IoT).

Orange Belgium is a subsidiary of the Orange

Group, present in 26 countries with a total customer base of 298

million customers worldwide on 31 December 2023. The Group is also

a leading provider of global IT and telecommunication services to

multinational companies under the brand Orange Business.

Orange Belgium is listed on the Brussels Stock

Exchange (OBEL).

For more information on the internet and on your

mobile: corporate.orange.be, www.orange.be or follow us on Twitter:

@pressOrangeBeOrange and any other Orange product or service names

included in this material are trademarks of Orange or Orange Brand

Services Limited.

Press contactSven Adams – sven.adams@orange.com

+32 (0)486 36 47 22press@orange.be

Investors contactKoen Van Mol –

koen.vanmol@orange.com +32 (0)495 55 14

99ir@orange.be

- 20240329 OBEL PR 7 97 vFIN UK

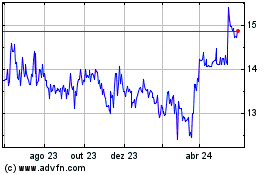

Orange Belgium (EU:OBEL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

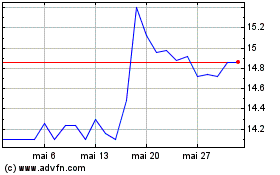

Orange Belgium (EU:OBEL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024