Net Income of R$ 55.3 mm in 1Q24, a 90.1% Increase YOY and Leases EBITDA Margin of 72.1%

24 Abril 2024 - 9:58PM

Net Income of R$ 55.3 mm in 1Q24, a 90.1% Increase YOY and Leases

EBITDA Margin of 72.1%

Log Commercial Properties (B3: LOGG3), a leading developer of

greenfield assets and lessor of Class A logistics warehouses in

Brazil, is pleased to announce its financial results for the first

quarter.

1Q24 Operational

Highlights:

- Deliveries

totaling 57,000 sqm of GLA were completed with a 100% pre-lease

rate

- Milestone of 2.0

million sqm of GLA historically delivered by the Company

- Gross absorption

of 134,000 sqm of GLA

- Stabilized

vacancy of 0.91%,

- Same Client Rent

of 1,9%, above inflation for the 7th consecutive quarter

1Q24 Financial Highlights:

- Strong EBITDA of

R$ 74.0 million in 1Q24, with a growth of 36.4%

- EBITDA from

leases of R$ 38.8 million and a margin of 72.1% in 1Q24

- Asset recycling

of R$ 1.7 billion in the last 12 months

- Adjusted net

debt reduction of 37.4%, totaling R$ 744.3 million in 1Q24

- Adjusted

leverage of 0.8x considering the asset sales in April

Management Comments

Superior Margins Above 40% in Recycling

Ensure Increasing Value Creation at LOG as a Greenfield Asset

Developer

In 2024, LOG continues to showcase the

attractivity, liquidity, and strong market demand for its assets.

The company's asset recycling strategy highlights its dedication to

sustainable growth and substantial value generation for

shareholders.

On April 19, the sale of the LOG Betim and LOG

Salvador assets was finalized. These properties, with a combined

gross leasable area (GLA) of 138,000 square meters, sold for a

total of R$ 509.7 million, achieving a gross margin of 40.9%.

The transaction with the BTG Pactual Real Estate

Investment Fund - BTLC11 reflects a warming market for real estate

investment funds and the compression of cap rates. This marks the

third deal with BTLC11 since its constitution in May 2023. With

this acquisition, the fund now manages approximately 413,000 square

meters of GLA, amounting to R$ 1.5 billion in assets.

Over the past twelve months, LOG's asset

recycling strategy has amassed over R$ 1.7 billion. These sales,

made at significant margins, demonstrate the company’s capability

to develop high-return greenfield projects.

LOG Salvador Sale: An IRR of 27.3%

Demonstrates Significant Return Potential in Asset

Development

The company has completed the sale of LOG

Salvador, a development comprising 87,600 square meters of GLA

across three phases. The first two phases, which are fully leased,

were delivered in the second and fourth quarters of 2023,

respectively. The third phase is currently under construction and

is scheduled for completion in the second quarter of 2024.

It is important to note that the sale of the

development, including a phase still under construction, over a

29-month period from land acquisition to asset sale, reflects a

significant return, with an IRR of 27.3% after all taxes.

Quarterly Deliveries 100% Pre-Leased

with an Average Rate of R$ 23.63, Reinforces Growing Demand for

LOG's Assets

LOG is advancing towards the completion of the

“Todos por 1.5” plan in 2024, with significant deliveries totaling

57,000 sqm of GLA in Q1 2024, including Log Natal and Log BH. The

average ticket price for these assets reached R$ 23.63 per sqm of

GLA and they were delivered 100% pre-leased.

The high level of pre-leasing, along with the

low stabilized vacancy rate of 0.91%, demonstrates the Company’s

ability to align supply and demand, and confirms the potential of

its business model.

The 13.5% CAGR in NAV Reflects the

Growth Potential and Results Generation for LOG

In 2020, LOG began a significant growth phase

with the launch of the "Todos por 1.5" and "Log 2 Milhões" plans.

The implementation of these strategies is set to sustainably

increase the company's NAV. Starting in 2024, LOG has set a new

production benchmark, aiming to deliver 500,000 square meters of

GLA annually.

This delivery target ensures an increase in the

company’s NAV CAGR, which from December 2019 to March 2024 was

13.5%.

The macroeconomic environment has been favorable

for LOG, particularly due to the opportunities for cap rate

compression. Additionally, LOG has achieved a YoC close to 13%,

which facilitates increased margins in asset recycling.

1Q24 Earnings Call

The Company will hold 1Q24 earnings conference call

tomorrow:

April 25th, 202410 am (Brasília)

/ 9 am (New York) - with simultaneous translationClick here to

access the video conference

For more information, please contact Investor Relations at

ri@logcp.com.br

Belo Horizonte, April 24th, 2024.

André VitóriaCFO and IRO

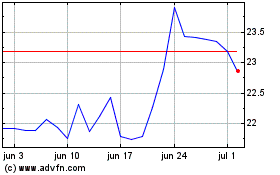

LOG Commercial ON (BOV:LOGG3)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

LOG Commercial ON (BOV:LOGG3)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025