Cara Therapeutics, Inc. (Nasdaq: CARA), a development-stage

biopharmaceutical company leading a new treatment paradigm to

improve the lives of patients suffering from pruritus, today

announced financial results and operational highlights for the

first quarter ended March 31, 2024.

“Our notalgia paresthetica (NP) pivotal clinical program is

progressing ahead of schedule and we now expect to report topline

efficacy and safety results from KOURAGE 1 Part A by the end of the

second quarter of 2024,” said Christopher Posner, President and

Chief Executive Officer of Cara Therapeutics. “We believe the

medical dermatology community’s interest in our clinical program

underscores the significant unmet need for an effective and safe

anti-pruritic treatment for the sizeable NP patient population. We

look forward to rapidly advancing the ongoing Phase 2/3 program of

our differentiated asset, oral difelikefalin, in this common but

under-explored sensory neuropathy.”

KOURAGE Update

KOURAGE 1 Part A is the dose-finding portion of the Phase 2/3

clinical program evaluating oral difelikefalin for the treatment of

moderate-to-severe pruritus in patients with NP. The Company

enrolled 214 patients and expects topline efficacy and safety

results from KOURAGE 1 Part A by the end of the second quarter of

2024. Part A is not powered for statistical significance. This

readout will provide key information, specifically the dose and

sample size to initiate the Phase 3 pivotal portion of the program

– Part B of KOURAGE 1 and the second study KOURAGE 2. Final topline

results from the first pivotal study are expected by the end of

2025 with the second pivotal study results in early 2026.

In March 2024, the Company hosted a virtual event, Meet the NP

Experts, featuring a panel of leading dermatologists and key

opinion leaders to discuss the unmet need in NP and the potential

of oral difelikefalin. A replay of the webcast is available under

“Events & Presentations” in the Investors section of the

Company’s website, www.CaraTherapeutics.com.

1Q24 KORSUVA Injection U.S.

Update

In the first quarter of 2024, KORSUVA®

(difelikefalin) injection generated net sales of approximately $1.8

million and the Company recorded collaborative revenue of

approximately $800,000, which represented the Company’s share of

the profit from sales of KORSUVA injection.

Wholesalers shipped 111,720 vials to dialysis

centers during the first quarter of 2024.

On March 31, 2024, the Transitional Drug Add-On

Payment Adjustment (TDAPA) period for KORSUVA injection expired.

After the TDAPA period, KORSUVA injection is reimbursed through the

ESRD PPS bundle.

First Quarter 2024 Financial

Results

Cash, cash equivalents and marketable securities

at March 31, 2024 totaled $69.8 million compared to $100.8 million

at December 31, 2023. The decrease in the balance primarily

resulted from $30.5 million of cash used in operating

activities.

For the first quarter of 2024, net loss was

$30.7 million, or $(0.56) per basic and diluted share, compared to

net loss of $26.7 million, or ($0.49) per basic and diluted share,

for the same period in 2023.

Revenues: Total revenue was $2.1 million and

$6.2 million for the three months ended March 31, 2024 and 2023,

respectively. Revenue primarily consisted of:

- $0.8 million and $2.8 million of collaborative revenue related

to our share of the profit from CSL Vifor’s sales of KORSUVA

injection to third parties during the three months ended March 31,

2024 and 2023, respectively.

- $0.6 million and $3.2 million of commercial supply revenue

related to sales of KORSUVA injection to CSL Vifor during the three

months ended March 31, 2024 and 2023, respectively.

- $0.6 million of other revenue

related to royalty payments earned in conjunction with ex U.S.

sales of KORSUVA/Kapruvia under agreements with CSL Vifor and

Maruishi Pharmaceuticals Co. Ltd., or Maruishi, during the three

months ended March 31, 2024, which were sold under the Purchase and

Sale agreement with HCRX Investments Holdco, L.P. and Healthcare

Royalty Partners IV, L.P., or the HCR Agreement, and considered

non-cash. There was no other revenue during the three months ended

March 31, 2023.

Cost of Goods Sold: Cost of goods sold was $0.6

million and $2.6 million for the three months ended March 31, 2024

and 2023, respectively, related to commercial supply revenue for

KORSUVA injection sales to CSL Vifor.

Research and Development (R&D) Expenses:

R&D expenses were $22.0 million for the three months ended

March 31, 2024 compared to $24.3 million in the same period of

2023. The lower R&D expenses in 2024 were primarily due to

decreases in stock-based compensation expense, payroll and related

costs, travel costs and other related conference costs as well as

lower costs associated with the discontinuation of our atopic

dermatitis and advanced chronic kidney disease programs, partially

offset by increases related to the oral difelikefalin NP

program.

General and Administrative (G&A) Expenses:

G&A expenses were essentially flat at $6.8 million for the

three months ended March 31, 2024 compared to $6.9 million in the

same period of 2023.

Restructuring Expenses: Restructuring expenses

were $2.4 million for the three months ended March 31, 2024 which

were related to our strategic prioritization of NP and the

associated workforce reduction in the 2024 period. There were no

restructuring expenses recorded during the three months ended March

31, 2023.

Other Income, net: Other income, net was

approximately $1.0 million for each of the three months ended March

31, 2024 and 2023.

Non-cash interest expense on liability related

to sales of future royalties and milestones: Non-cash interest

expense was $2.0 million which represented imputed interest on the

carrying value of the liability associated with the HCR Agreement

and the amortization of the related issuance costs associated with

the HCR Agreement for the three months ended March 31, 2024. There

was no non-cash interest expense for the three months ended March

31, 2023.

Financial Guidance

Cara expects that our current unrestricted cash

and cash equivalents and available-for-sale marketable securities

will be sufficient to fund our currently anticipated operating plan

into 2026. Our current operating plan assumes certain costs related

to our planned pivotal trials in NP.

About the KOURAGE Phase 2/3 Clinical

Program in Notalgia Paresthetica

KOURAGE is a Phase 2/3 clinical program

evaluating oral difelikefalin for the treatment of

moderate-to-severe pruritus in patients with notalgia paresthetica

(NP). The program is comprised of two studies – KOURAGE 1 and

KOURAGE 2 – which will likely be double-blind, placebo-controlled,

8-week studies with patients allowed to roll-over into open-label

52-week extensions.

KOURAGE 1 is composed of two parts. The

dose-finding portion of KOURAGE 1 (Part A) includes 214 patients

who are randomized equally to four arms (0.25 mg BID, 1.0 mg BID,

2.0 mg BID, placebo BID). Part A is not powered for statistical

significance.

Part B and KOURAGE 2 will likely be

double-blind, placebo-controlled, 8-week studies with patients

randomized 1:1 to either difelikefalin or matching placebo. The

primary endpoint for both the dose-finding portion of KOURAGE 1

(Part A) and the two pivotal studies Part B and KOURAGE 2 will

likely be the proportion of patients with a ≥4-point improvement at

Week 8 from baseline in the worst itch numeric rating scale.

About Cara Therapeutics

Cara Therapeutics is a development-stage

biopharmaceutical company leading a new treatment paradigm to

improve the lives of patients suffering from pruritus. The Company

is developing an oral formulation of difelikefalin, a selective,

peripherally acting, non-scheduled kappa opioid receptor agonist,

for the treatment of chronic pruritus associated with notalgia

paresthetica (NP), a common, underdiagnosed neuropathy affecting

the upper back for which there are no FDA-approved therapies. The

Company is conducting a Phase 2/3 clinical program in NP with

topline results of the dose-finding portion expected by the end of

the second quarter of 2024. Cara Therapeutics also developed an IV

formulation of difelikefalin, which is approved in the United

States, EU, and multiple other countries for the treatment of

moderate-to-severe pruritus associated with advanced chronic kidney

disease in adults undergoing hemodialysis. The IV formulation is

out-licensed worldwide. For more information, visit

www.CaraTherapeutics.com and follow the company on X (Twitter),

LinkedIn and Instagram.

Forward-looking Statements

Statements contained in this press release

regarding matters that are not historical facts are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Examples of these

forward-looking statements include statements concerning the

Company’s planned future regulatory submissions and potential

future regulatory approvals, future product launches, expected

timing of the initiation, enrollment and data readouts from the

Company’s planned and ongoing clinical trials, the potential

results of ongoing clinical trials, timing of future regulatory and

development milestones for the Company’s product candidate, the

potential for the Company’s product candidate to be an alternative

in the therapeutic areas investigated, including notalgia

paresthetica, the size and growth of the potential markets for

pruritus management such as notalgia paresthetica, the commercial

potential of the Company’s product candidate, and the Company’s

cash runway. Because such statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements. The risks

are described more fully in Cara Therapeutics’ filings with the

Securities and Exchange Commission, including the “Risk Factors”

section of the Company’s Annual Report on Form 10-K for the year

ending December 31, 2023 and its other documents subsequently filed

with or furnished to the Securities and Exchange Commission,

including its Form 10-Q for the quarter ended March 31, 2024. All

forward-looking statements contained in this press release speak

only as of the date on which they were made. Cara Therapeutics

undertakes no obligation to update such statements to reflect

events that occur or circumstances that exist after the date on

which they were made, except as required by law.

|

|

|

CARA THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

| |

March 31, |

|

December 31, |

| |

2024 |

|

2023 |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

46,996 |

|

|

$ |

51,775 |

|

|

Marketable securities |

|

22,777 |

|

|

|

48,983 |

|

|

Accounts receivable, net - related party |

|

1,718 |

|

|

|

2,765 |

|

|

Inventory, net |

|

2,741 |

|

|

|

2,821 |

|

|

Income tax receivable |

|

697 |

|

|

|

697 |

|

|

Other receivables |

|

506 |

|

|

|

555 |

|

|

Prepaid expenses |

|

5,790 |

|

|

|

8,154 |

|

|

Restricted cash |

|

- |

|

|

|

408 |

|

|

Total current assets |

|

81,225 |

|

|

|

116,158 |

|

|

Operating lease right-of-use assets |

|

3,826 |

|

|

|

4,864 |

|

|

Property and equipment, net |

|

3,548 |

|

|

|

3,322 |

|

|

Restricted cash, non-current |

|

1,500 |

|

|

|

1,500 |

|

|

Total assets |

$ |

90,099 |

|

|

$ |

125,844 |

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

14,875 |

|

|

$ |

25,592 |

|

|

Operating lease liability, current |

|

220 |

|

|

|

- |

|

|

Total current liabilities |

|

15,095 |

|

|

|

25,592 |

|

|

|

|

|

|

|

Liability related to sales of future royalties and milestones,

net |

|

38,376 |

|

|

|

37,079 |

|

|

Operating lease liability, non-current |

|

6,825 |

|

|

|

6,088 |

|

|

Total liabilities |

|

60,296 |

|

|

|

68,759 |

|

|

|

|

|

|

| Commitments and

contingencies |

|

- |

|

|

|

- |

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock |

|

- |

|

|

|

- |

|

|

Common stock |

|

54 |

|

|

|

54 |

|

|

Additional paid-in capital |

|

745,381 |

|

|

|

742,036 |

|

|

Accumulated deficit |

|

(715,441 |

) |

|

|

(684,745 |

) |

|

Accumulated other comprehensive loss |

|

(191 |

) |

|

|

(260 |

) |

| Total stockholders’

equity |

|

29,803 |

|

|

|

57,085 |

|

| Total liabilities and

stockholders’ equity |

$ |

90,099 |

|

|

$ |

125,844 |

|

|

CARA THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(amounts in thousands, except share and per share data) |

|

(unaudited) |

| |

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

2023 |

|

| |

|

|

|

| Revenue: |

|

|

|

|

|

|

Collaborative revenue |

$ |

788 |

|

|

$ |

2,750 |

|

|

| |

Commercial supply revenue |

|

640 |

|

|

|

3,191 |

|

|

| |

Royalty revenue |

|

- |

|

|

|

125 |

|

|

| |

Clinical compound revenue |

|

84 |

|

|

|

99 |

|

|

| |

Other revenue |

|

623 |

|

|

|

- |

|

|

| Total revenue |

|

2,135 |

|

|

|

6,165 |

|

|

| Operating

expenses: |

|

|

|

|

| |

Cost of goods sold |

|

620 |

|

|

|

2,590 |

|

|

| |

Research and development |

|

21,964 |

|

|

|

24,334 |

|

|

| |

General and

administrative |

|

6,816 |

|

|

|

6,891 |

|

|

| |

Restructuring |

|

2,401 |

|

|

|

- |

|

|

| Total operating

expenses |

|

31,801 |

|

|

|

33,815 |

|

|

| Operating

loss |

|

(29,666 |

) |

|

|

(27,650 |

) |

|

|

Other income, net |

|

952 |

|

|

|

985 |

|

|

| |

Non-cash interest expense on

liability related to sales of future royalties and milestones |

|

(1,982 |

) |

|

|

- |

|

|

| Net loss |

$ |

(30,696 |

) |

|

$ |

(26,665 |

) |

|

| |

|

|

|

|

|

| Net loss per

share: |

|

|

|

|

| Basic and

Diluted |

$ |

(0.56 |

) |

|

$ |

(0.49 |

) |

|

| |

|

|

|

|

|

| Weighted average

shares: |

|

|

|

|

| Basic and

Diluted |

|

54,588,090 |

|

|

|

53,872,038 |

|

|

| |

|

|

|

|

|

|

|

|

MEDIA CONTACT:Annie Spinetta6

Degrees973-768-2170aspinetta@6degreespr.com

INVESTOR CONTACT:Iris Francesconi, Ph.D.Cara

Therapeutics203-406-3700investor@caratherapeutics.com

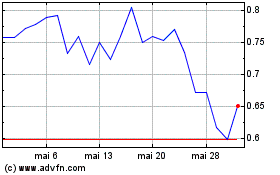

Cara Therapeutics (NASDAQ:CARA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Cara Therapeutics (NASDAQ:CARA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024