E Split Corp. Announces Overnight Offering

11 Abril 2024 - 4:19PM

Middlefield Group, on behalf of E Split Corp. (TSX: ENS and

ENS.PR.A) (the “Company”), is pleased to announce that the Company

is undertaking an overnight treasury offering of class A and

preferred shares (the “Class A Shares” and “Preferred Shares”,

respectively).

The sales period for this overnight offering

will end at 9:00 a.m. (ET) on Friday, April 12, 2024. The offering

is expected to close on or about April 19, 2024 and is subject to

certain closing conditions including approval by the Toronto Stock

Exchange (“TSX”).

The Class A Shares will be offered at a price of

$11.60 per Class A Share to yield 13.4% and the Preferred Shares

will be offered at a price of $10.10 per Preferred Share to yield

6.7% to maturity. The closing price on the TSX for each of the

Class A Shares and Preferred Shares on April 10, 2024 was $11.87

and $10.15, respectively. The Class A Share and Preferred Share

offering prices were determined so as to be non-dilutive to the

most recently calculated net asset value per unit of the Company

(calculated as at April 10, 2024), as adjusted for dividends and

certain expenses to be accrued prior to or upon settlement of the

offering.

The Company invests in common shares of Enbridge

Inc., a North American oil and gas pipeline, gas processing and

natural gas distribution company.

The Company’s investment objectives for the:

Class A Shares are to provide holders with:

(i) non-cumulative

monthly cash distributions; and(ii) the opportunity for capital

appreciation through exposure to the portfolio

Preferred Shares are to:

(i) provide holders

with fixed cumulative preferential quarterly cash distributions;

and(ii) return the original issue price of $10.00 to holders upon

maturity.

Middlefield Capital Corporation provides

investment management advice to the Company.

The syndicate of agents for the offering is

being co-led by CIBC Capital Markets, RBC Capital Markets, and

Scotiabank.

For further information, please visit our

website at www.middlefield.com or contact Nancy Tham in our Sales

and Marketing Department at 1.888.890.1868.

A short form base shelf prospectus

containing important detailed information about the securities

being offered has been filed with securities commissions or similar

authorities in each of the provinces of Canada. Copies of the short

form base shelf prospectus may be obtained from a member of the

syndicate. The Company intends to file a supplement to the short

form base shelf prospectus, and investors should read the short

form base shelf prospectus and the prospectus supplement before

making an investment decision. There will not be any sale or any

acceptance of an offer to buy the securities being offered until

the prospectus supplement has been filed with the securities

commissions or similar authorities in each of the provinces of

Canada.

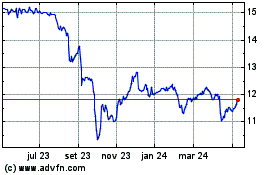

E Split (TSX:ENS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

E Split (TSX:ENS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025