Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the

Company”), a business development company (“BDC”), today announced

financial results for its 2024 fiscal year and fourth quarter, with

Net Investment Income (“NII”) per share up 53% from last year and

up 16% over last year’s fourth quarter, and adjusted NII per share

up 44% from last year and down 4% from last year’s fourth quarter.

The substantial year-over-year increase in NII reflects growth in

Assets under Management (“AUM”), strong overall portfolio

performance and margin improvement from year-over-year increased

rates and spreads on Saratoga Investment’s largely floating rate

assets, with costs of financing liabilities remaining largely

fixed.

Saratoga Investment’s annualized fourth quarter

dividend of $0.73 per share and adjusted net investment income of

$0.94 per share imply a 12.4% dividend yield and 16.0% earnings

yield based on its recent stock price of $23.57 per share on May 3,

2024. This substantial overearning of the dividend by 21c this

quarter, or $0.84 annualized per share, supports the increased

level of dividends, increases Net Asset Value (“NAV”), supports

increased portfolio growth and provides a cushion against adverse

events. In addition to the $0.13 dilution from increased shares

this year, this quarter’s elevated earnings power and quality

versus a year ago reflects a higher mix of recurring interest

income, up 29%, and lower other income revenue items, down 44%,

which includes structuring, advisory, and prepayment fees from a

less robust recent M&A environment. In addition, excise taxes

that are incurred once a year, were up $0.04 per share, or 71% over

last year’s fourth quarter.

Summary Financial Information

The Company’s summarized financial information

is as follows:

|

|

For the year ended and as of February 29,

2024 |

For the year ended and as of February 28,

2023 |

For the year ended and as of February 28,

2022 |

|

|

($ thousands except per share) |

|

AUM |

1,138,794 |

|

972,590 |

|

817,567 |

|

|

NAV |

370,224 |

|

346,958 |

|

355,781 |

|

|

NAV per share |

27.12 |

|

29.18 |

|

29.33 |

|

|

Investment Income |

143,720 |

|

99,104 |

|

70,741 |

|

|

Net Investment Income per share |

4.49 |

|

2.94 |

|

1.74 |

|

|

Adjusted Net Investment Income per share |

4.10 |

|

2.85 |

|

2.24 |

|

|

Earnings per share |

0.71 |

|

2.06 |

|

3.99 |

|

|

Dividends per share (record date) |

2.82 |

|

2.28 |

|

1.92 |

|

|

Return on Equity – last twelve months |

2.5 |

% |

7.2 |

% |

13.9 |

% |

|

Originations |

246,101 |

|

365,250 |

|

458,075 |

|

|

Repayments |

30,271 |

|

202,390 |

|

226,931 |

|

|

|

For the three months ended and as of February 29,

2024 |

For the three months ended and as of November 30,

2023 |

For the three months ended and as of February 28,

2023 |

|

|

($ in thousands except per share) |

|

AUM |

|

1,138,794 |

|

1,114,039 |

|

972,590 |

|

|

NAV |

|

370,224 |

|

359,559 |

|

346,958 |

|

|

NAV per share |

|

27.12 |

|

27.42 |

|

29.18 |

|

|

Investment Income |

|

37,233 |

|

36,340 |

|

32,315 |

|

|

Net Investment Income per share |

|

0.94 |

|

1.09 |

|

0.81 |

|

|

Adjusted Net Investment Income per share |

|

0.94 |

|

1.01 |

|

0.98 |

|

|

Earnings per share |

|

0.39 |

|

(0.31 |

) |

1.62 |

|

|

Dividends per share (declared) |

|

0.73 |

|

0.72 |

|

0.69 |

|

|

Return on Equity – last twelve months |

|

2.5 |

% |

6.6 |

% |

7.2 |

% |

|

– annualized quarter |

|

5.8 |

% |

(4.5 |

%) |

22.5 |

% |

|

Originations |

|

43,217 |

|

35,612 |

|

40,036 |

|

|

Repayments |

|

11,023 |

|

2,144 |

|

60,175 |

|

|

|

|

|

|

|

“The rise in interest rates has stabilized this

year, resulting in elevated margins on our growing portfolio

relative to the past year, and market expectations for interest

rate cuts have diminished with an apparent current environment of

near-term rate stability. In addition, our strong reputation and

differentiated market positioning, combined with our ongoing

development of sponsor relationships, continues to create

attractive investment opportunities from high quality sponsors at

attractive pricing, terms and absolute rates, despite the recent

constrained general volume of M&A,” said Christian L. Oberbeck,

Chairman and Chief Executive Officer of Saratoga Investment.

“Saratoga’s solid overall performance is

reflected in our continued strong key performance indicators this

past year, including: (i) adjusted NII per share increases of 44%

over the past year ($2.85 to $4.10 per share), (ii) current assets

under management growing to $1.139 billion, and (iii) dividends

increasing to 73c per share, up 6% from 69c per share in Q4 last

year and over-earned by 29% as compared to this quarter’s 94c per

share adjusted NII. This rapid increase in our adjusted NII has

resulted in substantial overearning of our dividend and a 16.0%

earnings yield, building NAV and further supporting growth.”

“We have made substantial progress in building

our NAV this year to further support the substantial growth of our

portfolio, raising more than $48 million in new equity at or above

net asset value, with $24 million raised in Q2, $10 million in Q3

and $14 million raised in Q4. This equity supports our strong

originations, strengthens our capital structure and reduces our

regulatory leverage.”

“Most importantly, at the foundation of our

performance is the high-quality nature, resilience and balance of

our $1.139 billion portfolio in the current environment, where we

have encountered challenges in two of our portfolio companies,

Pepper Palace and Zollege. This quarter both investments were

marked down $13.8 million to a total combined fair value of $6.3

million. The remaining core non-CLO portfolio was marked-up by $4.2

million, and the CLO and JV were marked up by $2.5 million, for a

net reduction in in portfolio value of $7.1 million this quarter.

Our core non-CLO portfolio is now 1.7% below cost. While

registering further markdowns this quarter in those two credits, we

are actively implementing management changes and capital structure

improvements which have the potential for future increases in

recovery value. The overall financial performance and strong

earnings power of our current portfolio reflects the strength of

the underwriting in our solid, growing portfolio companies and

sponsors in well-selected industry segments.”

“We continue to remain prudent and discerning in

terms of new commitments in the current volatile environment.

Originations this year demonstrate that, despite an overall robust

pipeline, there are periods when investments we review do not meet

our high-quality credit and pricing standards, like this quarter

where we originated no new portfolio company investments while

benefitting from fourteen follow-on investments in existing

portfolio companies we know well with strong business models and

balance sheets. Originations this year totaled $246.1 million, with

$30.2 million of repayments and amortization. Our overall credit

quality for this quarter remained strong at 98.1% of credits rated

in our highest category, with no change from last quarter with

three credits on non-accrual. With 86% of our investments at

quarter-end in first lien debt and generally supported by strong

enterprise values and balance sheets in industries that have

historically performed well in stressed situations, we believe our

portfolio and leverage is well structured for future economic

conditions and uncertainty.”

“As we navigate through the uncertainties in our

current environment, we remain confident in our experienced

management team, high underwriting standards and ability to

steadily grow portfolio size and maintain quality and investment

performance over the long-term.”

Discussion of Financial Results for the Year and

Quarter ended February 29, 2024:

As of February 29, 2024, Saratoga Investment’s

AUM was $1.139 billion, an increase of 17.1% from $972.6 million as

of February 28, 2023, and an increase of 2.2% from $1.114 billion

as of last quarter. The annual increase consists of $246.1 million

in originations, offset by $30.2 million of repayments and

amortizations, reflecting a continued strong pace of originations.

This past quarter, $43.2 million in originations was offset by

repayments and amortizations of $11.0 million. In addition, during

the fourth quarter, the fair value of the portfolio was offset

by $7.2 million of net unrealized depreciation, driven

primarily by (a) the core non-CLO portfolio that had net

depreciation of $9.6 million, comprised of (i) an additional $2.5

million unrealized mark-down of our Pepper Palace investment, and

(ii) an additional $11.3 million mark-down of our Zollege

investment, offset by (iii) $4.2 million of unrealized appreciation

across the remaining core BDC portfolio, and (b) our CLO and JV had

$2.5 million of unrealized appreciation, reflecting market

appreciation this quarter, partially offset by mark-downs due to

individual credits in the CLO broadly syndicated portfolio. The net

unrealized depreciation represented a 0.6% reduction in value of

the overall portfolio.

Saratoga Investment’s portfolio remains strong,

with 85.7% of the portfolio in first liens, and a continued high

level of investment quality in loan investments, with 98.1% of its

loans this quarter at its highest internal rating. Saratoga

Investment’s portfolio has an overall fair value that is 3.5% below

its cost basis, with the fair value of its core non-CLO portfolio

1.7% below its cost basis. Since Saratoga Investment took over the

management of the BDC, $917.0 million of repayments and sales of

investments originated by Saratoga Investment have generated a

gross unlevered IRR of 15.7%.

For the year ended February 29, 2024, total

investment income of $143.7 million increased by $44.6 million, or

45.0%, when compared to $99.1 million for the year ended February

28, 2023. For the three months ended February 29, 2024, total

investment income of $37.2 million increased by $4.9 million, or

15.2%, from $32.3 million as compared to the three months ended

February 28, 2023. As compared to the quarter ended November 30,

2023, total investment income grew by $0.9 million, or 2.5%, from

$36.3 million. This year and quarter’s investment income increases

were generated by (i) the impact of higher interest rates, both

base rates and spreads, as compared to last year, with the weighted

average current coupon on non-CLO BDC investments increasing from

12.1% to 12.5%, (ii) average non-CLO BDC assets increasing by 18.7%

year-over-year, and by 2.2% since last quarter, and (iii) other

income including a $5.9 million dividend received from the Saratoga

Investment JV for the year, and $1.2 million for the quarter.

As compared to the year and quarter ended

February 28, 2023, adjusted net investment income for the year

increased $17.8 million, or 52.4%, from $34.1 million to $51.9

million, and for the quarter increased $1.2 million, or 10.3%, from

$11.6 million to $12.8 million. The increases in investment

income were offset by (i) increased interest expense resulting from

the various new Notes Payable and SBA debentures issued during the

past year and (ii) increased base and incentive management fees

from higher AUM and earnings. As compared to the three months ended

November 30, 2023, adjusted net investment income for the quarter

decreased $0.3 million, or 2.6%, from $13.1 million last quarter,

primarily due to excise tax expense of $1.8 million incurred this

quarter resulting from undistributed taxable income as of calendar

year-end.

Total expenses for fiscal year 2024, excluding

interest and debt financing expenses, base management fees and

incentive fees, and income and excise taxes, increased

from $8.0 million to $8.5 million as compared to

fiscal year 2023. This represented 0.7% of average total assets on

an annualized basis, down from 0.8% last year. For the quarters

ended February 29, 2024, February 28, 2023 and November 30, 2023,

these expenses were $1.9 million, $2.3 million and $2.3 million,

respectively.

Net investment income on a weighted average per

share basis was $4.49 and $0.94 for the year and quarter ended

February 29, 2024. Adjusted for the incentive fee accrual related

to net capital gains, the net investment income on a weighted

average per share basis was $4.10 and $0.94, respectively. This

compares to adjusted net investment income per share of $2.85 and

$0.98 for the year and quarter ended February 28, 2023,

respectively, and $1.01 for the quarter ended November 30, 2023.

The weighted average common shares outstanding increased from 12.0

million to 12.7 million for the year-ends, and increased from 11.9

million to 13.1 million to 13.6 million for the quarters ended

February 28, 2023, November 30, 2023 and February 29, 2024,

respectively.

Net investment income yield as a percentage of

average net asset value (“Net Investment Income Yield”) was 16.0%

and 14.0% for the year and quarter ended February 29, 2024,

respectively. Adjusted for the incentive fee accrual related to net

capital gains, the Net Investment Income Yield was 14.6% and 14.0%,

respectively. In comparison, adjusted Net Investment Income Yield

was 9.9% and 13.6% for the year and quarter ended February 28,

2023, respectively, and 14.6% for the quarter ended November 30,

2023.

Return on equity (“ROE”) for the last twelve

months ended February 29, 2024 was 2.5%, down from 7.2%

for the comparable period last year. ROE on an annualized basis for

the quarter ended February 29, 2024 was 5.8%.

NAV was $370.2 million as

of February 29, 2024, an increase of $23.2

million from $347.0 million as of February 28,

2023, and an increase of $10.6 million as of November 30, 2023.

During this year and quarter, $49.0 million and $14.4 million of

new equity was raised at net asset value, respectively. The manager

of the company contributed $4.5m of that equity as part of the

issuances.

NAV per share was $27.12 as

of February 29, 2024, compared to $29.18 as

of February 28, 2023, and $27.42 as of November

30, 2023.

Investment portfolio activity for the year

ended February 29, 2024:

- Cost of investments made during the

period: $246.1 million, including investments in eight new

portfolio companies and sixty-five follow-ons.

- Principal repayments during the

period: $30.2 million, including six repayments of existing

investments, plus amortization.

Investment portfolio activity for the quarter

ended February 29, 2024:

-

Cost of investments made during the period: $43.2 million,

including zero investments in new portfolio companies and fourteen

follow-ons.

-

Principal repayments during the period: $11.0 million, including

one partial repayment of an existing investment, plus

amortization.

Additional Financial Information

For the fiscal quarter ended February 29, 2024,

Saratoga Investment reported NII of $12.8 million, or $0.94 on a

weighted average per share basis, and net realized and unrealized

losses on investments of $7.5 million, or $0.55 on a weighted

average per share basis, resulting in a net increase in net assets

from operations of $5.3 million, or $0.39 on a weighted average per

share basis. The $7.5 million net realized and unrealized loss on

investments was comprised of $7.2 million in net realized gains and

unrealized depreciation on investments, and $0.3 million in net

change in provision for deferred taxes on unrealized appreciation

on investments.

For the fiscal year ended February 29, 2024,

Saratoga Investment reported NII of $56.9 million, or $4.49 on a

weighted average per share basis, net realized and unrealized

losses on investments of $47.8 million, or $3.77 on a weighted

average per share basis, and a $0.1 million realized loss on the

extinguishment of debt, resulting in a net increase in net assets

from operations of $8.9 million, or $0.71 on a weighted average per

share basis. The $47.8 million net realized and unrealized loss on

investments was comprised of $47.1 million in net realized gains

and unrealized depreciation on investments, and $0.9 million in net

change in provision for deferred taxes on unrealized appreciation

on investments.

Portfolio and Investment Activity

As of February 29, 2024, the fair value of

Saratoga Investment’s portfolio was $1.139 billion, excluding $40.5

million in cash and cash equivalents, principally invested in 55

portfolio companies, one collateralized loan obligation fund (the

“CLO”) and one joint venture fund (the “JV”). The overall portfolio

composition consisted of 85.7% of first lien term loans, 1.6% of

second lien term loans, 1.4% of unsecured term loans, 2.7% of

subordinated notes in CLOs and 8.6% of common equity.

As of February 29, 2024, the weighted average

current yield on Saratoga Investment’s portfolio based on current

fair values was 11.4%, which was comprised of a weighted average

current yield of 12.6% on first lien term loans, 5.1% on second

lien term loans, 11.1% on unsecured term loans, 10.3% on CLO

subordinated notes and 0.0% on equity interests.

Portfolio Update:

On April 15, 2024, the Company’s Netreo

investment entered into a definitive agreement to be acquired

by BMC, a global leader in software solutions for

the Autonomous Digital Enterprise. The transaction closed on

May 1, 2024, and the Company received full repayment of its first

lien term loan, including accrued interest, and partial equity

proceeds at closing, with additional potential amounts held in

escrow for future distributions subject to certain conditions.

Liquidity and Capital Resources

As of February 29, 2024, Saratoga Investment had

$35.0 million in outstanding borrowings under its

$65.0 million senior secured revolving credit facility with

Encina. At the same time, Saratoga Investment had $175.0 million

SBA debentures in its SBIC II license outstanding, $39.0 million

SBA debentures in its SBIC III license outstanding, $269.4 million

of listed baby bonds issued, $250.0 million of unsecured unlisted

institutional bond issuances, five unlisted issuances of $52.0

million in total, and an aggregate of $40.5 million in cash and

cash equivalents.

With $30.0 million available under the

credit facility and $40.5 million of cash and cash equivalents

as of February 29, 2024, Saratoga Investment has a total

of $70.5 million of undrawn borrowing capacity and cash

and cash equivalents for new investments or to support its existing

portfolio companies in the BDC. In addition, Saratoga

Investment has $136.0 million in undrawn SBA debentures

from its recently approved SBIC III license. Availability under the

Encina credit facility can change depending on portfolio company

performance and valuation. In addition, certain follow-on

investments in SBIC II and the BDC will not qualify for SBIC III

funding. Overall outstanding SBIC debentures are limited to $350.0

million across all three SBIC licenses. As of

quarter-end, Saratoga Investment had $54.7

million of committed undrawn lending commitments

and $77.7 million of discretionary funding

commitments.

On July 30, 2021, Saratoga Investment entered

into an equity distribution agreement with Ladenburg Thalmann &

Co. Inc. and Compass Point Research and Trading, LLC, through which

Saratoga Investment may offer for sale, from time to time, up to

$150.0 million of common stock through an ATM offering. On July 10,

2023, Saratoga Investment increased the maximum amount of shares of

common stock to be sold through the ATM Program to $300.0 million

from $150.0 million. As of February 29, 2024, Saratoga Investment

sold 6,543,878 shares for gross proceeds of $172.5 million at an

average price of $26.37 for aggregate net proceeds of $171.0

million (net of transaction costs). During the three months ended

February 29, 2024, Saratoga Investment sold 501,105 shares for

gross proceeds of $14.3 million at an average price of $28.44 for

aggregate net proceeds of $14.3 million (net of transaction costs).

For the year ended February 29, 2024, Saratoga Investment sold

1,703,517 shares for gross proceeds of $49.0 million at an average

price of $28.51 for aggregate net proceeds of $49.0 million (net of

transaction costs). The Manager agreed to reimburse the Company to

the extent the per share price of the shares to the public, less

underwriting fees, was less than net asset value per share. For the

three months ended February 29, 2024, the Manager reimbursed the

Company $1.4 million. For the year ended February 29, 2024, the

Manager reimbursed the Company $4.5 million.

On March 27, 2024, the Company and its wholly

owned special purpose subsidiary, Saratoga Investment Funding III

LLC (“SIF III”), entered into a credit and security agreement (the

“Live Oak Credit Agreement”), by and among SIF III, as borrower,

the Company, as collateral manager and equity holder, the lenders

from time to time parties thereto, Live Oak Banking Company (“Live

Oak”), as administrative agent and collateral agent, U.S. Bank

National Association, as custodian, and U.S. Bank Trust Company,

National Association, as collateral administrator, relating to a

special purpose vehicle financing credit facility (the “Live Oak

Credit Facility”). The Live Oak Credit Facility provides for

borrowings in U.S. dollars in an aggregate amount of up to $50.0

million. During the first two years following the closing date, SIF

III may request one or more increases in the commitment amount from

$50.0 million to an amount not to exceed $150.0 million, subject to

certain terms and conditions and a customary fee. The terms of the

Live Oak Credit Agreement require a minimum drawn amount of $12.5

million at all times during the period ending March 27, 2025 and,

thereafter, the greater of: (i) $25.0 million and (ii) 50% of the

facility amount in effect at such time. The Live Oak Credit

Facility matures on March 27, 2027. Advances are available during

the term of the Live Oak Credit Facility and must be repaid in full

at maturity. SIF III may request an extension of the maturity date

by an additional one year, subject to the agreement of the lenders

and an extension fee. Advances under the Live Oak Credit Facility

are subject to a borrowing base calculation, and the Live Oak

Credit Facility has various eligibility criteria for loans to be

included in the borrowing base. Advances under the Live Oak Credit

Facility bear interest at a floating rate per annum equal to

Adjusted Term SOFR plus an applicable margin between 3.50% and

4.25% based on the Live Oak Credit Facility’s utilization. The Live

Oak Credit Agreement also provides for an unused fee of 0.50% on

the unused commitments.

Dividend

On February 15, 2024, Saratoga Investment

announced that its Board of Directors declared a quarterly dividend

of $0.73 per share for the fiscal quarter ended February 29, 2024,

paid on March 28, 2024, to all stockholders of record at the close

of business on March 13, 2024. This is Saratoga Investment’s

sixteenth quarterly dividend increase in a row.

The Company previously declared in fiscal 2024 a

quarterly dividend of $0.72 per share for the quarter ended

November 30, 2023, $0.71 per share for the quarter ended August 31,

2023 and $0.70 per share for the quarter ended May 31, 2023. During

fiscal year 2023, the Company declared a quarterly dividend of

$0.69 per share for the quarter ended February 28, 2023, $0.68 per

share for the quarter ended November 30, 2022, $0.54 per share for

the quarter ended August, 31, 2022 and $0.53 per share for the

quarter ended May 31, 2022.

Shareholders have the option to receive payment

of dividends in cash or receive shares of common stock, pursuant to

the Company’s DRIP.

Share Repurchase Plan

In fiscal year 2015, the Company announced the

approval of an open market share repurchase plan that allows it to

repurchase up to 200,000 shares of its common stock at prices below

its NAV as reported in its then most recently published financial

statements. Since then, the Share Repurchase Plan has been extended

annually, and the Company has periodically increased the amount of

shares of common stock that may be purchased under the Share

Repurchase Plan, most recently to 1.7 million shares of common

stock. On January 8, 2024, our board of directors extended the

Share Repurchase Plan for another year to January 15, 2025.

As of February 29, 2024, the Company purchased

1,035,203 shares of common stock, at the average price of $22.05

for approximately $22.8 million pursuant to the Share Repurchase

Plan. During the three months ended February 29, 2024, the Company

did not purchase any shares of common stock pursuant to the Share

Repurchase Plan. During the year ended February 29, 2024, the

Company purchased 88,576 shares of common stock, at the average

price $24.36 for approximately $2.2 million pursuant to the Share

Repurchase Plan.

2024 Fiscal Year and Fourth Quarter Conference

Call/Webcast Information

|

When: |

Tuesday, May 7, 2024 |

| |

1:00 p.m. Eastern Time (ET) |

| |

|

| How: |

Webcast: Interested parties may access a live

webcast of the call and find the Q4 2024 presentation by going to

the “Events & Presentations” section of Saratoga Investment

Corp.’s investor relations website, Saratoga events and

presentations). A replay of the webcast will also be available for

a limited time at Saratoga events and presentations). |

| |

|

| Call: |

To access the call by phone, please go to this link (Registration

Link), and you will be provided with dial in details. To avoid

delays, we encourage participants to dial into the conference call

fifteen minutes ahead of the scheduled start time. |

| |

|

About Saratoga Investment Corp.

Saratoga Investment is a specialty finance

company that provides customized financing solutions to U.S.

middle-market businesses. The Company invests primarily in senior

and unitranche leveraged loans and mezzanine debt, and, to a lesser

extent, equity to provide financing for change of ownership

transactions, strategic acquisitions, recapitalizations and growth

initiatives in partnership with business owners, management teams

and financial sponsors. Saratoga Investment’s objective is to

create attractive risk-adjusted returns by generating current

income and long-term capital appreciation from its debt and equity

investments. Saratoga Investment has elected to be regulated as a

business development company under the Investment Company Act of

1940 and is externally managed by Saratoga Investment Advisors,

LLC, an SEC-registered investment advisor focusing on credit-driven

strategies. Saratoga Investment Corp. owns two active

SBIC-licensed subsidiaries, having surrendered its first license

after repaying all debentures for that fund following the end of

its investment period and subsequent wind-down. Furthermore, it

manages a $650 million collateralized loan obligation

(“CLO”) fund and co-manages a joint venture (“JV”) fund that owns

a $400 million collateralized loan obligation (“JV CLO”)

fund. It also owns 52% of the Class F and 100% of the

subordinated notes of the CLO, 87.5% of both the unsecured loans

and membership interests of the JV and 87.5% of the Class E notes

of the JV CLO. The Company’s diverse funding sources, combined with

a permanent capital base, enable Saratoga Investment to provide a

broad range of financing solutions.

Forward Looking Statements

This press release contains historical

information and forward-looking statements with respect to the

business and investments of the Company, including, but not limited

to, the statements about future events or our future

performance or financial condition. Forward-looking statements can

be identified by the use of forward looking words such as

“outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “seeks,” “approximately,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates” or negative versions of those

words, other comparable words or other statements that do not

relate to historical or factual matters. The forward-looking

statements are based on our beliefs, assumptions and expectations

of our future performance, taking into account all information

currently available to us. These statements are not guarantees of

future performance, condition or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including, but not limited to: changes in the markets

in which we invest; changes in the financial, capital, and lending

markets; an economic downturn and its impact on the ability of our

portfolio companies to operate and the investment opportunities

available to us; the impact of interest rate volatility on our

business and our portfolio companies; the impact of supply chain

constraints and labor shortages on our portfolio companies; and the

elevated levels of inflation and its impact on our portfolio

companies and the industries in which we invests, as well as those

described from time to time in our filings with the Securities

and Exchange Commission.

Any forward-looking statement speaks only as of

the date on which it is made. The Company undertakes no duty to

update any forward-looking statements made herein or on the

webcast/conference call, whether as a result of new information,

future developments or otherwise, except as required by

law. Readers should not place undue reliance on any

forward-looking statements and are encouraged to review the

Company’s Annual Report on Form 10-Q for the fiscal year ended

February 29, 2024 and subsequent filings, including the “Risk

Factors” sections therein, with the Securities and Exchange

Commission for a more complete discussion of the risks and other

factors that could affect any forward-looking statements.

Financials

| Saratoga

Investment Corp. |

| Consolidated

Statements of Assets and Liabilities |

| |

|

|

|

|

| |

|

|

|

|

| |

|

February 29, 2024 |

|

February 28, 2023 |

| |

|

|

|

|

| ASSETS |

|

|

|

|

| Investments

at fair value |

|

|

|

|

|

Non-control/Non-affiliate investments (amortized cost of

$1,035,879,751 and $819,966,208, respectively) |

|

$ |

1,019,774,616 |

|

|

$ |

828,028,800 |

|

|

Affiliate investments (amortized cost of $26,707,415 and

$25,722,320, respectively) |

|

|

27,749,137 |

|

|

|

28,305,871 |

|

|

Control investments (amortized cost of $117,196,571 and

$120,800,829, respectively) |

|

|

91,270,036 |

|

|

|

116,255,582 |

|

| Total

investments at fair value (amortized cost of $1,179,783,737 and

$966,489,357, respectively) |

|

|

1,138,793,789 |

|

|

|

972,590,253 |

|

| Cash and

cash equivalents |

|

|

8,692,846 |

|

|

|

65,746,494 |

|

| Cash and

cash equivalents, reserve accounts |

|

|

31,814,278 |

|

|

|

30,329,779 |

|

| Interest

receivable (net of reserve of $9,490,340 and $2,217,300,

respectively) |

|

|

10,298,998 |

|

|

|

8,159,951 |

|

| Management

fee receivable |

|

|

343,023 |

|

|

|

363,809 |

|

| Other

assets |

|

|

1,163,225 |

|

|

|

531,337 |

|

| Current tax

receivable |

|

|

99,676 |

|

|

|

436,551 |

|

| Total

assets |

|

$ |

1,191,205,835 |

|

|

$ |

1,078,158,174 |

|

| |

|

|

|

|

|

LIABILITIES |

|

|

|

|

| Revolving

credit facility |

|

$ |

35,000,000 |

|

|

$ |

32,500,000 |

|

|

Deferred debt financing costs, revolving credit facility |

|

|

(882,122 |

) |

|

|

(1,344,005 |

) |

| SBA

debentures payable |

|

|

214,000,000 |

|

|

|

202,000,000 |

|

|

Deferred debt financing costs, SBA debentures payable |

|

|

(5,779,892 |

) |

|

|

(4,923,488 |

) |

| 8.75% Notes

Payable 2025 |

|

|

20,000,000 |

|

|

|

- |

|

|

Discount on 8.75% notes payable 2025 |

|

|

(112,894 |

) |

|

|

- |

|

|

Deferred debt financing costs, 8.75% notes payable 2025 |

|

|

(4,777 |

) |

|

|

- |

|

| 7.00% Notes

Payable 2025 |

|

|

12,000,000 |

|

|

|

12,000,000 |

|

|

Discount on 7.00% notes payable 2025 |

|

|

(193,175 |

) |

|

|

(304,946 |

) |

|

Deferred debt financing costs, 7.00% notes payable 2025 |

|

|

(24,210 |

) |

|

|

(40,118 |

) |

| 7.75% Notes

Payable 2025 |

|

|

5,000,000 |

|

|

|

5,000,000 |

|

|

Deferred debt financing costs, 7.75% notes payable 2025 |

|

|

(74,531 |

) |

|

|

(129,528 |

) |

| 4.375% Notes

Payable 2026 |

|

|

175,000,000 |

|

|

|

175,000,000 |

|

|

Premium on 4.375% notes payable 2026 |

|

|

564,260 |

|

|

|

830,824 |

|

|

Deferred debt financing costs, 4.375% notes payable 2026 |

|

|

(1,708,104 |

) |

|

|

(2,552,924 |

) |

| 4.35% Notes

Payable 2027 |

|

|

75,000,000 |

|

|

|

75,000,000 |

|

|

Discount on 4.35% notes payable 2027 |

|

|

(313,010 |

) |

|

|

(408,932 |

) |

|

Deferred debt financing costs, 4.35% notes payable 2027 |

|

|

(1,033,178 |

) |

|

|

(1,378,515 |

) |

| 6.25% Notes

Payable 2027 |

|

|

15,000,000 |

|

|

|

15,000,000 |

|

|

Deferred debt financing costs, 6.25% notes payable 2027 |

|

|

(273,449 |

) |

|

|

(344,949 |

) |

| 6.00% Notes

Payable 2027 |

|

|

105,500,000 |

|

|

|

105,500,000 |

|

|

Discount on 6.00% notes payable 2027 |

|

|

(123,782 |

) |

|

|

(159,334 |

) |

|

Deferred debt financing costs, 6.00% notes payable 2027 |

|

|

(2,224,403 |

) |

|

|

(2,926,637 |

) |

| 8.00% Notes

Payable 2027 |

|

|

46,000,000 |

|

|

|

46,000,000 |

|

|

Deferred debt financing costs, 8.00% notes payable 2027 |

|

|

(1,274,455 |

) |

|

|

(1,622,376 |

) |

| 8.125% Notes

Payable 2027 |

|

|

60,375,000 |

|

|

|

60,375,000 |

|

|

Deferred debt financing costs, 8.125% notes payable 2027 |

|

|

(1,563,594 |

) |

|

|

(1,944,536 |

) |

| 8.50% Notes

Payable 2028 |

|

|

57,500,000 |

|

|

|

- |

|

|

Deferred debt financing costs, 8.50% notes payable 2028 |

|

|

(1,680,039 |

) |

|

|

- |

|

| Base

management and incentive fees payable |

|

|

8,147,217 |

|

|

|

12,114,878 |

|

| Deferred tax

liability |

|

|

3,791,150 |

|

|

|

2,816,572 |

|

| Accounts

payable and accrued expenses |

|

|

1,337,542 |

|

|

|

1,464,343 |

|

| Interest and

debt fees payable |

|

|

3,582,173 |

|

|

|

3,652,936 |

|

| Directors

fees payable |

|

|

- |

|

|

|

14,932 |

|

| Due to

Manager |

|

|

450,000 |

|

|

|

10,935 |

|

| Total

liabilities |

|

|

820,981,727 |

|

|

|

731,200,132 |

|

| |

|

|

|

|

| Commitments

and contingencies |

|

|

|

|

|

|

|

|

|

|

| NET

ASSETS |

|

|

|

|

| Common

stock, par value $0.001, 100,000,000 common shares |

|

|

|

|

|

authorized, 13,653,476 and 11,890,500 common shares issued and

outstanding, respectively |

|

|

13,654 |

|

|

|

11,891 |

|

| Capital in

excess of par value |

|

|

371,081,199 |

|

|

|

321,893,806 |

|

| Total

distributable earnings (deficit) |

|

|

(870,745 |

) |

|

|

25,052,345 |

|

|

Total net assets |

|

|

370,224,108 |

|

|

|

346,958,042 |

|

| Total

liabilities and net assets |

|

$ |

1,191,205,835 |

|

|

$ |

1,078,158,174 |

|

| NET ASSET

VALUE PER SHARE |

|

$ |

27.12 |

|

|

$ |

29.18 |

|

| |

|

|

|

|

| Asset

Coverage Ratio |

|

|

161.1 |

% |

|

|

165.9 |

% |

| |

|

|

|

|

| Saratoga

Investment Corp. |

| Consolidated

Statements of Operations |

| |

|

|

|

| |

For the three months ended |

| |

February 29, 2024 |

|

February 28, 2023 |

| INVESTMENT

INCOME |

|

|

|

| Interest

from investments |

|

|

|

|

Interest income: |

|

|

|

|

Non-control/Non-affiliate investments |

$ |

29,979,395 |

|

|

$ |

23,079,577 |

|

|

Affiliate investments |

|

500,081 |

|

|

|

486,078 |

|

|

Control investments |

|

2,193,359 |

|

|

|

1,871,444 |

|

|

Payment-in-kind interest income: |

|

|

|

|

Non-control/Non-affiliate investments |

|

60,358 |

|

|

|

101,353 |

|

|

Affiliate investments |

|

229,742 |

|

|

|

195,684 |

|

|

Control investments |

|

272,344 |

|

|

|

126,728 |

|

| Total

interest from investments |

|

33,235,279 |

|

|

|

25,860,864 |

|

| Interest

from cash and cash equivalents |

|

647,460 |

|

|

|

1,133,079 |

|

| Management

fee income |

|

816,265 |

|

|

|

818,578 |

|

| Dividend

income(*): |

|

|

|

|

Non-control/Non-affiliate investments |

|

- |

|

|

|

1,770,514 |

|

|

Affiliate investments |

|

- |

|

|

|

- |

|

|

Control investments |

|

1,231,865 |

|

|

|

- |

|

| Total

dividend from investments |

|

1,231,865 |

|

|

|

1,770,514 |

|

| Structuring

and advisory fee income |

|

363,394 |

|

|

|

771,750 |

|

| Other

income |

|

939,110 |

|

|

|

1,960,333 |

|

|

Total investment income |

|

37,233,373 |

|

|

|

32,315,118 |

|

| |

|

|

|

| OPERATING

EXPENSES |

|

|

|

| Interest and

debt financing expenses |

|

12,551,258 |

|

|

|

10,255,051 |

|

| Base

management fees |

|

4,950,190 |

|

|

|

4,258,971 |

|

| Incentive

management fees expense (benefit) |

|

3,197,026 |

|

|

|

4,840,202 |

|

| Professional

fees |

|

359,740 |

|

|

|

468,238 |

|

|

Administrator expenses |

|

1,075,000 |

|

|

|

818,750 |

|

|

Insurance |

|

77,519 |

|

|

|

80,760 |

|

| Directors

fees and expenses |

|

70,500 |

|

|

|

60,000 |

|

| General and

administrative |

|

283,673 |

|

|

|

836,609 |

|

| Income tax

expense (benefit) |

|

54,119 |

|

|

|

(20,469 |

) |

| Excise tax

expense (benefit) |

|

1,829,837 |

|

|

|

1,067,532 |

|

|

Total operating expenses |

|

24,448,862 |

|

|

|

22,665,644 |

|

| NET

INVESTMENT INCOME |

|

12,784,511 |

|

|

|

9,649,474 |

|

| |

|

|

|

| REALIZED AND

UNREALIZED GAIN (LOSS) ON INVESTMENTS |

|

|

|

| Net realized

gain (loss) from investments: |

|

|

|

|

Non-control/Non-affiliate investments |

|

2,327 |

|

|

|

80,683 |

|

| Net realized

gain (loss) from investments |

|

2,327 |

|

|

|

80,683 |

|

| Net change

in unrealized appreciation (depreciation) on investments: |

|

|

|

|

Non-control/Non-affiliate investments |

|

(8,833,640 |

) |

|

|

7,099,245 |

|

|

Affiliate investments |

|

(251,934 |

) |

|

|

(3,287,169 |

) |

|

Control investments |

|

1,920,961 |

|

|

|

6,737,905 |

|

| Net change

in unrealized appreciation (depreciation) on investments |

|

(7,164,613 |

) |

|

|

10,549,981 |

|

| Net change

in provision for deferred taxes on unrealized (appreciation)

depreciation on investments |

|

(315,473 |

) |

|

|

(697,380 |

) |

| Net realized

and unrealized gain (loss) on investments |

|

(7,477,759 |

) |

|

|

9,933,284 |

|

| Realized

losses on extinguishment of debt |

|

- |

|

|

|

(382,274 |

) |

| NET INCREASE

(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

$ |

5,306,752 |

|

|

$ |

19,200,484 |

|

| |

|

|

|

| WEIGHTED

AVERAGE - BASIC AND DILUTED EARNINGS (LOSS) PER COMMON SHARE |

$ |

0.39 |

|

|

$ |

1.62 |

|

| WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING - BASIC AND DILUTED |

|

13,621,138 |

|

|

|

11,882,686 |

|

| |

|

|

|

| * Certain

prior period amounts have been reclassified to conform to current

year presentation. |

|

|

|

| Saratoga

Investment Corp. |

| Consolidated

Statements of Operations |

| |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

For the year ended |

| |

February 29, 2024 |

|

February 28, 2023 |

|

February 28, 2022 |

| INVESTMENT

INCOME |

|

|

|

|

|

| Interest

from investments |

|

|

|

|

|

|

Interest income: |

|

|

|

|

|

|

Non-control/Non-affiliate investments |

$ |

113,521,652 |

|

|

$ |

72,677,237 |

|

|

$ |

46,369,544 |

|

|

Affiliate investments |

|

3,299,816 |

|

|

|

4,773,527 |

|

|

|

3,308,471 |

|

|

Control investments |

|

8,507,909 |

|

|

|

6,602,594 |

|

|

|

7,345,691 |

|

|

Payment-in-kind interest income: |

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

766,697 |

|

|

|

359,910 |

|

|

|

1,150,695 |

|

|

Affiliate investments |

|

874,226 |

|

|

|

416,711 |

|

|

|

- |

|

|

Control investments |

|

814,925 |

|

|

|

386,889 |

|

|

|

327,171 |

|

| Total

interest from investments |

|

127,785,225 |

|

|

|

85,216,868 |

|

|

|

58,501,572 |

|

| Interest

from cash and cash equivalents |

|

2,512,416 |

|

|

|

1,368,489 |

|

|

|

3,584 |

|

| Management

fee income |

|

3,270,232 |

|

|

|

3,269,820 |

|

|

|

3,262,591 |

|

| Dividend

income(*): |

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

621,398 |

|

|

|

2,104,355 |

|

|

|

1,379,182 |

|

|

Affiliate investments |

|

- |

|

|

|

615,917 |

|

|

|

546,609 |

|

|

Control investments |

|

5,911,564 |

|

|

|

- |

|

|

|

- |

|

| Total

dividend from investments |

|

6,532,962 |

|

|

|

2,720,272 |

|

|

|

1,925,791 |

|

| Structuring

and advisory fee income |

|

2,149,751 |

|

|

|

3,585,061 |

|

|

|

4,307,647 |

|

| Other

income |

|

1,469,320 |

|

|

|

2,943,610 |

|

|

|

2,739,372 |

|

|

Total investment income |

|

143,719,906 |

|

|

|

99,104,120 |

|

|

|

70,740,557 |

|

| |

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

| Interest and

debt financing expenses |

|

49,179,899 |

|

|

|

33,498,489 |

|

|

|

19,880,693 |

|

| Base

management fees |

|

19,212,337 |

|

|

|

16,423,960 |

|

|

|

11,901,729 |

|

| Incentive

management fees expense (benefit) |

|

8,025,468 |

|

|

|

5,057,117 |

|

|

|

11,794,208 |

|

| Professional

fees |

|

1,767,015 |

|

|

|

1,812,259 |

|

|

|

1,378,134 |

|

|

Administrator expenses |

|

3,872,917 |

|

|

|

3,160,417 |

|

|

|

2,906,250 |

|

|

Insurance |

|

322,323 |

|

|

|

347,483 |

|

|

|

348,671 |

|

| Directors

fees and expenses |

|

351,297 |

|

|

|

360,000 |

|

|

|

335,596 |

|

| General and

administrative |

|

2,241,579 |

|

|

|

2,328,672 |

|

|

|

1,661,932 |

|

| Income tax

expense (benefit) |

|

42,926 |

|

|

|

(152,956 |

) |

|

|

(39,649 |

) |

| Excise tax

expense (benefit) |

|

1,829,837 |

|

|

|

1,067,532 |

|

|

|

630,183 |

|

|

Total operating expenses |

|

86,845,598 |

|

|

|

63,902,973 |

|

|

|

50,797,747 |

|

| NET

INVESTMENT INCOME |

|

56,874,308 |

|

|

|

35,201,147 |

|

|

|

19,942,810 |

|

| |

|

|

|

|

|

| REALIZED AND

UNREALIZED GAIN (LOSS) ON INVESTMENTS |

|

|

|

|

|

| Net realized

gain (loss) from investments: |

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

153,583 |

|

|

|

7,446,596 |

|

|

|

6,209,737 |

|

|

Affiliate investments |

|

- |

|

|

|

- |

|

|

|

7,328,457 |

|

|

Control investments |

|

- |

|

|

|

- |

|

|

|

(139,867 |

) |

| Net realized

gain (loss) from investments |

|

153,583 |

|

|

|

7,446,596 |

|

|

|

13,398,327 |

|

| Income tax

(provision) benefit from realized gain on investments |

|

- |

|

|

|

548,568 |

|

|

|

(2,886,444 |

) |

| Net change

in unrealized appreciation (depreciation) on investments: |

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

(24,167,727 |

) |

|

|

(5,330,880 |

) |

|

|

14,775,190 |

|

|

Affiliate investments |

|

(1,541,829 |

) |

|

|

574,354 |

|

|

|

(26,836 |

) |

|

Control investments |

|

(21,381,288 |

) |

|

|

(10,461,606 |

) |

|

|

2,271,639 |

|

| Net change

in unrealized appreciation (depreciation) on investments |

|

(47,090,844 |

) |

|

|

(15,218,132 |

) |

|

|

17,019,993 |

|

| Net change

in provision for deferred taxes on unrealized (appreciation)

depreciation on investments |

|

(893,166 |

) |

|

|

(1,715,333 |

) |

|

|

694,908 |

|

| Net realized

and unrealized gain (loss) on investments |

|

(47,830,427 |

) |

|

|

(8,938,301 |

) |

|

|

28,226,784 |

|

| Realized

losses on extinguishment of debt |

|

(110,056 |

) |

|

|

(1,587,083 |

) |

|

|

(2,434,410 |

) |

| NET INCREASE

(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

$ |

8,933,825 |

|

|

$ |

24,675,763 |

|

|

$ |

45,735,184 |

|

| |

|

|

|

|

|

| WEIGHTED

AVERAGE - BASIC AND DILUTED EARNINGS (LOSS) PER COMMON SHARE |

$ |

0.71 |

|

|

$ |

2.06 |

|

|

$ |

3.99 |

|

| WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING - BASIC AND DILUTED |

|

12,670,939 |

|

|

|

11,963,533 |

|

|

|

11,456,631 |

|

| |

|

|

|

|

|

| * Certain

prior period amounts have been reclassified to conform to current

year presentation. |

|

|

|

|

|

| |

|

|

|

|

|

Supplemental Information Regarding Adjusted Net

Investment Income, Adjusted Net Investment Income Yield and

Adjusted Net Investment Income per Share

On a supplemental basis, Saratoga Investment

provides information relating to adjusted net investment income,

adjusted net investment income yield and adjusted net investment

income per share, which are non-GAAP measures. These measures are

provided in addition to, but not as a substitute for, net

investment income, net investment income yield and net investment

income per share. Adjusted net investment income represents net

investment income excluding any capital gains incentive fee expense

or reversal attributable to realized and unrealized gains. The

management agreement with the Company’s advisor provides that a

capital gains incentive fee is determined and paid annually with

respect to cumulative realized capital gains (but not unrealized

capital gains) to the extent such realized capital gains exceed

realized and unrealized losses for such year. In addition, Saratoga

Investment accrues, but does not pay, a capital gains incentive fee

in connection with any unrealized capital appreciation, as

appropriate. All capital gains incentive fees are presented within

net investment income within the Consolidated Statements of

Operations, but the associated realized and unrealized gains and

losses that these incentive fees relate to, are excluded. As such,

Saratoga Investment believes that adjusted net investment income,

adjusted net investment income yield and adjusted net investment

income per share is a useful indicator of operations exclusive of

any capital gains incentive fee expense or reversal attributable to

gains. In addition, (i) adjusted net investment income in fiscal

2023 also excludes the interest expense and amortization of

deferred financing costs related to the 2025 SAK Notes during the

period while the 2027 SAT Notes were already issued and

outstanding, and (ii) adjusted net investment income in fiscal 2022

also excludes the interest expense and amortization of

deferred financing costs related to the 2025 SAF Notes during the

call notice period while the 2026 Notes were already issued and

outstanding. Both these expenses are directly attributable to the

issuance of the 2027 SAT Notes and the subsequent repayment of the

2025 SAK Notes, and the issuance of the 2026 Notes and the

subsequent repayment of the 2025 SAF Notes, and are deemed to be

non-recurring in nature and not representative of the operations

of Saratoga Investment. The presentation of this

additional information is not meant to be considered in isolation

or as a substitute for financial results prepared in accordance

with GAAP. The following table provides a reconciliation of net

investment income to adjusted net investment income, net investment

income yield to adjusted net investment income yield and net

investment income per share to adjusted net investment income per

share for the years ended February 29, 2024, February 28, 2023 and

February 28, 2022, and the quarters ended February 29, 2024 and

February 28, 2023.

| |

For the Years Ended |

| |

February 29, 2024 |

February 28, 2023 |

February 28, 2022 |

| |

|

|

|

|

Net Investment Income |

$ |

56,874,308 |

|

$ |

35,201,147 |

|

$ |

19,942,810 |

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

(4,957,306 |

) |

|

(1,782,095 |

) |

|

5,485,024 |

|

| Interest expense on 2025 SAF

Notes during call period |

|

- |

|

|

- |

|

|

274,439 |

|

| Interest expense on 2025 SAK

Notes during the period |

|

- |

|

|

655,305 |

|

|

- |

|

| Adjusted net investment

income |

$ |

51,917,002 |

|

$ |

34,074,357 |

|

$ |

25,702,273 |

|

| |

|

|

|

| Net investment income

yield |

|

16.0 |

% |

|

10.2 |

% |

|

6.1 |

% |

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

(1.4 |

%) |

|

(0.5 |

%) |

|

1.6 |

% |

| Interest expense on 2025 SAF

Notes during call period |

|

- |

|

|

- |

|

|

0.1 |

% |

| Interest expense on 2025 SAK

Notes during the period |

|

- |

|

|

0.2 |

% |

|

- |

|

| Adjusted net investment income

yield (1) |

|

14.6 |

% |

|

9.9 |

% |

|

7.8 |

% |

| |

|

|

|

| Net investment income per

share |

$ |

4.49 |

|

$ |

2.94 |

|

$ |

1.74 |

|

| Changes in accrued capital

gains incentive fee expense/ (reversal) |

|

(0.39 |

) |

|

(0.15 |

) |

|

0.48 |

|

| Interest expense on 2025 SAF

Notes during call period |

|

- |

|

|

- |

|

|

0.02 |

|

| Interest expense on 2025 SAK

Notes during the period |

|

- |

|

|

0.06 |

|

|

- |

|

| Adjusted net investment income

per share (2) |

$ |

4.10 |

|

$ |

2.85 |

|

$ |

2.24 |

|

(1) Adjusted net investment income is

calculated as adjusted net investment income divided by average net

asset value.(2) Adjusted net investment income per share is

calculated as adjusted net investment income divided by weighted

average common shares outstanding.

| |

|

|

|

| |

For the Quarters Ended |

| |

February 29, 2024 |

February 28, 2023 |

| |

|

|

Net Investment Income |

$ |

12,784,511 |

|

$ |

9,649,474 |

|

| Changes in accrued capital gains

incentive fee expense/ (reversal) |

|

- |

|

|

1,941,604 |

|

| Adjusted net investment

income |

$ |

12,784,511 |

|

$ |

11,591,078 |

|

| |

|

|

| Net investment income yield |

|

14.0 |

% |

|

11.5 |

% |

| Changes in accrued capital gains

incentive fee expense/ (reversal) |

|

- |

|

|

2.1 |

% |

| Adjusted net investment income

yield (1) |

|

14.0 |

% |

|

13.6 |

% |

| |

|

|

| Net investment income per

share |

$ |

0.94 |

|

$ |

0.81 |

|

| Changes in accrued capital gains

incentive fee expense/ (reversal) |

|

- |

|

|

0.17 |

|

| Adjusted net investment income

per share (2) |

$ |

0.94 |

|

$ |

0.98 |

|

(1) Adjusted net investment income yield is

calculated as adjusted net investment income divided by average net

asset value.(2) Adjusted net investment income per share is

calculated as adjusted net investment income divided by weighted

average common shares outstanding.

Contact: Henri SteenkampSaratoga

Investment

Corp.212-906-7800

Lena CatiThe Equity Group Inc.212-836-9611

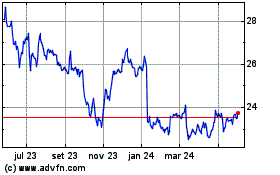

Saratoga Investment (NYSE:SAR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

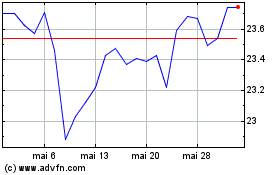

Saratoga Investment (NYSE:SAR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025