AIP Realty Trust (the “

Trust” or

“

AIP”) (TSXV: AIP.U) today announces as part of

its preparation to execute its forward plan, that it has completed

an issuance of 1,500,000 Class A Trust Units (each, a

“

Unit”) at a deemed issue price of US$0.50 per

Unit in satisfaction of an outstanding debt in the amount of

US$750,000 owed to AllTrades Industrial Development LLC

(“

AID”) pursuant to the terms of the previously

announced Master Funding and Forward Purchase Agreement dated

September 19, 2022 (the “

Agreement”) between AID

and AIP Realty Management LLC (a wholly-owned subsidiary of the

Trust) (the “

Unit Issuance”).

Completion of the Unit Issuance remains subject

to final approval from the TSX Venture Exchange (the

“TSXV”).

The Unit Issuance may constitute a “related

party transaction” as such term is defined by Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions (“MI 61-101”) as three of the

trustees and management of the Trust are officers and directors of

AllTrades Industrial Properties, Inc.

(“Alltrades”), indirect owner of AID. Pursuant to

subsections 5.5(e) of and 5.7(1)(c) of MI 61-101, AIP was exempt

from obtaining a formal valuation and approval of AIP’s minority

shareholders because AIP’s units trade on the TSXV and, pursuant to

subsection 5.5(e) of MI 61-101, the Agreements and the Credit

Facility were supported by Alpha Carta Ltd., AIP’s controlling

unitholder.

According to the policies of the TSXV, the

issuance of securities for debt by an issuer to a non-arm’s length

party in settlement of debt owed and arising from services provided

by such non-arm’s length party who will constitute a “Control

Person” (as defined in the policies of the TSXV), requires

disinterested securityholder approval. A majority of the

disinterested Unitholders of the Trust have approved the Unit

Issuance by way of a majority unitholder consent.

Prior to the closing of the Unit Issuance, there

were 3,424,448 Units issued and outstanding, as well as 1,100,000

preferred units – series B convertible of the Trust (the

“Preferred Units”), each convertible into one

Unit. Following the Unit issuance, there were 4,924,448 Units

issued and outstanding and Alltrades owns or controls approximately

30.46% of the outstanding Units, on an undiluted basis (or

approximately 24.90% of the outstanding Units assuming the

conversion of the Preferred Units). Alltrades holds no other

securities in the Trust.

The Trust has filed a material change report

following the completion of the Unit Issuance which is less than

the mandated 21 days in advance of the expected closing of the Unit

Issuance pursuant to MI 61-101. The Trust deems this timing

reasonable in the circumstances so that it was able to avail itself

of the financing opportunities and complete the Unit Issuance in an

expeditious manner.

Each of the Units issued under the Unit

Issuance, will be subject to a four month and one day hold period

from the date of issuance. There were no finder’s fees paid in

connection with the Unit Issuance.

About AIP Realty TrustAIP

Realty Trust is a real estate investment trust with a growing

portfolio of AllTrades branded Serviced Industrial Business Suites

(“SIBS”) light industrial flex facilities focused

on small businesses and the trades and services sectors in the U.S.

These properties appeal to a diverse range of small space users,

such as contractors, skilled trades, suppliers, repair services,

last-mile providers, small businesses and assembly and distribution

firms. They typically offer attractive fundamentals including low

tenant turnover, stable cash flow and low capex intensity, as well

as significant growth opportunities. With an initial focus on the

Dallas-Fort Worth market, AIP plans to roll out this innovative

property offering nationally. AIP holds the exclusive rights to

finance the development of and to purchase all the completed and

leased properties built across North America by its development and

property management partner, AllTrades Industrial Properties, Inc.

For more information, please visit www.aiprealtytrust.com.

For further information from the Trust,

contact:Leslie WulfExecutive Chairman(214)

679-5263les.wulf@aiprealtytrust.com

Or

Greg VorwallerChief Executive Officer(778)

918-8262Greg.vorwaller@aiprealtytrust.com

Cautionary Statement on

Forward-Looking InformationThis press release contains

statements which constitute “forward-looking information” within

the meaning of applicable securities laws, including statements

regarding the plans, intentions, beliefs and current expectations

of AIP Realty Trust with respect to future business activities and

operating performance. Forward-looking information is often

identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or

similar expressions and includes information regarding, receipt of

the TSXV approval in respect of the Unit Issuance, the ability to

obtain regulatory and unitholder approvals and other factors. When

or if used in this news release, the words “anticipate”, “believe”,

“estimate”, “expect”, “target, “plan”, “forecast”, “may”,

“schedule” and similar words or expressions identify

forward-looking statements or information. These forward-looking

statements or information may relate to proposed financing

activity, proposed acquisitions, regulatory or government

requirements or approvals, the reliability of third-party

information and other factors or information. Such statements

represent the Trust’s current views with respect to future events

and are necessarily based upon a number of assumptions and

estimates that, while considered reasonable by the Trust, are

inherently subject to significant business, economic, competitive,

political and social risks, contingencies and uncertainties. Many

factors, both known and unknown, could cause results, performance

or achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward- looking statements. The Trust does not intend, and

do not assume any obligation, to update these forward-looking

statements or information to reflect changes in assumptions or

changes in circumstances or any other events affecting such

statements and information other than as required by applicable

laws, rules and regulations.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release is not an offer of securities

for sale in the United States. The securities may not be offered or

sold in the United States absent registration or an exemption from

registration under U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Trust has not registered and will not

register the securities under the U.S. Securities Act. The Trust

does not intend to engage in a public offering of their securities

in the United States.

Source: AIP Realty Trust

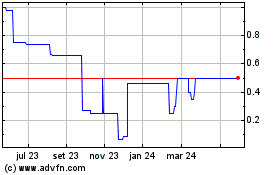

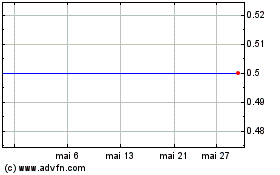

AIP Realty (TSXV:AIP.U)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

AIP Realty (TSXV:AIP.U)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025